Big picture thoughts on the macro/market outlook

Q2 2021 hedge fund letters, conferences and more

Welcome to the third quarter and the second half of the year! Things have certainly moved on and evolved since my original post (both in terms of market movements and the general consensus/sentiment). So I thought it would be helpful to take a quick progress check on the “10 Charts to Watch in 2021“.

In the original article I shared what I thought would be the 10 most important charts to watch for multi-asset investors in the year ahead (and beyond).

In this article I have updated those 10 charts, and provided some updated comments.

[Note: I have included the original comments from back at the start of the year, so you can quickly compare what I’m thinking now vs what I said back then]

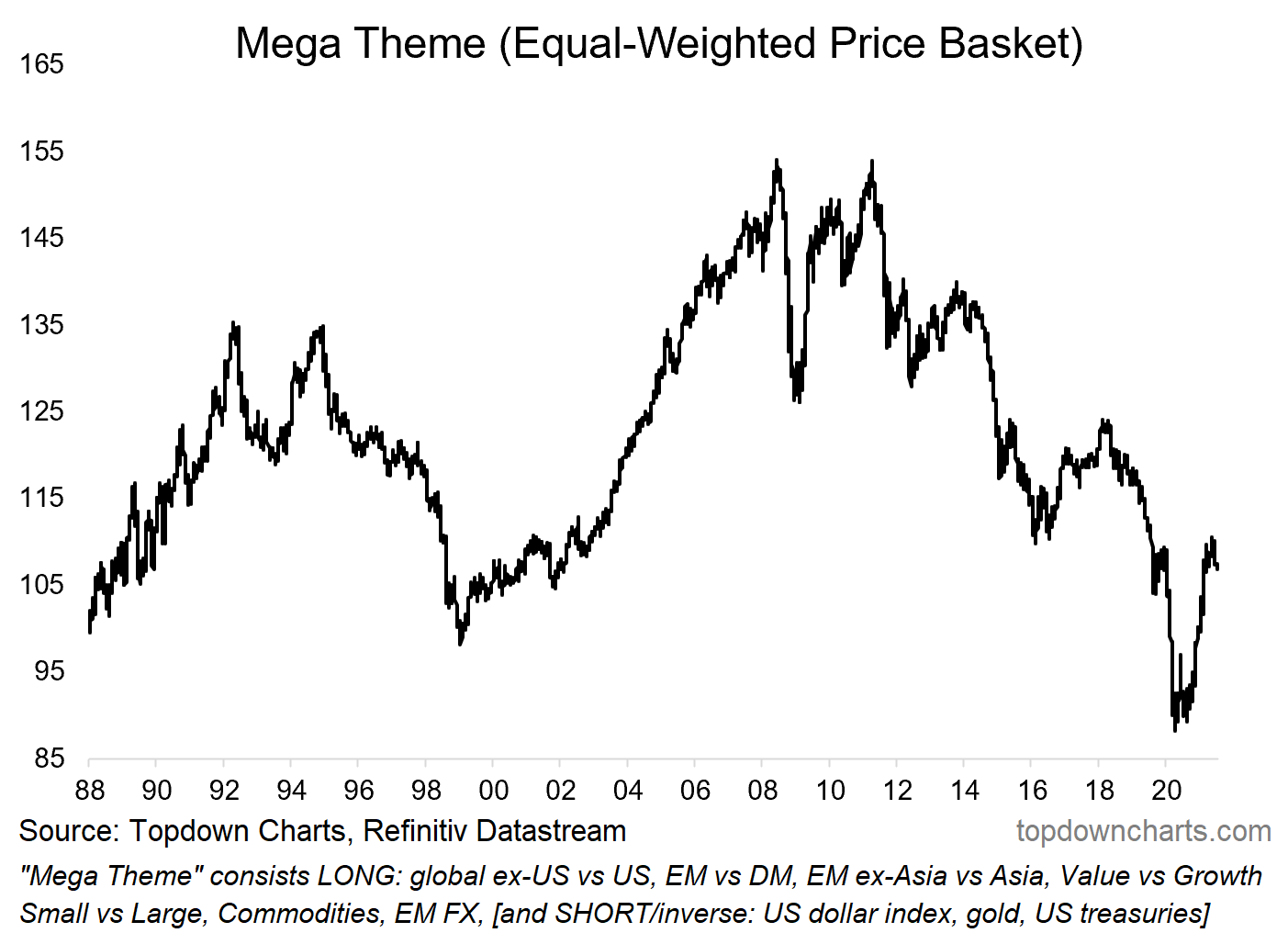

1. Mega Theme: This rather interesting combination of ideas has progressed very well since initiating it last year, and I would have to say that I am still by and large happy with each of the components – particularly on a more medium-term timeframe. But if we just look at the historical price action of this basket of ideas, we can see that such sharp movements are generally not sustainable, and so in some respects we should expect it to be doing exactly what it is now – i.e. into a more ranging/volatile regime.

“In the last regular edition of the Weekly Macro Themes report of 2020, I decided to combine all my big ideas into one “mega theme” given some of the echoes across the ideas in terms of price action and macro drivers. The result is this interesting chart which looks to be either at or near the bottom of a long-term secular trend, and the start of at least a short-term cyclical upturn.”

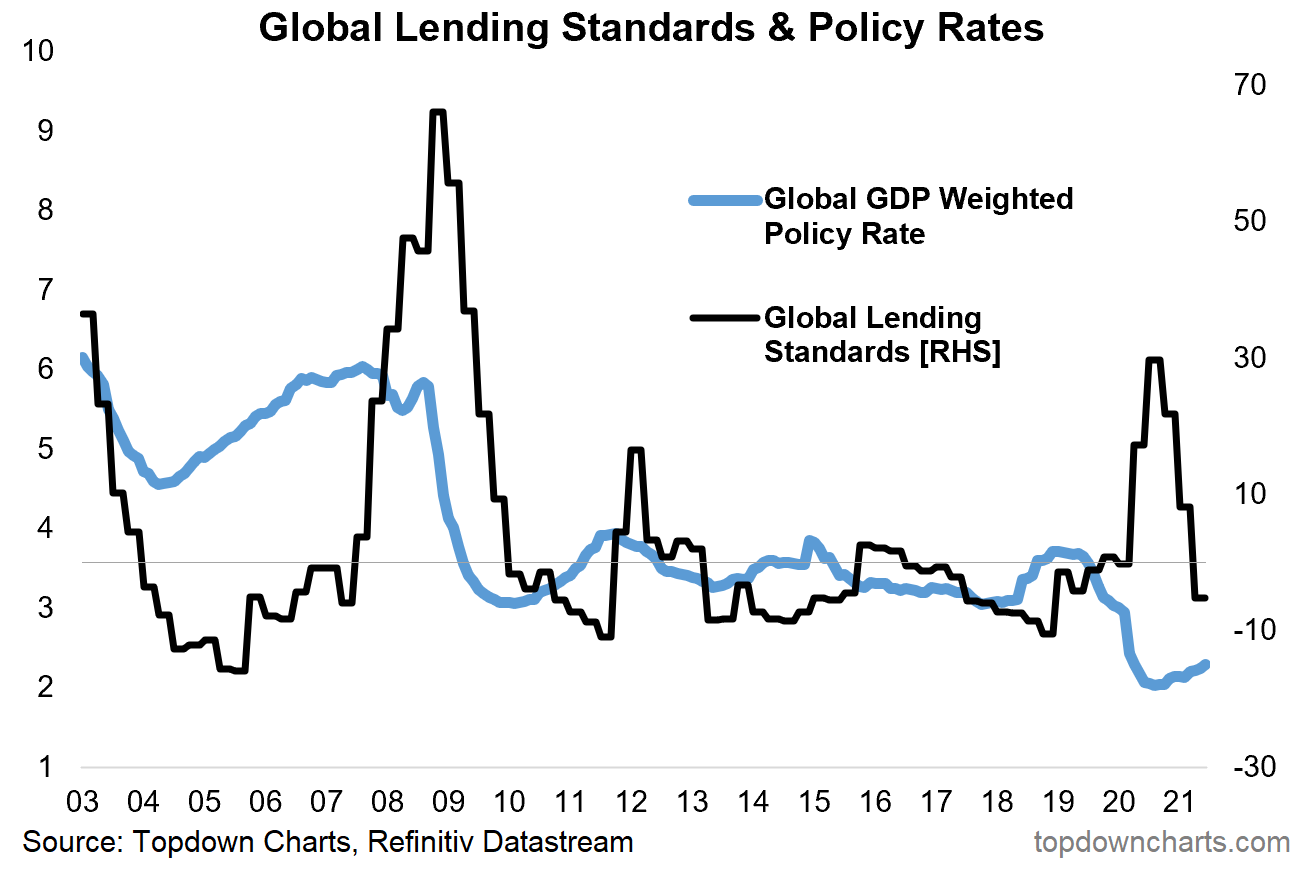

2. Monetary Policy (limits): Things have certainly progressed with this chart, the global monetary policy pivot (towards stimulus removal) is clearly getting underway. On my count at the time of writing, there have been 27 interest rate hikes across 17 central banks so far this year. Meanwhile, with better economic conditions, banks have begun to relax lending standards. So while the tides are turning on monetary policy, financial/credit conditions are still very easy, and some powerful tailwinds to growth are already baked in.

“The policy response to the pandemic was historic in terms of its speed, magnitude, and coordination across countries and between fiscal and monetary. But this chart perhaps highlights one limitation of monetary policy, the tag line is “interest rates are low, but good luck getting a loan” (given how much banks tightened up on lending standards). One thing on my mind is a possible passing of the torch from monetary policy to fiscal policy – as that’s going to be the thing that will achieve a more balanced and more transformative impact in the recovery.”

3. Global Trade Rebound: One expression or beneficiary of the historic monetary + fiscal stimulus (+ reopening) has been global trade. Global container throughput volumes have not only rebounded, but far exceeded previous highs. What’s more, the various leading indicators point to an ongoing expansion in global trade, and as we’ll see in the next chart, there is still a big backlog of orders to get through.

“The global economic shutdown saw an abrupt collapse in trade growth. But since then we have seen clear green shoots and the leading indicators point to an acceleration and continuation of the global trade growth rebound into 2021.”

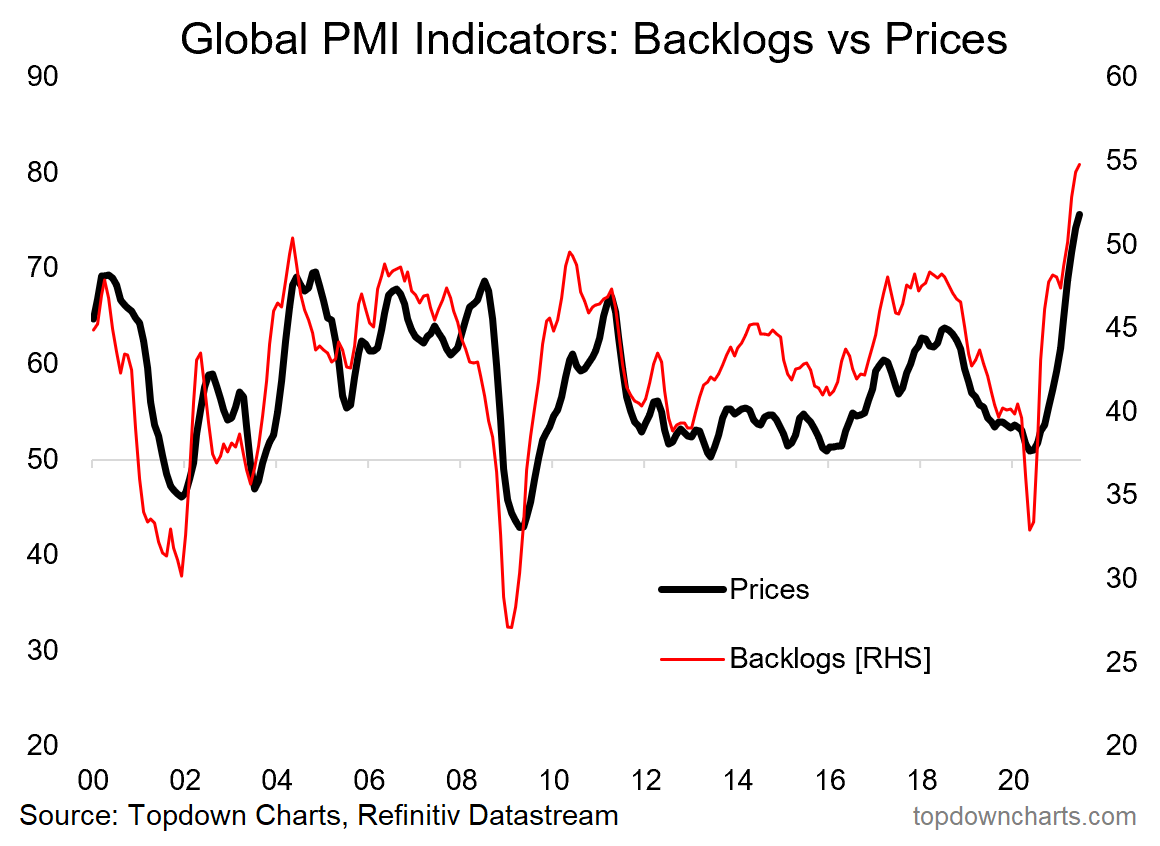

4. Global Backlogs: One of my pet topics, and something I caught onto early, the issue of backlogs and supply chain disruption (inventory & parts shortages, shipping delays, surging shipping costs, factory disruption, labor shortages) has only gotten worse. On reflection you basically have a demand shock (reopening + stimulus) and a supply shock (pandemic disruption), at a time where never before in history have we had this level of global integration and interdependence in the supply chain. Short-term it means pricing pressures are here to stay; further out it most likely has meaningful implications for capex and perhaps more onshoring as firms look to build capacity and resilience in their supply chains.

“A nice follow-on, the surge in backlogs (resulting from global supply chain disruption) has 2 key implications: upside risk to inflation, and a likely spike in activity as firms attempt to clear backlogs and restock inventories.”

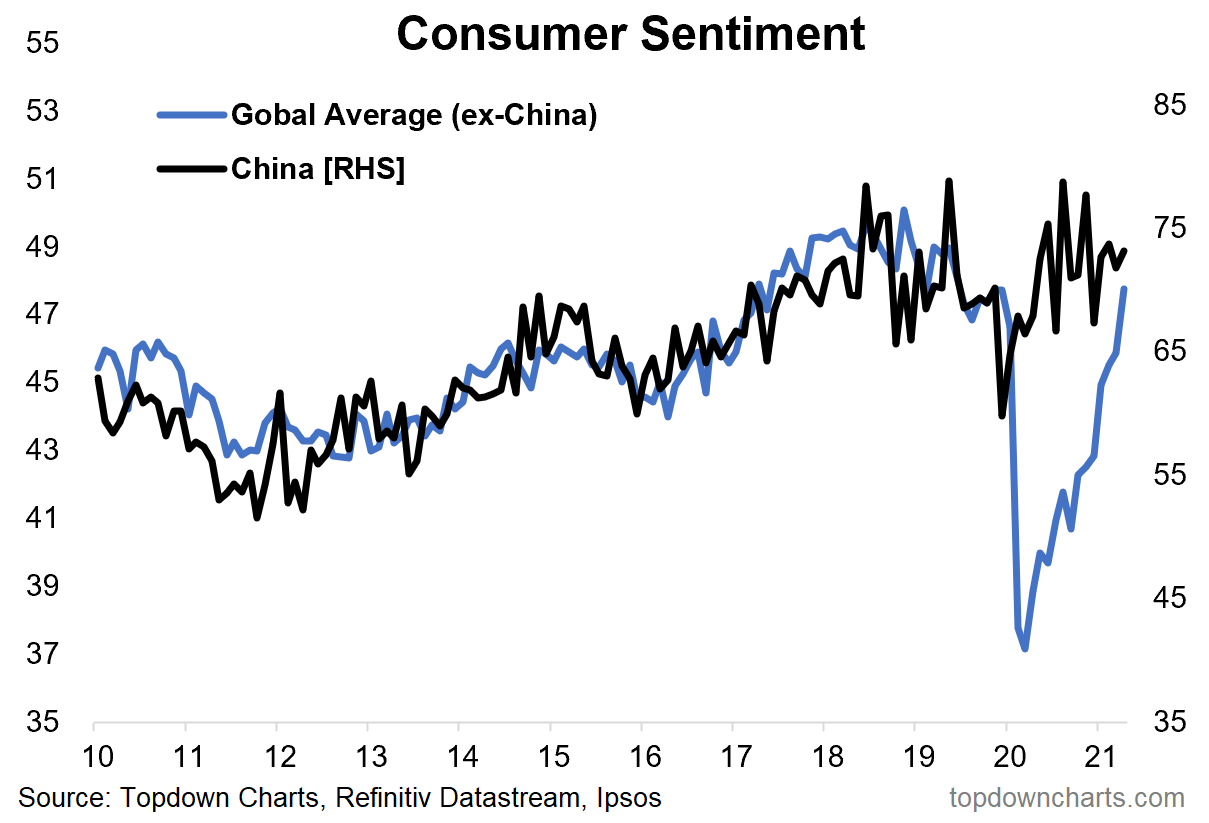

5. Consumer Normalization: Globally the consumer is going from careful to cheerful. I am looking for the consumer to be an important part of the next wave of the global economic recovery. The pandemic resulted in a surge in savings (expenses in lockdown, asset price inflation, stimulus checks), with household savings rates doubling across most developed economies. My view is it’s important to be open minded to a possible consumer spending boom.

“Consumer moods remain depressed *outside of China*. This chart provides a sort of playbook for the rest of the world, as well as a key means of keeping track of normalization, and a nod to a potential consumer boom post-vaccine.”

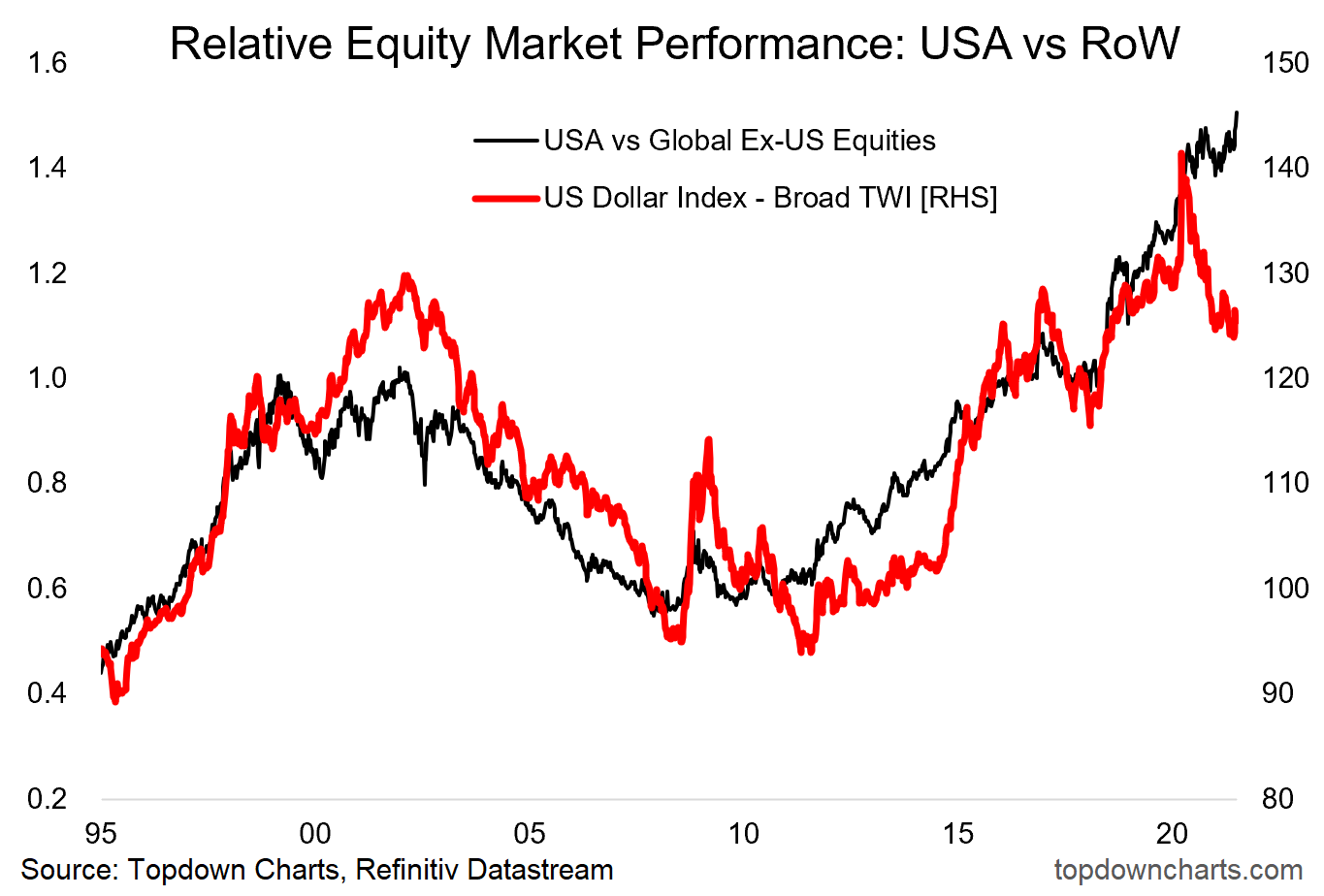

6. US vs the Rest of the World: After a brief pause, US equities have started to outperform vs global again. This is going to make the already yawning valuation gap all the more extreme, and in my view amounts to pulling on the rubber band. As I’ve detailed elsewhere, there is a compelling strategic case to rotate into global ex-US vs US equities; albeit I do acknowledge we need to see the short-term technicals confirm the strategic case for maximum conviction and for practical/timing considerations.

“All the key pieces of the puzzle seem to be falling into place for the rest of the world to start outperforming vs US equities. Along with that, I expect ongoing weakness in the US dollar.”

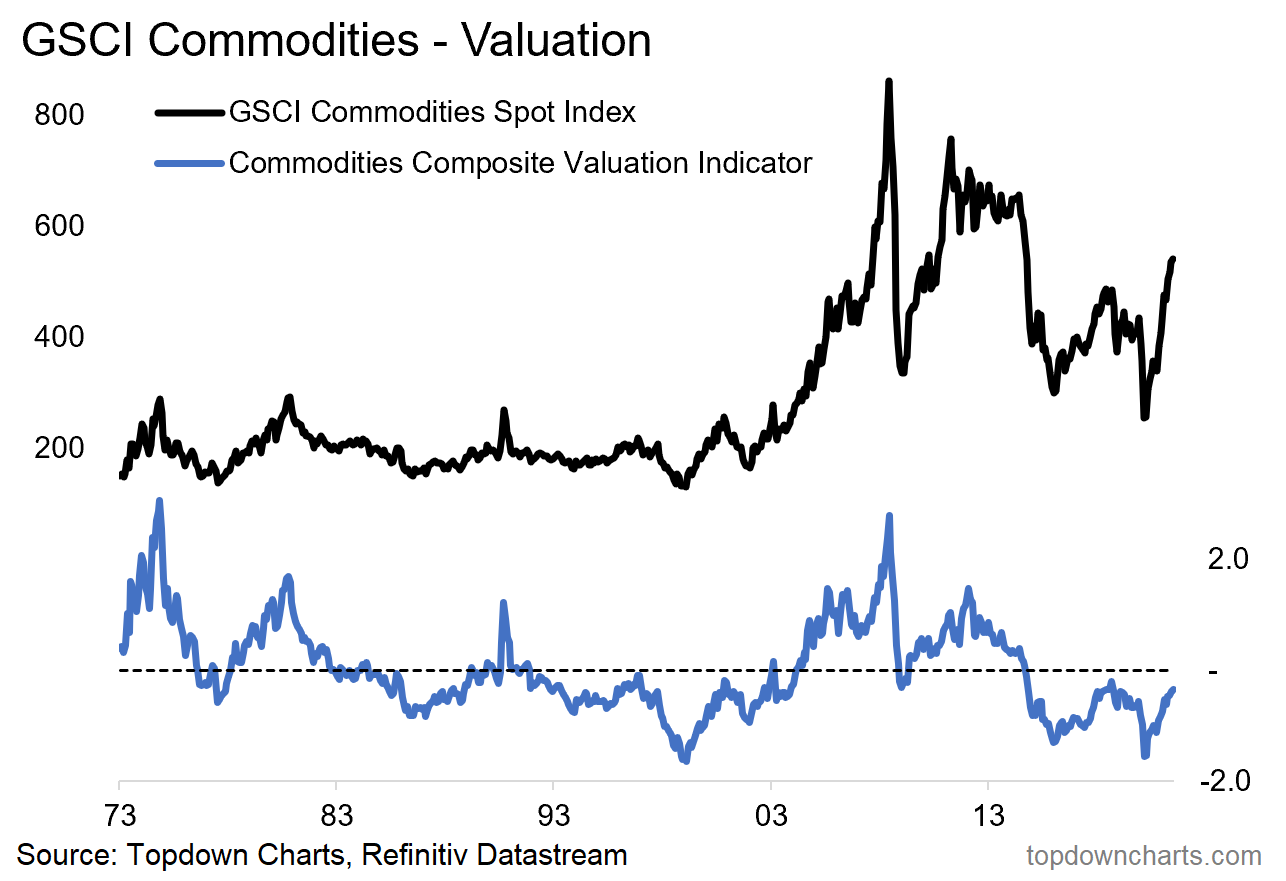

7. Commodities: The bull case for commodities is increasingly well understood – as such, positioning and sentiment became a bit frothy – and as such I would not be surprised to see a short-term commodity correction to wash out some of the froth. Further out though the case for an extended/prolonged bull market in commodities is very compelling e.g. multi-year supply tailwinds from years of underinvestment by commodity producers, longer term technicals/valuations, and both cyclical + thematic demand drivers.

“Given cheap valuations, a prolonged period of weak capex (i.e. futures supply tailwinds to price), pandemic disruption, an expected weaker USD, and economic recovery (with potential overshoot), remain decidedly bullish here.”

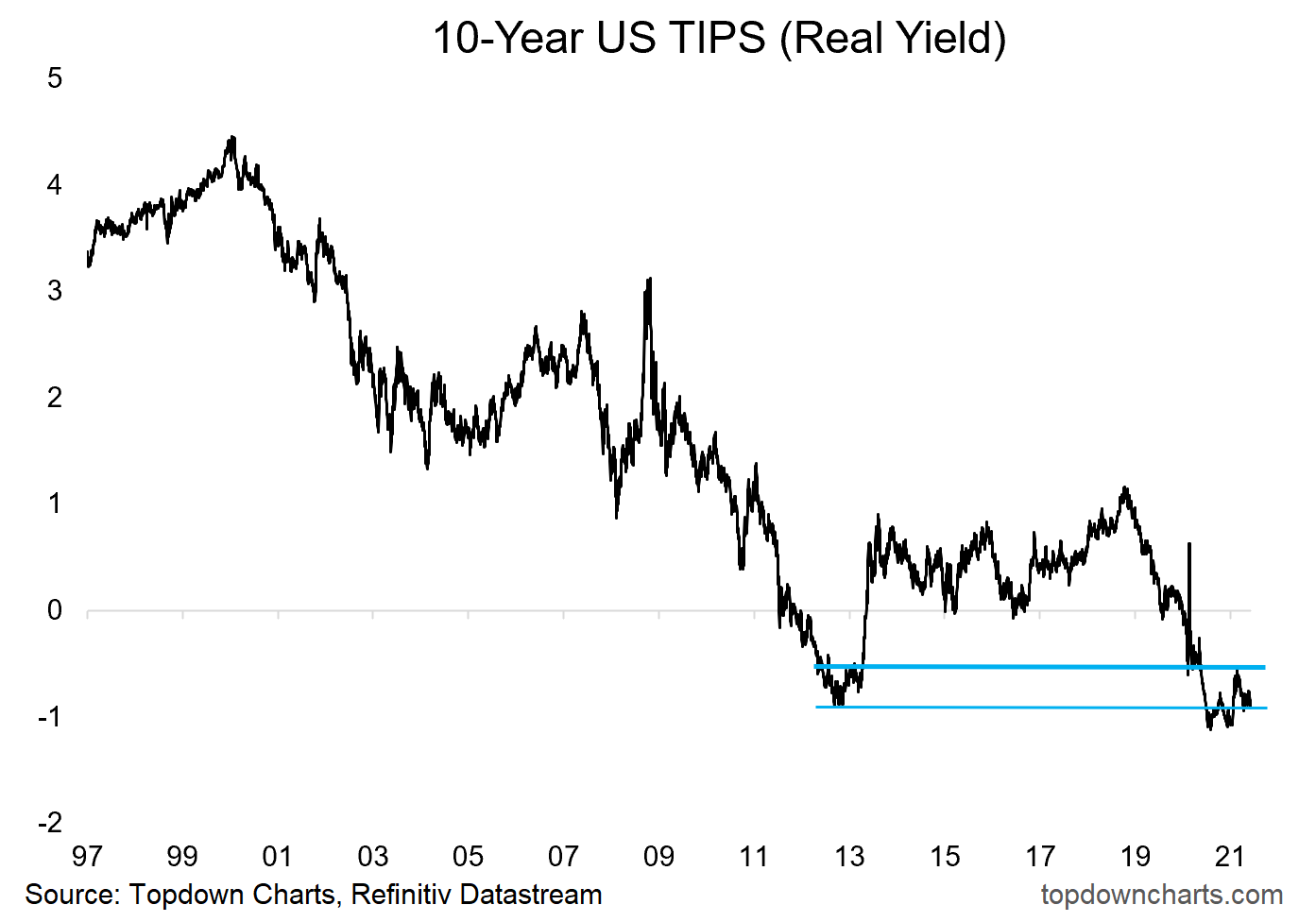

8. Real Yields: After an initial push higher, real yields found resistance and are currently contending with short-term support; a breach of which will surely open up a move lower (likely to test the all time lows). Further out though I continue to expect real yields to push higher on the back of higher growth from: reopening, recovery, rebuilding.

“In my view the two key drivers of US real yields are risk sentiment and growth expectations. Naturally on both fronts it was entirely rational to see real yields plunge this year. Going forward I expect improved risk sentiment and a rebound in growth expectations; therefore I expect higher real yields (and nominal yields).”

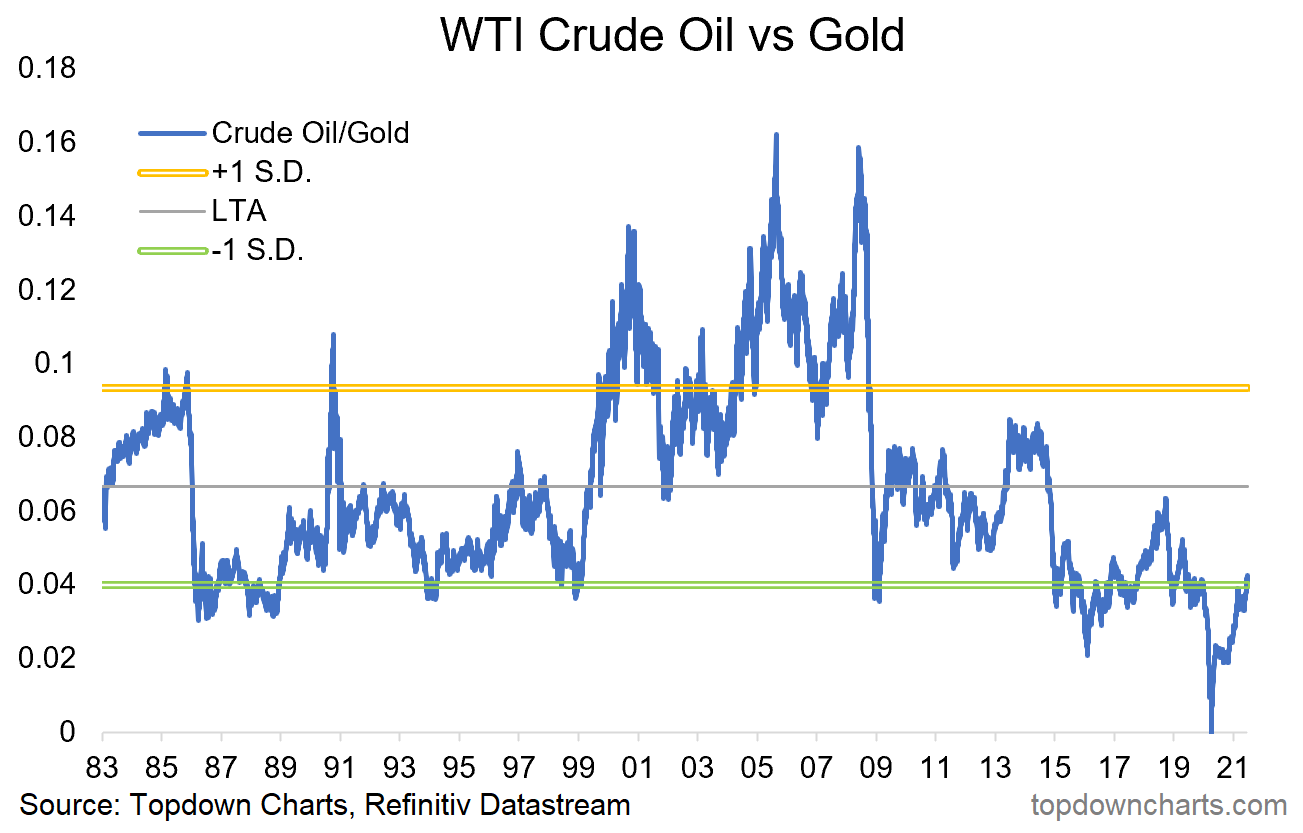

9. Crude Oil vs Gold: This one happened perhaps a little faster than I expected: since the lows, crude oil has substantially outperformed vs gold, and I don’t see much reason to change the prognosis there. Reopening, recovery, rebuilding likely puts further upward pressure on oil prices (and commodities in general), while gold likely lags behind as real yields rise and risk hedging demand dwindles. Short-term I would acknowledge that oil looks a little overbought and gold a little oversold, but medium-term expect oil to outperform vs gold.

“The logical next question should then be “what about gold?”. All else equal, a prospective environment of higher real yields would present a headwind to the consensus and crowded long gold trade. Aside from that, I believe a prospective passing of the torch from monetary to fiscal in the US is strong possibility (incoming Treasury Sec. Yellen has a deep appreciation for the limits of monetary policy and the need for fiscal policy to do more of the heavy lifting). This along with post-vaccine normalization should disproportionately benefit oil at the expense of gold, so I suspect we see some mean reversion in this chart.”

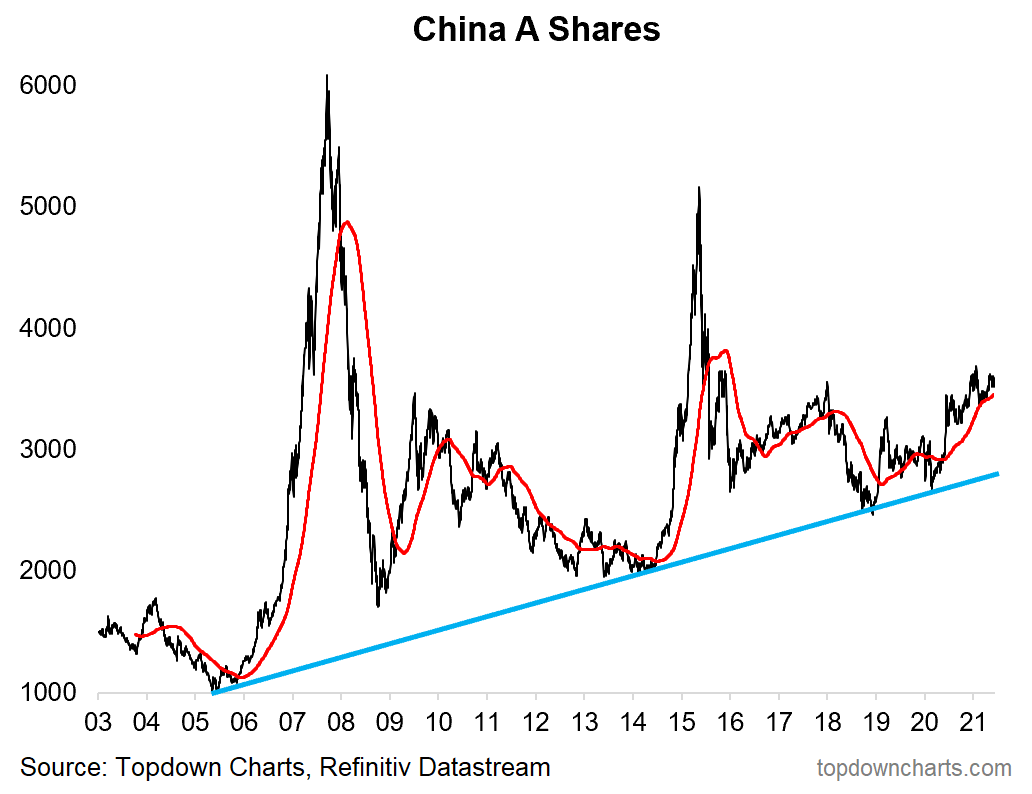

10. Chinese Equities and Emerging Markets: As China continues its stance of relative forbearance on policy stimulus, China A-shares have been largely rangebound. Aside from that, this brings me to my views on emerging market equities: I see better prospects for EM ex-Asia at the moment given attractive relative valuations, light positioning, relative value in the FX, promising technicals, and supportive macro/intermarkets. In lieu of a catalyst for China/Asia equities, I’m more focused on the rest of EM to drive performance near term.

“Last but not least is China. While I continue to watch a wide range of indicators, one in particular focus will be China A-shares, particularly as they brush up against a key overhead resistance level, and as policy makers in China possibly move toward actually tightening monetary policy in 2021. Indeed, in many respects, I suspect it will be more of China zigging, while the rest of the world is zagging. In any case, I remain convinced that it is still one of the most important economies and markets to watch in understanding the global macro/market picture.”

Summary and Key Takeaways:

- Monetary policy remains of critical importance, and financial conditions remain very supportive, but expect incrementally less stimulus going forward.

- Anticipate follow-through on the global economic recovery as stimulus, green shoots, and clearing of backlogs coalesce.

- Continued upside risk to inflation near-term given continued and even worsening backlogs, while the economic recovery squeezes capacity.

- Expect the risk-on/reflation/recovery macro environment helps some of the previously unfavored asset classes, and drives rotation within and across markets.

- Anticipate a more nuanced approach to global equity allocations will be more appropriate rather than just market cap weights: fade passive.

- Likely further upside for commodities, higher bond yields, and weaker USD… medium-term; shorter term corrective action is in progress.

- Still plenty of interesting opportunities out there!

Best regards,

Callum Thomas

Head of Research & Founder at Topdown Charts

Twitter: https://twitter.com/Callum_Thomas

LinkedIn: https://www.linkedin.com/in/callum-thomas-4990063/