Introduction – REITs

REITs are most often thought about as income-producing investments. Although this is generally a true statement, REITs can also be great builders of wealth if invested in correctly. To invest in REITs correctly, it is imperative that the investor understand the true nature of the beast. Furthermore, it is also critical to pay attention to valuation when considering REITs for your portfolio.

Q1 2023 hedge fund letters, conferences and more

Due to the dilutive nature of REITs, they are not generally known or thought of as fast growers. On the other hand, they are renowned for the consistency of their dividend growth and for the prodigious amount of income they produce for shareholders over time. Due to these factors, investors seeking reliable growth of capital coupled with a prodigious and growing income stream can utilize REITs as a predictable and important part of their long-term retirement planning.

However, the key to what is stated above is – as previously stated – investing in them correctly. REITs can be initially utilized for growth by reinvesting their dividends. Then, when income is needed, the dividends can be paid out providing exceptional income that investors can live off.

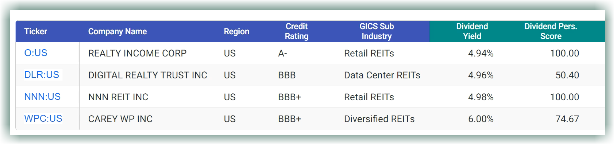

With this video, we’re going to take a dive into 4 high quality REITs that collectively yield more than 5% current income and can be purchased at attractive long-term valuations. In summary, these investments can be utilized to build wealth and/or produce significant income or both.

FAST Graphs Analyze Out Loud Video on Digital Realty Trust (DLR), NNN REIT Inc (NNN), Realty Income (O), WP Carey (WPC)

Article by FastGraphs.