Robinhood definitely caused a stock market shakeup. Invisibly polled over 1300 people using its Realtime Research tool to find out what people really think about it and the results are surprising. Not that 77% of those surveyed thought the shutdown was market manipulation — we expected that — but in how many people thought the whole situation was a good thing.

Q4 2020 hedge fund letters, conferences and more

Here’s what Invisibly learned:

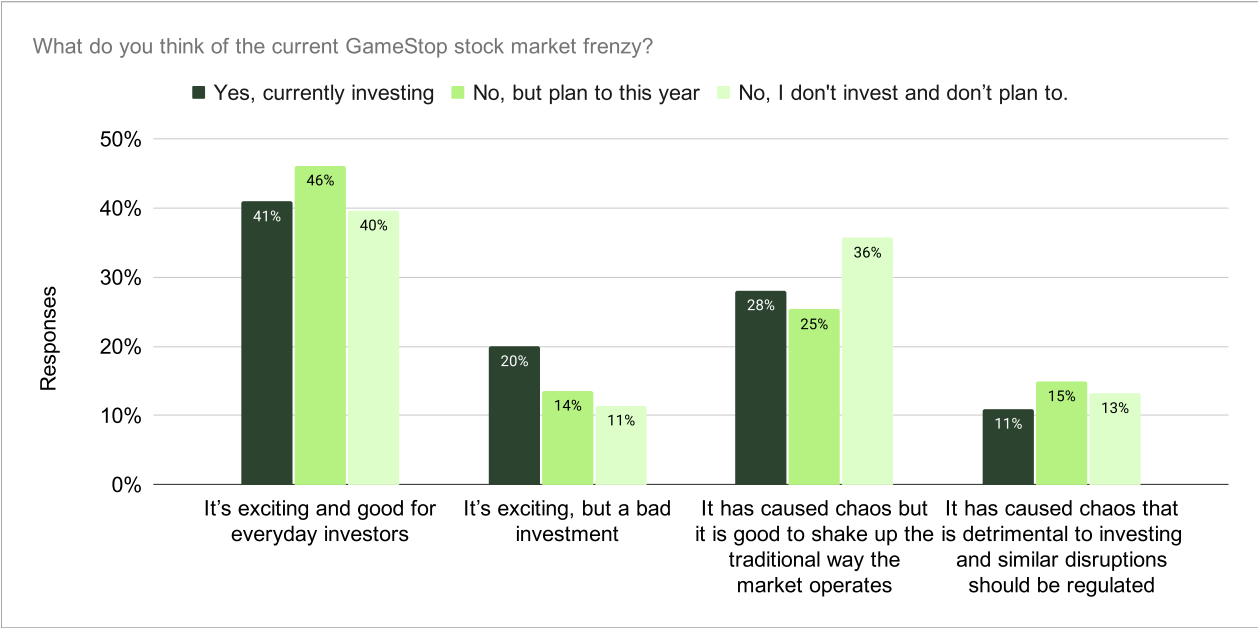

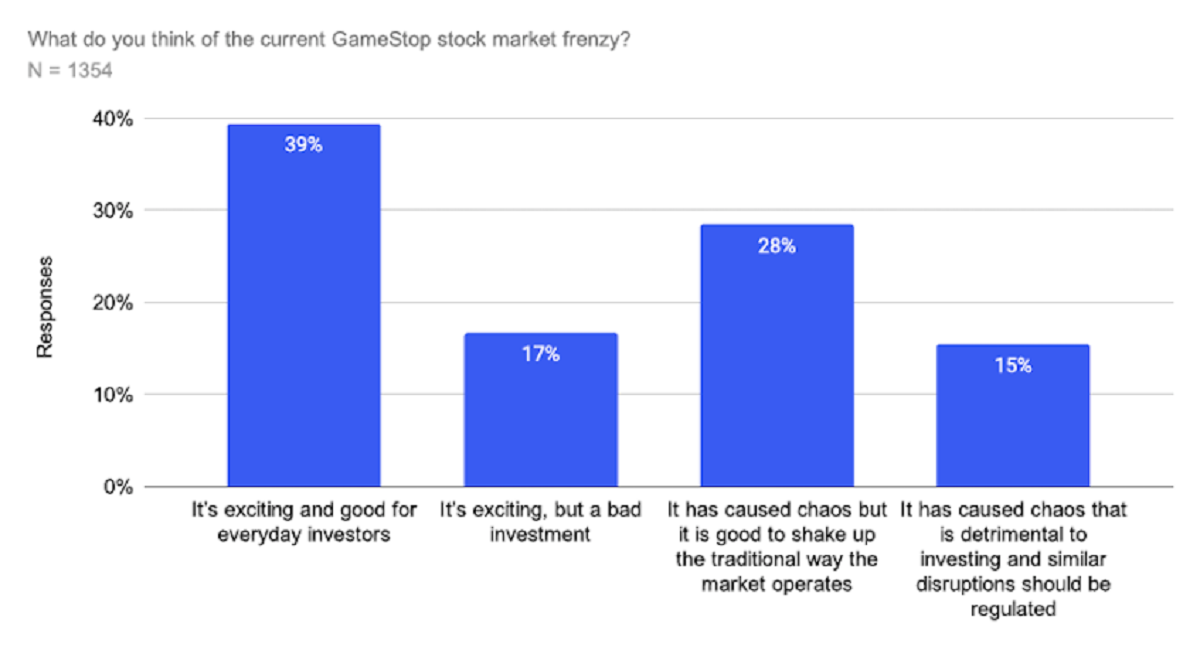

- 67% had some level of positive sentiment – 39% thought it was exciting and good for investors and 28% thought that despite the chaos it’s good to shake up the traditional way the market operates.

- 41% of current investors feel the shakeup is exciting and good for everyday investors

- 36% of non-investors think shaking things up is good, compared to 28% of those currently investing.

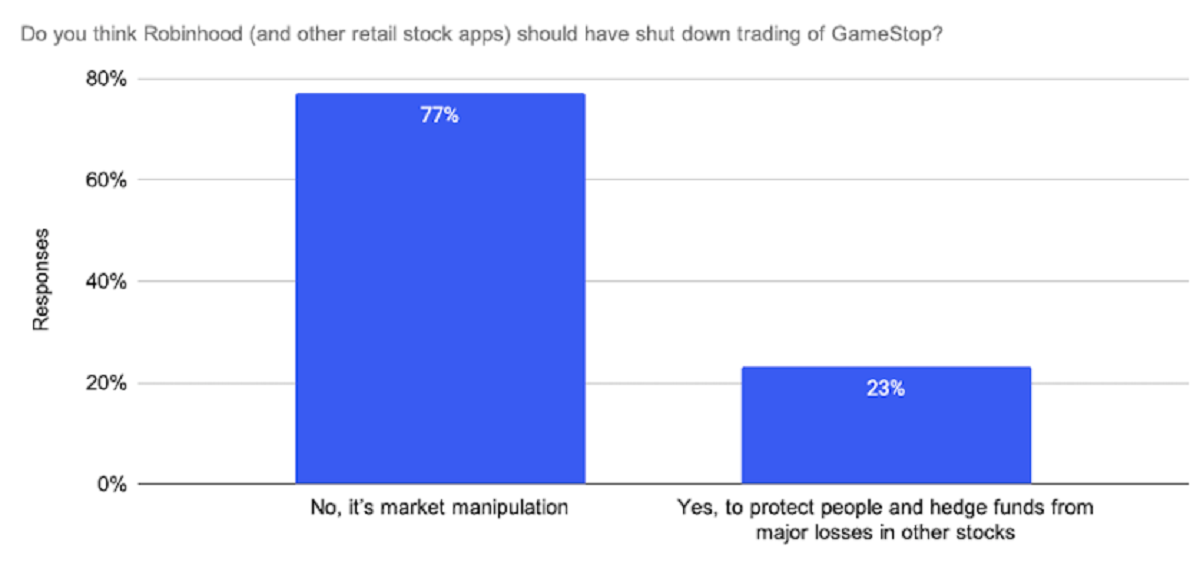

- Only 23% feel the shutdown was in order to protect people and the markets – the other 77% thought it was sheer market manipulation

Invisibly Realtime Research™ polling differs from traditional polling or online surveys and have proven to be extremely accurate at predicting behavior. In fact, Invisibly came the closest in accurately predicting the Presidential election results: FiveThirtyEight polls were off by 38 electoral votes. Invisibly was only off by 4 electoral votes.