Activist hedge fund strategies brought in among the strongest returns in the hedge fund industry in April, while overall industry returns are being dragged down by some mediocre performances, according to the just-released eVestment April 2018 Hedge Fund Performance Report.

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital: Financial Products You Should Avoid?

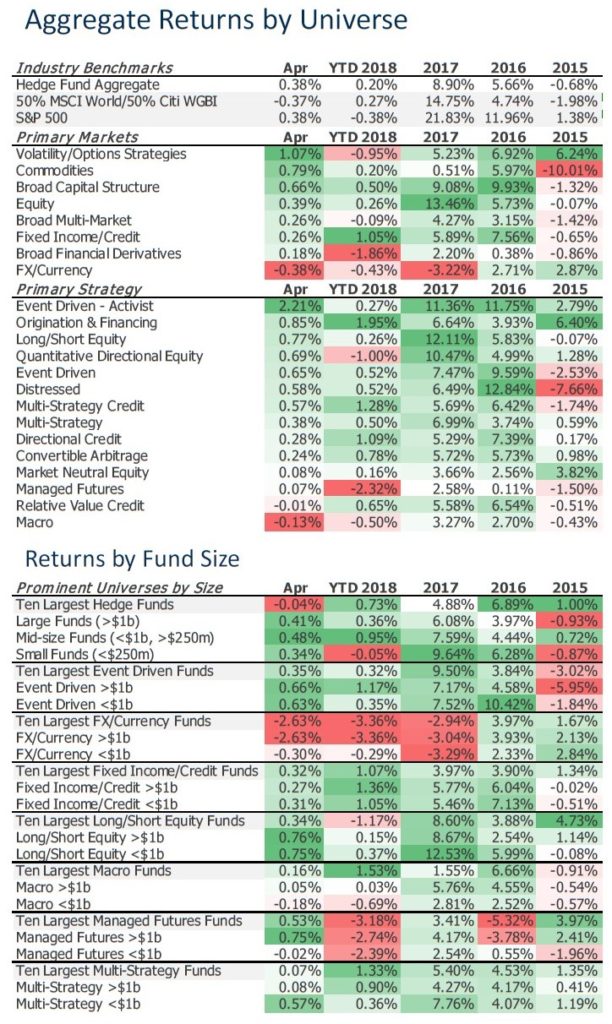

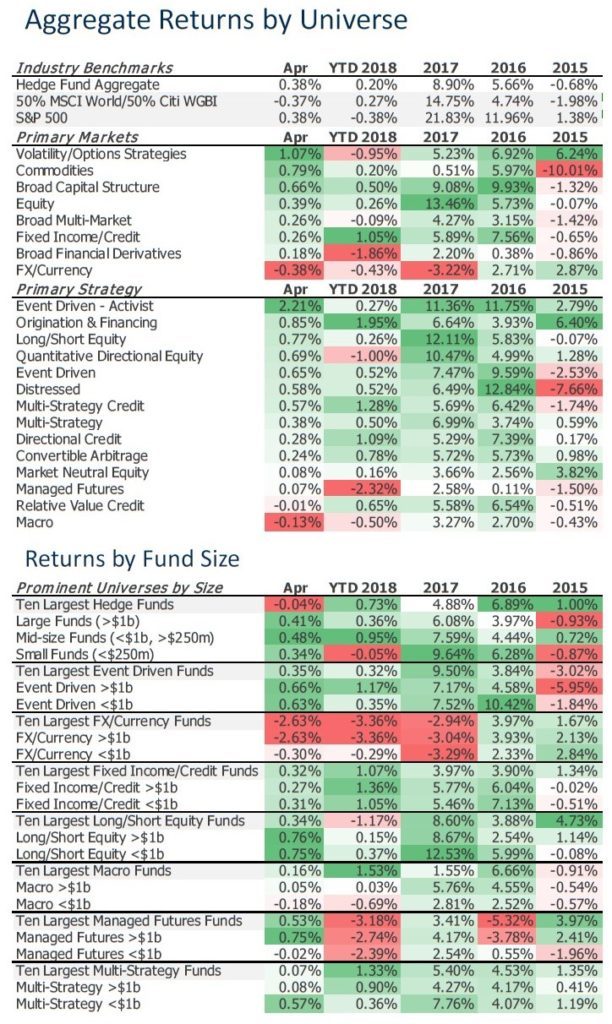

The overall industry returned +0.38% in April, bringing year-to-date (YTD) 2018 returns to a just-barely positive +0.20%. Activist strategies were by far the strongest performers among primary strategies, seeing +2.21% returns in April. However, YTD performance for activist strategies – at +0.27% – is just barely above the overall industry YTD return.

Overall, 60% of reporting funds saw positive returns in April, while only 52% of funds are positive YTD, indicating a muddied picture for the industry going forward with still two-thirds of the year ahead and a volatile geopolitical and business climate continuing to rattle world markets.

Some highlights from the April report include:

- While most primary strategies are in the green for April, Relative Value Credit and Macro strategies both turned in negative performances for the month, at -0.01% and -0.13% respectively.

- Managed Futures funds were just barely positive for the month at +0.07%, while YTD Managed Futures funds are the big laggard among primary strategies YTD at -2.32%.

- Among firms with primary regional or country exposure, India-focused funds were the big winner in April, returning +3.53%. YTD returns for India-focused funds are still down however, at -3.70% for the year. China-, Brazil- and Russia-focused funds were all negative for the month of April and are negative YTD.

- On average, funds based in the United States, Continental Europe and the United Kingdom saw positive results in April and so far this year. However, funds based in Asia saw -0.96% returns in April and are down YTD at -0.72%.

Article by Mark Scott, eVestment