The following is a presentation by Gabriel Grego, founder of Quintessential Capital Management, from the 2019 Sohn Hong Kong Conference on Allergan.

Q1 hedge fund letters, conference, scoops etc

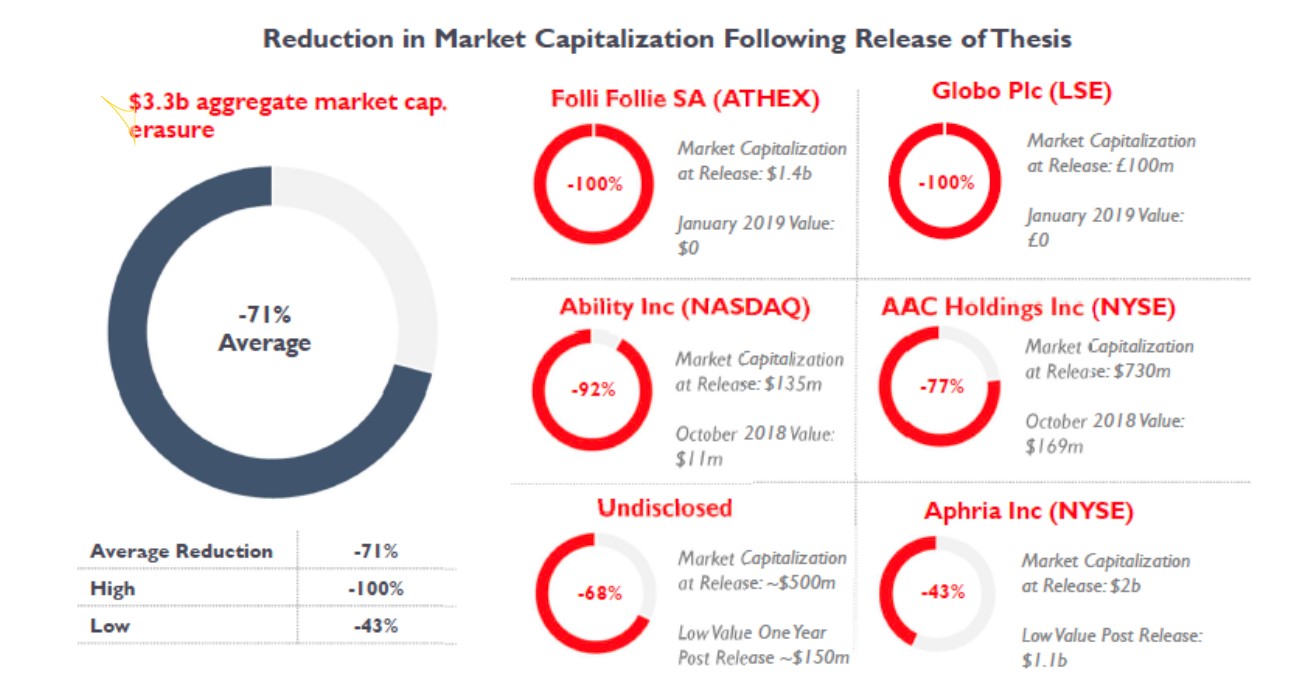

QCM: Effectiveness As Activist

Allergan: Unlocking Value Through Management Changes

QCM May 2019 –

(QCM is long AGN)

Allergan In A Nutshell

- Market Cap: $46b (NYSE)

- Industry: pharma

- Segments: esthetics, general medicine

- Sales: $15.7b

- EBITDA: $7.1b

- Known for: Botox

Challenging Stock Performance (-58% Since 2015)

History

- Formerly Actavis.

- Redomiciled to Ireland (tax inversion)

- Generics division sale to Teva, deleveraging

- M&A spree

- Recent issues:

- Loss of exclusivity

- Serial write offs

- Looming botox competition

- Activist shareholders involved

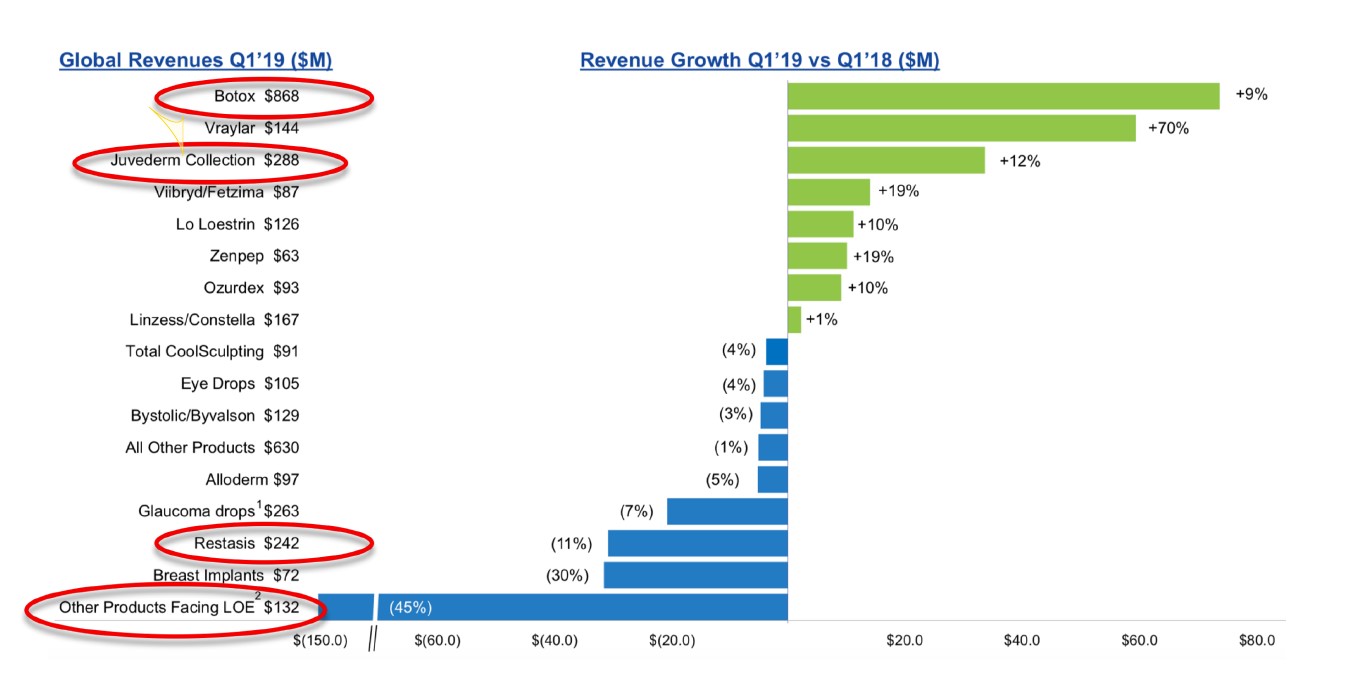

Product Portfolio

Not Exactly A Thriving Business At First Sight…

…But Appearances Can Be Deceptive…

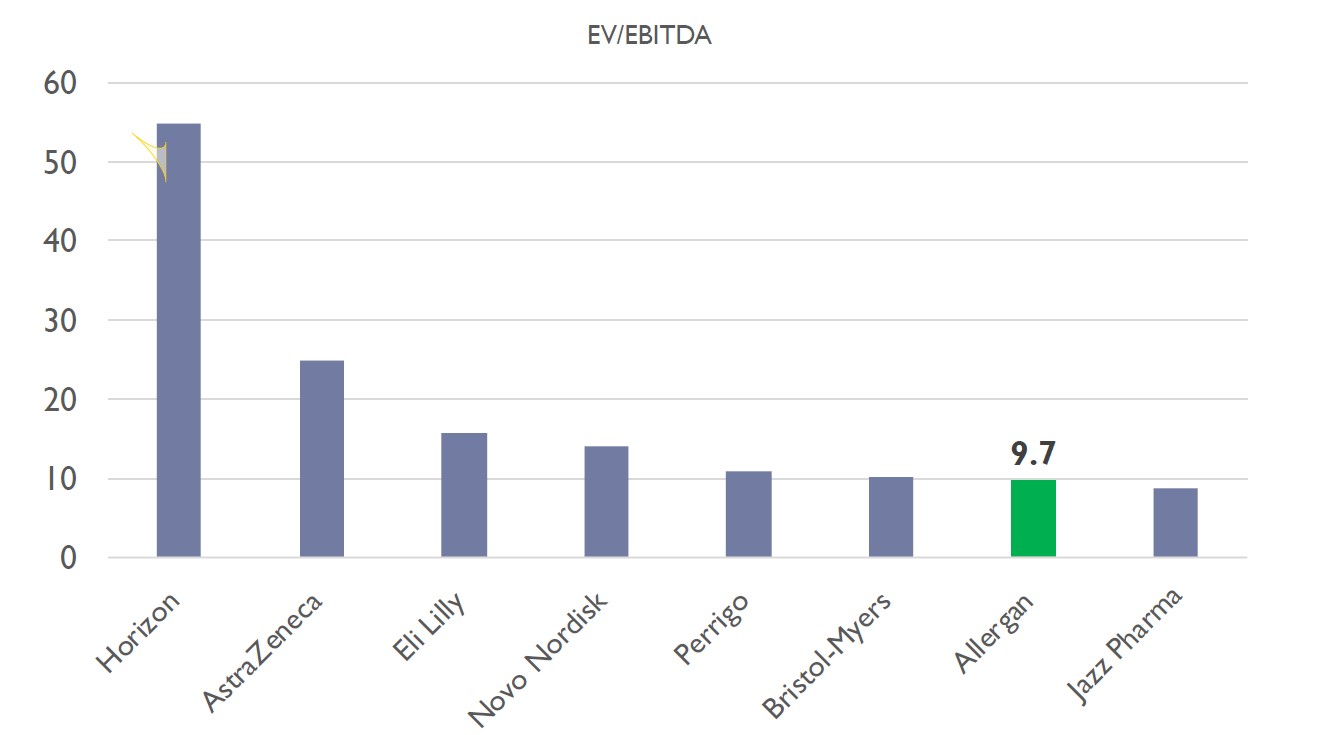

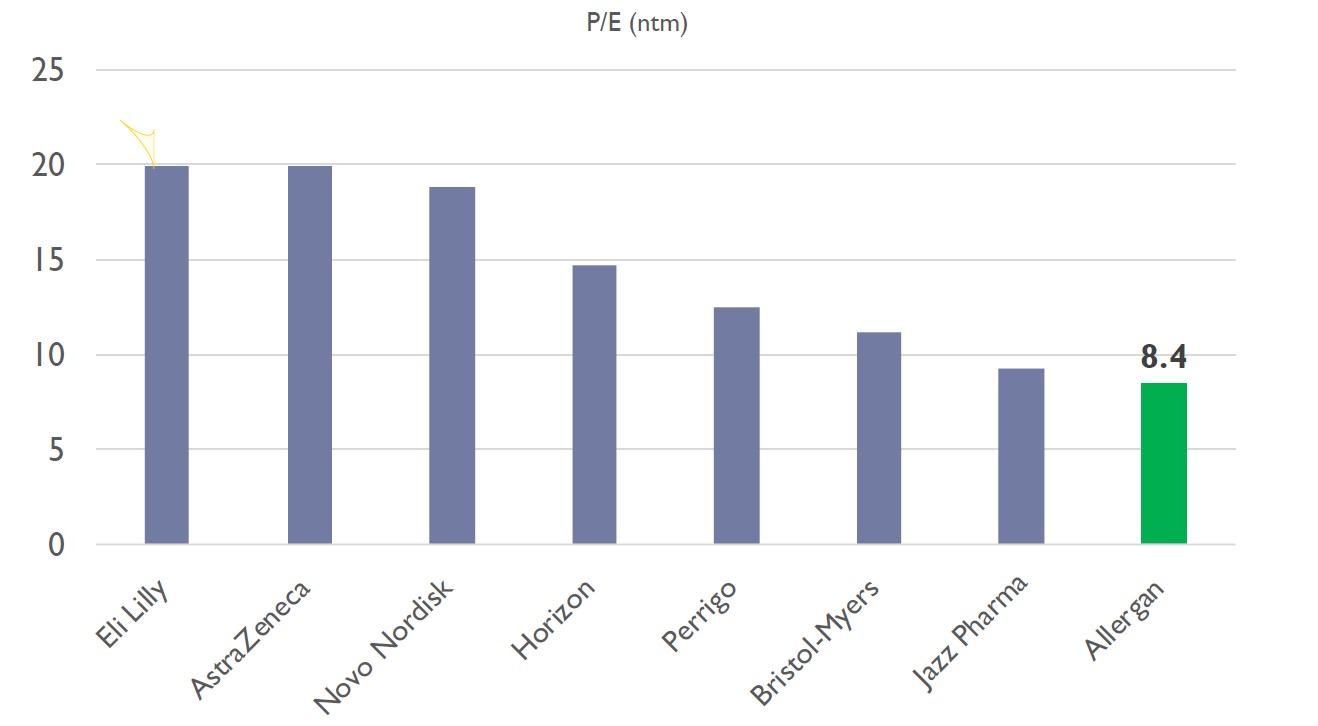

AGN: Inexpensive By Most Measures

EV/EBITDA: 9.7 (vs 13.5 Median*)

Valuation: FWD P/E 8.4 (vs. 17.9 Median*)

Why So Cheap? Plenty Of Uncertainty

- Botox: fear of new competitors

- Write offs: poor management?

- Loss of Exclusivity

- High leverage (3.2x EBITDA)

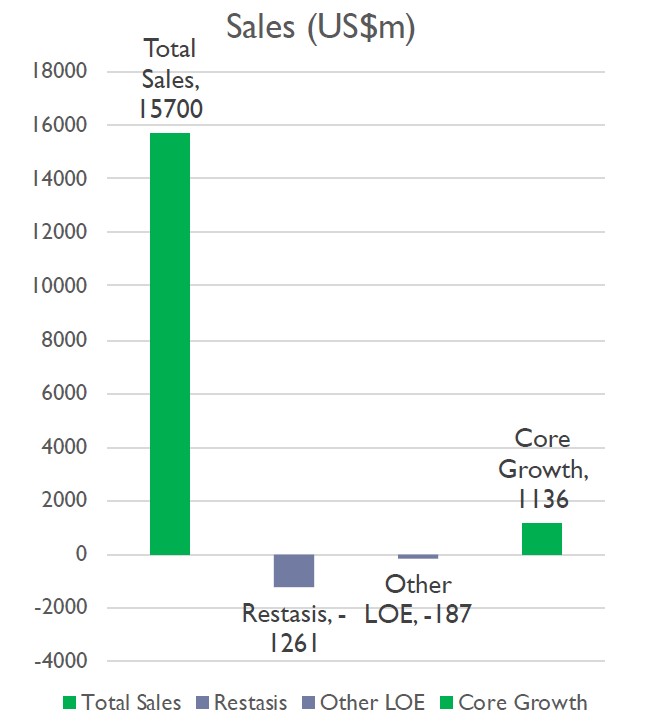

Loss Of Exclusivity: Can Be Managed

- Restasis + other LOE

- Only 9% of sales affected

- Mitigated by core growth*

->little/no impact on valuation

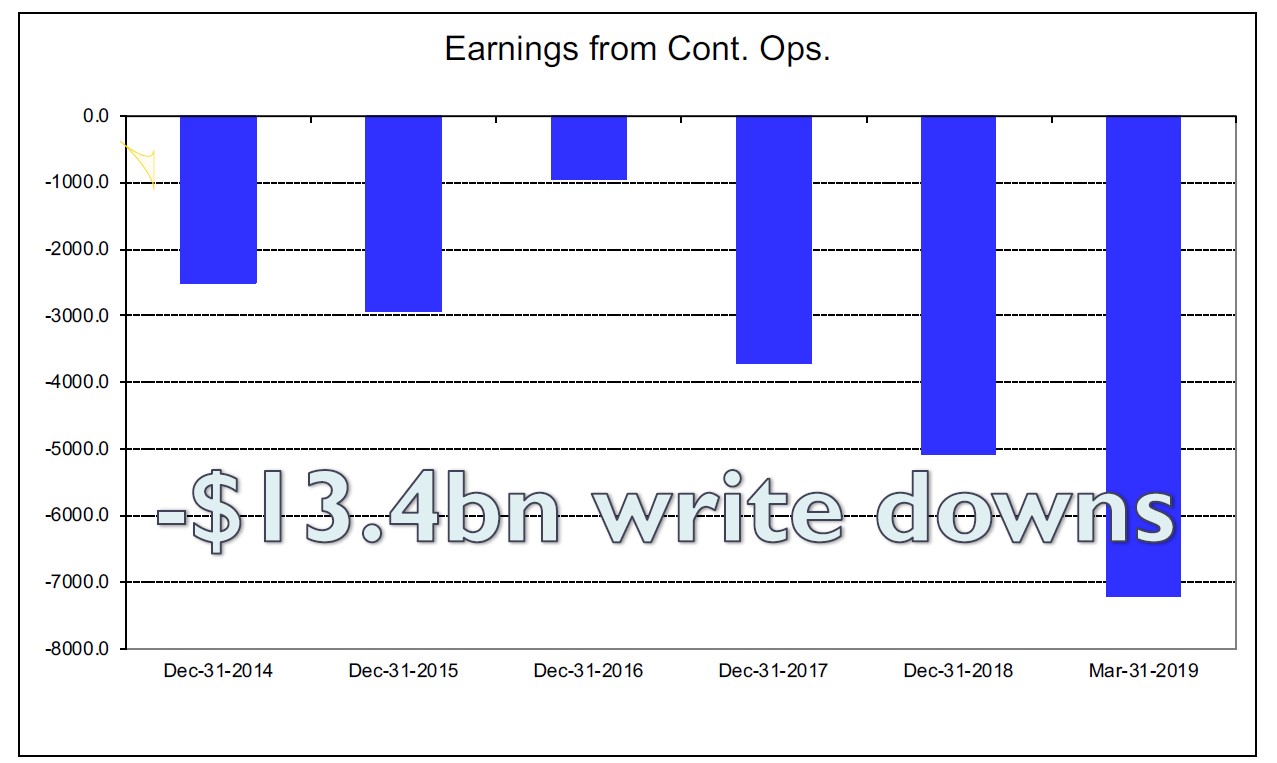

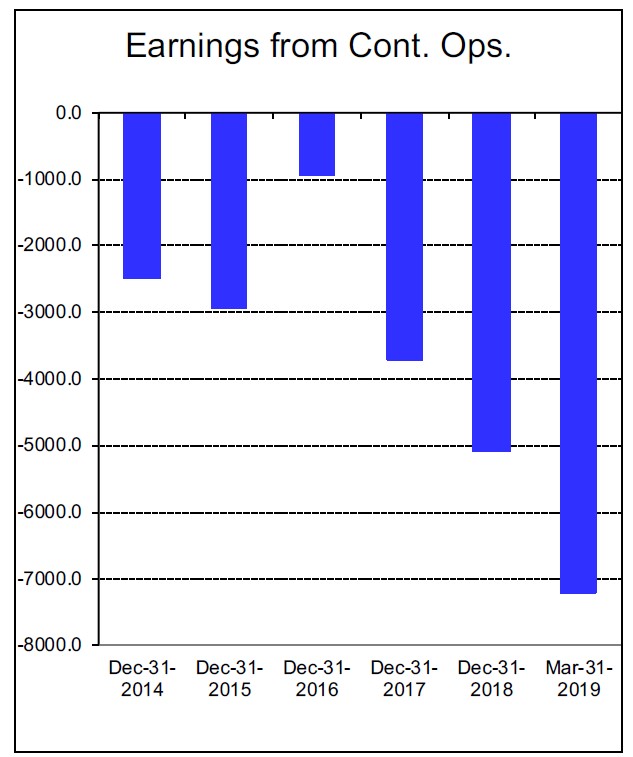

Write Offs: Poor Management?

- Questionable M&A

- Spectacular failures (e.g. Rapastinel)

- No new champions

- $13.4bn of balance sheet write-downs (in 4 years).

- Underperforming pipeline

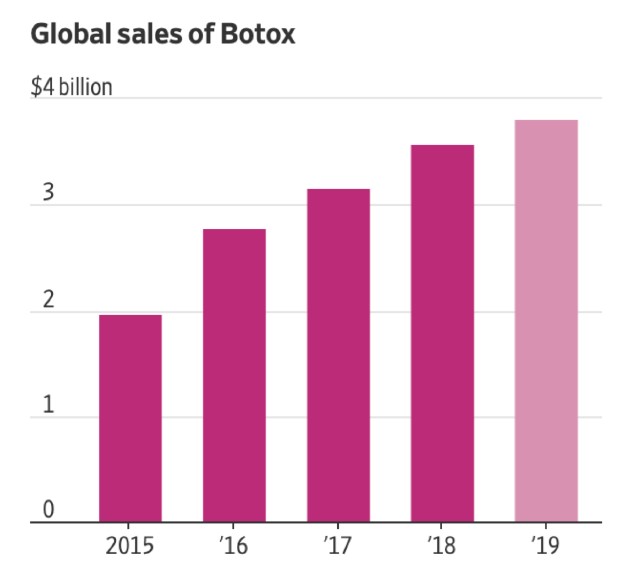

Botox: Great Franchise, But New Competition Looming

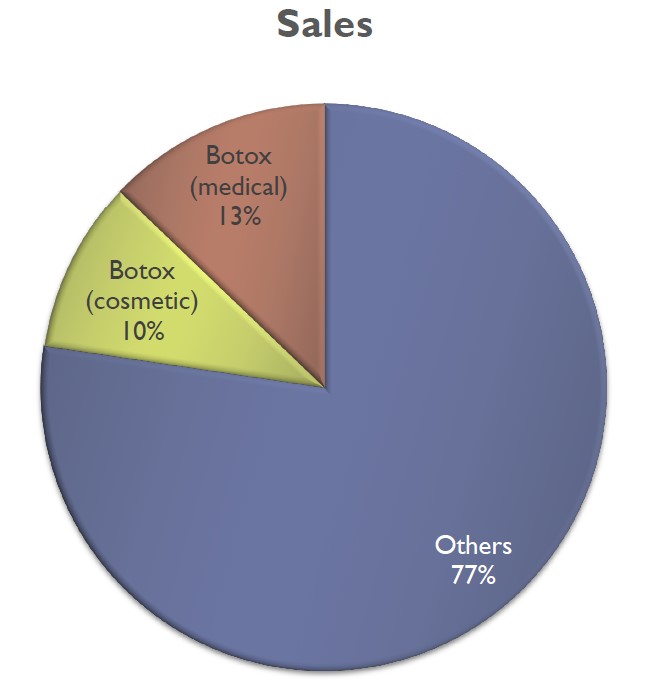

- 24% of total AGN sales

- Fast (9%) growth rate

- Demographic tailwind

- High margin

- Limited regulatory risk (cash-based)

…Still Dominant

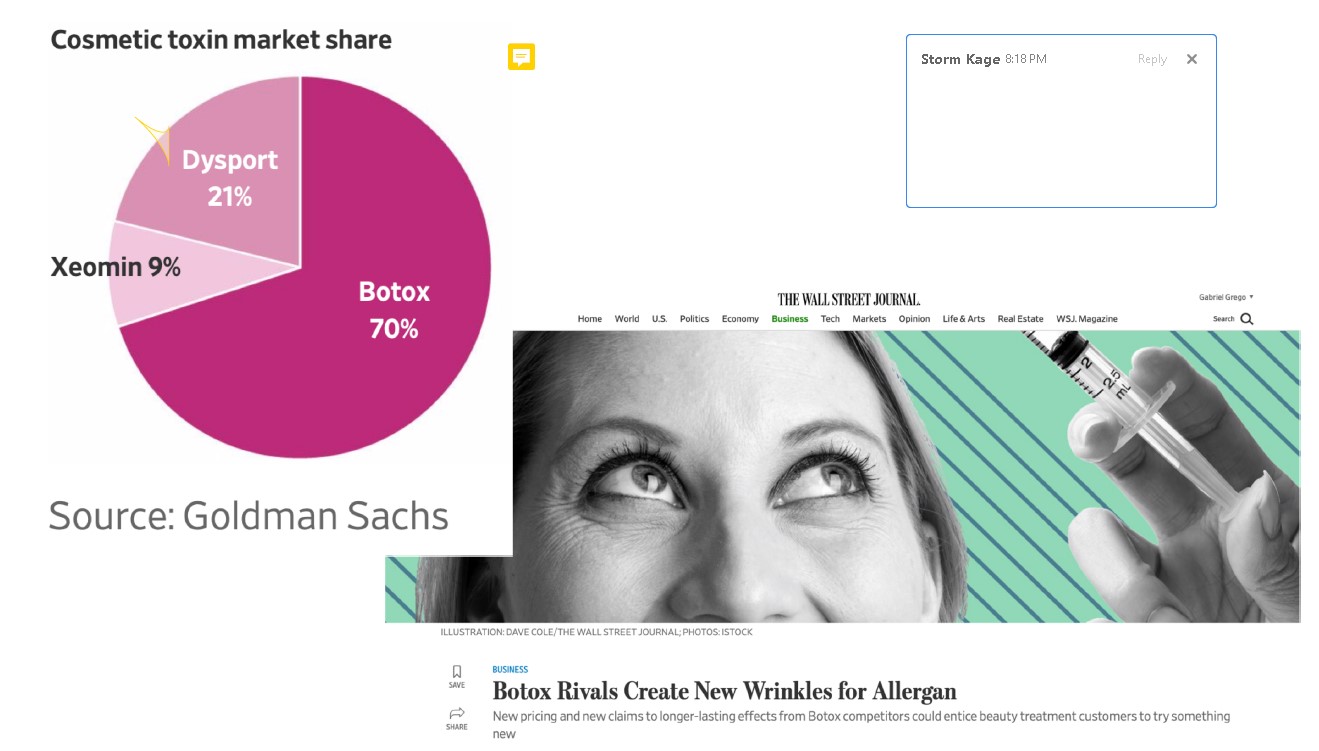

…But New Competitive Threats: Jeuveau

- Jeuveau (by Evolus)

- Seems clinically equivalent

- Marketed aggressively

- Discounts to doctors

- Branding

- Social media

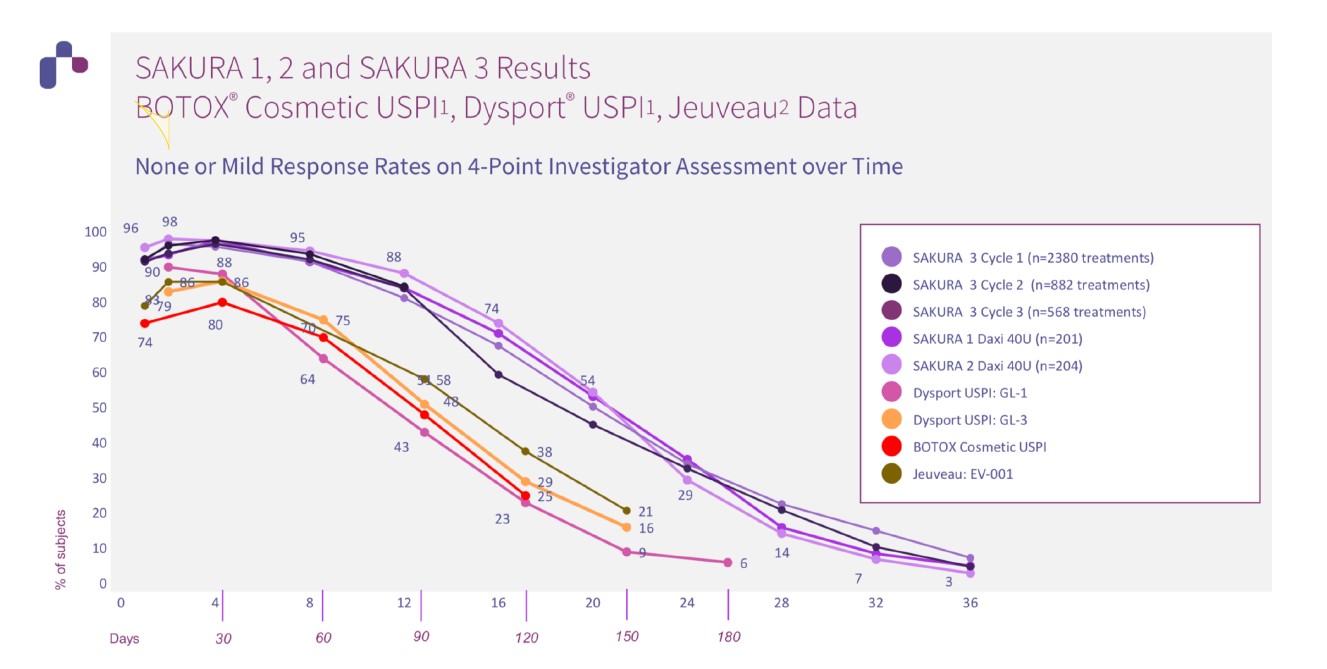

…But New Competitive Threats: Daxi

- Daxi (by Revance)

- Might be approved in 2020 for frown lines.

- Seems to lasts significantly longer than Botox*.

Daxi Clinical Studies

Assessing Competitive Threats: Bull Case

- Brand strength

- Some customer lock-in

- cosmetic portfolio synergies

- Resilience vis-à-vis old, stronger competitors

- Competitors provide little/no new benefits, no clinical history.

- Botox upcoming longer-lasting product

Assessing Competitive Threats: Bear Case

- Some Botox clients will switch, if incentives are large enough.

- Product choice usually driven by doctor, not patient.

- Competitors may provide discounts to doctors.

- Safety profile not an issue (products perceived as nearly equivalent).

- New products may be more effective/longer lasting

Botox Worst-Case-Ccenario: Not So Bad

- Cosmetic Botox: only 10% of AGN’s revenue.

- Medical Botox less threatened.

- Doctors store 2/3 products max. Botox must-have.

- Growing market (CAGR 7.6%) should accommodate new supply

Many Ways To Win…

- Management shakeout

- Total vs biz dev

- Stand still, deleverage & buyback

- Botox fears proven unfounded

- Split cosmetic/medical

- Sale

Notable Investors

- David Tepper (Appaloosa)

- Seth Klarman (Baupost)

Why We Believe Management Has To Go

- Failed M&A policy

- Bad buyback timing

- Questionable compensation

- Lack of candor

- Main reason for depressed stock price

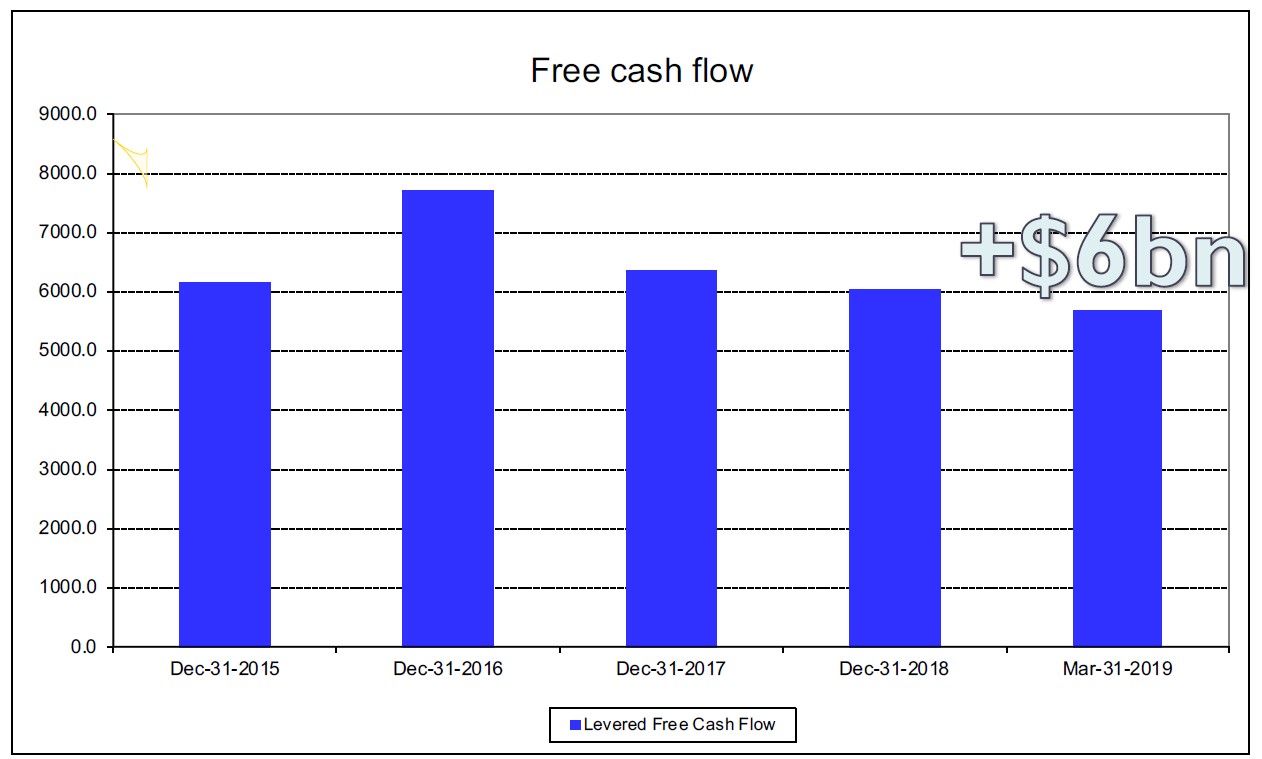

Conclusion

- Strong core portfolio.

- Botox threats probably overblown

- Very strong FCF generation

- Deleveraging & buyback underway

- Price multiple depressed

- Activists safeguarding questionable management