Normally April showers bring May flowers, but last month the spring weather was dominated by sunshine that caused stock prices to blossom to new, all-time record highs across all major indexes. More specifically, the S&P 500 jumped +5.2% last month, the NASDAQ catapulted +5.4%, and the Dow Jones Industrial Average rose +2.7%. For the year, the Dow and S&P 500 index both up double-digit percentages (11%), while the NASDAQ is up a few percentage points less than that (8%).

Q1 2021 hedge fund letters, conferences and more

What has led to such a bright and beaming outlook by investors? For starters, economic optimism has gained momentum as the global coronavirus pandemic appears to be improving after approximately 16 months. Not only are COVID-19 cases and hospitalizations rates declining, but COVID-19 related deaths are dropping as well. A large portion of the progress can be attributed to the 246 million vaccine doses administered so far in the United States.

Blossoming Economy

As a result of the improving COVID-19 health climate, economic activity, as measured by Gross Domestic Product (GDP), expanded by a healthy +6.4% rate during the first quarter. Economists are forecasting second quarter growth to accelerate to an even more brilliant rate of +10%.

As the economy further re-opens and pent-up consumer demand is unleashed, activity is sprouting up in areas like airlines, hotels, restaurants, bars, movie theaters and gyms. An example of consumer demand climbing can be seen in the volume of passenger traffic in U.S. airports, which has increased substantially from the lows a year ago, as shown below in the TSA (Transportation Security Administration) data.

Source: Calafia Beach Pundit

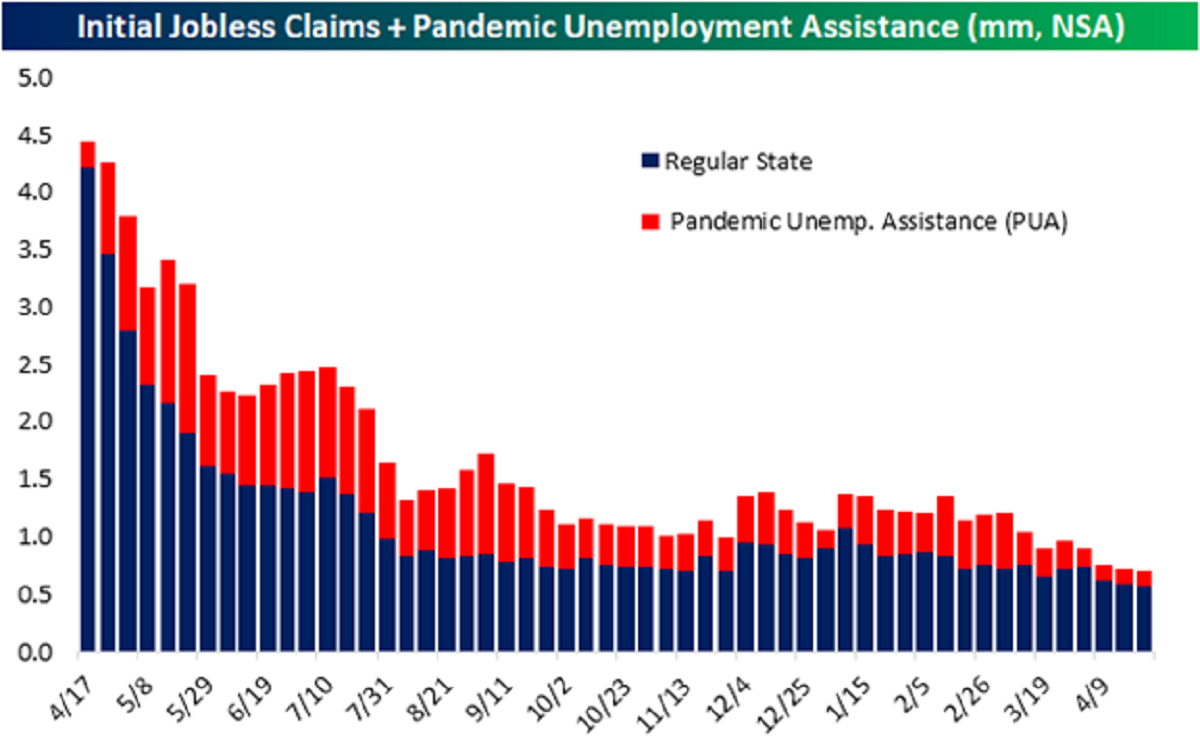

A germinating economy also means a healthier employment market and more jobs. The chart below shows the dramatic decline in the number of jobless receiving benefits and pandemic unemployment assistance.

Fed Fertilizer & Congressional Candy

Monetary and fiscal stimulus are creating fertile ground for the surge in growth as well. The Federal Reserve has been clear in their support for the economy by effectively maintaining its key interest rate target at 0%, while also maintaining its monthly bond buying program at $120 billion – designed to sustain low interest rates for the benefit of consumers and businesses.

From a fiscal perspective, Congress is serving up some sweet candy by doling out free money to Americans. So far, roughly $4 trillion of COVID-19 related stimulus and relief have passed Congress (see also Consumer Confidence Flies), and now President Biden is proposing roughly an additional $4 trillion of stimulus in the form of a $2 trillion jobs and infrastructure plan and a $1.8 trillion American Families Plan.

Candy and Spinach

While Congress is serving up trillions in candy, eventually, Americans are going to have to eat some less appetizing spinach in the form of higher taxes. Generally speaking, nobody likes higher taxes, so the question becomes, how does the government raise the most revenue (taxes) without upsetting a large number of voters? As 17th century French statesman Jean-Baptiste Colbert proclaimed, “The art of taxation consists in so plucking the goose as to get the most feathers with the least hissing.”

President Biden has stated he will only increase income taxes on people earning more than $400,000 annually and increase capital gains taxes for those earning more than $1,000,000 per year. According to CNBC, those earning more than $400,000 only represents 1.8% of total taxpayers.

Bitter tasting spinach for Americans may also come in the form of higher inflation (i.e., a general rise in a basket of goods and services), which silently eats away at everyone’s purchasing power, especially those retirees surviving on a fixed income. Federal Reserve Chairman Jerome Powell sees any increase in inflation as transitory, but if prices keep rising, the Federal Reserve will be forced to increase interest rates. Such a reversal in rates could choke off economic growth and potentially force the economy into a recession.

If you strip out volatile energy prices, the good news is that underlying inflation has not spiraled higher out of control, as you can see from the chart below.

Source: Calafia Beach Pundit

In addition to the concerns of potential higher taxes, inflation, and rising interest rate policies from the Federal Reserve, for many months I have written about my apprehension about the speculation in SPACs (Special Purpose Acquisition Companies) and cryptocurrencies like Bitcoin. There are logical explanations to invest selectively into SPACs and purchase Bitcoin as a non-correlated asset for diversification purposes and a hedge against the dollar. But unfortunately, if history repeats itself, speculators will eventually end up in a pool of tears.

While there are certainly some storm clouds on the horizon (e.g., taxes, inflation, rising interest rates, speculative trading), April bloomed a lot of flowers, and the near-term forecast remains very sunny as the economy emerges from a global pandemic. As long as the government continues to provide candy to millions of Americans; the Federal Reserve remains accommodative in its policies; and the surge in pent-up demand persists to drive economic growth, we likely have some more time before we are forced to eat our spinach.

Wade W. Slome, CFA, CFP®

Plan. Invest. Prosper.

This article is an excerpt from a previously released Sidoxia Capital Management complimentary newsletter (May 3, 2021). Subscribe on the right side of the page for the complete text.

DISCLOSURE: Sidoxia Capital Management (SCM) and some of its clients hold positions in certain exchange traded funds (ETFs), but at the time of publishing had no direct position in GME or any other security referenced in this article. No information accessed through the Investing Caffeine (IC) website constitutes investment, financial, legal, tax or other advice nor is to be relied on in making an investment or other decision. Please read disclosure language on IC Contact page.

Article by Investing Caffeine