“Davidson ” submits:

Q4 hedge fund letters, conference, scoops etc

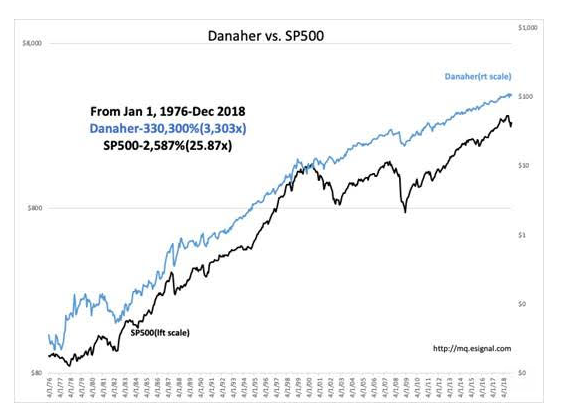

Are the growth companies the F.A.N.G. type issues which occur every investment cycle or simply well managed but typically over-looked basic year-over-year improvers of our standards of living? The answer lies in the story of Danaher(DHR), which most of Wall Street tends to ignore, and companies operated similar to DHR. The performance history from Jan 1976 thru Dec 2018 of 330,300% compared to that of the SP500’s 2,587%(more than 100x higher return) so stretches one’s imagination as to what is possible that such a record receives a typical dismissive response that not only is this not possible but that it is not repeatable. Largely missed by Wall Street is that the long-term performance of the major indices is determined by companies like DHR. What is a growth company? F.A.N.G.-type or DHR-type?

The better companies are the DHR-types.

The truth behind well-managed companies is that Wall Street does not understand them. Currently taught financial analysis techniques are heavily reliant on mathematical models adjusted quarter-over-quarter. The short-term reliance on mathematical analysis misses entirely the basis of long-term sustained corporate performance as responsible for price performance. The basis for long-term performance rests squarely on management culture. One needs to learn to listen carefully to management. The better management cultures spell out what they plan to do and what they expect the outcomes to be. Investment analysis then monitors this process and the outcomes. Crucial to this type of analysis is how management behaves during periods of business stress, i.e. unexpected down-turns. Identifying which managements qualify as ‘well-managed’ is a skill derived from actual investment experience over an investment cycle. Academic programs have no focus on this aspect of business.

Multiple years of studying management’s performance reveals that corporate culture is correlated to share performance over the long-term. A focus on corporate culture does not fit any mathematical model. Understanding corporate culture requires developing judgement regarding management decision-skillsets over a broad range of business activity including but not limited to selecting other key management personnel, product/service offerings, acquisitions, business extensions and investor presentation skills. Identifying the better managements, developing one’s own investment judgement, comes from experience which is something that cannot be taught. It couples close attention to management’s decisions with business financials and investor responses. DHR’s long-term performance results from strong corporate business culture consistently renewed. Even with changes in management, DHR’s corporate culture remained on course.

A focus on management culture produces intangible recommendations. Wall Street analysis provides tangible price forecasts based on multiples for EPS(Earnings Per Share), CF&FCF(Cash Flow&Free Cash Flow) or other specific financial outcomes. These are issued quarter-to-quarter. Specific investment price targets are never possible in my opinion. While specific price targets provide psychological comfort to investors, the eventual pricing relies on the market psychology at some point in the future for which no mathematical solution is possible and influenced by events no one could possibly predict. Yet, specific forecasts are routinely provided and just as routinely revised leaving with investors in a quandary with the reliability of the original research. The use of mathematical models imply guaranteed outcomes by Financial Planners. Investors are given a false sense of security in my opinion for which there is no basis. Markets have consistently evolved with human innovation, invention and geopolitical events none of which has ever been predicted. Those providing advisory services use past trends to predict the future. These models have never predicted or prevented injury to investors as their marketers often claim. It is far better to be aware of the many themes in flux and invest with management teams who have demonstrated exceptional skills adjusting to previous downturns.

A management culture focus forecast only offers the expectation but no guarantee that share prices are likely to be higher or lower. The focus on management capability cuts across every business sector, i.e. it is not industry or sector dependent. There are no comparisons to the valuations of sectors or other businesses. Each company has its own unique relationship to investors, i.e. investor psychology is company specific. Each company develops its own ‘Recency Effect’. The Recency Effect is the evolving market psychology regarding share pricing over a period of multiple reporting periods, usually observed over 18mos-60mos.

These 6 specific companies serve as good examples of current investment opportunities well below their historical market pricing. They include Multi-Color(LABL), Exxon Mobil(XOM), Fastenal(FAST), Kansas City Southern(KSU), Beacon Roofing(BECN) and Neogenomics(NEO). They span a wide range of sector. FAST and KSU are shown with the Chemical Activity Barometer(CAB), a reliable indicator of general economic activity that remains quite positive.

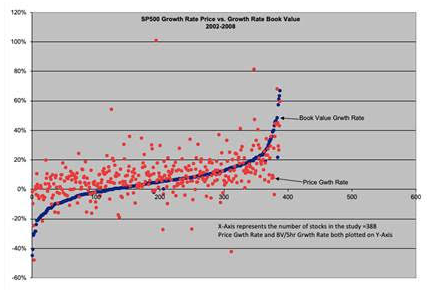

What distinguishes the ‘New, New Thing” from the “True&Tried” but well-managed is the long-term performance of building shareholder equity. Shareholder equity has been shown to be highly correlated with share price performance over a market cycle. For those with a statistical background, you will appreciate a P value of 0.001, “highly statistically significant”. The companies which qualify as potential investments include the 6 issues used as examples and DHR. The company, once identified, is assessed for its relative level of market psychology. The Recency Effect provides a trend of market pricing metrics which guide to buying when pricing is low and selling when pricing is elevated. This is a 2yr-5yr investment perspective which is monitored weekly. These companies are not unique in the products and services they provide. They all fit the common theme of standard of living improvements. What they do is to operate consistently profitably, increasing net income, dividends and shareholder equity on a per share basis.

In contrast are the F.A.N.G. type companies which are present in every business cycle. They represent the “New, New Thing”, which explode in price to high valuations. In this cycle, as has been typical in past cycles, investors apply unusual metrics to justify market pricing which sound managements would never consider. F.A.N.G.-type issues spend capital to drive revenue growth leaving Net Income and Shareholder Equity out of consideration. Eventually, history looks back at F.A.N.G. type companies as relatively short-lived speculations commonly referred to as Momentum issues. The pricing of Momentum driven stocks is directly related to their favorable news coverage rather than their underlying business financial metrics.

Markets are what they are: A collection of investor types broadly defined as Momentum and Value Investors. Typically in a cycle, it is the Momentum issues which dominate the media content to such a degree that one is rarely made aware of any other possibility. It is the Momentum issues which provide the boom and bust most investors experience. It drives most market participants to attempt to be traders of the Momentum issues. The majority of investors believe incorrectly that price trends represent real corporate growth. The reality is that true long-term shareholder value is created outside the media limelight as in the examples discussed. Of the 3,000 issues in the Russell 3000 Index, roughly 3%(about 100 issues) qualify as companies with seasoned skilled management cultures. These are the true growth companies in my opinion.

The Investment Process: Learn how to identify the companies with the better corporate cultures. Think long-term, 2yr-5yr. Monitor everything weekly including existing and emerging economic themes to be aware of longer-term threats to one’s portfolio. Buy a portfolio of issues(~50 issues equally allocated) when prices are low, sell when prices are high. Repeat!