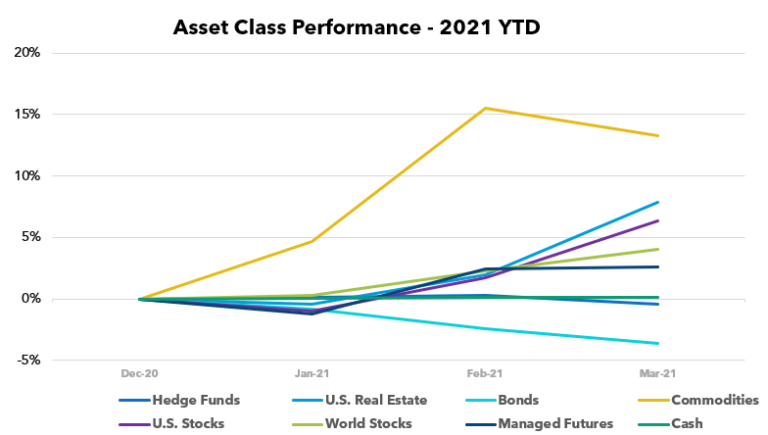

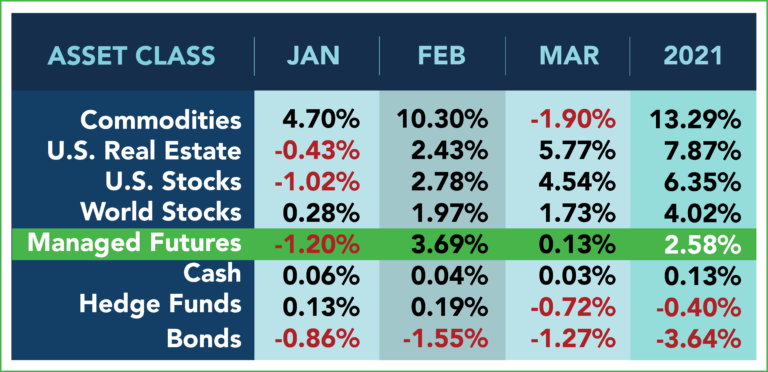

Commodities have been the biggest topic so far this year, but we saw a small dip in performance in March due to the (unforeseen) bullish report released by USDA. Commodities are expected to pick back up in the following months, and overall are still performing high with positive double-digit returns for the year.

Q1 2021 hedge fund letters, conferences and more

In other news, real estate and stocks are holding their position in the middle while bonds are continuing their downward trajectory, looking like they’re getting no help any time soon.

Past performance is not indicative of future results.

Past performance is not indicative of future results.

Sources: Managed Futures = SocGen CTA Index,

Cash = US T-Bill 13 week coupon equivalent annual rate/12, with YTD the sum of each month’s value,

Bonds = Vanguard Total Bond Market ETF (NYSEARCA:BND),

Hedge Funds = IQ Hedge Multi-Strategy Tracker ETF (NYSEARCA:QAI)

Commodities = iShares S&P GSCI Commodity-Indexed Trust ETF (NYSEARCA:GSG);

Real Estate = iShares U.S. Real Estate ETF (NYSEARCA:IYR);

World Stocks = iShares MSCI ACWI ex-U.S. ETF (NASDAQ:ACWX);

US Stocks = SPDR S&P 500 ETF (NYSEARCA:SPY)

All ETF performance data from Y Charts

Article by RCM Alternatives