In his latest piece titled – Disclosure Dilemma: When more (data) leads to less (information)!, Aswath Damodaran explains why greater disclosure is actually hurting investors rather than helping them saying:

Q2 2021 hedge fund letters, conferences and more

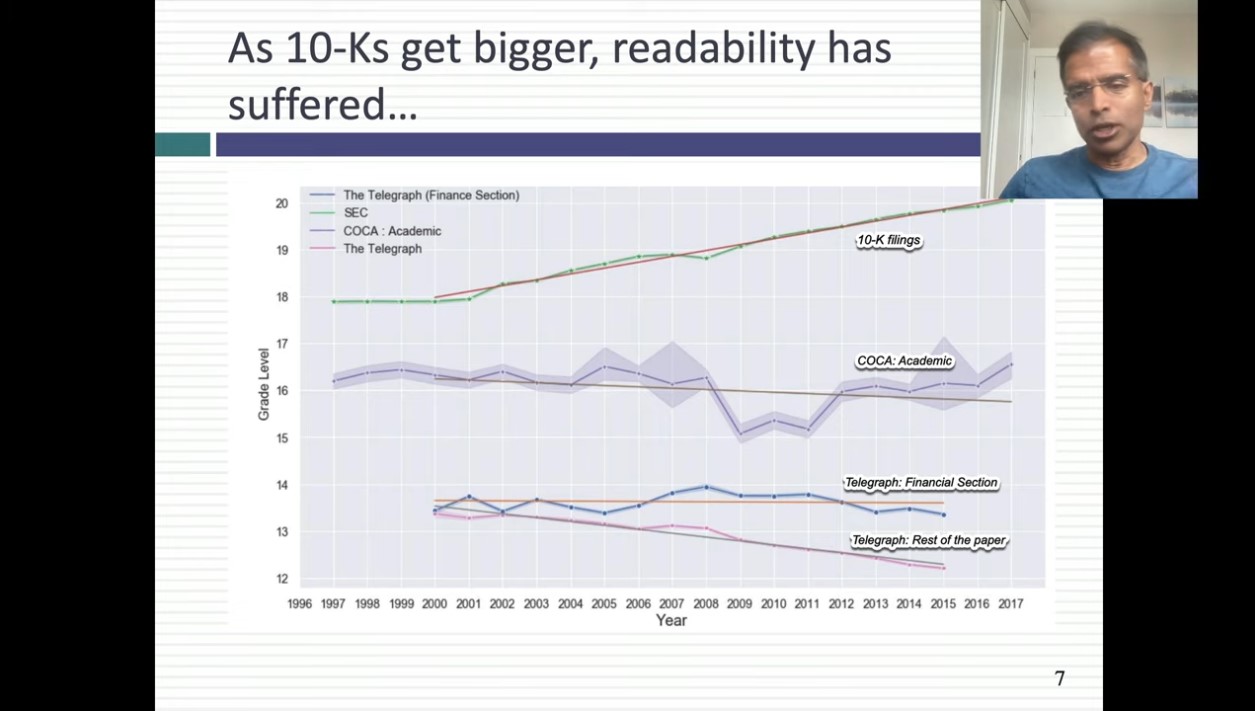

As companies disclose more and more, investors should be becoming more informed and valuing/pricing companies should be getting easier, right?

In my view, the answer is no, and I think that investors are being hurt by the relentless urge to add more disclosures. I am not the first, nor will I be the last one, arguing that the disclosure demon is out of control, but many of the arguments are framed in terms of the disclosure costs exceeding benefits, but these arguments cede the high ground to disclosure advocates, by accepting their premise that more disclosure is always good for investors and markets.

On the contrary, I believe that the push for more disclosure is hurting investors and creating perverse consequences, for many reasons:

- Information Overload

- Feedback Loop

- Cater To The Audience

- Make It About The Future Not The Past

- Mission Confusion

You can read the entire article here:

Aswath Damodaran: Disclosure Dilemma: When more (data) leads to less (information)!

For all the latest news and podcasts, join our free newsletter here.

Article by The Acquirer’s Multiple