Bronte Amalthea Fund commentary for the month of December 2018.

Q3 hedge fund letters, conference, scoops etc

US markets had their worst December since the great depression year of 1931, but the month was a very good one for Bronte. Good enough also to make it an okay quarter despite October and especially November being somewhat patchy.

Our shorts, in mostly over-hyped and over-levered companies, worked quite well. Our longs in generally high-quality companies declined by only one-third as much as the market average. No long “misbehaved” in December despite the poor market conditions, whereas in each of October and November a single (but not the same) long significantly degraded our performance.

Pleasingly, across the month, our shorts went down much more than our longs. This was particularly pronounced before the December 26th rally. At that point, we were up for the month while the US market was down 15% percent. On December 26, the US market rose about 5 percent and we were approximately flat. The post-Christmas market has been quite strong, but we have gained only a little.

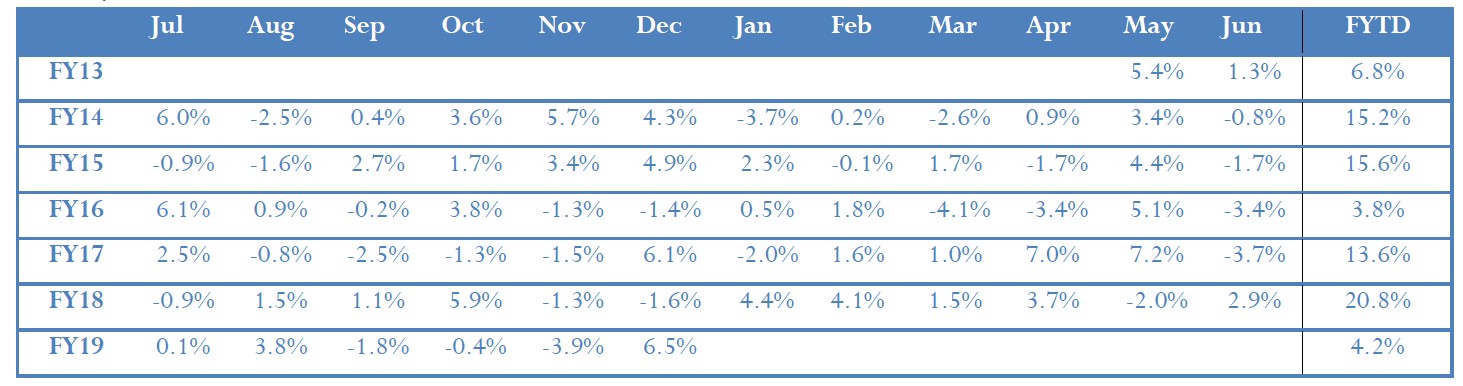

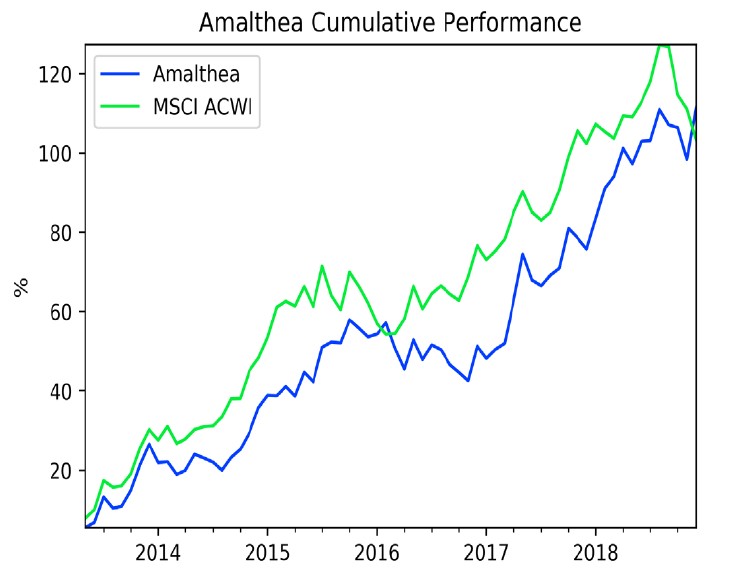

This capped a good 2018, where we made money on both our long and our short books. Just how good a year can be seen comparing Bronte to the main global indices.

This is especially pleasing given just how poorly the German index performed, as Germany is our largest country of long exposure. We were – in a macro-sense – poorly positioned for the year but decent stock-picking made up for it.

There are more truly great companies in America than in Europe. California alone probably has more great companies than any single European country. But it is easier in Europe to find great companies at less than nose-bleed valuations. We thus remain overweight Europe despite a decade of underperformance by European indices. This positioning has not served us well, but at current valuations we are not inclined to change.

We are hopeful that in a market downturn, America’s great companies retreat to values at which we are happier to buy. Alas it hasn’t happened yet.

The good December has, as fortunate outcomes sometimes do, made our task at Bronte slightly difficult. Our basic model is to short low quality, typically heavily promoted, companies and go long very good companies that we buy with the intention of holding for a very long time.

True bear markets spare almost nobody: even good quality companies decline in price. We expect to episodically lose money on our longs. But (hopefully) our shorts will decline more, thereby protecting most of your value.

Even more importantly, the shorts deliver cash we can deploy into buying more high-quality companies when their valuations are more attractive. She with the biggest pile of high-quality assets at the end wins. We plan to reach this nirvana by shorting the trashier end of the market – and converting the gains into high quality assets purchased at attractive prices.

Our current positioning

We are less long than our default positioning and we still find it easy to discover shorts (and are comfortable with our short book). This has served us well of recent times, but we would love to be longer. A downside of our portfolio construction is that when markets rally our shorts bounce much harder. Generally, these stocks offer their owners hopes and dreams, and when fear departs hope will rush back in to fill the vacuum – often assisted by panicked covering from over-extended short sellers.

Nonetheless, despite the pull-back, we haven’t found too much we are comfortable buying. As noted above, in the very strong markets between Christmas and New Year we were approximately flat. We missed out on the bounce almost entirely. Should the market further rediscover its animal spirits we will struggle to keep up.

But we have found a few atypical longs. During our latest overseas research trip we visited several small-cap companies, mostly with the intention of cross-checking other positions. Serendipitously we found some of them to be worthwhile quality investments. Liquidity and size constraints mean these small caps (based in French Canada and Switzerland) will never amount to more than a few percent of the portfolio. We think they will work well though.

These small-caps are helpful, but our main goal is new 8-10 percent positions we can hold for decades. This is, of course, our endless quest, but is made more necessary and more pressing by December’s market plunge and the gains generated from our short book.

Thanks again for the trust you have placed in us.

The Bronte team