He’s right, for the long-term holder, now is the time to add or initiate new positions. You may not catch the bottom but, as I’ve always said, “fortunes are made in bear markets”. It is when buyers get the best prices.

Q2 2022 hedge fund letters, conferences and more

“Davidson” submits:

Every day, the loudest voices are coupled to price shifts declaring one economic outcome or another. These are amplified in the media which is geared to Google searches driving the daily programming indicating the highest daily investor interest. The media is about maximizing advertising revenue and is unconnected to economic reality beyond that. This coupling of market psychology to economics without support of fundamentals, especially when delivered with the certainty of fact (which it is not), makes investing as a contrarian seem perilous. But, the contrary position to a market trend driven by overly-weighted consensus is always the path to the better profits. It is called Value Investing. But, one must filter out correctly the data the consensus has buried in the noise and decide if it overrides that view. History is a good guide. No recession has ever been predicted correctly by the consensus. Today, it is estimated that 90%+ of advisors predict recession. Consensus is always priced in the market. With recession pricing, one has to search for what is not part of the discussion.

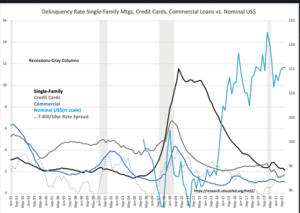

Inverted yield curve, debt delinquencies rising, US$ strength destabilizing the global economy, rising rates, rising inflation and layoffs at tech companies are the headlines. Some of this is correct, some is not and most is not meaningful when it is sorted and the value of each is considered. The one fundamental ruling them all is debt delinquency. Delinquency Rate…Nominal US$ correlates prominent indicators with recession periods quarterly from Jan 1991. Every major recession has an identical factor i.e., excess consumption leading to rising defaults in all areas of credit prior to the eventual correction. This condition has always been accompanied by the T-Bill/10yr Treas rate spread narrowing as investors shifted reserve capital into longer maturity investments seeking higher returns thus leaving them without a safety net. This bears repeating: Rising T-Bill rates into rising 10yr Treas rates indicating a high level of speculation. An event occurs which results in a normal panic reaction with investors pulling back a little. But, rather than having some reserve to weather the event, investors are forced to sell longer-term assets. This is a liquidity squeeze caused by investors having placed themselves by their bullishness into an ‘imbalance of asset maturities’. Having committed all capital to longer-term assets as shown by T-Bills rising to invert high 10yr Treas rates, forces a correction across all assets leading to additional debt defaults from an already high level. A recession ensues no one expected.

Financial recessions have a rising delinquency pattern well established prior to onset. This is present in every recession. The data is from Jan 1991 and reveals this clear pattern in all areas of credit, home mtgs, credit cards and commercial loans. It is unmistakable. The T-Bill/10yr Treas has in the past always provided a complementary inversion. A rising US$ indicting capital seeking safety in the US has also been a feature. $WTI(West Texas Crude price) declining is part of the response and is now firmly part of algorithmic hedging. This chart uses the revised Nominal US$, a broad currency trade weighted index incepted from 2006, but the same pattern is present in the earlier US$ indices for 75yrs+. What makes this time different is that the consensus call for recession is not supported by any indication of the financial distress present in every prior financial recession. It is important to note that the COVID Recession was self-inflicted when financial conditions were very sanguine. The COVID Recession lasted 1mo, March 2020-April 2020, as a result. Some, even today, declare economic weakness requires stimulus. Headlines rarely proclaim commonsense.

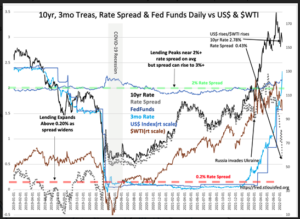

The 10yr, 3mo Treas Rate Spread… daily reflects a panic reaction to not only severe energy supply issues in EU but in recent days an attempt to impose a farming ban in The Netherlands as part of forcing less fossil fuel use and less greenhouse gas generation. The response was to drive the US$ sharply higher, the 10yr rates lower and T-Bill rates higher as investors sought to hedge portfolios by selling oil futures lower which required shifting capital out of T-Bills. It is this panic which is driving yield curve towards inversion in my analysis. Panic not speculation! This is a unique condition and a response to self-imposed regulations to “Global Warming” for which there is no evidence.

Net/net it looks scary but financial conditions are not risky. This is yet another panic, unique in that there is no precedent, leaving those following past patterns without guidance if they ignore fundamentals.

This mess is an equity buying opportunity!!