The post was originally published here.

Highlights:

- Over the past 9 years, Disney saw a 5% CAGR revenue growth

- Streaming platform Disney+ comprises new growth engine

- Fast recovery of theme parks could drive revenue rebound

Q2 2022 hedge fund letters, conferences and more

Download the full report as a PDF

How Walt Disney actually makes money

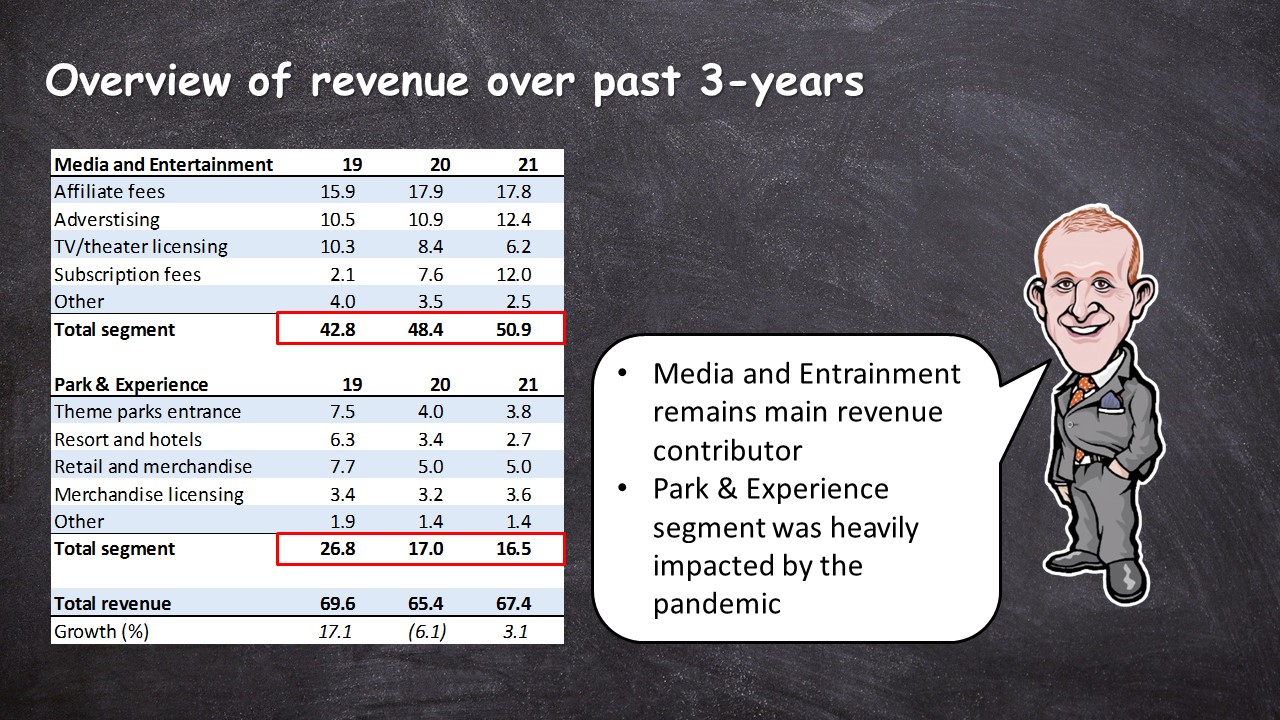

Overview of revenue over past 3-years

- Media and Entrainment remains main revenue contributor

- Park & Experience segment was heavily impacted by the pandemic

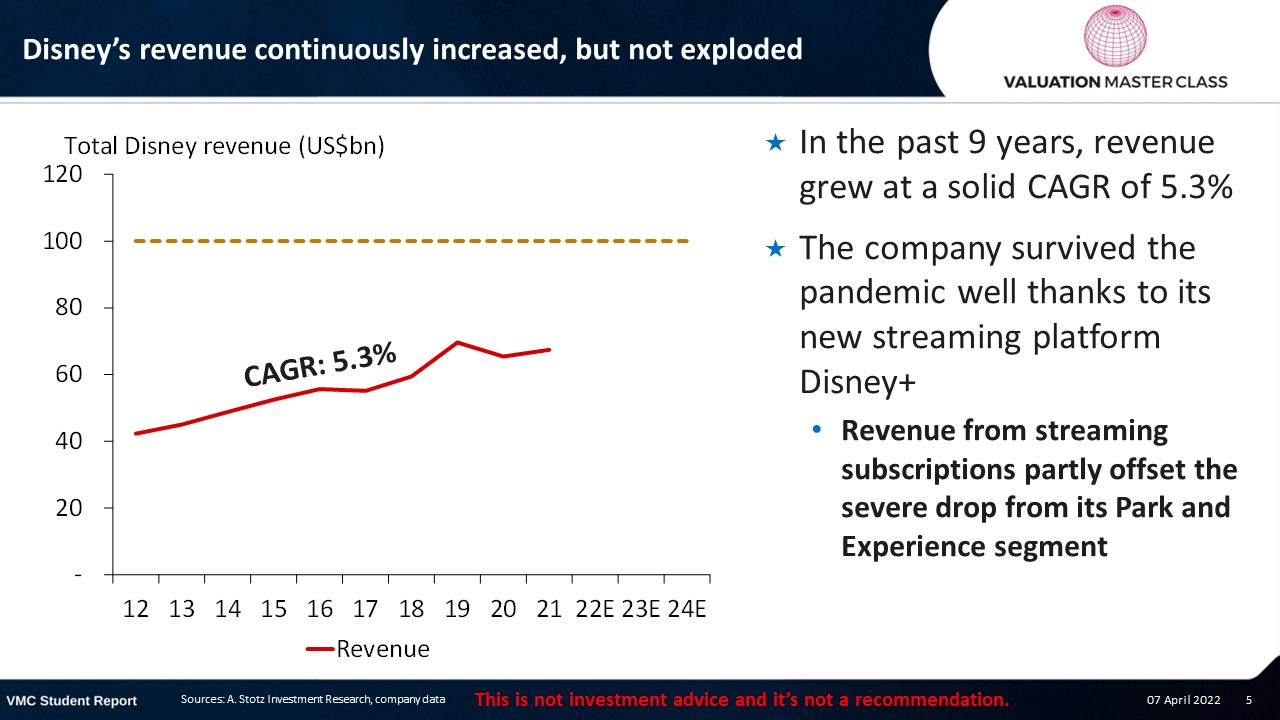

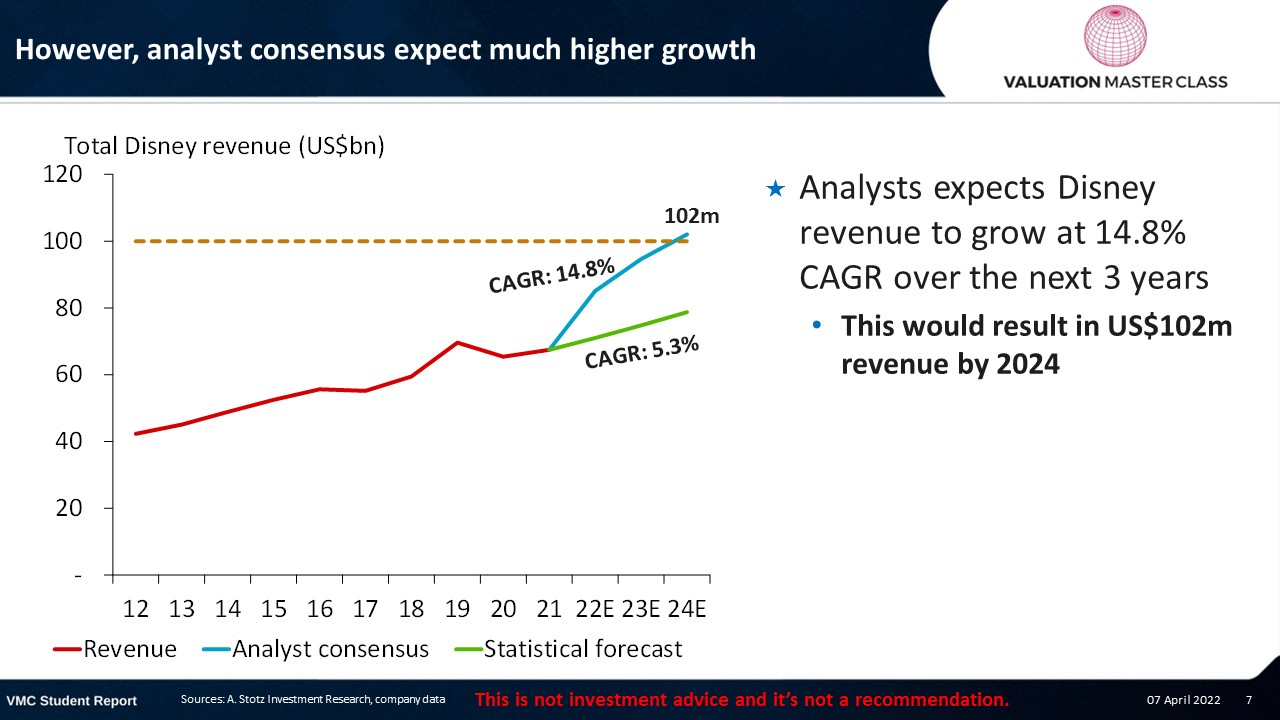

Disney’s revenue continuously increased, but not exploded

- In the past 9 years, revenue grew at a solid CAGR of 5.3%

- The company survived the pandemic well thanks to its new streaming platform Disney+

- Revenue from streaming subscriptions partly offset the severe drop from its Park and Experience segment

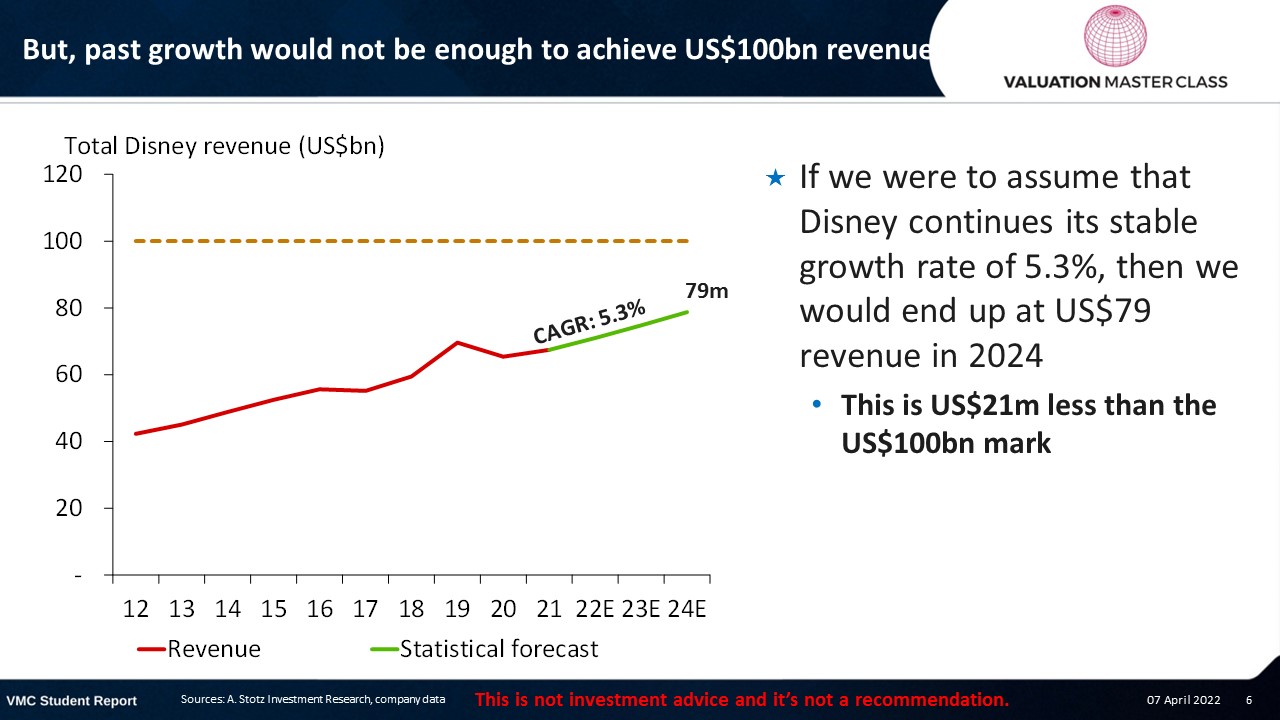

But, past growth would not be enough to achieve US$100bn revenue

- If we were to assume that Disney continues its stable growth rate of 5.3%, then we would end up at US$79 revenue in 2024

- If we were to assume that Disney continues its stable growth rate of 5.3%, then we would end up at US$79 revenue in 2024

However, analyst consensus expect much higher growth

- Analysts expects Disney revenue to grow at 14.8% CAGR over the next 3 years

- This would result in US$102m revenue by 2024

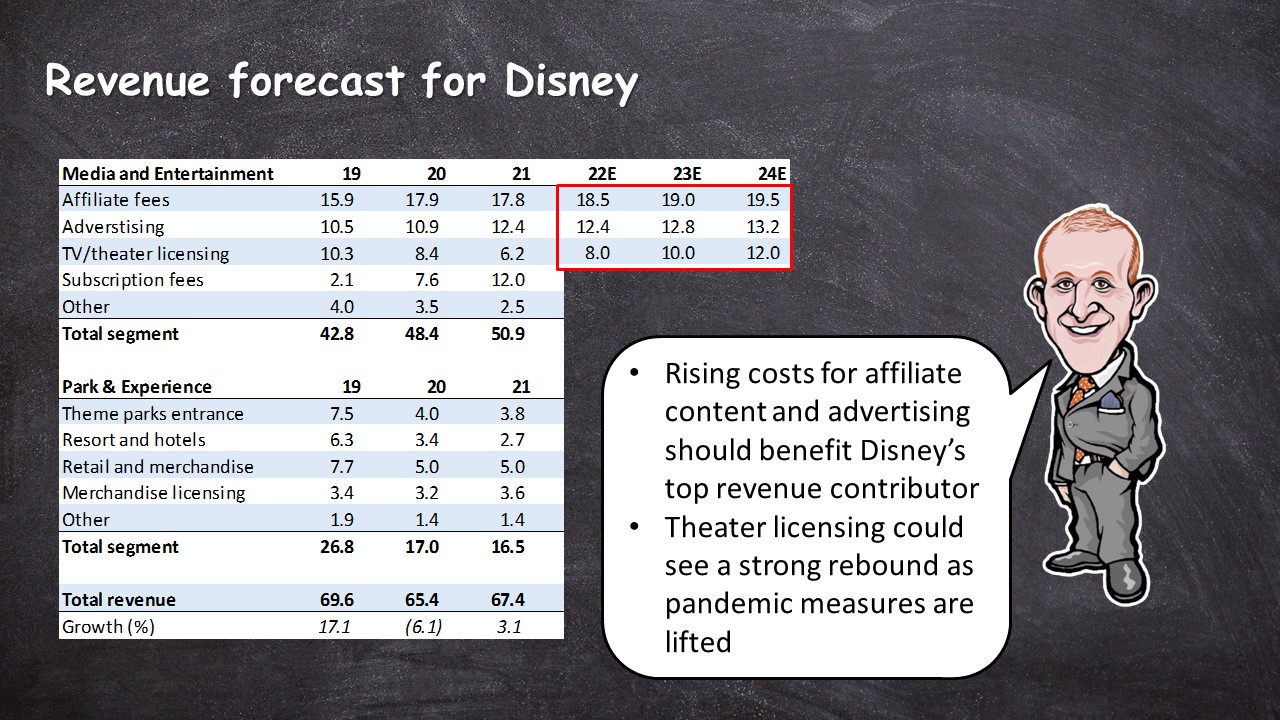

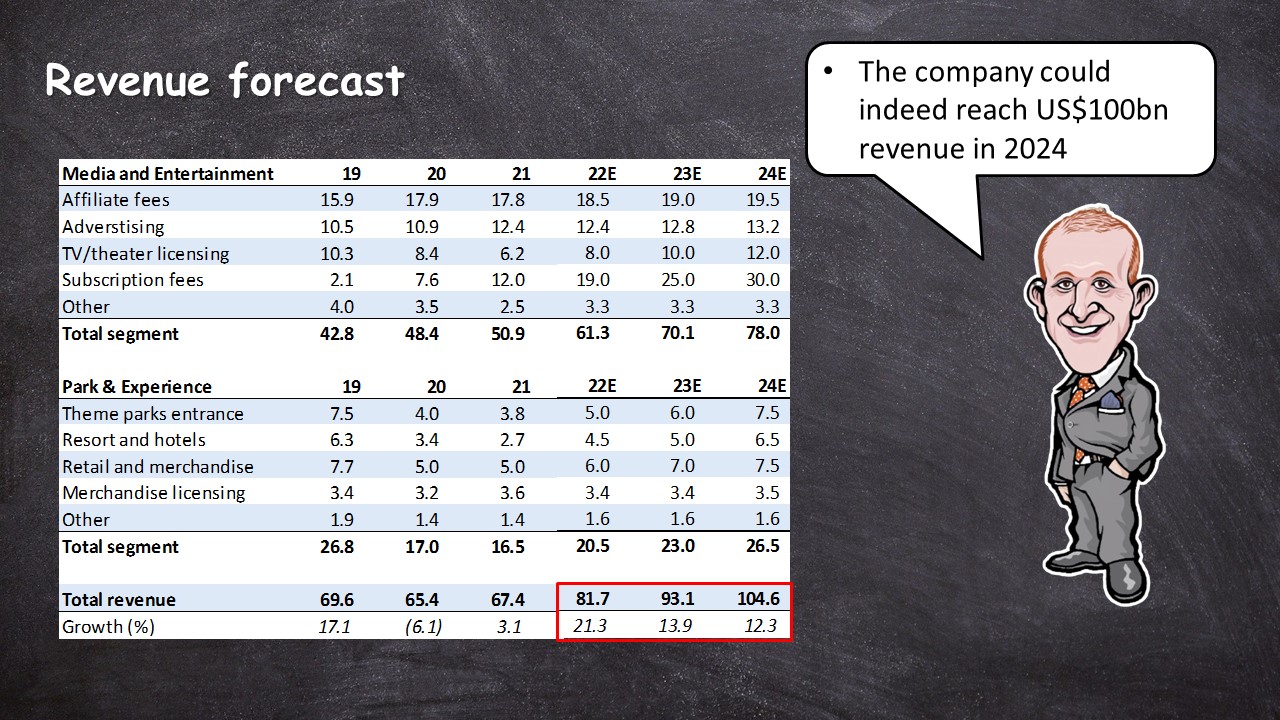

Revenue forecast for Disney

- Rising costs for affiliate content and advertising should benefit Disney’s top revenue contributor

- Theater licensing could see a strong rebound as pandemic measures are lifted

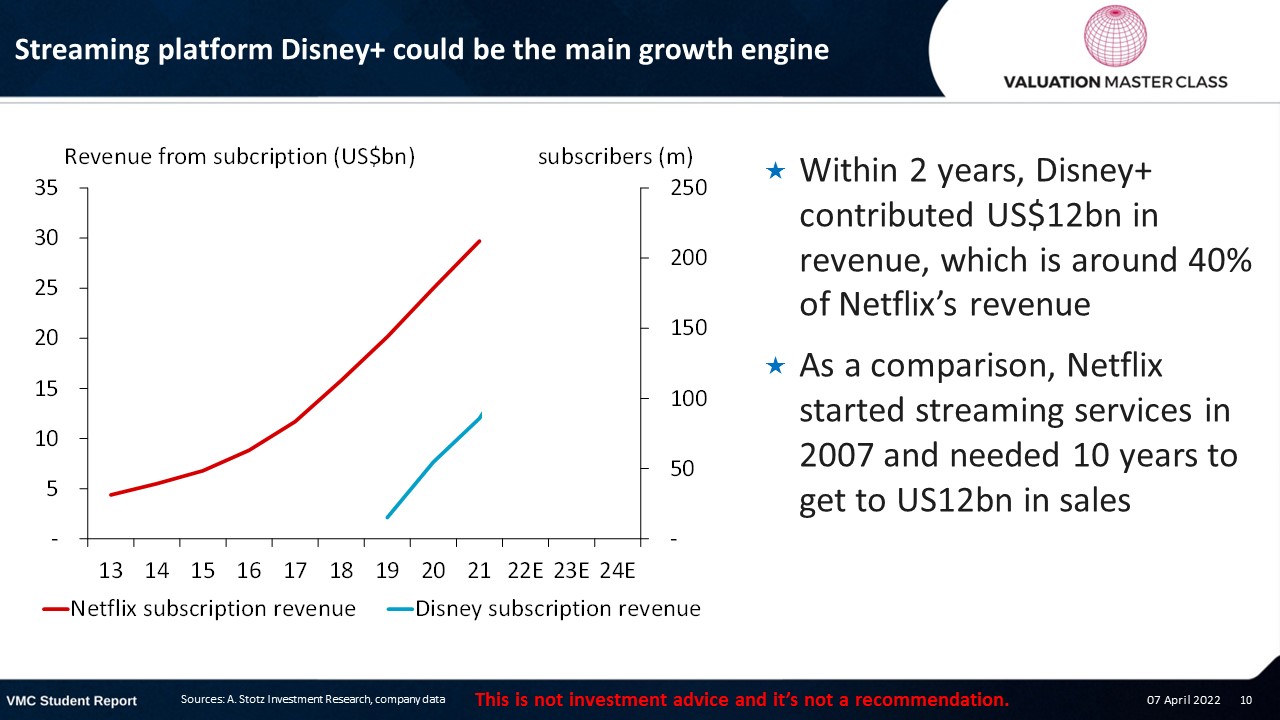

Streaming platform Disney+ could be the main growth engine

- Within 2 years, Disney+ contributed US$12bn in revenue, which is around 40% of Netflix’s revenue

- As a comparison, Netflix started streaming services in 2007 and needed 10 years to get to US12bn in sales

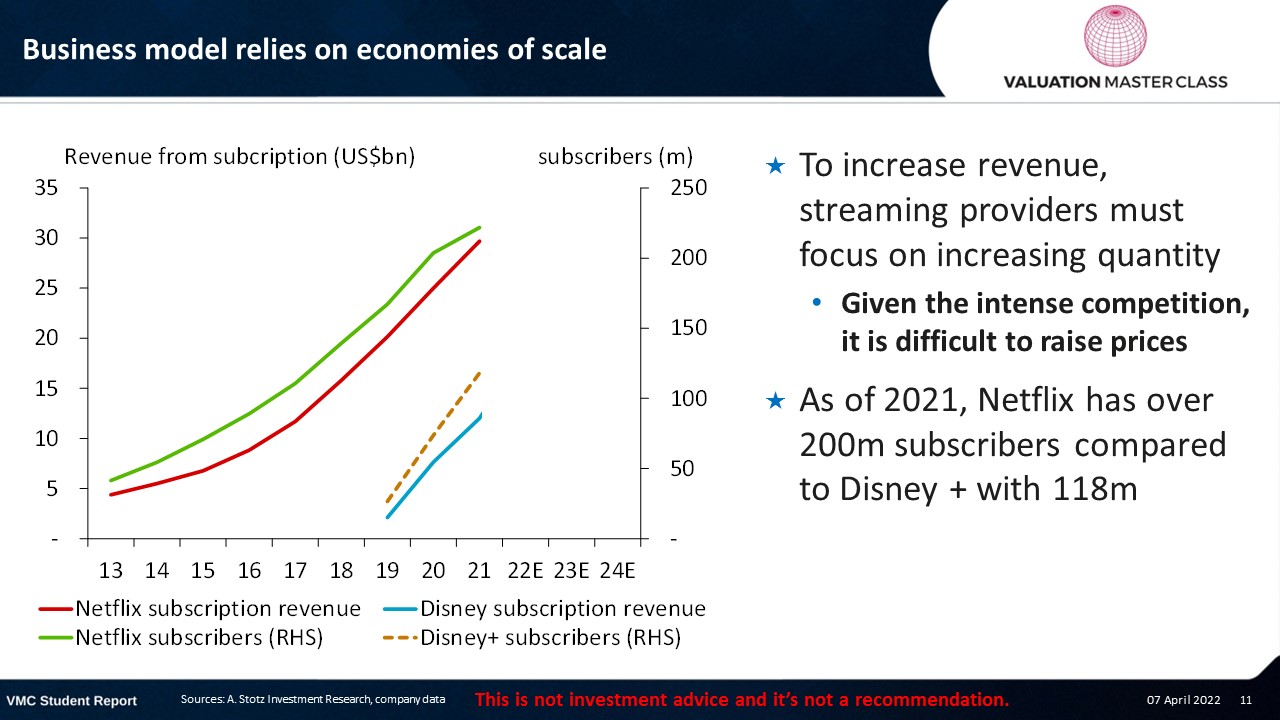

Business model relies on economies of scale

- To increase revenue, streaming providers must focus on increasing quantity

- Given the intense competition, it is difficult to raise prices

- As of 2021, Netflix has over 200m subscribers compared to Disney + with 118m

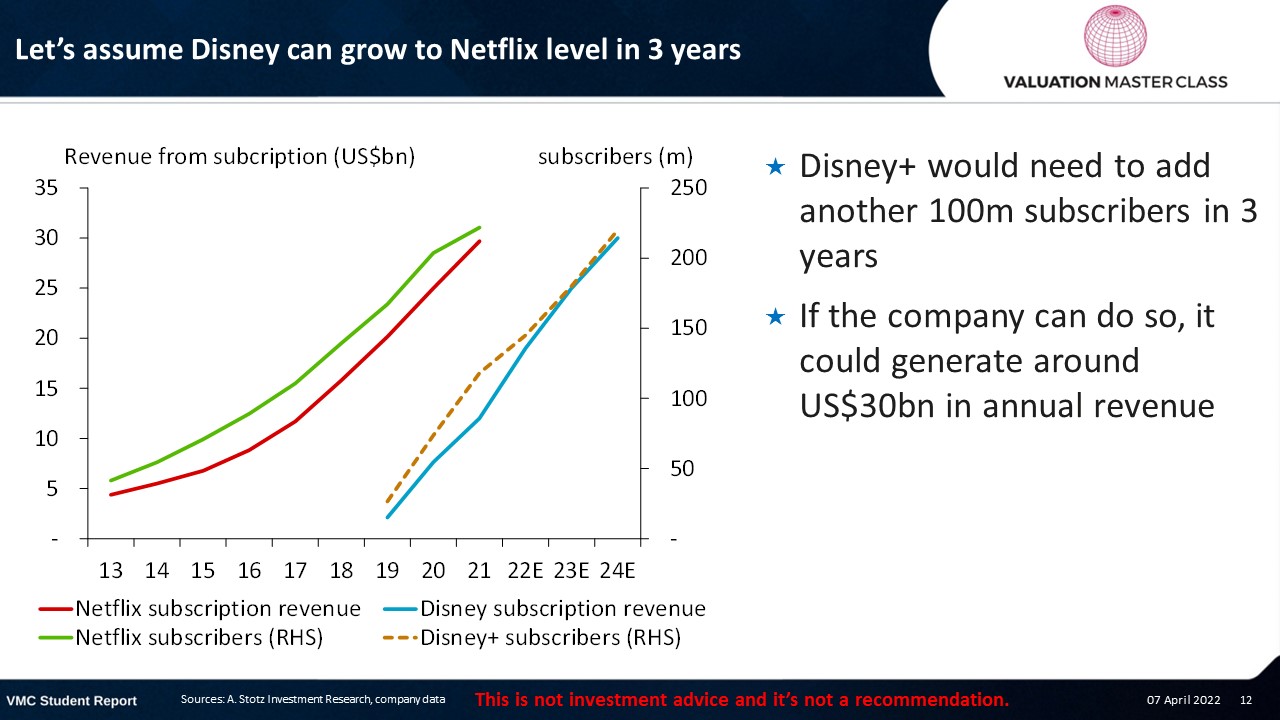

Let’s assume Disney can grow to Netflix level in 3 years

- Disney+ would need to add another 100m subscribers in 3 years

- If the company can do so, it could generate around US$30bn in annual revenue

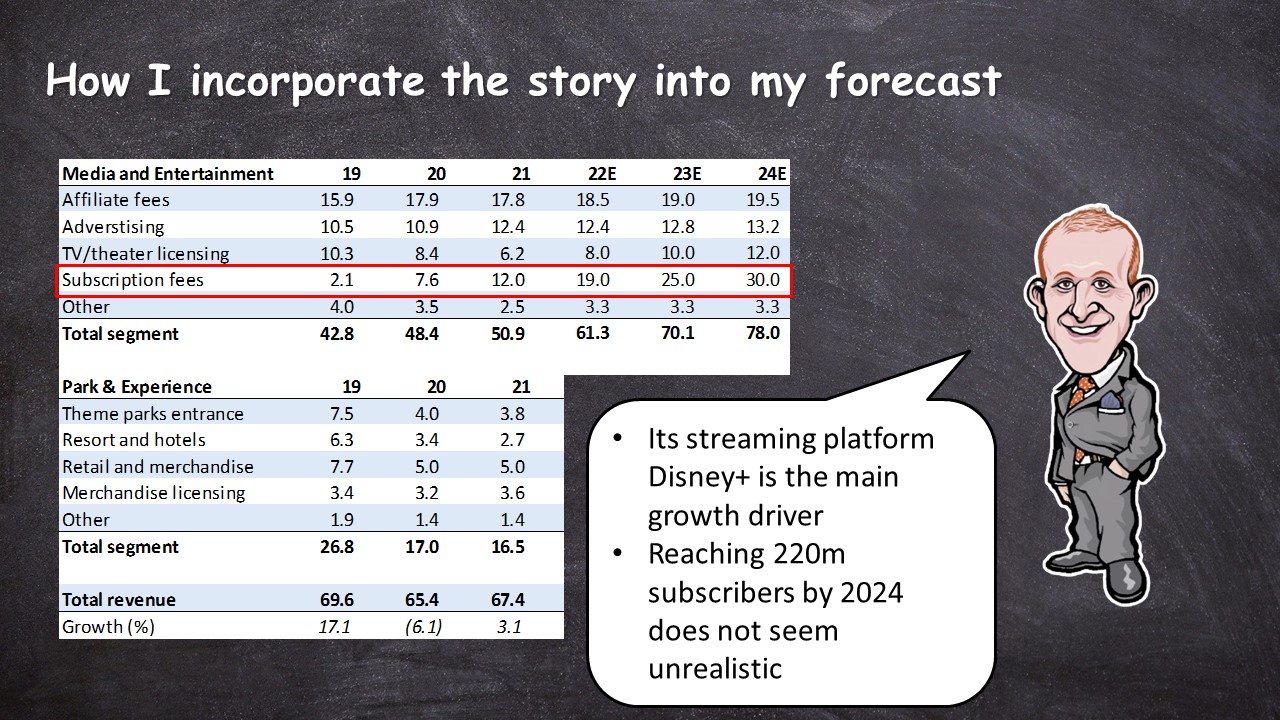

How I incorporate the story into my forecast

- Its streaming platform Disney+ is the main growth driver

- Reaching 220m subscribers by 2024 does not seem unrealistic

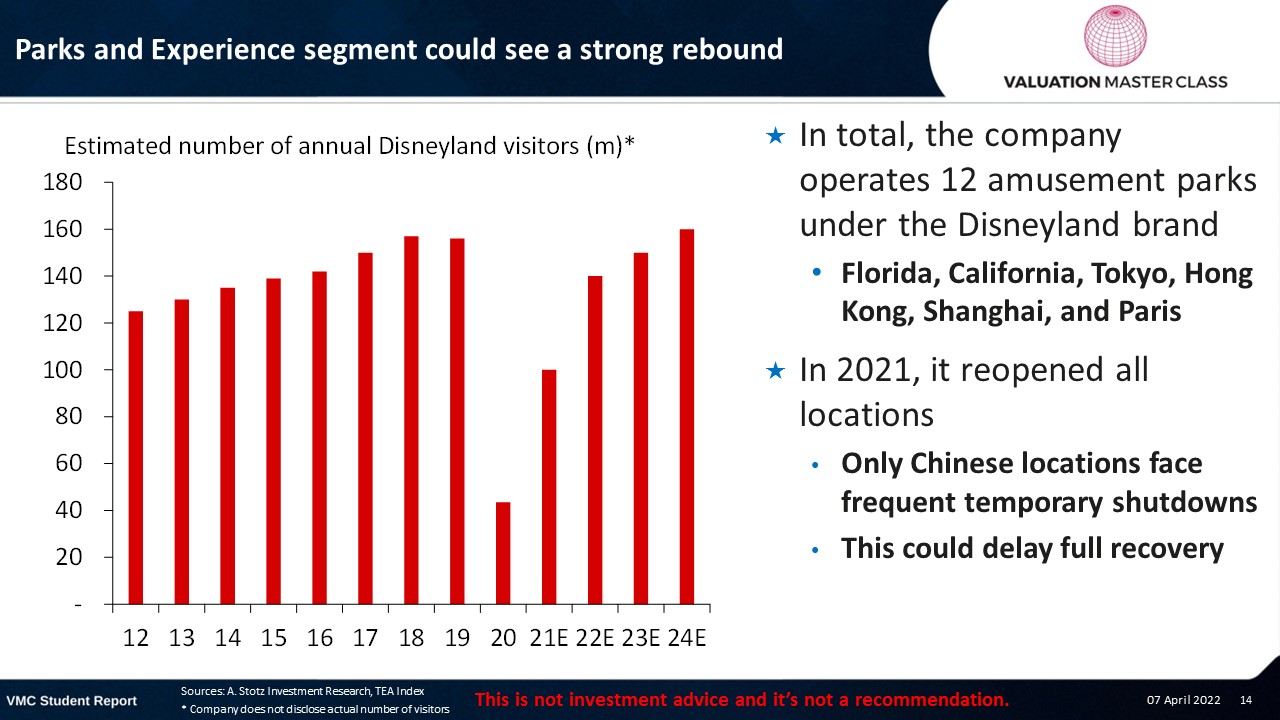

Parks and Experience segment could see a strong rebound

- In total, the company operates 12 amusement parks under the Disneyland brand

- Florida, California, Tokyo, Hong Kong, Shanghai, and Paris

- In 2021, it reopened all locations

- Only Chinese locations face frequent temporary shutdowns

- This could delay full recovery

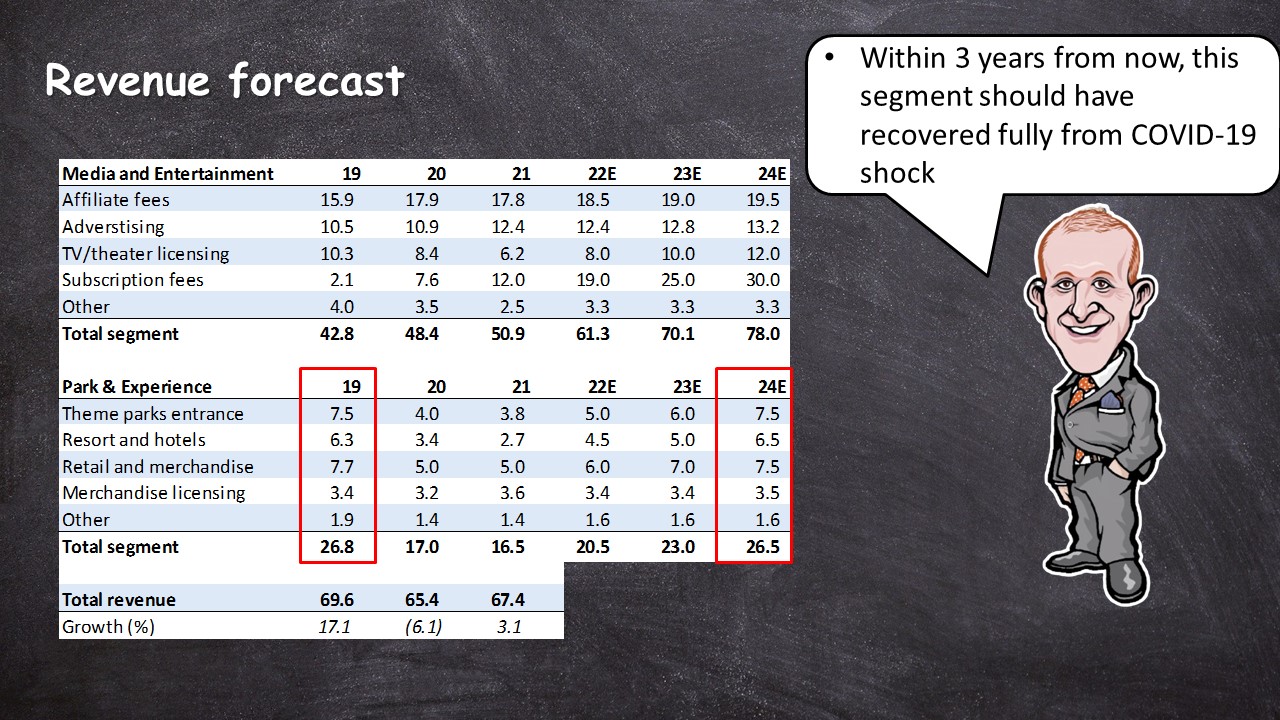

Revenue forecast

- Within 3 years from now, this segment should have recovered fully from COVID-19 shock

- The company could indeed reach US$100bn revenue in 2024

Conclusions

- We imposed two main assumptions

- Full recovery of amusement parks, hotels, and merchandise revenue by 2024

- Disney+ reaches more than 200m subscribers by 2024 which is roughly equivalent to current Netflix subscribers

- Under these assumptions, the US$100bn mark is possible

Download the full report as a PDF

Article by Andrew Stotz, Become a Better Investor.