Here’s a great interview with Charlie Munger and Yahoo Finance Editor-In-Chief Andy Serwer. During the interview Munger discusses the first rule of value investing:

Q1 hedge fund letters, conference, scoops etc, Also read Lear Capital

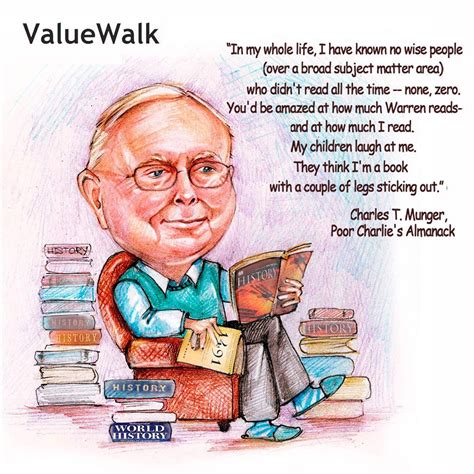

Value investing has changed over the years, but the fundamental way its disciples think about it hasn’t, according to Berkshire Hathaway (BRK.A, BRK.B) vice chair Charlie Munger.

“It’s gotten hard in the United States to find easy value investments because the world is so competitive,” Munger told Yahoo Finance editor-in-chief Andy Serwer after the Berkshire Hathaway 2018 Annual Shareholders Meeting.

………………………………..

“I liked the cheap real estate. I liked the competitive position. I liked the way the personnel system worked. I liked everything about it,” said Munger. “And I thought, even though it’s three times book, or whatever it was then, that it’s worth more. But that’s not a formula.”

In fact, Munger has contempt for formulas.

“If you want a formula, you should go back to graduate school,” said Munger. “They’ll give you lots of formulas that won’t work.”

You can watch the full interview here:

(Source: Yahoo Finance)

You can read the full article at Yahoo Finance here.

For more articles like this, check out our recent articles here.