From Crescat Capital’s email to investors

Crescat’s hedge funds had a strong month as global equity markets faltered.

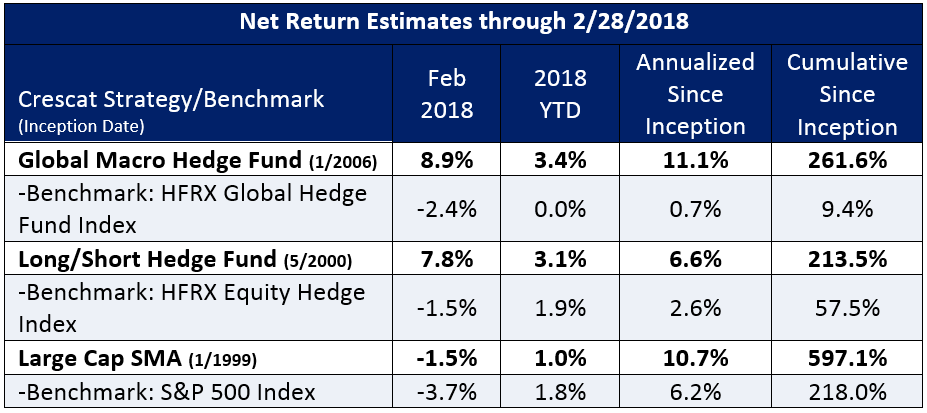

Estimated net returns for February:

In our strong opinion, the China credit bubble is finally bursting. A recent Bloomberg article explains that China is getting ready to put severe withdrawal restrictions on deposits in the banking and fintech industries. This is a big deal. Money market withdrawal curbs are an indication of bank runs and social unrest.

If the Chinese economy is finally imploding, the synchronized global growth story will come to an end quickly. China was more than 50% of global growth for the last decade, but this was made possible only by excessive and unsustainable credit expansion that is now unwinding. We strongly believe this is only the beginning of a global bear market for risk assets.

The size of the problem with Chinese bank and shadow bank deposits is enormous. There are $35 trillion in bank assets plus at least another $10 trillion in off-balance sheet bank assets, mostly illiquid, with an estimated 20% of them made up of non-performing loans. This is an unprecedented banking and currency bubble both in gross USD equivalent and relative to GDP for any country ever. This is a much bigger bubble than the US banking bubble in 2007. These assets are supported by supposedly liquid short-term deposits of 1.4 billion oppressed Chinese people.

Global fiduciaries still believe that China is an emerging market growth story that is a great place to invest. They will have to wake up and sell Chinese assets based on market action and news flow already coming and still to come. Xi Jinping assuming the lifetime dictatorship role is the catalyst coinciding with the bubble burst. This move coincides with Peter Navarro, Trump’s China hawk, gaining more influence in the administration, indicating that a US policy hard line on China is coming very soon to add to the fire. A global trade war has only just started. With the Xi news breaking several days ago, globally, China and Hong Kong were the largest equity index decliners to end the month of February.

While our hedge funds remain net short global equities and poised to capitalize on these and other imbalances, our large-cap strategy is also positioned conservatively by holding cash, precious metals, and inexpensive, defensive equities that generate strong free cash flow. In times when (1) equity markets are under pressure, (2) bond markets are selling off, (3) cost push inflation is on the horizon, and (4) geopolitical issues are rising, we believe gold serves as a great safe haven asset. Historically, the price of gold and the S&P 500 has been almost uncorrelated. In 2018, however, these two have moved remarkably close, and with a positive weekly correlation of over 0.9. The last two days were the first time in a while that this correlation has flipped to negative. This could be the beginning of a major rally for precious metals.