Perhaps the story of China’s shadow banking sector is best told in a story by Bloomberg journalist Andrew Monahan. He speaks with a Chinese online investment platform developer selling “trust” investments, which consist of high-risk loans packaged into an opaque wrapper.

“Where on the platform does it tell you what is inside the investment?” Monahan asked the Chinese shadow bank promoter, pointing to a key component that triggered the 2008 financial crisis. Valuewalk had earlier reported that many SWAPs and related investments don’t disclose their investment contents.

“Investors don’t care about that,” the Chinese investment salesperson said. “All they care about is the yield.”

- 2017 Hedge fund Letters

- China’s Credit Bubble Is By Far Biggest Ever – In-Depth From Crescat Capital

- Chinese Debt Collapse? On Par With Greece Like Wheel Out Of Control

- China’s Banking System Facing Possible Asset bubble Crash: DB

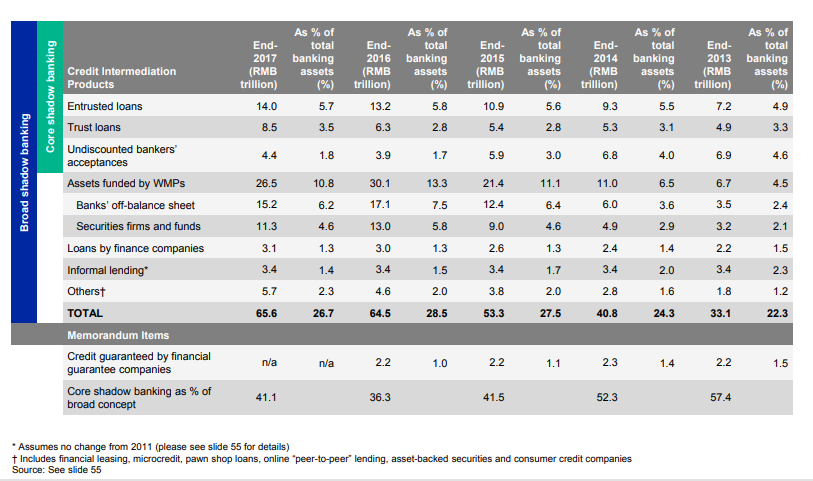

According to a Moody’s report, the total shadow banking industry in China represents a RMB65.6 trillion market, with trust loans making up RMB8.5 trillion of that. While what lies underneath is a concern, the problem is being addressed.

The good news is that the growth of China’s shadow banking largess appears to be slowing. Assets in the opaque markets only increased RMB1.1 trillion in 2017 compared with RMB11.2 trillion in 2016. Likewise, shadow banking declined 79.3% of GDP in 2017 compared to high point of 86.7% in 2016.