At Crescat, we have had significant success identifying and capitalizing on major macro themes over the years. The result has been industry leading long-term, risk-adjusted performance across all three products where we have substantially beaten the S&P 500 and other active and passive managers persistently net of all fees. All three of our strategies are actively managed with low correlation to their benchmarks and other managers. Long-term outperformance necessarily comes with short-term underperformance due to our low correlation to the benchmarks because we act independently based on our own research. This also means that we are far from being closet index funds and we can often zig when other managers zag. Below you can see the strong, long-term performance of all three products, affirming our commitment to protection and preservation of capital:

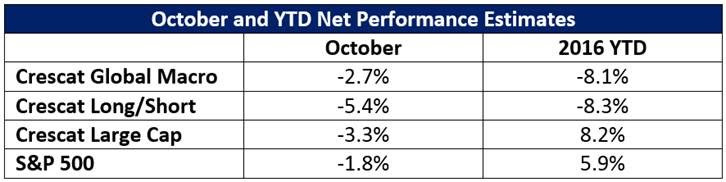

Lastly, October performance reports will be available in the next few weeks. Thank you for the continued support as we work hard to deliver growth and protection of capital.

In the event you were unable to attend the Crescat Capital Q4 Quarterly Conference Call this morning, a replay can be viewed by clicking below, as well as visiting our website.

Crescat Capital Q4 2016 Quarterly Conference Call

[drizzle]

[/drizzle]