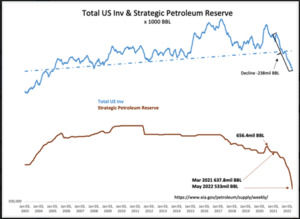

At every level, US fossil fuel inventories continue to decline. The decline in the SPR has accelerated.

This is not getting better anytime soon…….

Q1 2022 hedge fund letters, conferences and more

“Davidson” submits:

-

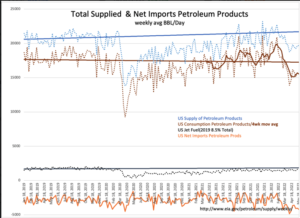

US Crude Production flat at 11.9mil BBL/Day, Total US Crude Inv fall 7mil BBL(-1mil working inv & -6mil SPR), US Crude Imports decline 0.9mil BBL/Day(6.3mil BBL/Week) Fudge factor 1,225mil BBL/Day(8.57mil BBL/Week)

-

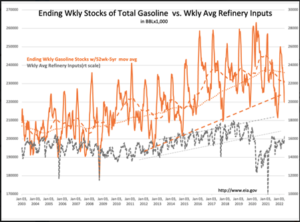

US Gasoline Inv decline 0.5mil BBL, US Refining Input rises 0.3mil BBL/Day, US Refined Products Export remain higher at the expense of US inventories