Today’s chart comes from the recently launched “Top 5 Charts Of The Week” report – which is our entry-level subscription service.

Q2 hedge fund letters, conference, scoops etc

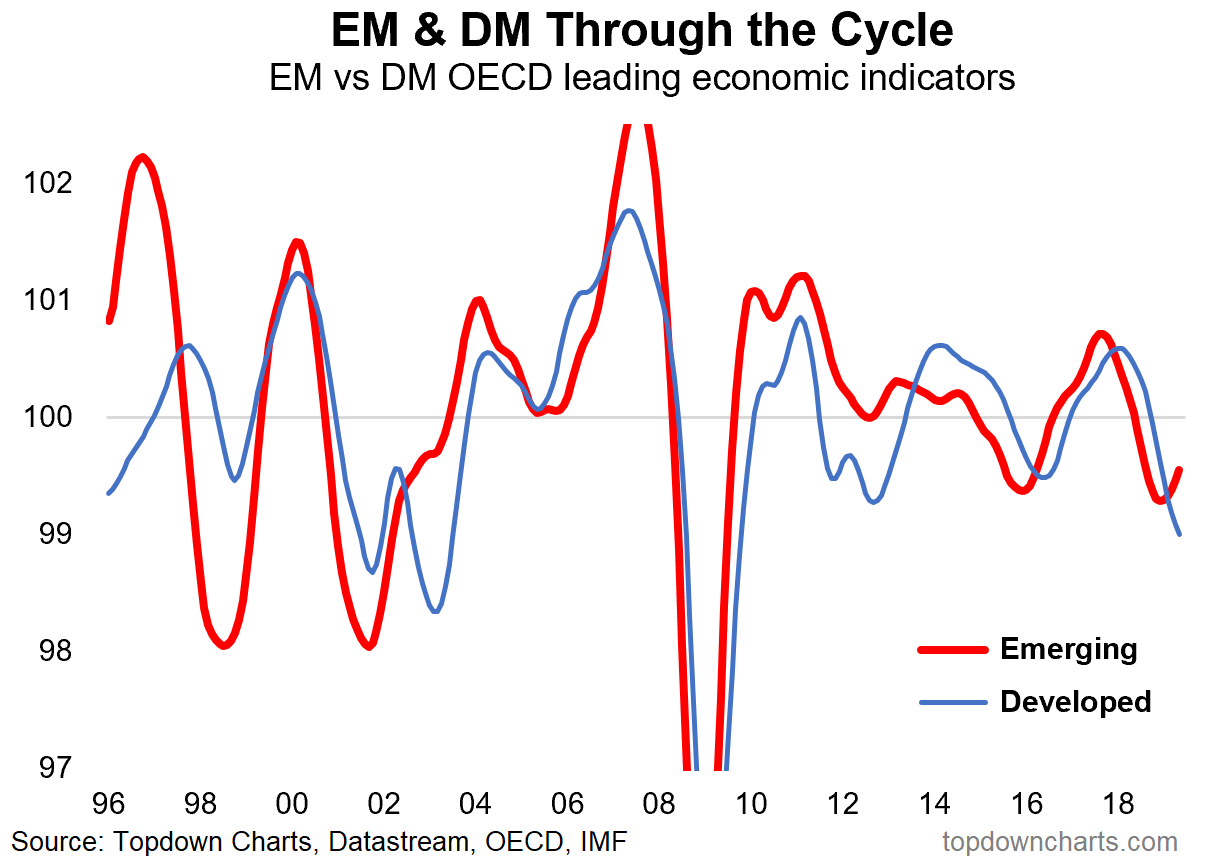

The chart shows the OECD composite leading economic indicators, which I have aggregated for developed and emerging market countries (based on GDP weights). There are a couple of clear and meaningful takeaways with this chart.

First: emerging markets appear to be turning the corner. They were the first to rollover, and it seems they are now also the first to see a rebound in the cyclical outlook. This is a very important development for the global economic outlook and goes against the seemingly widespread pessimism – with the consensus apparently looking for a global recession.

Second: developed economies are getting worse. This does go against the optimistic tone I sounded in the previous paragraph, however I would note, that at least in 2016 – emerging markets turned first and lead developed economies into recovery/re-acceleration.

There’s a few reasons why this makes sense: firstly emerging markets now account for the dominant share of world GDP; second, EM economies are typically more sensitive to the global cyclical pulse and shifts in financial conditions; thirdly, EM central banks are far from the zero-lower-bound, and hence have greater scope to stimulate their economies.

So with what on first glance looks like a fairly simple chart, there is a lot going on here, and I think this could even be contender for chart of the year. But of course we will need to see how things unfold going into the second half. I remain stubbornly optimistic on the global economic outlook and continue to preference over-weights to risk assets (albeit more opportunistically).

Again, if you’d like to subscribe to the Top 5 Charts report (where this chart came from), please click through and I will send you the latest report.

Thanks,

Callum Thomas

Head of Research at Topdown Charts Limited

Article by Topdown Charts