Over the past dozen months or so, companies in the U.S. have significantly increased their buybacks spending, i.e., buying back their own shares.

Q2 hedge fund letters, conference, scoops etc

We have already explained buybacks phenomenon in older articles, however, we would like to explain this again:

“Buyback or share repurchase is a transaction whereby a company buys back its own shares from the marketplace. After repurchase, the shares are canceled or held as treasury shares, so they are no longer held publicly and are not outstanding. Because a share repurchase reduces the number of shares outstanding, it increases prices of the existing shares trading on the market.”

Example: If we have 100,000 shares in circulation, each worth 10 USD, then the total value of all shares, and the company is 1 million USD. If the company will buy 20,000 shares from the market using free cash and will put them out of circulation, 80,000 shares will remain in circulation. Given that the company is still worth 1 million USD, but the value per share will increase to 12.5 USD. Without a change of the company’s value, we raised share price by 25%.

Funds allocated for this purpose are so large that they can be compared to earlier activities of the Federal Reserve or European Central Bank, which both were buying assets on the market, thus raising their prices. If the demand of U.S. companies for shares is so significant, can investors be confident about further stock prices increases?

Additional demand on the stock exchange

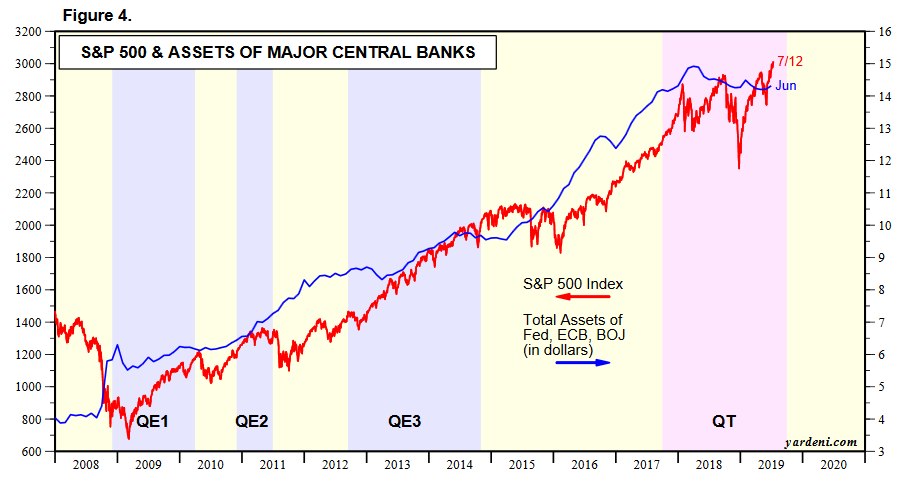

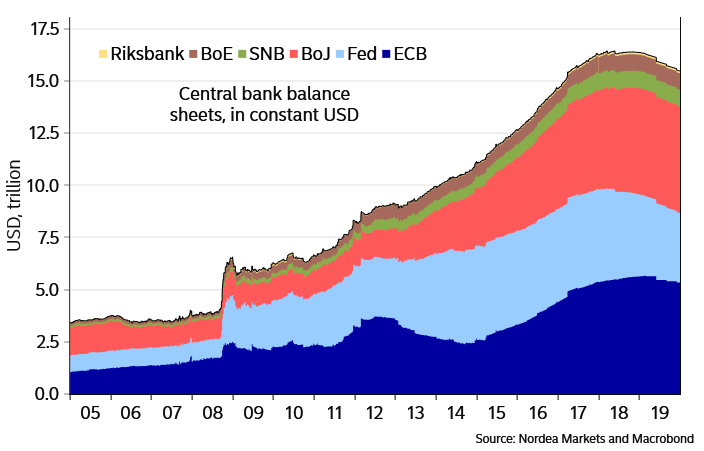

Since the recent financial crisis, largest central banks have been buying shares, government bonds and corporate bonds from the market interchangeably. This way, they provided additional demand, thanks to which value of assets on stock exchanges gone up. The aforementioned asset purchase (the so-called QE or simply printing) made central bank’s balance sheets to grow very strongly . Below you can see how the total value of balance sheets of the ECB, FED and central banks of England, Switzerland, Japan and Sweden have changed over time.

As you can see, since 2009 we have been dealing with an uninterrupted upward trend. Peak has been reached in 2018, when the Fed has started reducing its balance sheet and the ECB has finished its asset purchases.

If so, taking into account close correlation between increase in central banks’ balance sheets and the S&P 500 index (see chart below), in 2018, stock prices in the U.S. should start to fall.

2018 was in fact not very successful in terms of stocks performance (including those in the U.S.), while the first half of 2019 brought a rebound in share prices. Why did this happen?

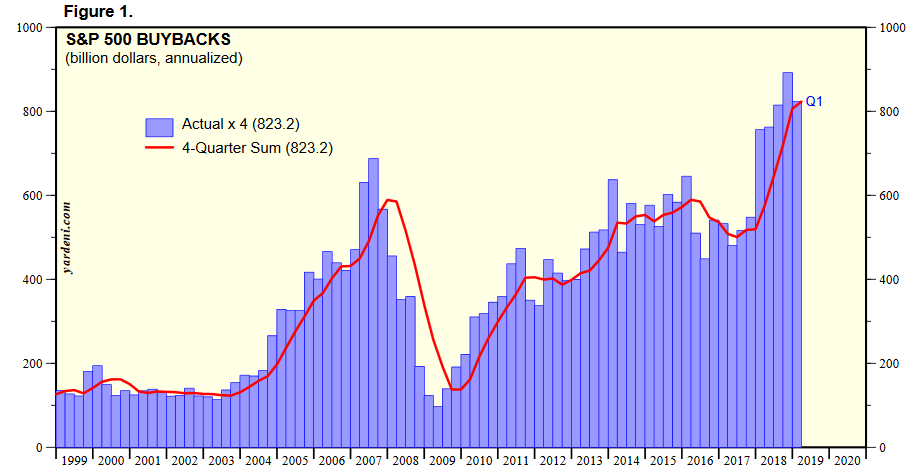

Of course, this was partially due to narrative change of the FED and ECB (announcements of going back to loosening monetary policy). Significant role in this had above mentioned buybacks. Between April 1, 2018 and March 31, 2019, U.S. companies spent 823 billion USD on buying their own shares! That’s almost 70 billion USD a month.

source: yardeni.com

For comparison, in 2016, desperate European Central Bank increased their asset purchases program from 60 to 80 billion euros per month. So we’re talking about very similar sizes which shows how huge funds have been put into buybacks.

By the way, as you can see in the above chart, Buybacks most often get large when stocks are very expensive. Usually after that, market experiences price drops. Nowadays, U.S. companies again buy shares when they are expensive. From shareholders perspective, such a policy is harmful, but buybacks increases share prices, which translates into an increase in options prices held by management of the company. We therefore have, a clash of long-term and short-term thinking. For some, company’s prospects are more important, and for others – immediate increase portfolio value.

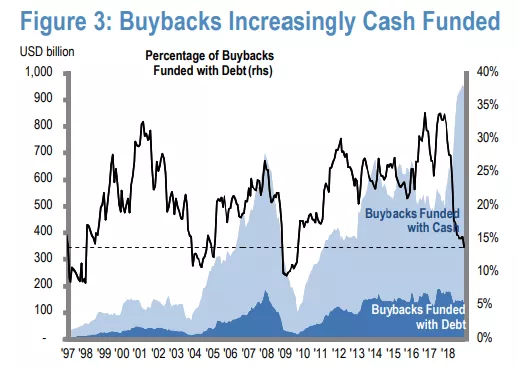

If we were to find a positive, it is the information that a relatively small part of the stocks is bought using debt. According to recent JP Morgan bank calculations, it is about 15% of all buybacks.

source: JP Morgan

As you can see, the vast majority of buybacks are carried out using cash. Donald Trump’s tax reform has great impact on this, which allowed American giants like Apple to transfer cash from abroad back to the United States.

Buybacks mania continues and is expected to last at least until the end of the year. This year companies plan to repurchase shares amounting to about 800 billion USD, which means maintaining the current pace.

Interestingly, companies inform in advance about their plans related to buybacks. Sometimes there are exceptionally large operations e.g., a single company intends to repurchase its own shares for several billion dollars or even more. In this situation, investor may think: if the demand for shares is certain, does it profit me when I buy company’s shares in advance?

Let’s see if that is true.

Market gives no guarantee

We should start with the fact that a company announcing a large buyback program, usually adds that “it may be suspended, terminated or modified”. At this point, warning light should already come on.

However, let’s look at the situations in where large buybacks have actually occurred.

In 2016-2017, General Electric purchased its own shares for 24 billion USD (20% of the current capitalization of the company). However, this was not reflected in the company’s quotations, as shares lost 35% over this period. In turn, from the beginning of 2016 until today General Electric has lost 60%.

Another example is Citigroup, a company that was very involved in buying its own shares (a total of 45 billion dollars) over the last decade. An exceptionally intense period was in the second half of 2017 and the entire 2018. For the majority of this time, the company maintained its value so by the end of 2018 it would suddenly lose more than 30%.

Situation was similar with FedEx, which in 2018 spent 1 billion USD on buying back its own shares. At the end of this period, shares sharply declined due to deteriorating global economic situation. In mid-March, we had a situation when FedEx shares increased by nearly 2% in one trading session. This was due to information that the company was supposed to increase scale of buybacks. Considering that the CAPE ratio was around 25, investors could not consider this to be an extremely good idea for the company’s prospects. Apparently, buyers simply assumed that the shares repurchases would raise the price.

As you can see, large buyback programs do not guarantee profits. This is also confirmed over the long-term perspective. Let’s consider 20 companies with the largest buybacks over the last decade, and then compare their performance to the market average (in case of S&P 500, it is 14% per year).

It turns out that out of these 20 companies, only 5 (!) generated returns better than the S&P 500 index. Eleven companies managed to beat inflation, but they underperformed the market. In turn, four brought losses in real terms.

Summary

We do not think that all buybacks are bad. We can imagine a company with solid fundamentals that is not very popular among investors. As a result, it is relatively undervalued. In addition, it has a lot of free cash. In this situation, management actually has reasons to consider buying own shares. What’s the reason? Big potential for share price increases.

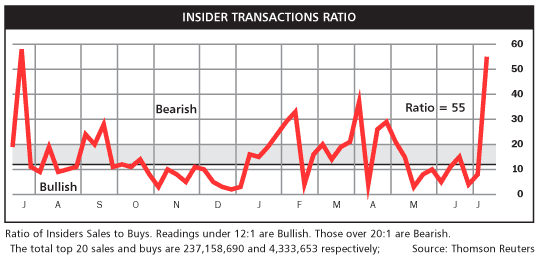

Unfortunately, reality shows that companies most often decide conducting buybacks when stocks are expensive. This often happens because it is about executing private interests of top management (which is often a large part of the compensation – shares), which also impacts the company’s prospects. A great example is the current situation in which buybacks are done at very high price levels, while insiders (employees of companies) sell off shares at an exceptionally fast pace. The graph shows ratio of sales transactions to purchase transactions triggered by insiders.

Last time, this ratio was so high a year ago.

It is worth remembering that by opting for buybacks, companies give up at the same time, for example, more spending on research and development. In the long term, this may make competition from other countries overcome by their innovation. Of course, we are not talking about Europe, which is rather retreating in development, but about companies from Asia.

It is possible that factors which speak for buybacks are not publicly known. Management boards of the largest companies are closely related to the financial sector. Inside this group there are informations that we do not have access to. These include news about central bank plans. Therefore, we can only talk about whether management boards of the largest companies have not received a message like: “if necessary, we will restore asset purchases and create strong inflation, so buybacks will come out for good. Lack of cash will also not be a problem because we will introduce negative interest rates. ” Such a message could justify hundreds of billions spent every year on buying back own shares.

Returning to the title question, even the biggest buybacks do not give us a guarantee that the company chosen by us will bring profit. Ultimately, buying back own shares does not have to be positively perceived by the market. It can be considered as the management’s submission of short-term benefits over the long-term prospects.

Article by The Independent Trader