The latest results from the weekly surveys on Twitter showed a slight rebound in technicals sentiment, with the all important fundamentals sentiment still holding up well – at least for equities.

This lines up with our optimistic view on the fundamentals and the data pulse which for now is still holding up well. In contrast to equities, bond market sentiment has seen a notable pullback from extreme bearishness, and ironically this could be just the thing that is required to set up the market for another push higher in bond yields. With markets in flux, it pays to stay on top of investor sentiment, so check out the charts below and follow us for updates.

The key conclusions on equity and bond market sentiment are:

-Equity “fundamentals” sentiment is still holding up, and now “technicals” sentiment is starting to rebound from deep pessimism.

-Bond market sentiment has seen at least a partial reset both on surveyed sentiment and broader market sentiment.

-The solid readings in the ‘nominal surprise index’ and earnings revisions momentum line up with the optimistic view on the fundamentals outlook, and remains a key swing factor on the overall risk outlook.

FREE – What Quant Models Wont Pick Up On Dangerous Long-Term Bond Trends

1. Equity Fundamentals vs Technicals: The latest weekly survey on Twitter showed a solid rebound in “technicals” sentiment, as investors apparently reassess the risks of a bear market. Meanwhile fundamentals sentiment has held up fairly steady; not undergoing the same swings as we’ve seen in technicals sentiment. It speaks to the thesis that this is largely a technical/sentiment driven correction with fundamentals little changed.

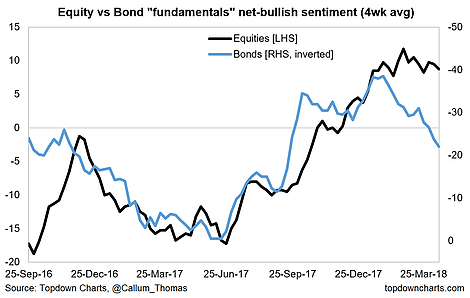

2. Bonds vs Equities fundamental sentiment: However there are some mixed signals on the fundamentals sentiment as we’ve seen a big turnaround or correction in bond market sentiment on the fundamentals outlook vs equity market sentiment. The gap between these two is also a concern, because if equity fundamental sentiment starts to ‘catch-down’ to bonds it would mark a turning point and a shift to a more bearish outlook.

Global Growth Has Peaked, We Are In A “Dangerous New Phase”

3. Earnings/Macro Pulse: But if you look at a couple of key indicators we track: the ‘nominal surprise index’ (this tracks a combination of the Citi US inflation surprise index and the economic surprise index – giving a view on how the inflation and general economic data is turning out vs expectations), and the ‘earnings revisions indicator’ (this combines earnings revisions ratio and the rate of change in forward earnings). The bottom line here is that the nominal growth impulse for the USA has been surprising to the upside, and it comes at a time when earnings revisions momentum is running hot. It stands is stark contrast to the 2015/16 period where the global equity market correction at that time was more driven by doubt on the fundamentals (not so now!).

How far could the USD fall before it became disruptive? HSBC Has A Number

4. Bond Survey Sentiment: Moving back into the bond side of things, the bull bear spread for bonds in the weekly Twitter survey shows a bit of a correction in extreme bearishness from the start of this year through April as bond bears tempered their views. I wonder whether this pullback in bearishness is enough of a reset to fuel a drive higher in bond yields… some might argue that the bond survey respondents are implying a move back to 2.5% for the US 10 year treasury yield, but it comes back to the macro picture, which still looks good.

5. Composite Treasuries Sentiment: Taking a broader view of bond market sentiment (our composite bond market sentiment indicator combines the signal from futures positioning, fund flows, implied volatility, and global bond market breadth), it’s readily apparent that bond market sentiment has seen a reset from relatively stretched bearishness to just on the bullish side of neutral (i.e. the indicator is saying participants have gone from expecting higher bond yields to expecting lower bond yields). Again, this could amount to simply a shaking out of extreme bearish sentiment before another leg higher in bond yields. As with the stock market outlook, a big part of this will come down to the macro/earnings pulse remaining on the positive side – and indeed this is a key focus for us at this point, and something we’ve been talking at length to clients about.

Follow us on: