ETFGI reports ETFs and ETPs listed globally gather net inflows of US$28.1 Bn during October 2018

LONDON — November 13, 2018 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed globally gathered net inflows of US$28.1 Bn during October, with all but the Middle east and Africa seeing positive net flows.

Q3 hedge fund letters, conference, scoops etc

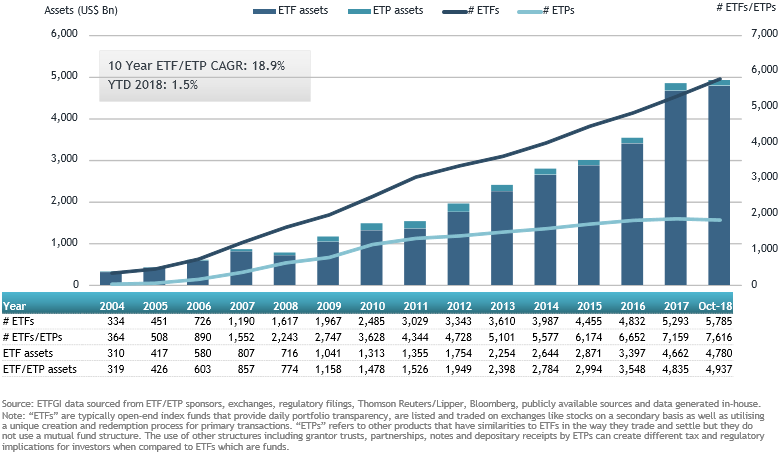

Following a turbulent month for financial markets, total assets invested in the global ETF and ETP industry fell 5.99% during October, from US$5.25 Tn at the end of September, to US$4.94 Tn, according to ETFGI’s October 2018 Global ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Total Assets in ETFs and ETPs listed globally decline 5.99% to $4.94 Tn in October.

- Net new assets gathered by ETFs/ETPs listed globally were $28.06 Bn in October.

- 57th consecutive months of net inflows into ETFs/ETPs listed globally.

“Few markets managed to avoid the October sell off, as investors grew jittery at the prospects of further rate hikes from the US treasury and any hope of resolutions to trade disputes appeared to be diminishing, be it in Europe or the US. Developed and developing markets saw similar declines during the month. Aside from the US, where strong year-to-date performance cushioned the fall, October pushed many indices deeper into negative territory for the year. The S&P 500 fell 6.84% over the month, retaining a 3.1% gain year-to-date, while European markets fell 7.82%, bringing year-to-date decline to 9.56%. EM markets down 7.60% and Frontier markets down 3.36%, bringing year to date declines to 15.07% and 10.68%, respectively.” according to Deborah Fuhr, managing partner and a founder of ETFGI.

At the end of October 2018, the Global ETF/ETP industry had 7,616 ETFs/ETPs, with 14,802 listings, assets of $4.94 Tn, from 392 providers listed on 71 exchanges in 57 countries. Following net inflows of $28.06 Tn and market moves during the month, assets invested in ETFs/ETPs listed globally decreased by 5.99%, from $5.25 Tn at the end of September 2018, to $4.94 Tn.

Growth in Global ETF and ETP assets as of the end of October 2018

Equity ETFs/ETPs listed globally attracted net inflows of $19.9 Bn in October, growing net inflows for 2018 to $271.18 Bn, less than the $371.58 Bn in net inflows at this point last year. Fixed Income ETFs and ETPs listed globally saw net outflows of $2.10 Bn in October, bringing net inflows for 2018 to $72.0210 Bn, considerably less than the $131.56 Bn in net inflows at this point last year.

October marked the 57th consecutive month of net inflows into ETFs/ETPs listed globally, Year-to-date in 2018 there have been net inflows of $379 Bn, less than the $539 Bn in net inflows at this point last year.

Substantial inflows during October can be attributed to the top 20 ETFs by net new assets, which collectively gathered $32.1 Bn. The iShares Core S&P 500 ETF (IVV US) gathered $4.64 Bn, the largest net inflow in October.

Top 20 ETFs by net new assets October 2018: Global

| Name | Ticker | Assets (US$ Mn) Oct-18 |

ADV (US$ Mn) Oct-18 |

NNA (US$ Mn) YTD 2018 |

NNA (US$ Mn) Oct-18 |

| iShares Core S&P 500 ETF | IVV US | 156,359 | 1,703 | 15,205 | 4,643 |

| NEXT FUNDS Nikkei 225 Leveraged Index ETF | 1570 JP | 5,266 | 2,074 | 3,153 | 3,567 |

| Vanguard S&P 500 ETF | VOO US | 99,362 | 1,124 | 14,506 | 2,071 |

| Communication Services Select Sector SPDR Fund | XLC US | 3,707 | 258 | 3,879 | 1,848 |

| iShares Core Nikkei 225 ETF | 1329 JP | 6,049 | 7 | 2,311 | 1,845 |

| SPDR Bloomberg Barclays 1-3 Month T-Bill ETF | BIL US | 5,320 | 214 | 3,367 | 1,776 |

| iShares Core MSCI Total International Stock ETF | IXUS US | 11,782 | 112 | 4,851 | 1,762 |

| iShares MSCI Japan ETF | EWJ US | 16,746 | 878 | (536) | 1,721 |

| iShares 1-3 Year Treasury Bond ETF | SHY US | 15,098 | 275 | 3,889 | 1,345 |

| ChinaAMC China 50 ETF | 510050 CH | 6,895 | 399 | 2,159 | 1,317 |

| Huatai-Pinebridge CSI 300 ETF | 510300 CH | 4,955 | 212 | 2,931 | 1,315 |

| ProShares UltraPro QQQ | TQQQ US | 4,184 | 1,251 | 1,414 | 1,295 |

| JPMorgan Ultra-Short Income ETF | JPST US | 3,361 | 73 | 3,252 | 928 |

| iShares Short Treasury Bond ETF | SHV US | 15,635 | 195 | 7,599 | 916 |

| iShares Russell 1000 Value ETF | IWD US | 36,585 | 393 | (3,481) | 896 |

| TOPIX Exchange Traded Fund | 1306 JP | 71,524 | 47 | 17,890 | 857 |

| Vanguard FTSE Developed Markets ETF | VEA US | 65,974 | 698 | 6,343 | 849 |

| Vanguard Total Stock Market ETF | VTI US | 98,508 | 703 | 6,822 | 848 |

| MAXIS TOPIX ETF | 1348 JP | 9,947 | 3 | 2,645 | 816 |

| iShares MSCI USA Minimum Volatility ETF | USMV US | 17,037 | 230 | 1,437 | 787 |

Similarly, the top 10 ETPs by net new assets collectively gathered $1.56 Bn by the end of October 2018.

Top 10 ETPs by net new assets October 2018: Global

| Name | Ticker | Assets (US$ Mn) Oct-18 |

ADV (US$ Mn) Oct-18 |

NNA (US$ Mn) YTD 2018 |

NNA (US$ Mn) Oct-18 |

| SPDR Gold Shares | GLD US | 28,570 | 1,248 | (3,181) | 475 |

| iShares Gold Trust | IAU US | 10,645 | 195 | 1,284 | 198 |

| Invesco Gold ETC | SGLD LN | 4,413 | 7 | 30 | 167 |

| ETFS Physical Gold | PHAU LN | 5,992 | 5 | 201 | 120 |

| VelocityShares 3x Long Crude Oil ETN | UWT US | 215 | 111 | (21) | 107 |

| Xtrackers Physical Gold Euro Hedged ETC | XAD1 GY | 1,753 | 2 | 341 | 97 |

| Xtrackers Physical Gold ETC (EUR) | XAD5 GY | 2,254 | 1 | 1,729 | 94 |

| Large Cap Growth Index-Linked ETNs due 2028 | FRLG US | 378 | 5 | 415 | 85 |

| VelocityShares Daily 3x Inverse Natural Gas ETN | DGAZ US | 451 | 198 | 382 | 75 |

| ETFS Nickel | NICK LN | 430 | 0 | 369 | 70 |

Investors have tended to invest in core, market cap and lower cost ETFs in October.