Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives.

Q3 2019 hedge fund letters, conferences and more

If the debt of the public or private sector were viewed the same way we measure that of a corporation, no alarms would be sounded. Given its low cost of carry, that debt is unobjectionable.

Several weeks ago, when I wrote that the federal government’s debt had not yet reached crisis proportions, several of the commenters disagreed. They expressed the opinion that the size of the debt was frightening and the U.S. Treasury was in bad trouble. As one commenter remarked, “no sensible household would tolerate such profligacy.”

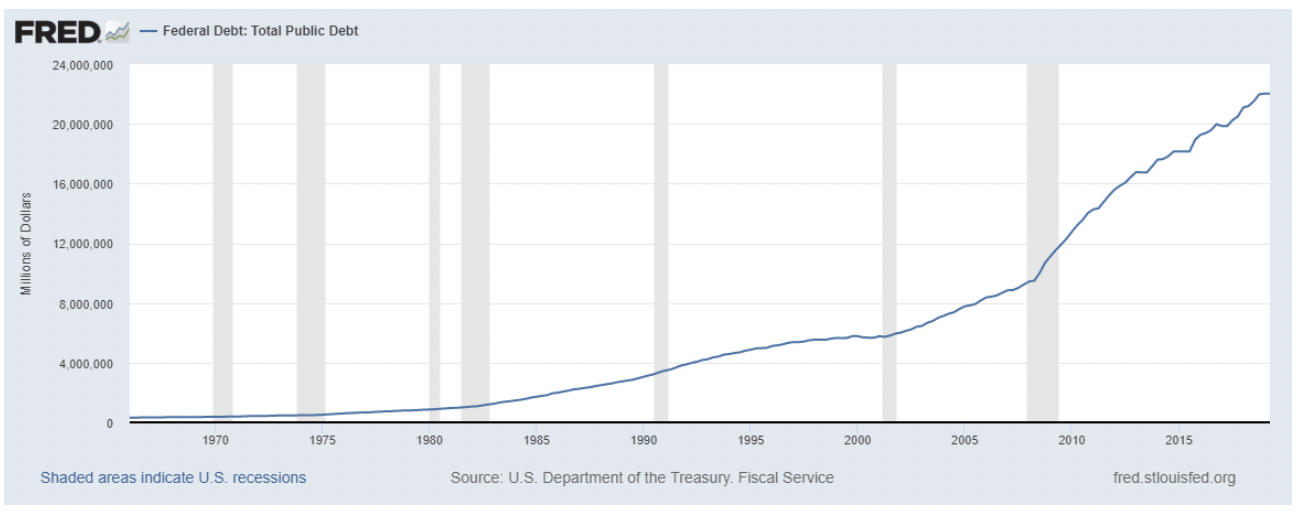

The commenters were certainly correct about the size and growth of the federal debt. It is extraordinary.

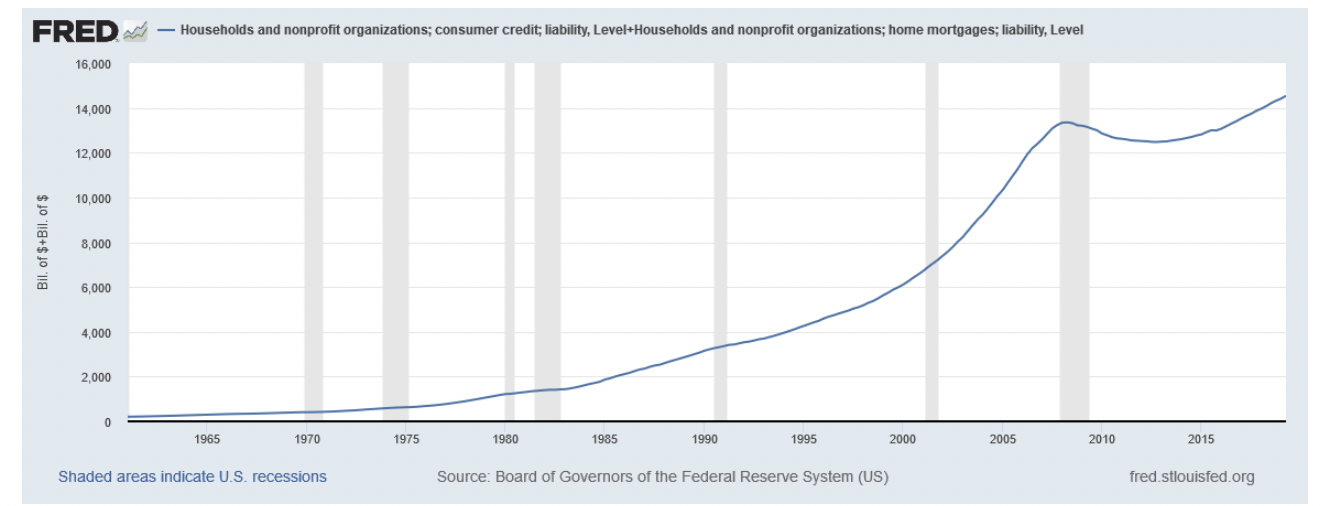

But households have taken the same fiscal path as Uncle Sam. Over the past six decades, they have borrowed and then borrowed more.

Since the 1960s, both the private and public sector have been on sustained borrowing binges. Those worried about America’s national indebtedness have not had to choose between the budgeting of the government and the taxpayers. Neither sector has been “sensible”; each of their histories is as a portrait of extravagance without limit. For every dollar the Treasury has borrowed, the taxpayers have borrowed one for themselves.

In my article last month, I argued that the history of the federal debt left some hope that things were not so absolutely awful when the Treasury debt was measured against tax collections. But, for the last six decades, even the trend of debt measured against incomes has gone steadily upwards. In both sectors, the ratio of total debt to income has increased three-fold.

If one is going to find good news in all this, the only place to look is in the data for the cost of carry. The Federal Reserve does a careful calculation of what households have to pay to carry their debt. When measured against disposable personal income, this debt “nut” presents a much less frightening picture. The data suggests that households have been a great deal more cautious about borrowing than they were in previous upturns of the business and employment cycle. Consumer debt is, indeed, at an “all-time” high; but, if American households were a business, it would be very difficult to argue that the present coverage ratio is particularly alarming, when measured against the past.

Read the full article here by Advisor Perspectives