This is a guest contribution by Ryan Krueger of investment advisory firm Krueger & Catalano. You can follow Ryan on Twitter @RyanKruegerROI.

[buffett]

Q2 hedge fund letters, conference, scoops etc

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.

He is profoundly successful by many financial measurements. Annual earnings placed him inside the top 0.01% of the world. On a first-name basis with CEOs of some Fortune 500 companies, he is on top of his industry. He lives in a custom built luxury home in the nicest neighborhood of one of the most vibrant cities in the world. His family travels wherever they want, and acquires anything they desire.

That looks a lot different than this nervous wreck I listened to next. He wondered if there would always be enough inflows just to keep up with countless outflows. Often, he was forced to sell down assets to cover the difference when he came up short. Worst of all, he knew the stress was unhealthy.

These two are the same person.

He openly dreamed of a simpler path with me. He confessed to knowing a guy really well, 20 years older, who he was often very jealous of. This older guy has everything he needs and wants already. His front yard is the Pacific Ocean. He built a small home so there is almost no maintenance to worry about. He pauses after opening the door for a breathtaking sunrise, and the only delay in his barefoot commute to work… waves with his surf board. His stress-free days usually end with a taco, ice-cold cerveza, and a lot of smiles with a close tribe of friends. And, he does it all on about $9 a day.

As a professional money manager, I am supposed to tell you the difference in retirements is investment success. I escaped Wall Street so I could tell the truth instead. Too much attention is focused on how much money to have in order to retire, and not enough on the choices we make for how to use it.

Maybe these two men are extreme examples, but they do have one thing in common. They happen to be brothers. Yup. Choices led each to opposite ends of the peace of mind spectrum, not investment returns.

“Your net worth is determined by what remains after your bad habits are subtracted from your good habits.”

– Ben Franklin

There are countless and confusingly different ways to measure wealth and plan for retirement. We are going to skip all of those, and focus on something so much more valuable – Financial Freedom. It is healthier, more inspiring, and lasts longer. Financial Freedom occurs when multiple streams of secure income exceed all expenses (needs and wants), and can last until the age of 100. Overflow is kept separate, as contingency cash, for unplanned events.

We found 5 keys to finally, and definitively solve the question: How Much is Enough?

Key #1: Informed Simplicity

Regardless of how big any of your numbers appear to be on various financial statements or potential deals, they must result in a simple written plan that can be summarized on one detailed sheet of paper. To measure progress it must be simple to track.

Complexity is the enemy of execution and discipline. From our belief system that we also write down, one of the easiest rules to test all of your investments against is this one: If you cannot explain it to your spouse it does not belong in your house. This simple question has a better track record than any of Wall Street’s most sophisticated tools for risk analysis. Can you hand him or her an efficient plan, printed on one page, and explain it all simply?

“Simplicity is the ultimate sophistication.”

– Leonardo Da Vinci

Key #2: Multiple Streams of Secure Income

When your mailbox money coming in, is more than expenses going out, you are in good shape. But, we are aiming for something even better. A single uninsured source of income (like real estate for example) may offer great yield but substantial risk, illiquidity, and a lot of wear and tear over time. Until you have multiple streams of income, with more than one from a completely secure source, you do not have enough. These are four that will show up on every Financial Freedom Plan we build.

- Social Security: Optimize to best navigate hundreds of claiming rules

- Pension: Either corporate pension, or if none, fund a personal pension

- Municipal & Treasury Bonds: Safest most liquid form of mailbox money

- Dividends: Inflation beating mailbox money

Notice one thing those four streams of income have in common? None are inside of a fund or Wall Street product. The bottom three have all stood the test of time for a century or more.

Key #3: Our Benchmark is 100

For Financial Freedom, income must be available until at least 100 years of age. Years ago we got a lot of funny looks from prospective clients when they heard this requirement. We had to remind some that we do not monitor diet or exercise, we require this only of our math. We are not comfortable planning for an average retirement period.

We wrote about the misleading math of average rates of return. Average life expectancy numbers will doom even more financial plans. Those average ages take into account all deaths. Calculating income streams for a married couple to retire at 65, who is still alive at that time, is an entirely different question. The Society of Actuaries’ data reveals that half of those couples who are in good health will have at least one of the two celebrating a 95th birthday and beyond!

“Live as if you were to die tomorrow. Learn as if you were to live forever.”

-Mahatma Gandhi

The number of years in retirement is moving higher, more consistently, than any investment return number trying to keep up.

We have the great honor of celebrating 100+ year-old birthdays with a few three generation client families. Planning for their legacies is inspiring to us. Regardless of when our time runs out, knowing that multiple sources of secure income will outlive us means that any extra appreciation in asset values is just that – extra – and not part of the income plan. This incomparable peace of mind gives birth to planning who or what we would like to give that extra to.

Key #4: Planning > Predicting

If any part of your retirement plan is based on predictions of future growth then you do not have enough yet, or you have too much at risk. So, every single conversation, concern, or hope about the performance of the markets is just fine to have, but should not be able to scratch one penny of your income.

Even the most sophisticated and wealthiest families who have been referred to us are often confused by this part of the Financial Freedom Plan. Assets that fluctuate in value are just fine to own, but only after your multiple streams of income are planned for. The discipline of planning and removing enough of your nest egg from harm’s way, I assure you, will last longer than anybody’s market predictions track record.

Part of that planning is eliminating any $1 of unnecessary risk, costs, or taxes which has the same effect on your bottom line as making another $1 in profit. Really think about that. Making a plan more efficient has dramatically more compounding results on the math than predicting does.

“Predicting rain does not count, building the ark does.”

– Warren Buffett

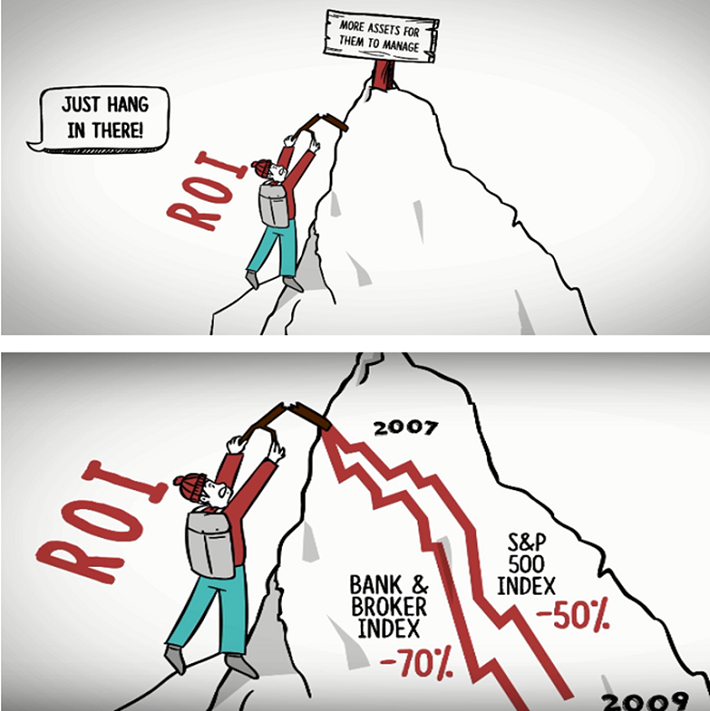

Key #5: Completely Re-Define Your ROI

We humbly suggest you turn almost everything Wall Street has taught you upside down. We are not throwing stones from a distance. We spent the first half of our careers inside the belly of the biggest bank/brokerage beast. Their business model is adding to a mountain of assets for them to charge fees on, plain and simple. Their first obligation is to produce profits for their shareholders. They hope to provide a decent return on investment (ROI) for their customers some of the time, along the way. When disaster strikes, the solution is always the same, “hang in there.” That ROI always wins for the mountain. But, investors have to know how much is enough, and when to stop climbing. We escaped Wall Street in 2006 for this reason.

Rather than focus on their traditional ROI, what if you turn those letters upside down in YOUR favor?

Rather than focus on their traditional ROI, what if you turn those letters upside down in YOUR favor?

- I: Income is the only outcome that matters to achieve Financial Freedom

- O: Opportunities for risk capital come AFTER your income is secured

- R: Reason you want to be Financially Free

That Reason is the only intangible part of our question – How Much is Enough? As much as we agonize over numbers every single day, let us candidly share something just as important from three decades worth of notes measuring the most successful Financial Freedom Plans. Have a clear purpose for just what to do next with your most valuable of all assets – more time. Once we have all the hows and whats of the math solved, then you can focus exclusively on your why. That reason is just as important as the numbers.

We are thrilled to share any page of our playbook with Sure Dividend (I am a longtime subscriber myself!). If any piece of any one of them helps you get to a better place, wherever that is, we are happy. We at least have one thing in common if you read this far – a strong belief that curiosity beats conviction. Anybody, including us, who think they have all the answers do not even understand the questions. NONE of the above is in any way a recommendation, we would not dream of making one of those to anybody we do not know. It is just a few thoughts on our best and honest answers to an important question we think should be explored more.

We are happy to answer any question you might have and can be reached at ryan@kc-roi.com and would love to hear your feedback on what YOU think.

Click here to read part 1 of the Financial Freedom Day series. Stay tuned for part 3!

Thanks for reading this article. Please send any feedback, corrections, or questions to support@suredividend.com.

Article by Ryan Krueger, Sure Dividend

ValueWalk readers can click here to instantly access an exclusive $100 discount on Sure Dividend’s premium online course Invest Like The Best, which contains a case-study-based investigation of how 6 of the world’s best investors beat the market over time.