Advisor Perspectives welcomes guest contributions. The views presented here do not necessarily represent those of Advisor Perspectives

Q1 hedge fund letters, conference, scoops etc

Quantitative investment researchers often seek uniquely optimal parameterizations of their strategies amongst a broad “robust” region of parameter choices. However, this ignores a critically important feature of investing – Diversification. By diversifying across many equally legitimate parameter choices – an ensemble – investors may be able to preserve expected performance with a higher degree of stability.

We examined this concept under the microscope using Dual Momentum – and in particular Global Equity Momentum – as our case study.

Our objectives were twofold:

- Verify the strength and robustness of the Dual Momentum concept and specifically the Global Equity Momentum strategy

- Describe how to use ensemble methods to preserve expected performance while minimizing the probability of adverse outcomes

Note: This article summarizes the actionable themes covered in our comprehensive report, “Global Equity Momentum: A Craftsman’s Perspective”. Click here to download the full report .

A brief history of global equity momentum

Global Equity Momentum (GEM) was formalized by Gary Antonacci in 2012. The strategy relies on the equity risk premium and two known style premia, trend and momentum, to rotate between U.S. and foreign stocks while moving to bonds when U.S. stocks exhibit a negative trend. The original paper tested the strategy with monthly data over the period 1974-2011. Gary later extended the analysis to cover the period 1950 – 2018, which introduced two out-of-sample periods (1950 – 1973 and 2012 – 2018).

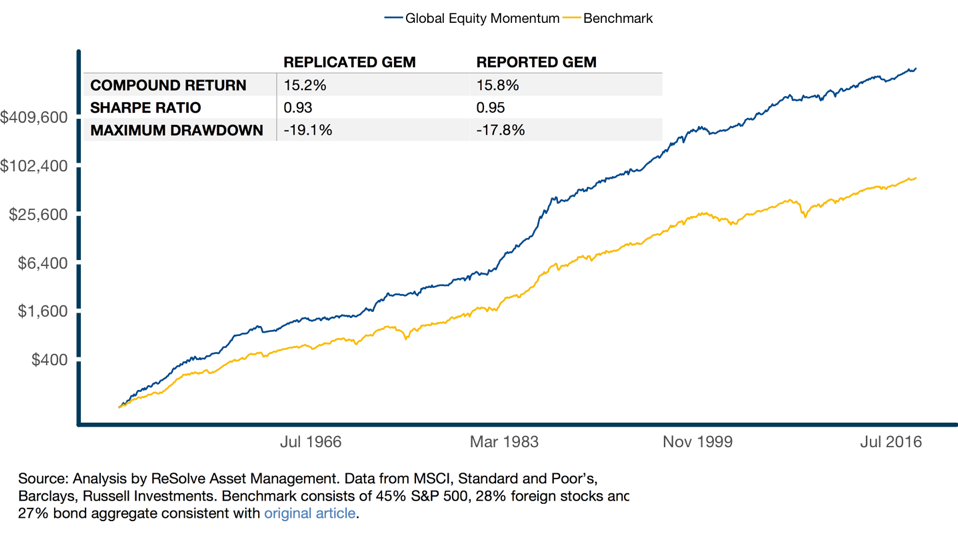

GEM has produced attractive absolute and risk-adjusted performance since 1950, both in- and out-of-sample. We replicated the original research using close data proxies. Figure 1 shows that our results tracked the author’s results very closely despite minor differences in how we constructed our index of foreign stocks.

Figure 1. Performance of Global Equity Momentum, 1950 – September 2018. HYPOTHETICAL AND SIMULATED RESULTS

Source: Analysis by ReSolve Asset Management. Data from MSCI, Standard and Poor’s, Barclays, Russell Investments. Benchmark consists of 45% S&P 500, 28% foreign stocks and 27% bond aggregate consistent with original article.

The Original GEM strategy was specified with a 12-month lookback period to measure both trend and momentum, consistent with prior literature on these effects. Many articles have also observed trend and momentum effects for shorter and longer horizons from 1-18 months or longer.

We examined GEM strategies specified with all possible combinations of absolute and relative momentum formed on 1-18 month lookbacks. With 18 possible parameterizations of trend lookbacks and 18 possible momentum lookbacks, there are 324 possible strategy combinations.

Read the full article here by Adam Butler, Advisor Perspectives