ETFGI reports assets invested in the Global ETF and ETP industry decreased to 5.32 trillion US dollars at the end of May 2019.

Q1 hedge fund letters, conference, scoops etc

LONDON— June 13, 2019 — ETFGI, a leading independent research and consultancy firm covering trends in the global ETF/ETP ecosystem, reported today that ETFs and ETPs listed Globally saw net outflows of US$4.05 billion in May, bringing year-to-date net inflows to US$141.04 billion. Assets invested in the Global ETF/ETP industry have decreased by 4.6%, from US$5.57 trillion at the end of April, to US$5.32 trillion, according to ETFGI’s May 2019 Global ETF and ETP industry landscape insights report, an annual paid-for research subscription service. (All dollar values in USD unless otherwise noted.)

Highlights

- Assets invested in the Global ETF/ETP industry declined to US$5.32 Tn.

- Assets invested in the Global ETF/ETP industry decreased by4.6% in May.

- During May 2019, ETFs/ETPs listed Globally saw$4.05 Bn in net outflows.

- 1st month of net outflows into ETFs/ETPs listed globally since January 2014.

“Markets appear to have returned to the uncertainty of 2018, after the US/China Trade war escalated further. In addition to that, Mr. Trump threatened higher tariffs on Mexican goods. The S&P 500 finished May down 6.4%, bringing year-to-date returns to 9.7%.” according to Deborah Fuhr, managing partner and founder of ETFGI.

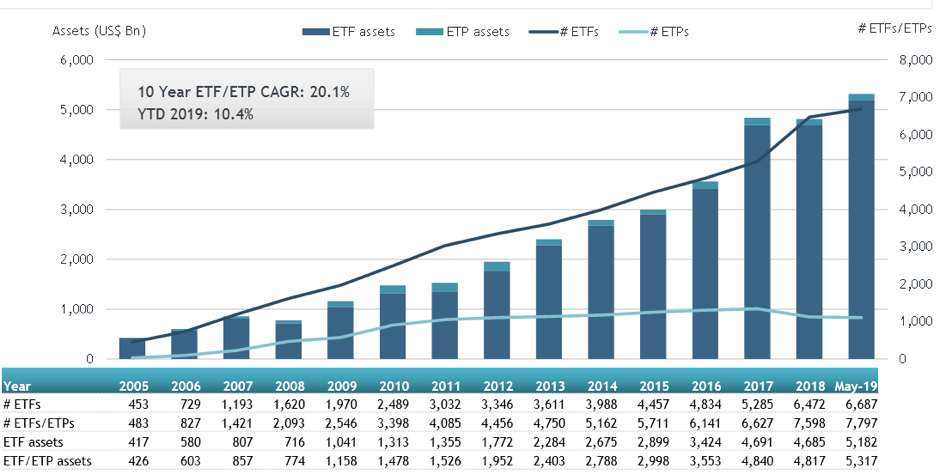

At the end of May 2019, the Global ETF/ETP industry had 7,797 ETFs/ETPs, from 415 providers listed on 71 exchanges in 58 countries. Following net outflows of $4.05 Bn and market moves during the month, assets invested in the Global ETF/ETP industry decreased by 4.6% from $5.57 Tn at the end of April, to $5.32 Tn in May 2019.

Growth in Global ETF and ETP assets as of the end of May 2019

Equity ETFs/ETPs listed Globally attracted net outflows of $18.92 Bn in May, bringing net inflows for 2019 to $52.14 Bn, substantially less than the $116.54 Bn in net inflows equity products had attracted by the end of May 2018. Fixed income ETFs/ETPs listed Globally attracted net inflows of $10.76 Bn in May, bringing net inflows for 2019 to $79.39 Bn, considerably greater than the $33.62 Bn in net inflows fixed income products had attracted by the end of May 2018.

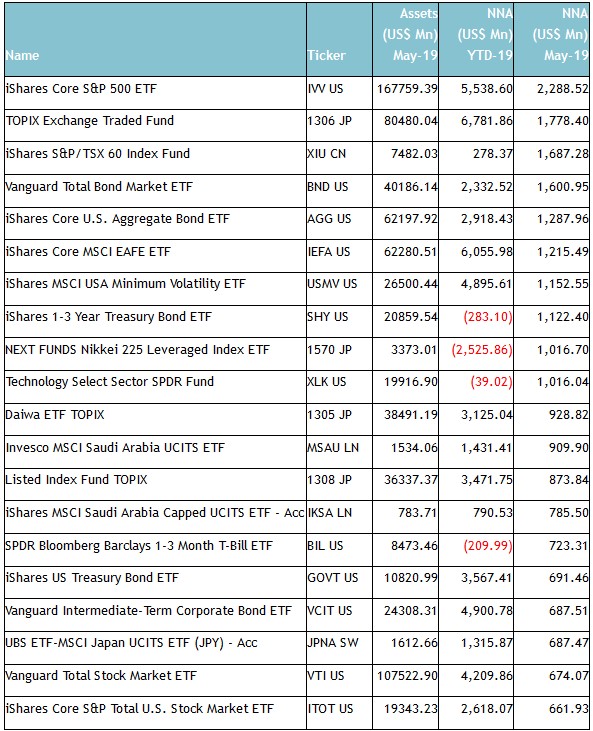

Substantial inflows can be attributed to the top 20 ETF’s by net new assets, which collectively gathered $21.79 Bn in May, the iShares Core S&P 500 ETF (IVV US) gathered $5.54 Bn alone.

Top 20 ETFs by net new assets May 2019: Global

The top 10 ETP’s by net new assets collectively gathered $1.22 Bn in March. NEXT NOTES S&P500 Dividend Aristocrats Net Return ETN (2044 JP) gathered $302 Mn.

Top 10 ETPs by net new assets May 2019: Global

Investors have tended to invest in fixed income/leveraged ETFs in May.

Article by ETFGI