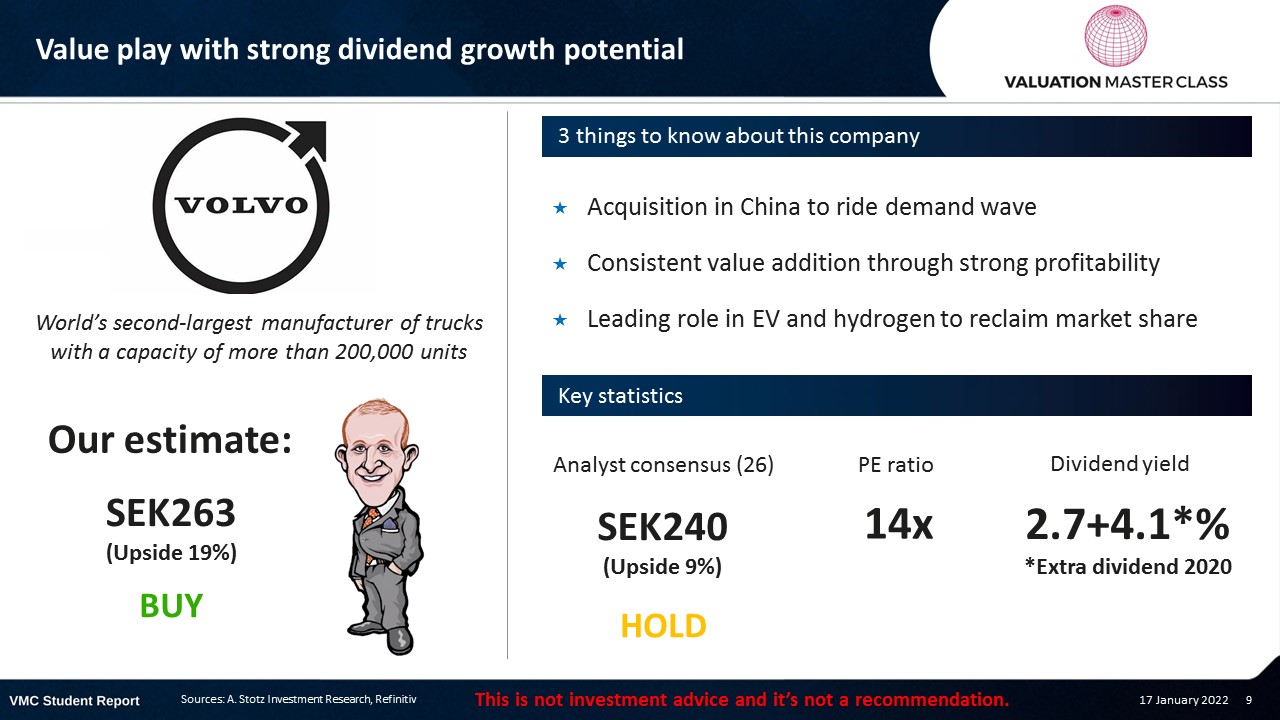

- Value play with strong dividend growth potential

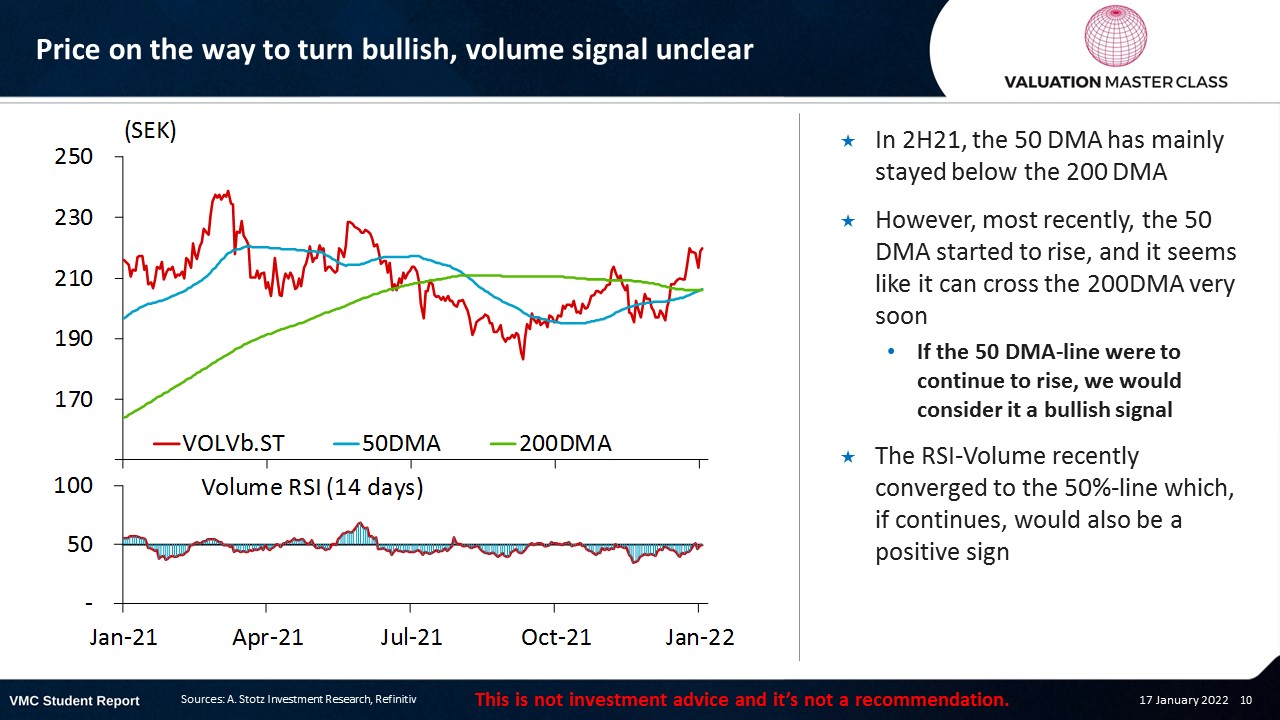

- Price on the way to turn bullish, volume signal unclear

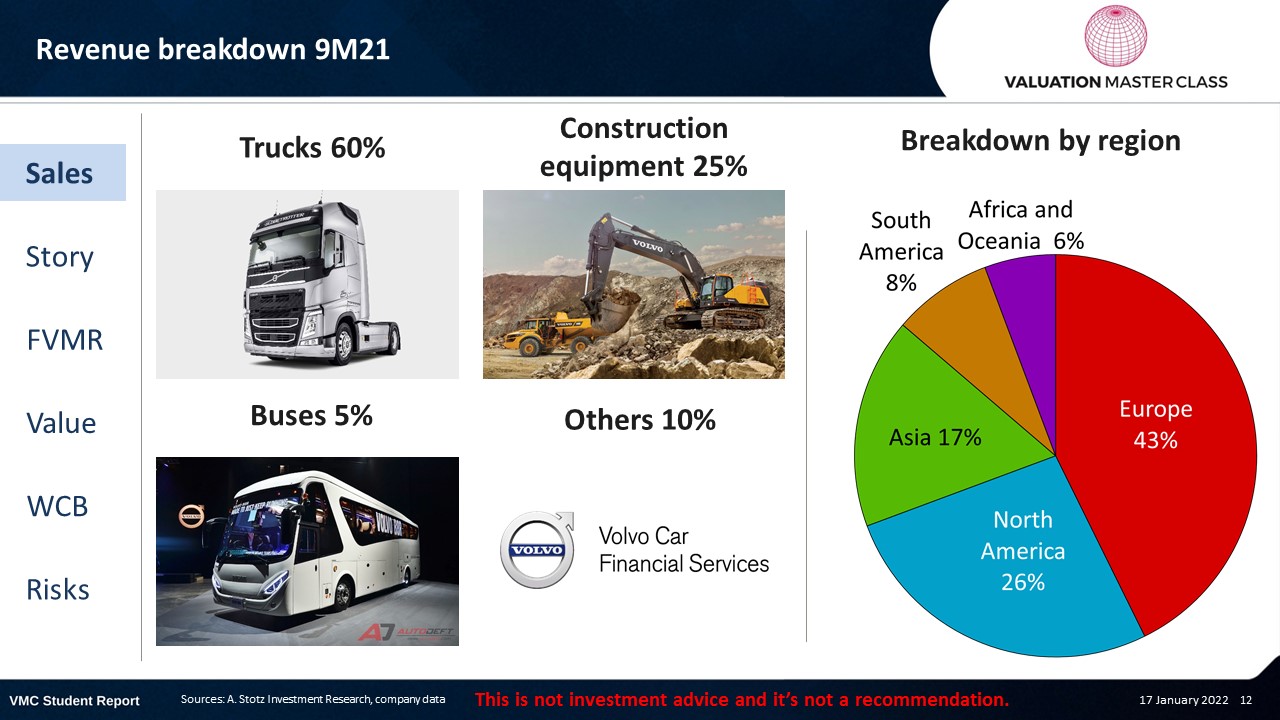

- Volvo’s revenue breakdown 9M21

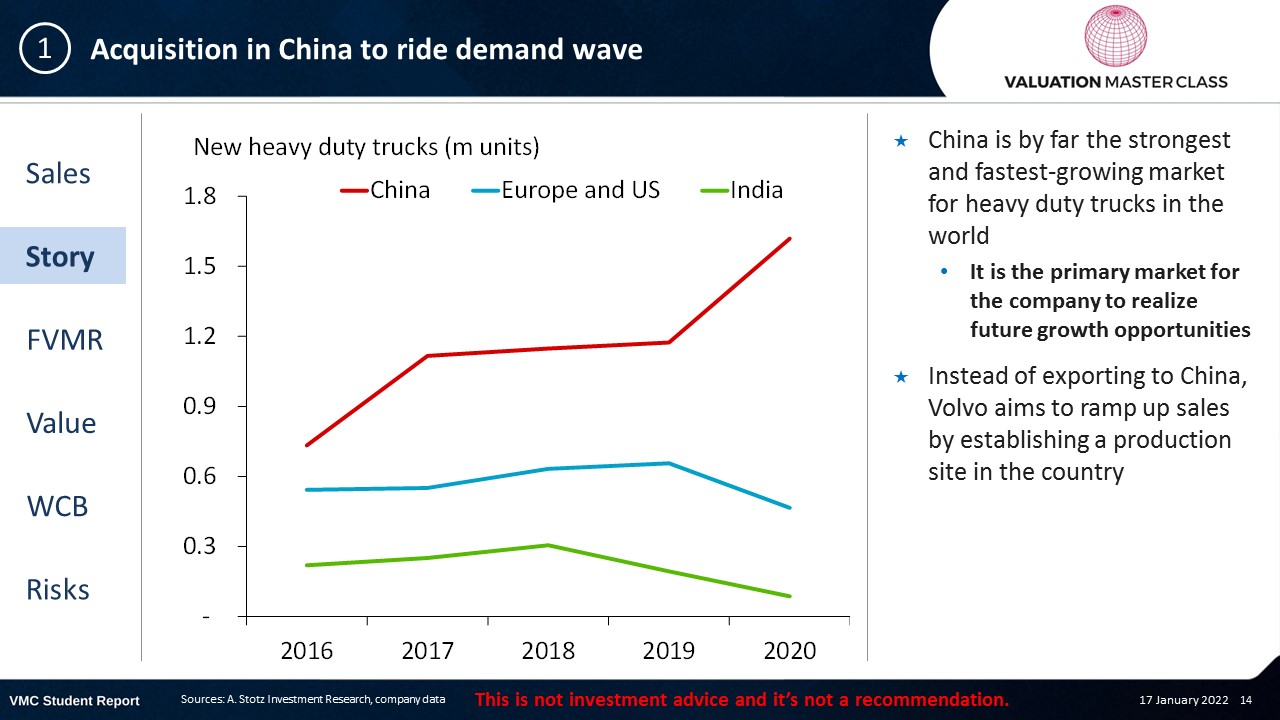

- Acquisition in China to ride demand wave

- New production site adds 7% capacity

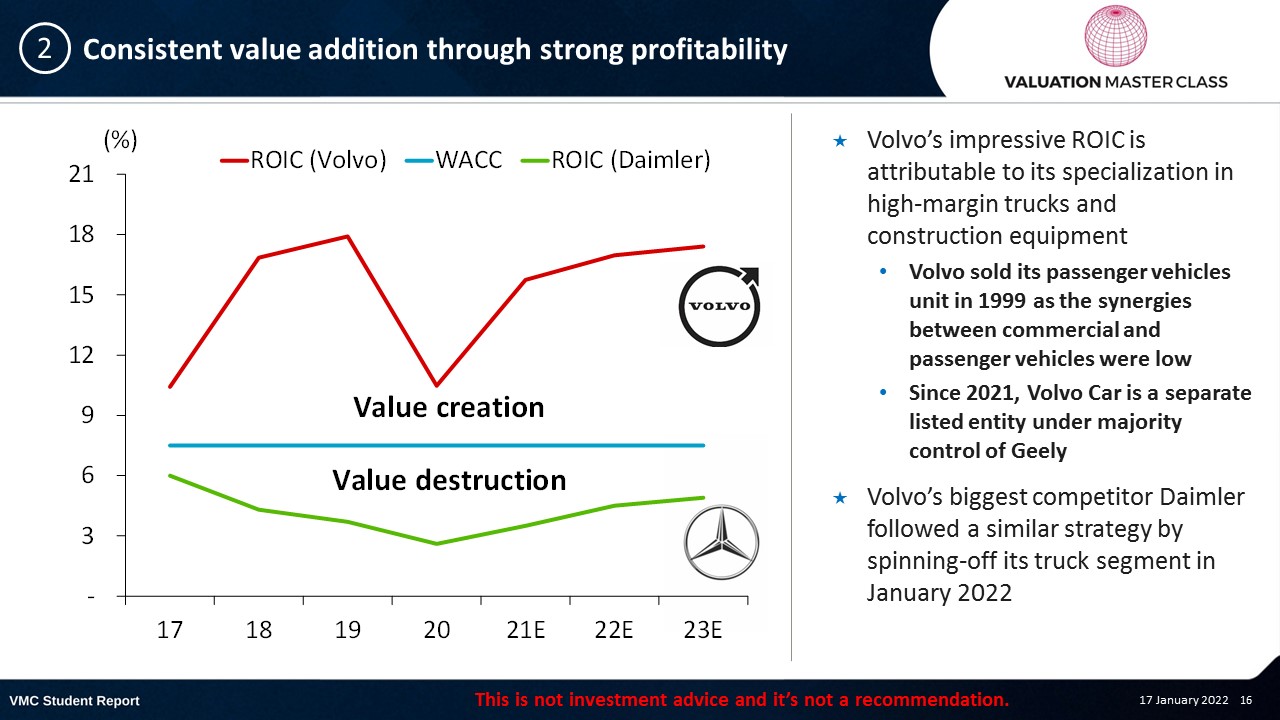

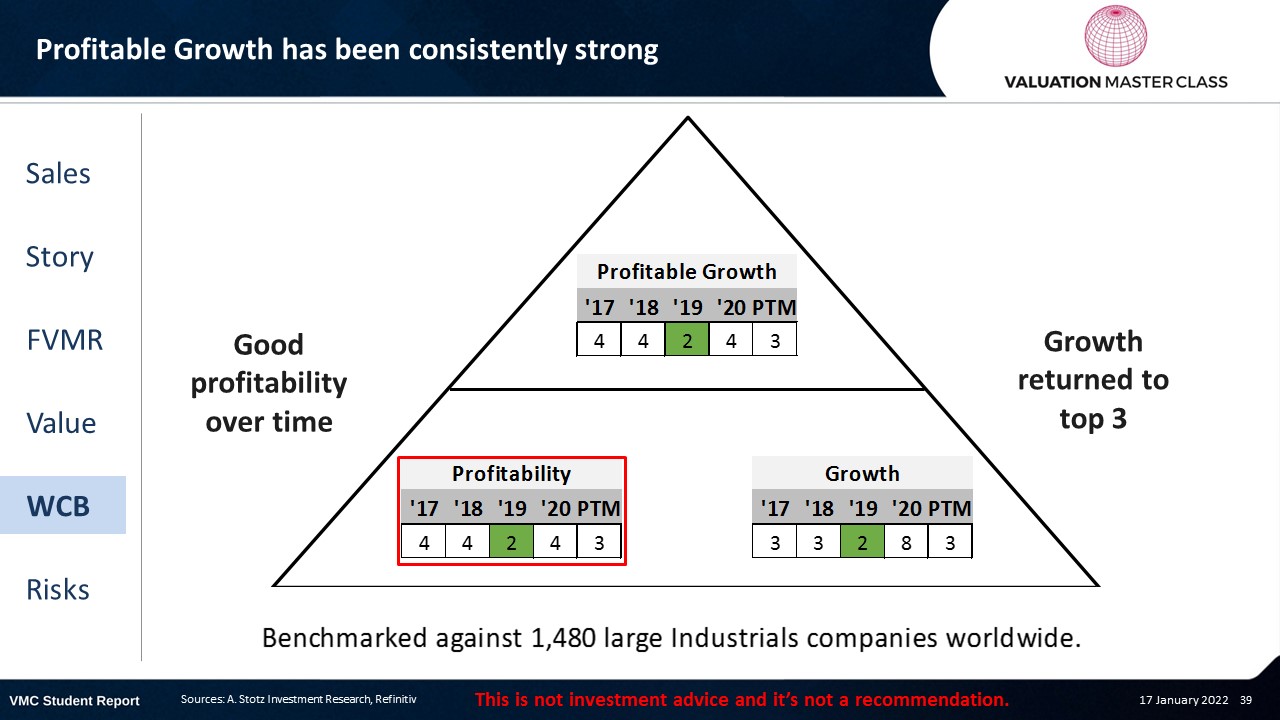

- Consistent value addition through strong profitability

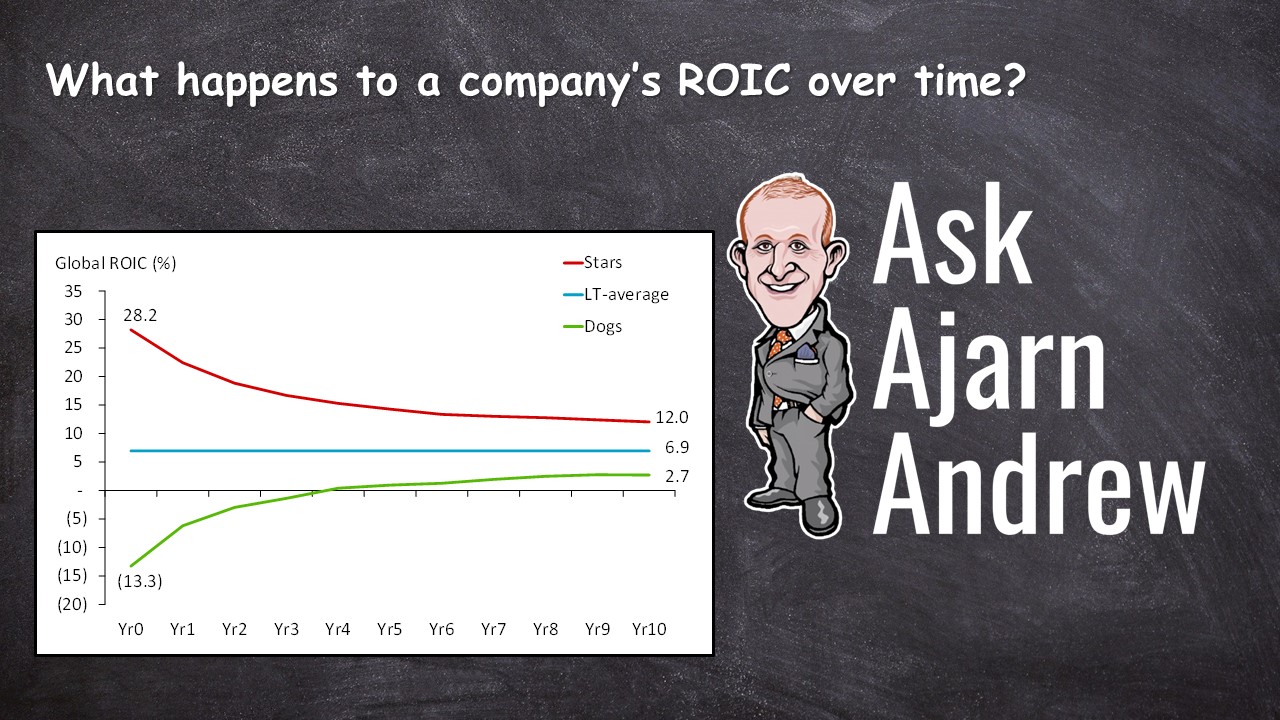

- What happens to a company’s ROIC over time?

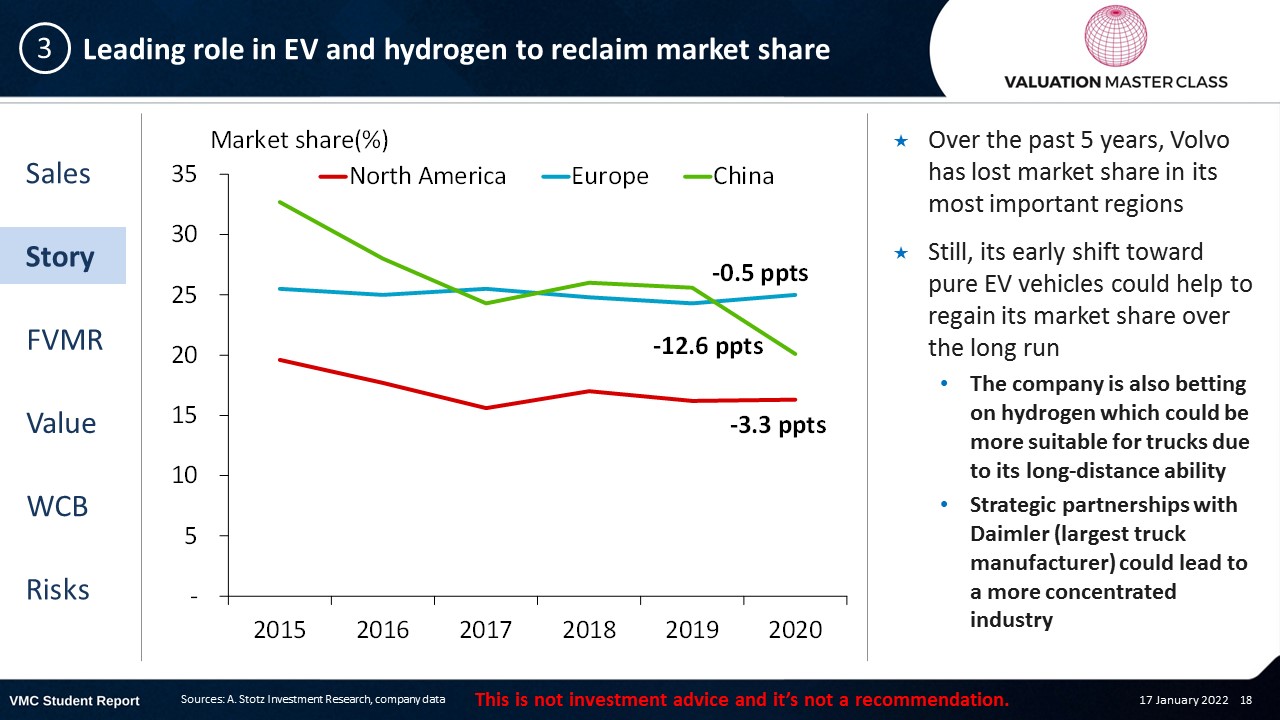

- Leading role in EV and hydrogen to reclaim market share

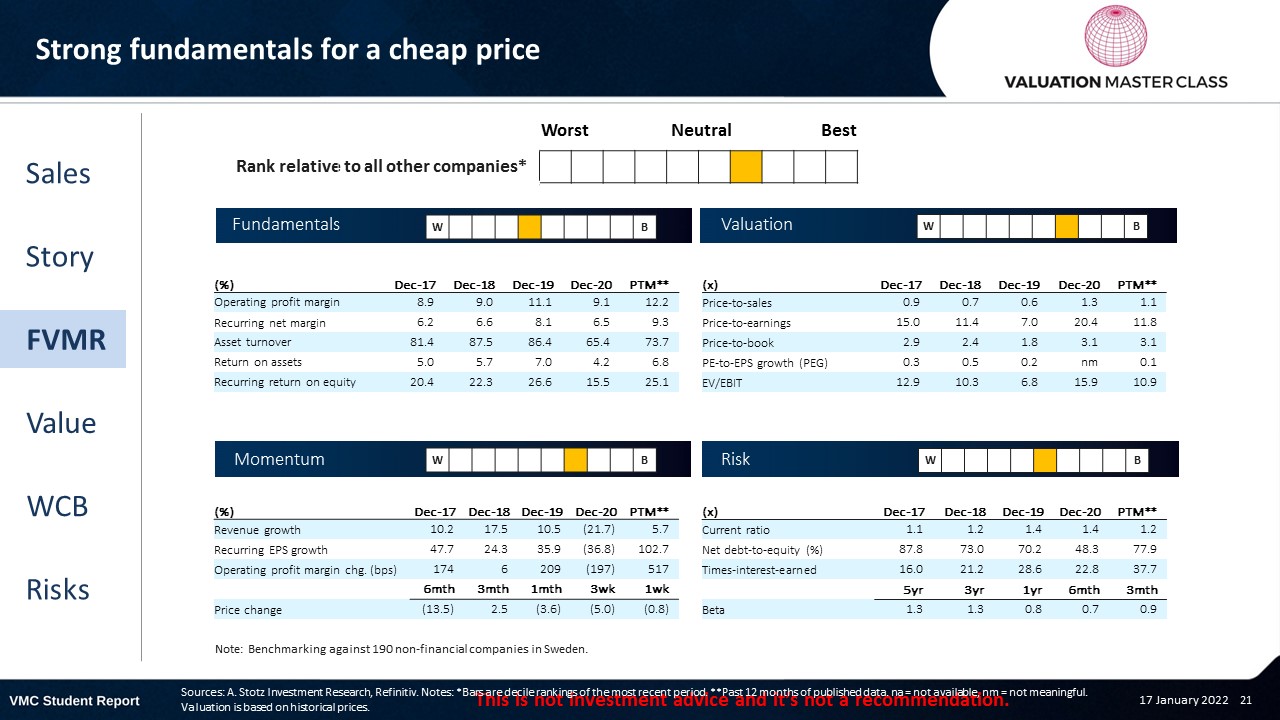

- FVMR Scorecard – Volvo

- Consensus remains cautious but sees upside

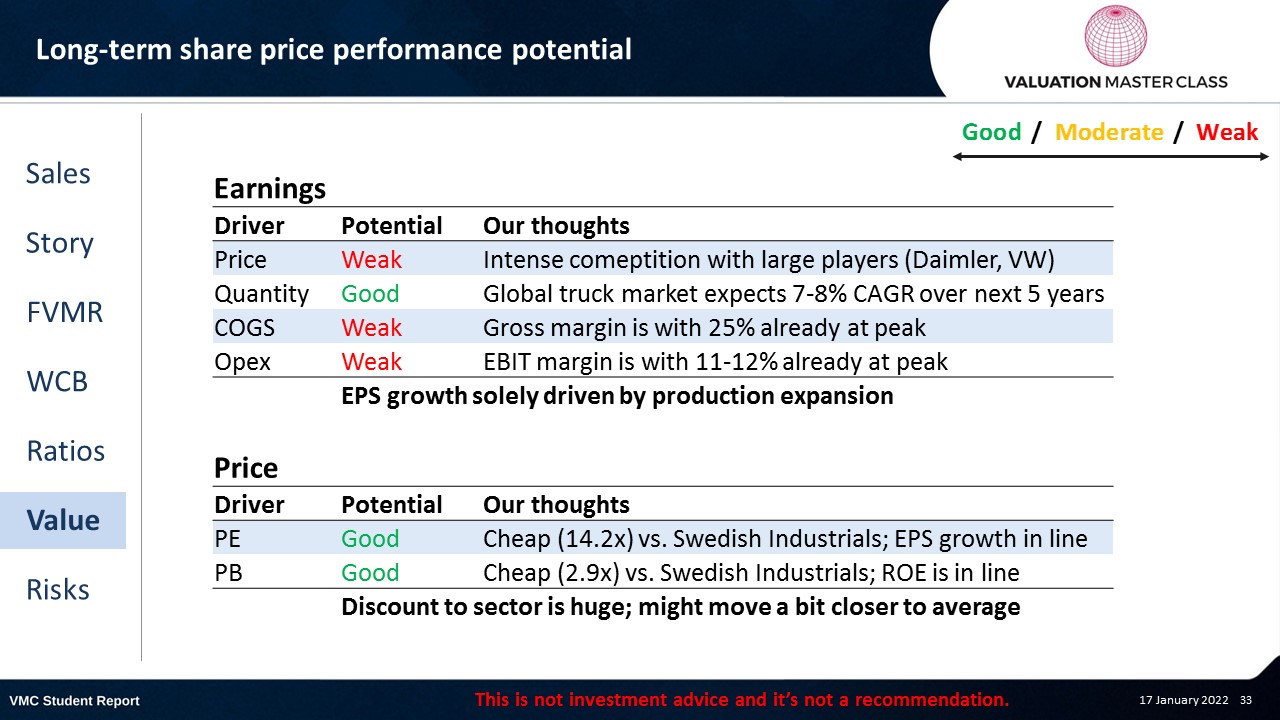

- Long-term share price performance potential

- World Class Benchmarking Scorecard – Volvo

- Key risk is intensified competition in local markets

- Conclusions

Value play with strong dividend growth potential

The post was originally published here.

Highlights:

- Acquisition in China to ride demand wave

- Consistent value addition through strong profitability

- Leading role in EV and hydrogen to reclaim market share

Download the full report as a PDF

Price on the way to turn bullish, volume signal unclear

- In 2H21, the 50 DMA has mainly stayed below the 200 DMA

- However, most recently, the 50 DMA started to rise, and it seems like it can cross the 200DMA very soon

- If the 50 DMA-line were to continue to rise, we would consider it a bullish signal

- The RSI-Volume recently converged to the 50%-line which, if continues, would also be a positive sign

Q1 2022 hedge fund letters, conferences and more

Volvo’s revenue breakdown 9M21

Acquisition in China to ride demand wave

- China is by far the strongest and fastest-growing market for heavy duty trucks in the world

- It is the primary market for the company to realize future growth opportunities

- Instead of exporting to China, Volvo aims to ramp up sales by establishing a production site in the country

New production site adds 7% capacity

- Volvo confirmed its plan to acquire JMC Heavy Duty Vehicle which owns a manufacturing site in Taiyuan, China

- The acquisition accumulates to SEK1.1bn

- With the acquisition, Volvo aims to ramp up its sales in China

- It adds 15,000 trucks to Volvo’s capacity

- As a comparison, in 2020, Volvo delivered 4,500 trucks to China

Consistent value addition through strong profitability

- Volvo’s impressive ROIC is attributable to its specialization in high-margin trucks and construction equipment

- Volvo sold its passenger vehicles unit in 1999 as the synergies between commercial and passenger vehicles were low

- Since 2021, Volvo Car is a separate listed entity under majority control of Geely

- Volvo’s biggest competitor Daimler followed a similar strategy by spinning-off its truck segment in January 2022

What happens to a company’s ROIC over time?

Leading role in EV and hydrogen to reclaim market share

- Over the past 5 years, Volvo has lost market share in its most important regions

- Still, its early shift toward pure EV vehicles could help to regain its market share over the long run

- The company is also betting on hydrogen which could be more suitable for trucks due to its long-distance ability

- Strategic partnerships with Daimler (largest truck manufacturer) could lead to a more concentrated industry

FVMR Scorecard – Volvo

- A stock’s attractiveness relative to stocks in that country or region

- Attractiveness is based on four elements

- Fundamentals, Valuation, Momentum, and Risk (FVMR)

- Scale from 1 (Best) to 10 (Worst)

Consensus remains cautious but sees upside

- 17 analysts expect the company to outperform while 9 analysts still stay cautious

- Analysts expect strong revenue growth in the next two years, but might be too pessimistic in 23E

- Given that the global truck segment is expected to grow by 7-8% until 25E, I believe that Volvo can maintain a growth rate above 5%

Get financial statements and assumptions in the full report

P&L – Volvo

- Net profit sees a strong rebound in 21E and could exceed its pre-pandemic level in 22E

- The strong bottom-line is mainly driven by the margin expansion, but also strong growth prospects

Balance sheet – Volvo

- Net assets have fallen in 2020 after selling UD truck segment to Isuzu Motors

- However, increased CAPEX for capacity expansion and battery development lead to increase in net fixed assets again

- The company is moderately leveraged

- In 2020, its net-debt to equity ratio stood at 0.9x

Cash flow statement – Volvo

- Strong operating cash flow allows the company to resume its dividend payments in line with its pre-pandemic policy

- I expect dividend yield over the near-term to range between 2.5-3.5%

Ratios – Volvo

- After the revenue rebound in 22E, we assume revenue growth to normalize

- Beyond 2022, I see a healthy annual revenue growth potential around 5%

- EBIT margin expansion in 21E likely to stay

- This helps Volvo to be among the most profitable trucks manufacturer

Long-term share price performance potential

Free cash flow – Volvo

- Strong cash flow generation is crucial for returning dividends to shareholders

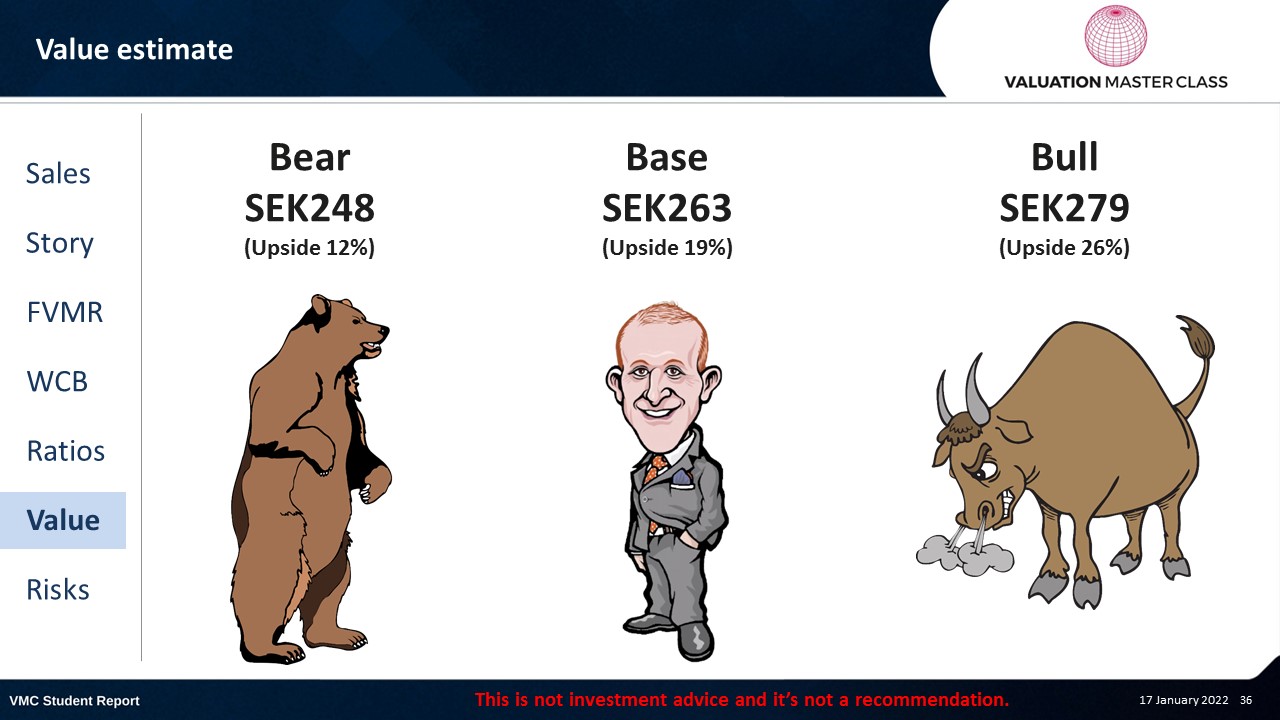

Value estimate – Volvo

- I see a slightly higher revenue growth than consensus

- Tapping further into the Chinese market could constitute a catalyst for the share price

- Truck market has favorable growth prospects

World Class Benchmarking Scorecard – Volvo

- Identifies a company’s competitive position relative to global peers

- Combined, composite rank of profitability and growth, called “Profitable Growth”

- Scale from 1 (Best) to 10 (Worst)

Key risk is intensified competition in local markets

- Adverse regulatory environment in China could hamper business

- Underestimating smaller local competitors could make expansion difficult

- Failure to keep up with technological shift to long-distance EV vehicles

Conclusions

- Riding demand wave in China is biggest potential for growth

- Fast adaption to EV and hydrogen give it a timing advantage in the market

- Industry-leading ROIC, but still trading at a discount

Download the full report as a PDF

Article by Andrew Stotz, Become a Better Investor.