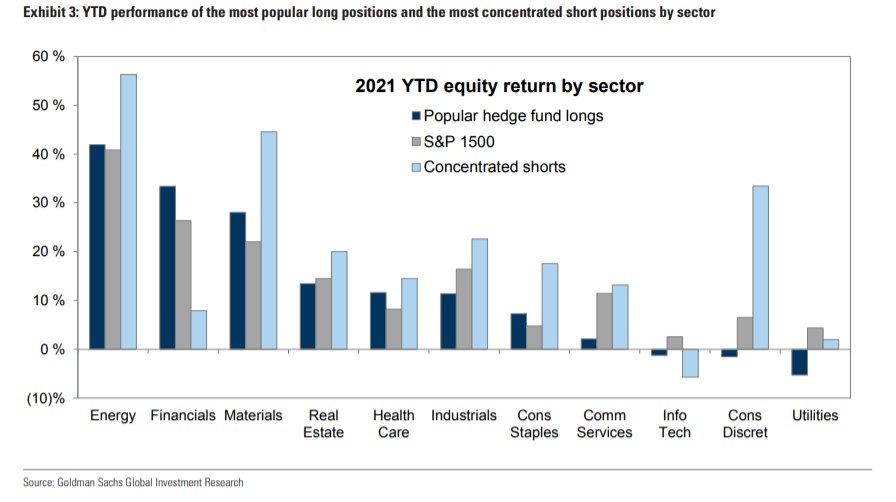

According to Goldman Sachs ‘ Hedge Fund Trend Monitor report, hedge funds rotated away from growth stocks, reduced leverage, and increased their tilt towards the Industrial, Material, and Energy sectors in the first quarter of 2021. Q1 2021 hedge fund letters, conferences and more The report analyses the holdings of 807 different hedge funds worldwide, with cumulative gross equity exposure of $2.7 trillion ($1.8 trillion long and $876 billion short). The first quarter of 2020 was a difficult period for hedge funds. Goldman’s Hedge Fund VIP basket, a basket of the most loved hedge fund stocks, has lagged the S&P…

Goldman Sachs: Hedge Funds Rotated From Growth To Value And Reduced Leverage In Q1

Sign up now and get our in-depth FREE e-books on famous investors like Klarman, Dalio, Schloss, Munger Rupert is a committed value investor and regularly writes and invests following the principles set out by Benjamin Graham. He is the editor and co-owner of Hidden Value Stocks, a quarterly investment newsletter aimed at institutional investors. Rupert owns shares in Berkshire Hathaway. Rupert holds qualifications from the Chartered Institute For Securities & Investment and the CFA Society of the UK. Rupert covers everything value investing for ValueWalk