Even before Russia invaded Ukraine the economy felt pretty dicey. There was inflation, a weird post-pandemic job market, and the prospect of a more hawkish Fed. Now markets are even more volatile as sanctions roil the global outlook. For anyone counting the days until retirement, it’s been a harrowing ride.

Plans you made in December to retire this year may not look so good now. Your nest egg has taken a big hit if you’re invested in the stock markets, with the S&P 500 down almost 9% in the last two months. So what should you do? Should you just wait a few more months to see what happens, start looking for a new job or hold on to the one you have a little longer?

Q4 2021 hedge fund letters, conferences and more

The fact is, the future has always been uncertain and always will be. Times like this just make the uncertainty more apparent. We face many unknowns today: the prospect of another Cold War will certainly send energy prices higher, which means inflation will be a concern for the foreseeable future, and there could be knock-on impacts for financial markets from the Russian sanctions. So if you’re leaning toward that wait-and-see strategy, you may be waiting for a long time. We could be in for a new normal.

The financial industry doesn’t often admit it, but retirement is a risk management problem. You need to think about maximizing each source of income while protecting it from downside risk — and there’s lots of potential downside these days. You can still retire, you just have to be proactive and resilient to a more uncertain world. To be honest, you have no choice.

Odds are you have three different sources of retirement income to manage: your retirement savings, Social Security and your human capital. Your goal is to balance each of these sources so you can get the most income for the least amount of risk. With stock values pared back, conventional advice (like the 4% spending rule) would suggest that you simply need to spend less. But current times illustrate why the conventional wisdom is bad advice. How are you supposed to spend less when prices are rising? Austerity is also asking a lot of seniors who already have missed on family visits and once in a life-time trips because of the pandemic.

The good news is you have other sources of income.

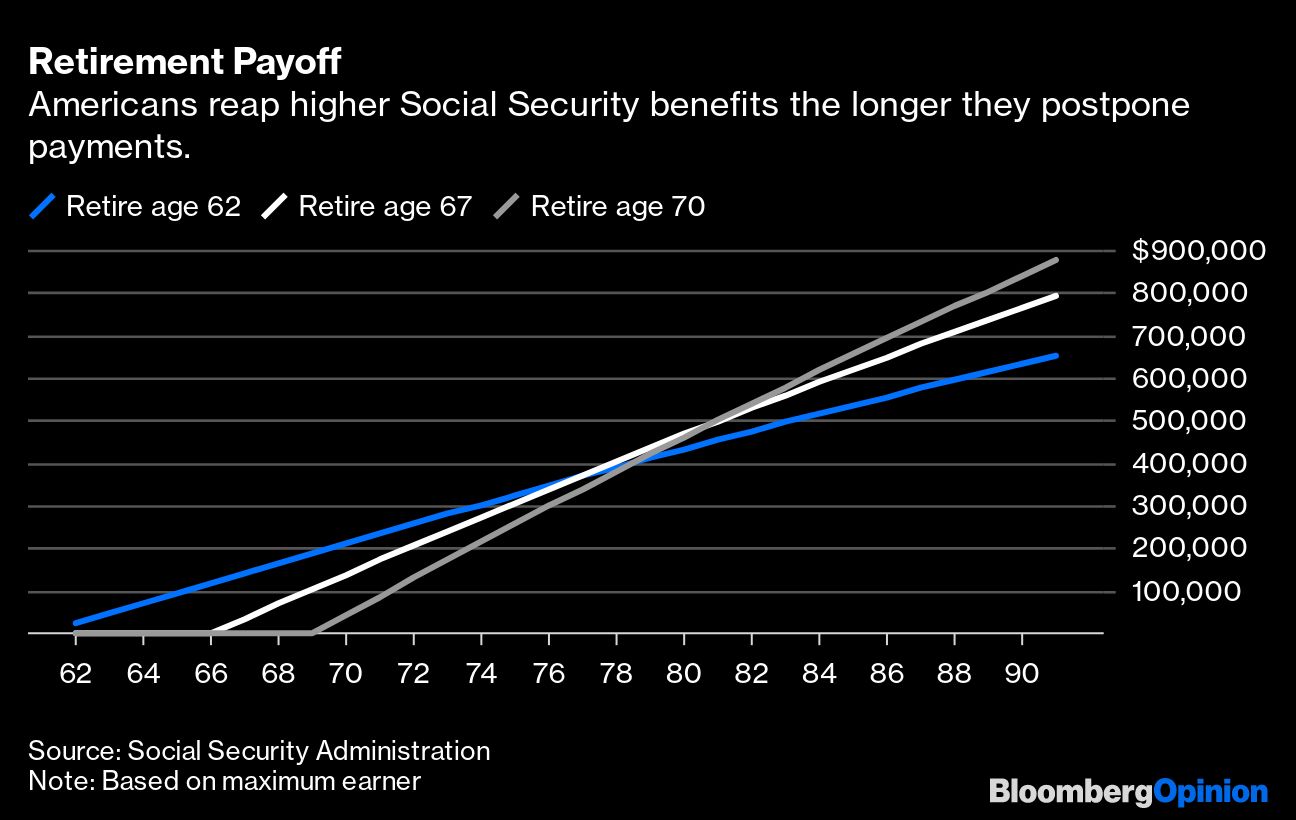

Social Security is indexed to inflation, making it relatively secure. It’s based on your career earnings, but there are still things you can do to increase it. If you claim Social Security at age 70 instead of 62 the sum total of your accrued benefits will be 17% higher if you make it to age 82 (which is the male life expectancy at 62). And remember that’s low risk, inflation-indexed income; there’s no better deal on the market.

Of course, delaying benefits means fewer years collecting them, but if you end up living to your early 80s you’ll come out ahead. The figure below plots how much you’ll get from Social Security (inflation-adjusted and discounted using today’s TIPS curve) at each age depending on when you retire.

And if you already claimed Social Security you can still change your mind and get higher benefits.

Read the full article by Allison Schrager, Advisor Perspectives