The concept of dividend growth investing can seem overwhelming at first. After all, investors have thousands of dividend-paying stocks to choose from. To help simplify things, at Sure Dividend we prefer to focus on dividend stocks with proven business models, durable competitive advantages, and long histories of dividend growth.

Q3 2019 hedge fund letters, conferences and more

Our favorite place to look for dividend stocks is the Dividend Aristocrats list, which includes companies that have increased their dividends for at least 25 consecutive years. Of the 505 stocks in the S&P 500 Index, just 57 currently qualify as Dividend Aristocrats. In other words, just over 1 out of 10 components of the S&P 500 Index—the most widely-used measure of the best U.S. businesses—makes it onto the list.

As a result, we view the Dividend Aristocrats as an exclusive group of high-quality dividend growth stocks to buy and hold for the long run.

Dividend Investing: Keep It Simple

Dividend stocks come in all shapes and sizes—mega-caps with market values above $200 billion, all the way down to small-caps with market caps above $2 billion. Even some micro-cap stocks pay dividends to shareholders.

Not only that, but dividend policies vary. Some companies pay out a relatively large portion of their earnings, resulting in high dividend yields above 5%. On the other hand, many companies choose to pay smaller dividends but offer the potential for high dividend growth over time. But not all dividend stocks are automatic buys.

High-yield stocks carry a number of risks, the most dangerous of which is the risk of a dividend cut. Dividend stocks with especially high yields look very attractive on the surface, but could also be in danger. Sometimes, stocks have high yields because their share prices have collapsed—a signal that the market doubts the company’s financial outlook. In bad times, high-yield stocks may be forced to cut their dividends, a very bad outcome for income investors.

By contrast, investors could look to stocks with low yields that offer the potential for rapid dividend increases over time. This is not unusual; companies in a growth phase will often choose to pay out less cash flow to shareholders, preferring instead to reinvest greater resources back into the business. This could work out well for investors if the company’s growth investments are successful and allow for higher dividend increases down the road.

There is no right answer to dividend investing, but we feel investors should ultimately focus on the underlying fundamentals of any stock they are considering for purchase. Those looking for dividend stocks that will stand the test of time should focus on buying strong businesses with competitive advantages and growth potential. This is why we prefer to look first and foremost at the Dividend Aristocrats.

Why the Dividend Aristocrats?

Legendary value investor Warren Buffett, Chairman of Berkshire Hathaway, famously coined the term “economic moat” to describe a business with an impenetrable competitive advantage. Typically, these include companies with world-class brands, a global reach, and economies of scale that insulate it from the threat of a new company taking its market share.

We believe many of the Dividend Aristocrats possess a wide economic moat, which has allowed them to raise their dividends for at least 25 years. In many cases, Dividend Aristocrats have raised their dividends much longer than 25 years. Some even have maintained over 40-50 years of consecutive dividend increases. These businesses have lasted through any number of challenges, including but not limited to wars, recessions, and periods of elevated geopolitical risk. And yet, they have managed to keep raising their dividends each year without interruption.

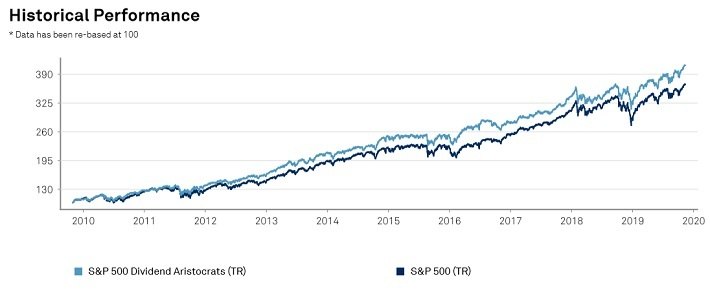

Put simply, the proof is in the pudding. The Dividend Aristocrats as a whole have outperformed the broader market index over the past several years, with lower volatility as well. According to Standard & Poor’s, the S&P 500 Index has generated annualized total returns of 13.0% over the past 10 years through October 31st. In the same 10-year period, the Dividend Aristocrats have generated annualized total returns of 14.0%, representing a full percentage point of annual outperformance for the Dividend Aristocrats.

Source: Dividend Aristocrats Fact Sheet

Also, consider that the last 10 years included an uninterrupted bull market, when investors might assume steady dividend stocks would underperform the index. However, the opposite occurred, and in fact, the Dividend Aristocrats outperformed with a lower level of volatility than the broader index. In the past 10 years, the S&P 500 Index has had a standard deviation—a widely-used measure of stock market risk—of 12.5%. This compares to a standard deviation of 11.3% for the Dividend Aristocrats in the same time frame. This means the Dividend Aristocrats not only generated outperformance but did so with less risk than the S&P 500 Index in the past 10 years.

We believe the Dividend Aristocrats remain attractive today, even after a prolonged period of outperformance. Income investors can increase their dividend yields by focusing on the Dividend Aristocrats. As a whole, the Dividend Aristocrats collectively yield 2.5% right now, compared with a 1.9% dividend yield for the S&P 500 Index and a 1.87% yield for the 10-year U.S. Treasury Bond.

There are a few Dividend Aristocrats that offer an even higher yield, along with excellent business models and the ability to provide dividend growth each year, even during recessions. For example, health care giant Johnson & Johnson (JNJ), industrial conglomerate 3M Corp. (MMM), and oil and gas major Exxon Mobil (XOM) provide yields of 3% to 5%, and each raises its dividends each year at a rate that exceeds inflation. These are just a few possible examples of the 57 Dividend Aristocrats that could be suitable for long-term dividend investors.

Final Thoughts

In today’s investing climate, high yields are hard to find. The stock market sits near a record high while falling interest rates mean lower yields on corporate and government bonds. For income investors and value investors alike who desire higher yields as well as the potential for income growth over time, we recommend taking a closer look at the Dividend Aristocrats.

What is Old School Value?

Old School Value is a suite of value investing tools designed to fatten your portfolio by identifying what stocks to buy and sell.

It is a stock grader, value screener, and valuation tools for the busy investor designed to help you pick stocks 4x faster.

Check out the live preview of AMZN, MSFT, BAC, AAPL and FB.

Article by Old School Value