The question I frequently get lately is “inflation is here, what should I invest in?” Given record levels of monetary policy stimulus, central bank plans to let inflation run hot, and rising fiscal deficits, it’s a good question. Since we can’t hide from it there are things you can do to minimize its impact.

Q2 2021 hedge fund letters, conferences and more

We are witnessing strong levels of inflation in categories such as labor, logistics and raw materials. Some of it we see everyday, like in food, gas, and lumber. There’s also the inflation we don’t see, like the cost of a shipping container that’s about 10 times what it was a year ago (and good luck finding one).

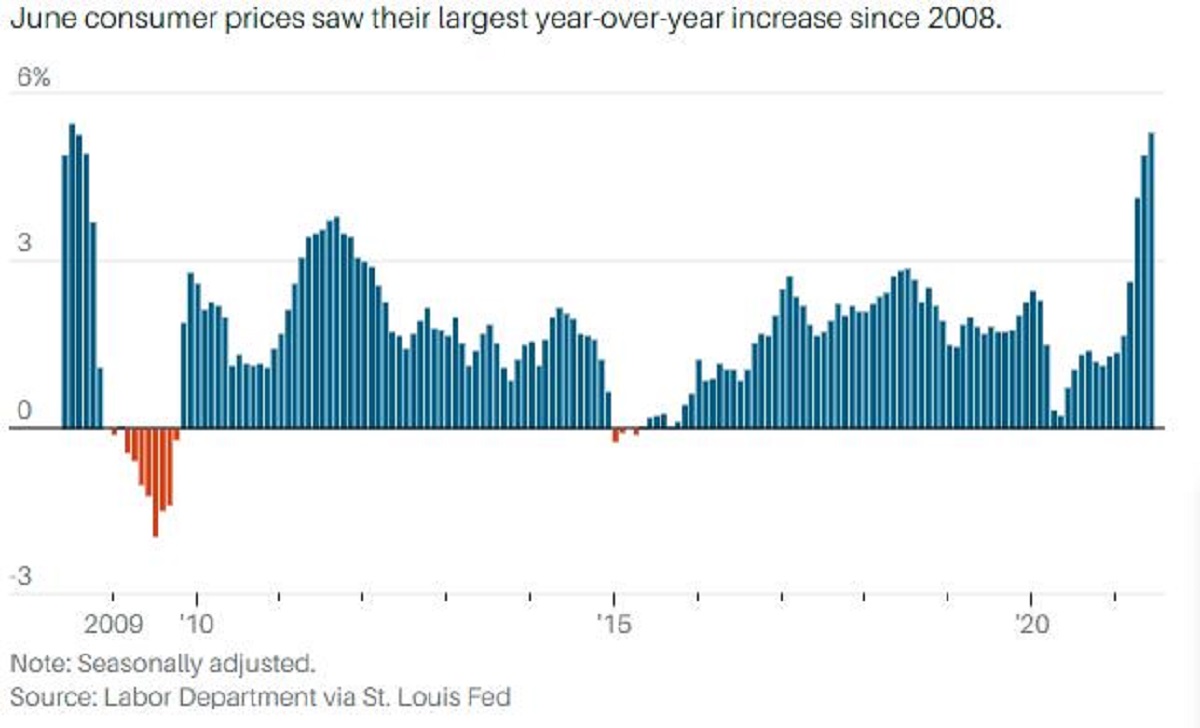

First I want to address the financial headline that’s making the round: Consumer prices continued to surge in June, up 5.4%, rising at the fastest pace since August 2008 and raising fresh questions over whether price inflation will be transitory. This rate more than doubles the Federal Reserve’s 2% annual inflation target. Ok, the number is “breaking news” but it was highly expected and that’s why the markets didn’t react much to the “shocking” headline. And once you dig a little bit you realize the number is highly distorted.

Some of the hot inflation readings in recent months have largely been attributed to the so-called base effect, where depressed pandemic levels from a year ago translate to artificially higher year-over-year rates. The latest CPI reading is a measure of the June 2021 number over the June 2020 number. But in June 2020 the country was still deep in the pandemic trough. It’s akin to taking a hot bun out of the oven and comparing it to a frozen one. Eventually the base effect will disappear and in another few months we will have more accurate readings.The point that headlines can be misleading. Either way, your grocery cart is costing more and that doesn’t make anybody feel better.

Back to the opening question. I wish there was a simple answer, a simple solution. As easy as asking your pharmacist for an ointment cream. “You have this symptom, take this and it will be gone.” The truth is that investing is not easy, despite the impression the TV people and the Reddit crowd gives. If it was easy, we would all be rich. And I wouldn’t be getting that question so many times.

Here’s what we are dealing with: Inflation: 5.4%, 10-year bond yields: 1.4%, Gold: flat over the last year, Bitcoin: 50% off its high. I’m mentioning Bitcoin and gold because they are both considered inflation hedges. As for Bitcoin, the narrative is constantly changing.

My point is that inflation hedging is not as easy as it sounds. So I decided to throw together a post to summarize my thinking on how to approach inflation. Please note that I’m not a pharmacist so my answer is more complex.

I split the post in two parts. The first part is a short 101 primer on inflation and interest rates. It helps to understand the relation between the two. The second part touches on the investment approach. Feel free to jump around.

Inflation 101

It’s the rise in price. It’s an invisible tax. The loss of purchasing power. Your dollar today buys less goods and services than it did ten years ago. The old tale was that grandpa used to take grandma out on the town for $1 and come home with spare change.

Here’s an inflation chart since 2008:

What are the causes of inflation?

The classic definition is too much money chasing too few goods because of an expansion of the money supply. Inflation has many causes, but they mainly break down into two camps: demand-pull and cost-push. Demand-pull happens when an increase in the demand for goods and services leads producers to raise prices. Cost-push occurs when producers raise prices because their costs have gone up.

Right now, the inflation we see is due to a “supply shock”. Problems in the manufacturing chains and logistics have led to an increase in price. It remains to be seen if it’s “transitory” like the central banks tells us, or if it’s permanent and on the rise. The increase in wages suggests that some inflation is permanent. When businesses run into rough times, they may be inclined to cut workers’ pay. But in practice, that doesn’t happen much (more likely to cut hours or layoffs which explains why recessions tend to lead to higher unemployment instead of lower wages).

How do you measure inflation?

We live in a world where nobody agrees on anything and this includes inflation reading. The official measure is the Consumer Price Index (CPI). It measures a basket of goods and services. The CPI is the most widely used measure of inflation and, by proxy, of the effectiveness of the government’s economic policy. It has its flaws. It has its critics. Some question the methodology. It’s constantly revised. Some say it understates inflation. Others say it’s overstates because it doesn’t fully recognize the improvement of the things we buy (your amazing new laptop cost less than the one you bought three years ago).

There’s no perfect way to measure inflation. You have Core CPI, Raw CPI, the Personal Consumption Expenditure Index (PCE) which is the preferred metric by certain institutions. Some just look at the price of gas at the pump. In general people look at housing, gas, food, and medical bills and they say I wish it only went up 2%!

How do you fight inflation?

Central banks, like the Federal Reserve, set interest rates. That’s the rate that banks borrow from them. Now any mention of the Federal Reserve sets you on a path of a never ending rabbit hole and four clicks in you reading about the Illuminati. So I’m going to keep at the “Explain It Like I’m Five” level. If central banks raise rates the cost of borrowing goes up and trickles down to your mortgage and credit card payments.

The idea is that when rates rise there’s less money in the economy (more attractive to save also). This can be done to slow an overheated economy. The opposite is true. Lower interest rates to stimulate the economy.

The 2% Inflation Target

Central banks have set an inflation target of 2%. Why 2%? Back when inflation was a major problem the Bank of New Zealand decided that 2% was the right number. In 1989 when inflation was running at 7.6%, the guy in charge, Don Brash, went on TV and said inflation should be at 2% and everybody said fine. Guess what, in 1991 inflation was at 2%. That’s where the 2% target comes from. There’s nothing magic about that number. Don just felt like it was a good number. As a result, most central banks in the world said we want to do the same thing and the 2% target became the anchor piece of monetary policy. At 2% inflation, the value of a dollar falls by half over 35 years, whereas at 4% it falls in half every 18 years.

However, it should be noted that since the pandemic the central banks are moving away from the 2% target and are willing to “overshoot” to get the economy back on its foot. I have no clue if that’s the right approach or not. I think they are making stuff up as we go.

Real Interest Rates

Nominal Interest rate % – Inflation % = Real Interest Rate

Example: 1% Interest Rate – 3% Inflation = -2% Real Interest rate

If your mortgage is 2%, and inflation is at 4%, you are paying a negative interest rate.

Be careful of emerging market yield. When you see interest rates in foreign countries at let’s say 10%. But if inflation is at 15%, your real return is -5%. Not good. And you also have foreign exchange risk to consider, asset volatility, politics, capital control etc…

Part II

Now back to the main question, where do you put your money during a period of inflation?

Let’s start with the stuff I would avoid. Sometimes, success in investing is not about picking the winners, but about avoiding the losers.

Long-term Bonds

When rates rise long-term bonds get slaughtered. Long term bonds are most sensitive to interest rate changes. Owning a bond is essentially like possessing a stream of future cash payments. It’s straight up math. If you have a bond with a face value of $1000 and makes an interest payment of $10 per year, it has a coupon yield of 1%. Rates go up to 5%, what happens to your bond? It goes down hard. The price of the bond is lowered so that the coupon payments and maturity value equal yield of 5%.

For the actual calculation you have to take into account the duration of the bond and two of the most basic concepts of finance, the time value of money and net present value. It describes the difference between the value of a dollar today and a dollar in the future, based on the interest rate that can be earned on that money. Assuming a rate of 10%, $1 received in one year has a present value of 91 cents. A dollar in two years discounted at 10% has a present value of 83 cents, and so on.

Bonds are normally the starting point for investors. The price of the 10-year T-Bill normally dictates the price of all other assets. They are supposed to be the safest investments. It’s the risk free rate. This means all the other rates are built off the top of that. In theory it means a riskier asset wouldn’t yield less. In practice we know it’s not exactly true. Greece has negative yielding bonds. Go figure. Add it to the other anomalies of the current world we live in.

On a global level, bonds with a value of about $15 trillion currently trade with a negative yield. What’s going on here? This is investment money that is guaranteed to produce a loss of capital.

This is a combination of massive buying panic in bonds (raising prices and lowering yields) and the bond market is a massive bubble. Why? There’s a belief that there will be another sucker who will buy them from you at a higher price in the future.

At the moment the 10-year T-Bill yields 1.3% and for some reason investors can’t get enough of that stuff. That same T-Bill was yielding 1.7% a couple weeks ago and everybody agreed that there was only one way it could go: Up up up! Well that would be too easy. A prolonged drop in the U.S. Treasury yields are catching bond and fixed income traders by surprise! Despite lingering concerns about rising inflation and a gradual removal of Fed stimulus. They call it the “treasury mystery”. I don’t know how these macro guys can keep a job.

Back to math. The CPI inflation read reached an eye-popping 5% last month. So the real return on your 10-yr T-Bill is 1.25% – 5%= -3.75%. Great way to lose your purchasing power. Inflation and returns will wipe you out.

I wouldn’t count on long-term government bonds to finance his retirement.

High Flying Hot Stocks

These are the flavor of the month stocks. A lot of these stocks don’t have profits or even a sustainable business model. They are valued on future projections.These projections are discounted back to present value. When interest rates are low, they look good. If the baseline for expected inflation changes from 2% to 4%, then discount rates investors will use goes up as well. A 2 point change in discount rate puts significant downward pressure on the value of future cash flows. This is again about math.

Cash

The thinking is similar to bonds. You need to answer key questions. What are you planning to do with the cash? What is it for?

If you are saving for the short-term, like building up a downpayment for a house. Staying in cash is fine. But if you are just piling up cash for retirement inflation will wipe you out.

If I can expand on that line of thinking, cash represents a call option on future ideas. You want to be in a position to take advantage of opportunities. You should always have some cash around because when we have a moment of peak distress, like March 2020, you want to back up the truck for opportunities that are really attractive.

Crypto

The young people don’t talk about gold. Crypto is their “gold”. Yes the blockchain is revolutionary and I’m sure one day we will find a way to make it work at scale. But I’m talking about cryptocurrencies here. Betting on which crypto will go up is not investing. Look, the whole crypto thing is fun. I’m an observer. I’m sure great things will eventually come out of it. But serious investing? There are serious flaws with Bitcoins. It’s flawed as a currency. Then you have your environmental issues, regulatory issues, the crackdowns, the scams, and the hacks. And unlike gold there’s a maintenance cost related to the miners.

Playing/speculating on crypto is one thing. Inflation hedge? Not my go to.

Investments to consider:

TIPS

Treasury Inflation Protected Securities (TIPS) are a much sought after insurance plan against CPI surprises. But they are expensive. Demand has pushed up their prices and depressed their future returns. Unfortunately, TIPS do not always live up to their billing. TIPS rely on the CPI, which may understate inflation. The yield on a TIPS bond is equal to the Treasury bond yield minus the expected inflation rate. If nominal Treasury rates are low, below the expected inflation rate, TIPS yield can fall in negative territories. TIPS have historically performed relatively better only when inflation is greater than expected, given their greater sensitivity to inflation.

You have to understand how they work. You wouldn’t put all my money in it. If you think expectation is greater than expected, this could be an interesting investment. TIPS can play a role in a balanced portfolio.

Commodities

Commodities tend to do well during periods of inflation but that doesn’t necessarily make it an easy place to invest.

Lumber is down 50% from its peak. Last week lumber was trading around $770 per thousand board feet. That’s down from its $1,515 all-time high on May 28. It would have taken six weeks to lose half your investment.

Copper, the commodity that electric cars can’t get enough, is also down.

Oil is up. But oil and gas have thei

Article by Brian Langis