“So I should say that civilizations begin with religion and stoicism: they end with skepticism and unbelief, and the undisciplined pursuit of individual pleasure. A civilization is born stoic and dies epicurean.” ~ Will Durant

Good morning!

This is an extra dirty Dirty Dozen [CHART PACK] this week as I’m running on wee sleep and didn’t feel like taking the time to sex up the charts. I’ll be back with the regular goods next week. Regardless, here’s some charts and a bit of what I’m looking at…

Q4 2021 hedge fund letters, conferences and more

- Here’s the most recently updated list of western sanctions against Russia. It’s a looong list so the below is just a screenshot. You can find the rest here from the FT or here to get around the paywall.

- There’s going to be a wide range of lasting and significant impacts from Putin’s decision to invade Ukraine. Germany making serious moves to build out its energy independence is one of them (list from BBG below, article here). They also floated the idea of doing a 180 on their nuclear policy, which is literal music to my ears.

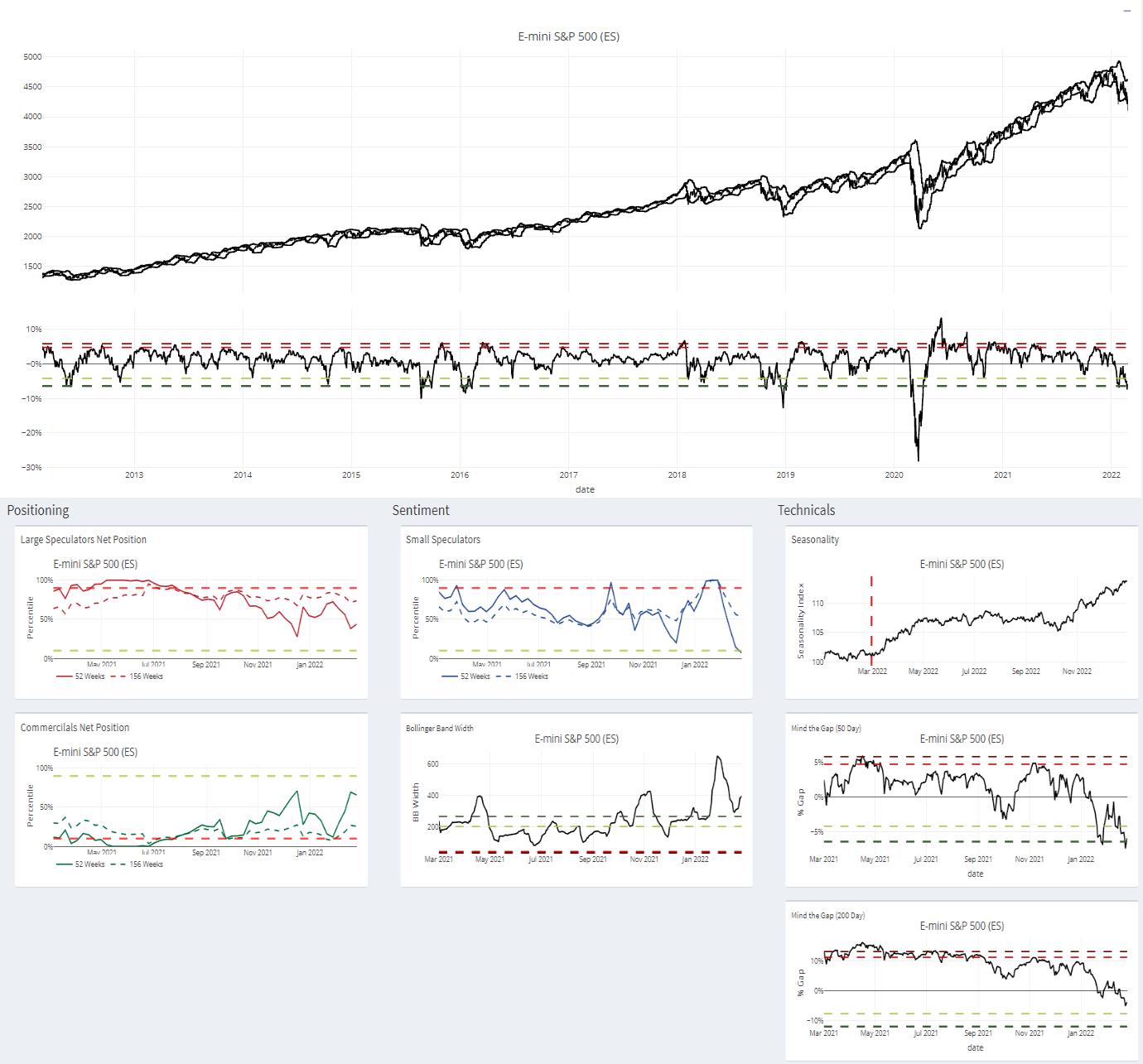

- For equities it continues to be a tough read. I suggest not being too anchored to any one scenario and instead let the chart develop and tell you where it’s headed.

We’ve been bearish for the past 2+ months but we now have a pretty significant bear trap reversal below the large neckline. We’ll have to see where things trade at the start of the week. But the market could have bottomed. This is not my base case but it is one I’m actively entertaining.

- One reason is that maybe geopol activity gets the Fed to lighten up on the tighten up. Fed Fund pricing has already come down a decent bit over the past two weeks. And the geopol backdrop may give them cover to continue to run easy policy with high inflation.

- Also, the SPX’s price to 50dma spread is at levels that often, though not always, coincide with bottoms. Not to mention, small specs now are crowding bearish, and strong positive seasonality kicks in about another week.

- Short interest in Qs is at 4-year highs as well (chart via @MacroCharts).

- I continue to watch bitcoin closely as it’s been a good lead for risk-on/off.

- There’s a number of beaten-down tech names that I like here and SQ is definitely one of them. Chart shows a strong monthly reversal off its lower BB. Brandon wrote this one up for Collective members recently, which peeps can find in the Vault.

- Twitter the perennial loser and red-headed stepchild of the big tech platforms is about to enter greener pastures I think. I’ll be sharing my thoughts on this with the group soon. But we have a technical double bottom on the weekly combined with a massive reality-perception valuation gap.

- In the commodity space, the wheat chart continues to play out nicely. The inverted H&S pattern is complete. We’ll be adding to our long position on pullbacks/consolidations.

- The price to MA gaps show how overextended wheat is in the short-term though, so careful with your entries.

- Donate, pray, write/call your political leaders, etc… Make sure to do your part to support the people of Ukraine and their right to exist as a nation and the freedom to choose their own path.

Thanks for reading.

Stay frosty and keep your head on a swivel.

Article by Alex Barrow, Macro Ops