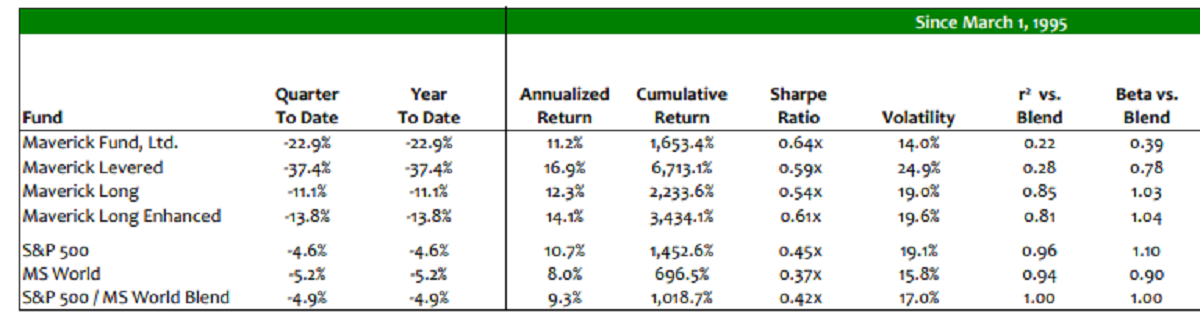

Maverick Capital’s flagship hedge fund lost -22.9% in the first quarter of 2022 according to a copy of the firm’s quarterly update, which ValueWalk has been able to review. The firm’s flagship fund, Maverick Fundamental Hedge, accounts for $3.7 billion of the group’s $8.1 billion of assets under management. Even after losses in the first quarter, since its inception at the beginning of March 1995, Lee Ainslie’s flagship fund has produced an annualized return of 11.2% with a Sharpe ratio of 0.6% and volatility of 14%. It has produced a cumulative return for investors of 1,653% since its inception. Q1…

Maverick Capital Slides 22.9% In Q1, Short Bets Yield Positive Returns [Exclusive]

Sign up now and get our in-depth FREE e-books on famous investors like Klarman, Dalio, Schloss, Munger Rupert is a committed value investor and regularly writes and invests following the principles set out by Benjamin Graham. He is the editor and co-owner of Hidden Value Stocks, a quarterly investment newsletter aimed at institutional investors. Rupert owns shares in Berkshire Hathaway. Rupert holds qualifications from the Chartered Institute For Securities & Investment and the CFA Society of the UK. Rupert covers everything value investing for ValueWalk