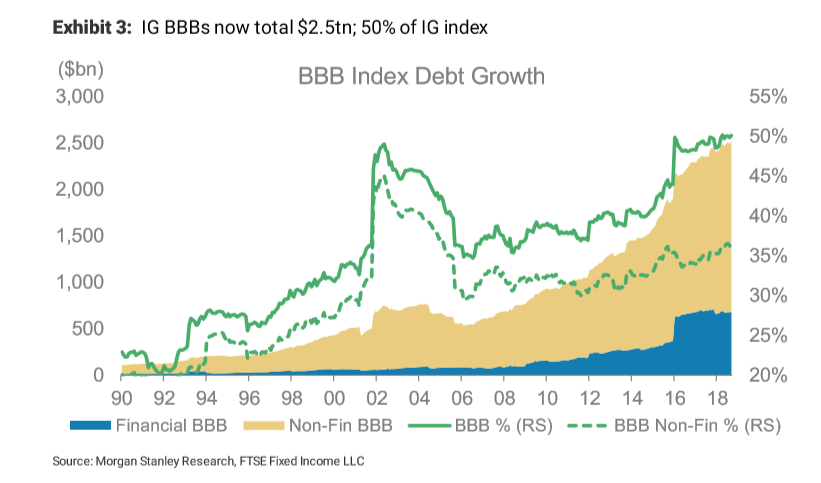

There is a “beast” growing in the slightly damaged BBB investment grade debt market, a Morgan Stanley Corporate Credit Research report notes. As quantitative easing has engineered developed world real interest rates to turn negative in some cases, corporates have loaded up on debt. The now $2.5 trillion market risky but investment grade debt, up 227% since the bottom on the global financial crisis, the last time an underlying debt bubble was causation for a daisy-chain derivatives burst. But don’t worry, strategist Adam Richmond said in the October 5 report. The debt problem won’t materialize, at least not before credit…

Morgan Stanley Calls BBB Investment Grade Debt A Beast, Warns Of Major Credit Dangers

Mark Melin

Mark Melin is an alternative investment practitioner whose specialty is recognizing the impact of beta market environment on a technical trading strategy. A portfolio and industry consultant, wrote or edited three books including High Performance Managed Futures (Wiley 2010) and The Chicago Board of Trade’s Handbook of Futures and Options (McGraw-Hill 2008) and taught a course at Northwestern University's executive education program.