Long-term success is rarely achieved without some suffering. In other words, you are unlikely to enjoy gains without some pain. Last month was certainly painful for stock market investors. On the heels of concerns over the Russia-Ukraine war, Federal Reserve interest rate hikes, China-COVID lockdowns, inflation/supply chain disruptions, and a potential U.S. recession, the S&P 500 index declined -8.8% for the month, while the technology-heavy NASDAQ index fell -13.3%, and the Dow Jones Industrial Average weakened by -4.9%.

Q1 2022 hedge fund letters, conferences and more

For long-term stock investors who have reaped the massive +520% rewards from the March 2009 lows, they understand this gargantuan climb was not earned without some rocky times along the way. As you can see from the chart below, there have been no shortage of issues and events to worry about over the last 15 years (2007 – 2022):

- 2008-2009: Financial Crisis

- 2010: Flash Crash (electronic trading collapse)

- 2011: Debt Ceiling – Eurozone Collapse

- 2012: Greek Debt Crisis – Arab Spring (anti-government protests)

- 2012: Presidential Elections – Sequestration (automatic spending cuts) – Cyprus Financial Crisis

- 2013: Federal Reserve Taper Tantrum (threat of removing monetary policy accommodation)

- 2014: Ebola Virus Outbreak

- 2015: China Economic Slowdown

- 2018: China Trade Tariffs – Federal Reserve Interest Rate Hikes

- 2020: COVID-19 Global Pandemic – Recession

- 2022: Russia-Ukraine War -Federal Reserve Interest Rate Hikes – Inflation/Supply Chain – Slowing China

So, that’s the bad news. The good news is that after the stock market eventually bottomed (S&P 500) around each of these events, one year later, stock prices rebounded on average approximately +32%, and prices moved even higher in the following two years. Suffice it to say, in most instances, patiently waiting and taking advantage of heightened volatility usually results in handsome rewards for investors over the long-run. As Albert Einstein stated, “In the middle of every difficulty lies an opportunity.”

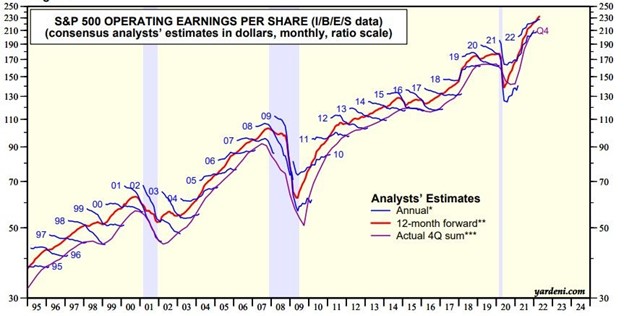

There have been plenty of false recession scares in the past, and this could prove to be the case again. Although I have noted some of the key headwinds the economy faces above, it is worth noting that current corporate profits remain at/near all-time record highs (see chart below) and the 3.6% unemployment rate effectively stands at/near generationally record low levels. What’s more, housing remains strong, and consumer balance sheets remain very healthy as a result of elevated savings rates that occurred during COVID.

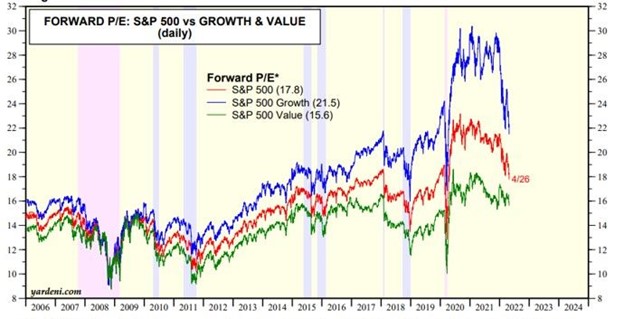

The S&P 500 is already off -14% from its highest levels experienced at the beginning of the year. Although there are no clear signs of a looming recession presently, if history is a guide, much of the pessimism is likely already discounted in current stock prices. Stated differently, even if the economy were to suffer a garden-variety recession, we may already be closer to a bottom than the potential gains from a subsequent rebound. The 15-year chart shows that stock prices have become significantly more attractively valued in recent months.

Panic is rarely a profitable strategy, so now is probably not the best time to knee-jerk react to the price declines. Peter Lynch, arguably one of the greatest all-time investors (see Inside the Brain of an Investing Genius), said it best when he stated, “Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.”

Market corrections are never comfortable, but successful, long-term investing comes with a price…no pain, no gain!