In 2017, American officials discovered that ZTE was selling phones to US enemies like North Korea.

Q4 hedge fund letters, conference, scoops etc

The US government told ZTE to stop. It refused. So lawmakers banned ZTE from doing any business in America.

ZTE had been manufacturing roughly 25% of its phone parts in the US. So the ban crippled its business overnight.

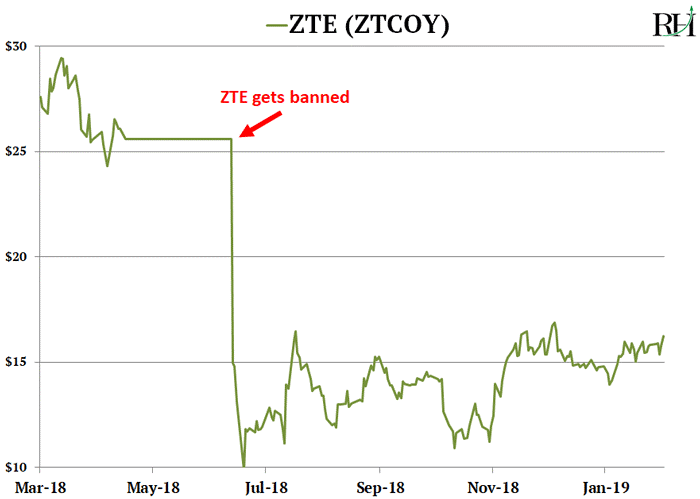

ZTE’s shares plunged 55% in two weeks, and the stock has never recovered:

Now president Trump is getting ready to bring down a much larger and more important firm. And this time two “forgotten” stocks stand to hand investors big gains in the fallout.

Trump Is Likely to Outlaw Huawei in America

As you may have heard, Chinese phone maker Huawei is accused of putting secret “backdoors” into its phones. If true, they allow Huawei to spy on Americans who use Huawei phones.

Huawei is officially a private company. But it is widely known to be an arm of the Chinese government.

The US and China have been squabbling over this for a while. But the situation has reached its boiling point.

President Trump is widely expected to sign an executive order outlawing Huawei products in America.

Keep in mind, Huawei isn’t some rinky-dink company. It sells more phones than Apple (AAPL) and generates as much revenue as Microsoft (MSFT).

But most importantly, Huawei is the world’s largest maker of 5G infrastructure.

Who Will Replace This Top 5G Supplier?

5G is one of the most disruptive technologies today.

It is the new lightning-fast cell network our phones will soon run on. And the “Great Upgrade” to 5G is one of the largest infrastructure projects in history.

That’s why I recommended a company that is already raking in cash from the 5G buildout in my free special report, The Great Disruptors. You can get you free copy here.

It had secured $100-billion worth of 5G contracts—over five times more than any of its rivals.

But with Trump expected to ban Huawei, almost all of Huawei’s 5G infrastructure contracts have been cancelled.

AT&T cancelled its 5G deal with Huawei last year. UK-based Vodafone cancelled its 5G contract with Huawei this year.

The governments of Japan, Australia, and New Zealand have stepped in to ban their cell companies from working with Huawei on 5G.

Of course, all the 5G infrastructure still needs to be built…

Billions of Dollars Are Set to Flow to Nokia (NOK) and Ericsson (ERIC)

You might call these two “forgotten” stocks.

Not all that long ago they dominated the cell phone market. Nokia alone controlled 50% of the cell phone market in 2007.

Today it controls less than 1%. And Ericsson shut down its phone business years ago.

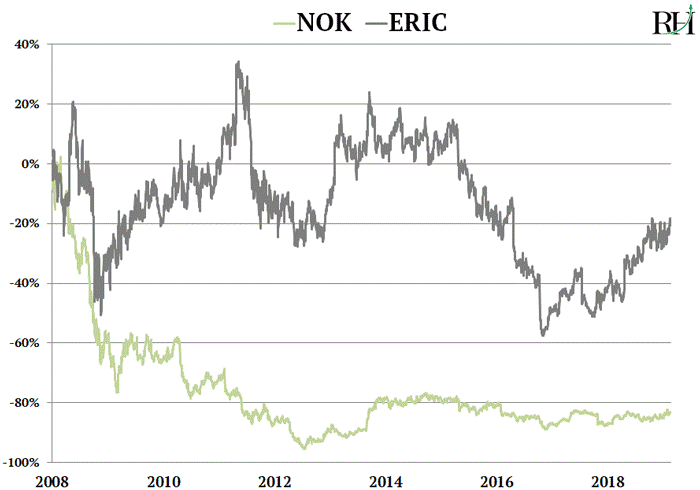

They both totally missed the smartphone revolution. Their stocks have gone nowhere over the past decade:

But Nokia and Ericsson are two of the world’s only makers of 5G equipment. Nokia and Ericsson control 50% of the 5G infrastructure market, according to IHS Markit.

And here’s the key.

There are only four major makers of 5G equipment and infrastructure in the world: Ericsson, Nokia, Huawei, and ZTE.

As I mentioned, Huawei and ZTE are essentially banned from the Western world. Which means phone companies have little choice. They must work with Ericsson and Nokia to get 5G up and running.

Nokia and Ericsson Are Already Singing Multi-Billion-Dollar Contracts

The two companies recently won multi-billion-dollar 5G infrastructure contracts from Verizon and AT&T—the two largest US phone companies.

And 3rd-place T-Mobile has agreed to pay Nokia and Ericsson $3.5 billion each to build its 5G networks.

In short, Nokia and Ericsson have been handed the giant 5G infrastructure market on a silver platter.

When Nokia reported earnings two weeks ago, its network equipment sales shot above $6 billion for the first time in five years. Meanwhile, Ericsson’s 5G-related revenue jumped 10% last quarter.

It’s a Rare Low-Risk, High-Reward Investment Opportunity

The market is beginning to recognize both companies will be big winners from the 5G buildout.

After a decade of being stuck in the mud, Ericsson’s stock has surged 50% in the past year. Nokia stock has climbed 20%.

As the 5G rollout kicks into high gear, both stocks are low-risk, money-making opportunities.

For example, Nokia sold around $20-billion worth of network equipment last year. My research shows this should jump above $50 billion in the next two years as 5G ramps up.

So no matter what happens with the stock market, a tidal wave of money is about to flow into Nokia and Ericsson.

Article By Stephen McBride