In his recent interview with Charlie Rose, Ray Dalio explained why we are now in a period of stagflation. Here’s an excerpt from the interview:

Q1 2022 hedge fund letters, conferences and more

Rose: Are we close to having stagflation?

Dalio: Yeah. We are in stagflation.

Rose: We are? Stagflation is simply where you have inflation, and yet at the same time you have high unemployment…

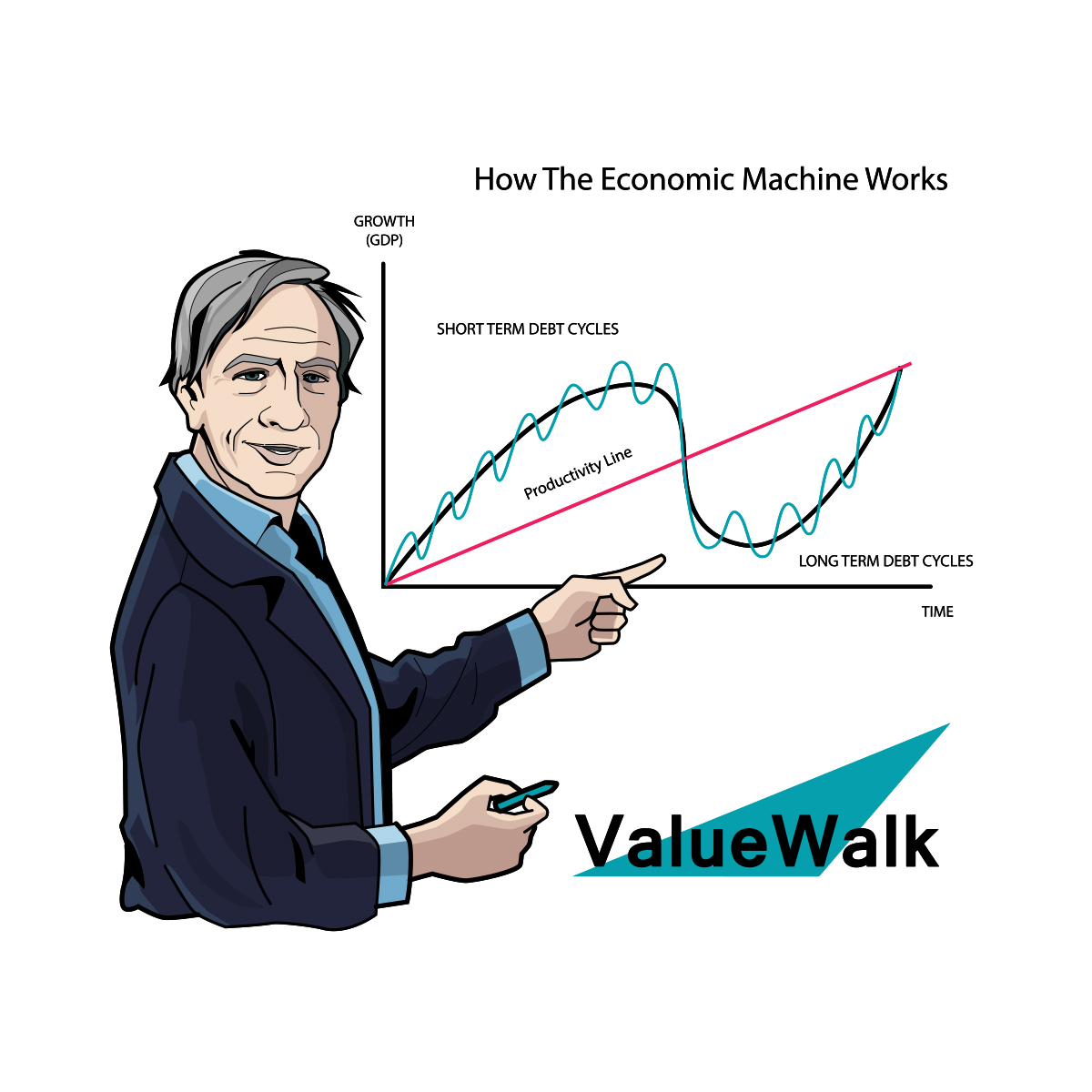

Dalio: You have economic weakness. In other words you have a stagnant economy, stagnant meaning low growth and with high inflation. And that happens through this monetary situation that I’m describing in which the Central Bank tries to deal with a middle course. Other words. What is the Central Bank want? Not too high inflation and not too low growth.

And so when there’s a lot of debt, because one man’s debts are another man’s assets, it becomes very difficult at balancing act and that is when you have stagflation when you produce it.

So just like in the sixth… the 1960s, late 60s. We spent a lot of money on guns and butter, we called it, the Vietnam War and social programs and so on.

We wrote too many checks relative to the money we had in the bank, which was gold at the time. 1971 the devaluation, then they print a lot of money into that stagnation, stagflation. So stagflation is trying to… is the middle course when there’s two different…

You can watch the entire discussion here:

For all the latest news and podcasts, join our free newsletter here.

Article by The Acquirer’s Multiple.