“Overoptimism and overconfidence are two well-known psychological traits of our species. They are particularly dangerous in the late stages of an economic cycle where these terrible twins

result in investors overestimating return and underestimating risk – a potentially lethal combination of errors.” – James Montier, GMO The Late Cycle Lament: The Dual Economy, Minsky Moments, and Other Concerns

Q3 hedge fund letters, conference, scoops etc

Every day on my way to work, I drive past the Vanguard corporate campus. I’ve met Jack Bogle a handful of times – humble, determined and gracious. Mr. Bogle passed Wednesday at age 89.

In 1976, Mr. Bogle launched what is now called the Vanguard 500 Index Fund, the first such market matching fund for individual investors. The fund follows a cap-weighted investment methodology and many now simply view it as “the market.” An indexing machine, today Vanguard is the world’s second largest asset manager with more than 20 million investors in about 170 countries and approximately $5 trillion under management.

The Wall Street Journal’s Jason Zweig wrote, “Mr. Bogle deliberately designed Vanguard to drive fees as low as possible. Knowing full well how radical his idea was, Mr. Bogle headquartered his new company in Valley Forge, Pennsylvania, near the site where George Washington had drilled the rag-tag Continental Army into a revolutionary fighting force.”

In a Barron’s interview published in December, his last interview, Bogle said investors should prepare for 2019 by decreasing exposure to stocks and increasing investments in defensive strategies, such as fixed income securities like bonds. Not too dissimilar to my view.

‘Trees don’t grow to the sky, and I see clouds on the horizon. I don’t know if and when they’ll arrive. A little extra caution should be the watchword,’ Bogle told Barron’s. ‘If you were comfortable at a 70 percent to 30 percent [allocation to stocks and fixed income], under these circumstances you’d like to go back to 60 percent to 40 percent, or something like that…’ He said, it’s time ‘to really be thinking how much risk you want to have’ and make some defensive moves.

Mr. Bogle was an industry titan. A gift. RIP Jack Bogle and welcome home.

Last week, I wrote about the 2019 Beginning Year Valuations, Coming Returns, and Coach. If you missed it, in short summary, I agree with Mr. Bogle. One of the charts I shared came from GMO. They posted their most recent forecast this week (below). GMO is forecasting that U.S. large-cap equities will return a negative 2.5% per year over the coming seven years (after factoring in inflation). Note the red arrows.

If your time horizon is 30 years, the outlook is far better, but if your time frame is shorter, adjust your expectations. And know that the path to zero percent is likely to get bumpy. Some big up moves, some big down moves.

You may notice that the -2.5% number for U.S. large-cap stocks is better than the chart I shared with you last week. It was dated November 30, 2018. The December stock market correction hurt portfolios but improved the outlook from -4.1% annualized to -2.5% over the coming seven years. Still not good. However, there are better return opportunities. Take a look at the +8.2% Emerging Market Value seven-year annualized return expectation. But who do you know that has the guts to overweight EM? Try to sell that idea to your client.

GMO has been posting its monthly forward return forecasts since the 1990s. The forecast to actual outcome has been pretty good. Not perfect but not to be ignored. Today valuations are high because asset prices are high. And they are high by most every measure. You can see a summary here.

My two cents is that bargains are coming our way. They will present some time over the next several years. The next recession will create that opportunity. Thus, more defense today than offense.

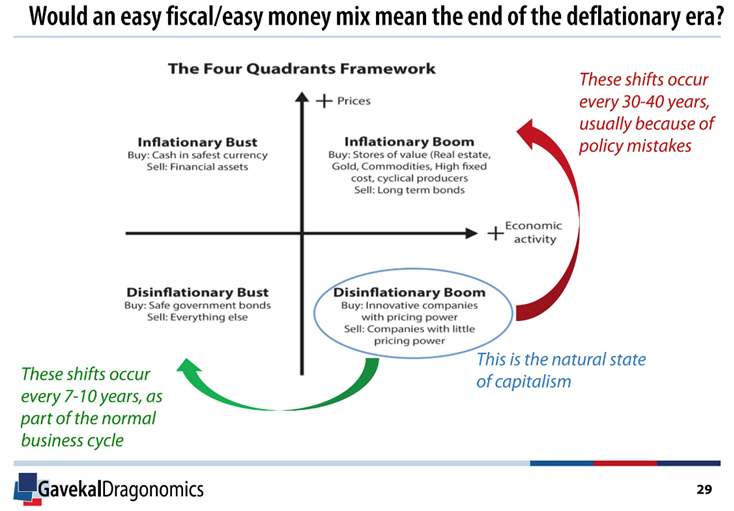

Mr. Bogle suggested reducing exposure to stocks and increasing allocations to bonds. I find it hard to switch more money into bonds when 10-year Treasury bonds are yielding just 2.75%. Call those returns flat after inflation is factored in. And I believe the coming restructuring of the debt mess will turn us towards a period of inflation. For now, deflation rules. Such shifts occur every 30 to 40 years. Note the red arrow in the next chart.

A traditional buy-and-hold process could work over the next 30 years and, if you rebalance and invest new money each month, you could do ok. I’m most worried about the next few years. It will be a roller coaster ride on the way to earning GMO’s zero percent before inflation on equities over the coming seven years. And 70 percent to stocks and 30 percent to bonds or 60/40 or 50/50 will deliver about the same. That sounds depressing but there are a number of things you can do.

There is opportunity. When the cycle shifts from “Disinflationary Boom” to “Inflationary Boom,” you’ll want to overweight gold and commodities in your portfolio. And, we are seeing a handful of innovative companies with pricing power that are not dependent on the direction of the stock market. There are opportunities in healthcare, biotech and medical technology. The risk-reward dynamics are strong. Further, I met a gentleman in Vail this week who is creating a new class of securities that is tied to brand revenue. Yields potentially in the 8% range. So while the markets are going to be bumpy, there is reason to be optimistic. No matter if you are 25 years old or a 70-plus year old.

I do want to circle back to the valuation argument one last time and try to say it in a way that you can explain it to your clients, your spouse and your children. I love Buffett’s hamburger analogy. He suggested investors should think about investing like the Buffett family thinks about hamburgers. Warren said that the Buffett’s love hamburgers and when they go down in price, they sing the “Hallelujah Chorus” because they can buy a lot more for their money and when they go up in price, they weep.

When I read James Montier’s The Late Cycle Lament: The Dual Economy, Minsky Moments, and Other Concerns, I thought he did a great job in messaging the current challenges facing traditional stock market investors today. Perhaps a bit more geekish than hamburgers, but it speaks to the reality of investing in businesses when prices are high. Montier writes,

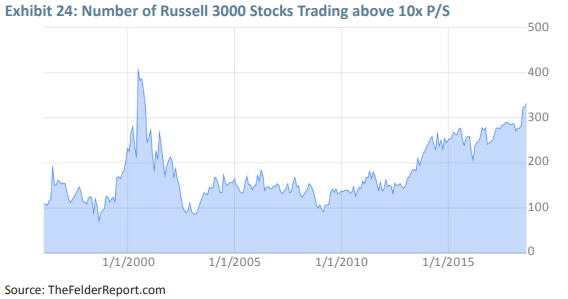

My colleague, Rick Friedman, sent me a chart that I could not resist including as Exhibit 24. (Yes, I’m a sucker for a good dose of confirmatory bias any day.) It shows the number of stocks in the Russell 3000 that currently trade at more than 10x price to sales. Once again we stand at levels not seen since the dot com era. Why is 10x P/S so interesting…well it reminds me of one of my favorite quotations on the insanity of valuations. This one comes from Scott McNealy, the then CEO of Sun Microsystems:

“At 10 times revenues, to give you a 10-year payback, I have to pay you 100% of revenues for 10 straight years in dividends. That assumes I can get that by my shareholders. That assumes I have zero cost of goods sold, which is very hard for a computer company. That assumes zero expenses, which is really hard with 39,000 employees. That assumes I pay no taxes, which is very hard. And that assumes you pay no taxes on your dividends, which is kind of illegal. And that assumes with zero R&D for the next 10 years, I can maintain the current revenue run rate. Now, having done that, would any of you like to buy my stock at $64? Do you realize how ridiculous those basic assumptions are? You don’t need any transparency. You don’t need any footnotes. What were you thinking?”

By the way, here is a look at my favorite way to analyze price-to-sales ratio as shared in this next chart from Ned Davis Research. Just focus on the two red “We are here” arrows. Bottom line: When median price-to-sales is above 1.5, the gains per annum have been a low 1.76%.

If you had the opportunity to risk-protect your money in the late 1990s, I’m pretty sure you’d go back and do that. Same with the period just prior to the Great Financial Crisis. And that’s pretty much the point I’m making today. The hamburgers are very expensive.

Grab that coffee and find your favorite chair. I really believe the corporate bond market should be front and center on our radars and let’s keep an eye on the recession charts. You’ll find several bullet points on Fed policy and corporate bonds and the link to Trade Signals where you’ll also find the most recent recession signal charts.

♦ If you are not signed up to receive my weekly On My Radar e-newsletter, you can subscribe here. ♦

Follow me on Twitter @SBlumenthalCMG

Included in this week’s On My Radar:

- Fed Policy and Corporate Bonds

- Trade Signals – Equity Signals Remain in Sell, Fixed Income Signals Mixed; Will US Government Shutdown Cause Recession?

- Personal Note – Snow

Fed Policy and Corporate Bonds

“Nothing is normal about normalizing an abnormal policy setting in the context of an abnormal economic recovery.”

– David Rosenberg, Chief Economist and Strategist, Gluskin Sheff + Associates

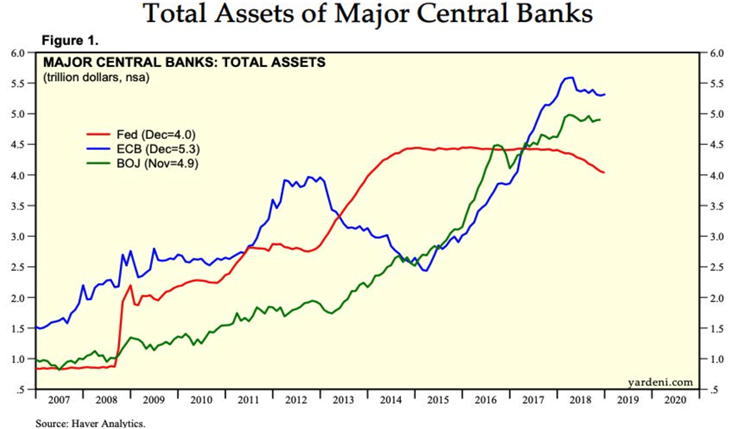

Rosie is right! Keep your lights turned on… All of the major central bankers are attempting to exit the grandest of economic experiments. We know how powerful the QE liquidity was to risk assets on the way up. We can only guess what it may be like when they pull the liquidity punch bowl away. Eventually, I believe they will be back… and with a debt reset plan. We just don’t yet know what that may look like.

Fed Policy

To put this into perspective, following are a few charts I came across this week. You can see the Fed is letting their balance sheet roll off (red line), the ECB (blue line) looks to have peaked and is attempting QE exit for the first time since 2013 and Japan (green line) is topping.

This next chart is from Ed Yardeni and shows the trajectory of the major central bank balance sheets (Fed, ECB, BOJ) and how the stock market has tracked the QE infused liquidity growth.

Corporate Bonds

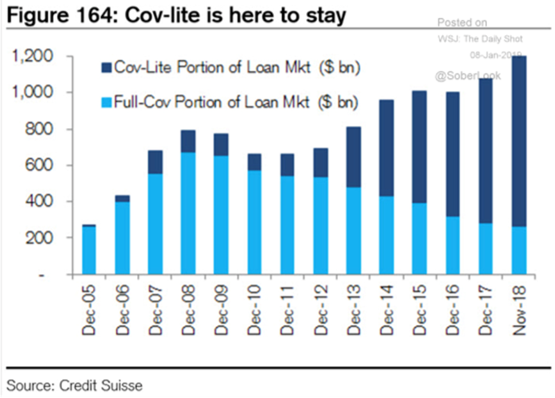

I keep talking about the forthcoming “epic” opportunity in high yield credit. The reason I believe it will be so big is because of the record poor quality of recovery protection investors get from the bond issuers. The next chart shows us just how much more risk bond investors are taking today versus at the top of the last economic cycle peak in 2008.

- Full covenant protection (“Full-Cov”) means you have lent your money on terms favorable to you and the likelihood of getting much of your money back in the event of default is good.

- “Cov-Lite” means you have lent money on less favorable terms and, in the event of default, you will not recover as much of your money.

Simply compare the light blue vs. dark blue in 2007/08 vs. today.

The next chart shows the maturity calendar over the coming few years. Note that approximately 30% of outstanding high-yield bonds will need to refinance their debt between now and year-end 2020. Liquidity will evaporate in the next recession and if recession hits within the next three years, a lot of companies will be in trouble.

I’ll conclude with this: here is the chart that James Montier’s colleague, Rick Friedman, sent him. It shows the number of stocks in the Russell 3000 that currently trade at more than 10x price-to-sales. Once again, we stand at levels not seen since the dot-com era.

Source: James Montier, GMO, “The Late Cycle Lament: The Dual Economy, Minsky Moments, and Other Concerns”

As James said, “One can’t help but think that should a bad outcome prevail, once again many an investor will be left with those words ‘What were you thinking?’ ringing in their ears.” Risk protect what you have and keep some extra cash in the kitty so you will be able to take advantage of the opportunity I believe will present when defaults spike in the next recession. Seek special opportunities, increase allocation to risk-managed trading strategies and overall stick to the downside risk management drill.

Trade Signals – Equity Signals Remain in Sell, Fixed Income Signals Mixed; Will US Government Shutdown Cause Recession?

January 16, 2019

S&P 500 Index — 2,614

Notable this week:

Last week, the Ned Davis Research (NDR) CMG Large Cap Momentum Index signaled a reduction in equity exposure to 40% from 80%. The balance of the equity market signals remain in sell signals.

The CMG Managed High Yield Bond Program moved to a buy signal last week. The Zweig Bond Model remains in a sell signal (suggesting short-duration high quality bond market exposure over high quality long-duration ETFs and mutual funds). Pessimism remains extremely elevated.

We remain on global and US recession watch. Risk of global recession is high, while there’s a lower risk of recession in the US, although the prolonged partial shutdown of the federal government could adversely affect economic growth and employment.

Click here for this week’s Trade Signals.

Important note: Not a recommendation for you to buy or sell any security. For information purposes only. Please talk with your advisor about needs, goals, time horizon and risk tolerances.

Personal Note – Snow

“A simple rule for success: If you are going to complain about it, do something about it.

Turn a complaint into a solution.” – Jon Gordon, Positive Warrior

My Susan shared the above quote with me this morning. It’s good for parenting and it’s good for business and it’s really good for life’s journey. It’s so easy to find things to complain about; let’s turn towards solutions. And that may be the test this weekend for us and our kids. A big snow storm has its sights set on the Northeast this weekend. Up to two feet in some places. The Penn State Ski Team just cancelled the weekend ski competition due to snow. Go figure. Get the shovels ready.

Speaking of skiing, the conference in Vail this week and the skiing was simply outstanding. Yesterday’s 10 inches of fresh powder was great fun.

John Mauldin, Brian Schreiner and I are hosting an investor dinner next Tuesday in Tampa. Meetings in NYC follow on January 28 and I’ll be attending the annual Inside ETF’s Conference in Hollywood, Florida on February 9-13. Please let me know if you are attending.

Also, put the Mauldin Strategic Investment Conference on May 13-16 in Dallas on your calendar. I’m admittedly biased, but I can honestly say it is the single best investment conference I attend each year. This year, CMG will be hosting a breakfast where we’ll share some of the investment opportunities we are seeing.

Thank you for reading On My Radar. Please know how much I appreciate you and the time you spend with me each week.

♦ If you are not signed up to receive my weekly On My Radar e-newsletter, you can subscribe here. ♦

Best regards,

Steve

Stephen B. Blumenthal

Executive Chairman & CIO