With US stock market valuations exceeding all historical valuation levels—except for those hit at the peak of the dot-com craze—Rob Arnott examines the subsequent performance of companies, which were at one time the largest companies in the world.

Q1 hedge fund letters, conference, scoops etc

Rob Arnott: Are Valuations Irrelevant?

Slides:

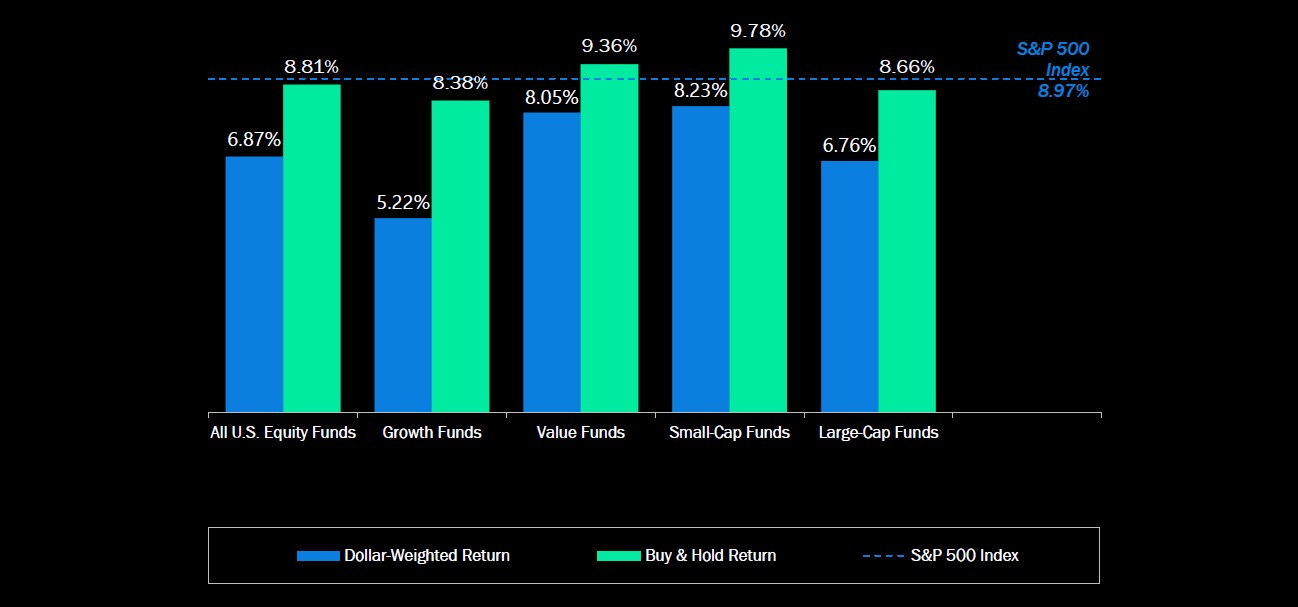

Most Investors Are Trend Chasers!

Source: Hsu, Myers, and Whitby, “Timing Poorly: A Guide to Generating Poor Returns While Investing in Successful Strategies,” Journal of Portfolio Management (Winter 2016).

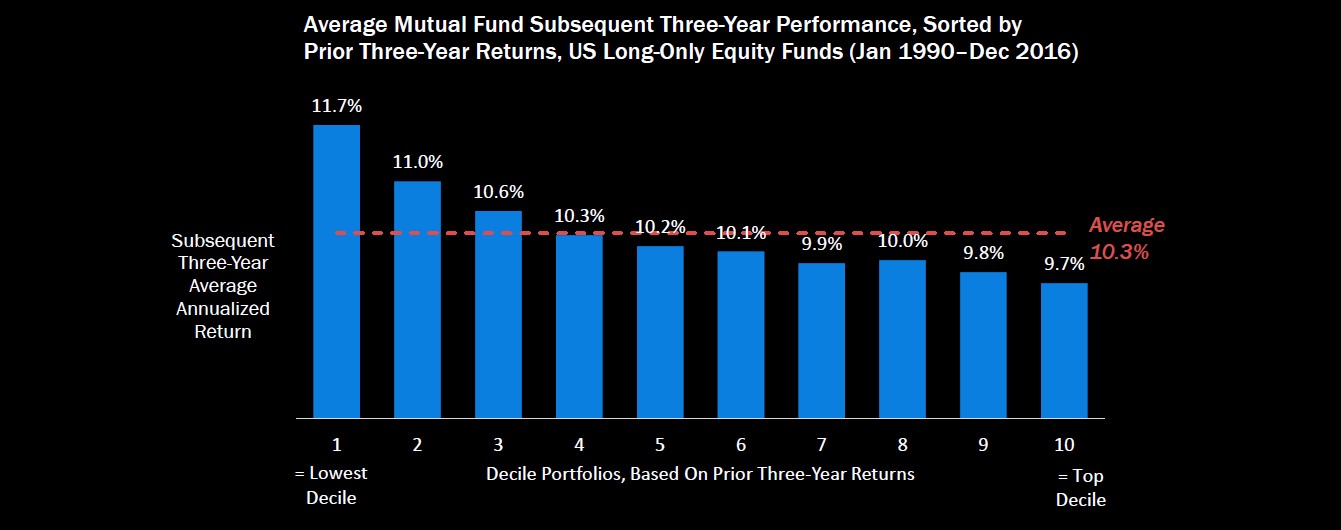

Actively Managed Mutual Funds…A Naïve Contrarian Strategy Can Work

This result is arguably created by our industry’s favorite decision rule: Three bad years and out!

Source: Research Affiliates, LLC, based on data from Morningstar Direct.

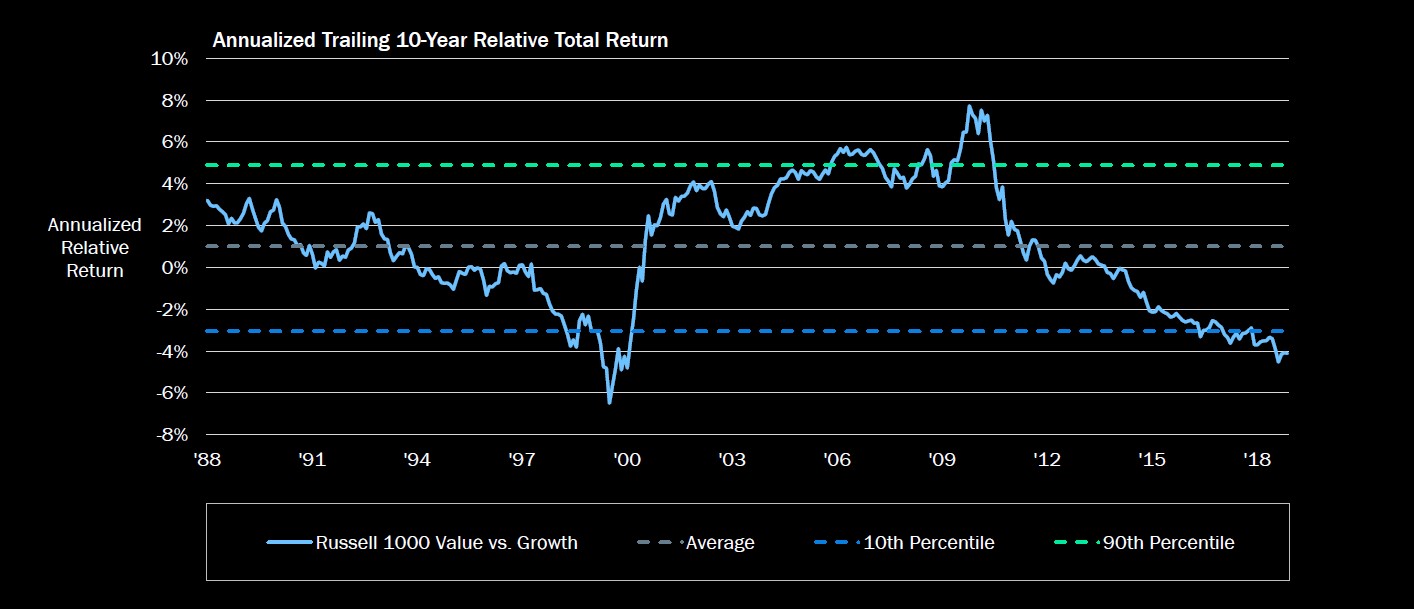

What Style Are Investors Chasing Today? Growth!

Source: Research Affiliates, LLC, using data from FactSet. Data as of 12/31/2018.

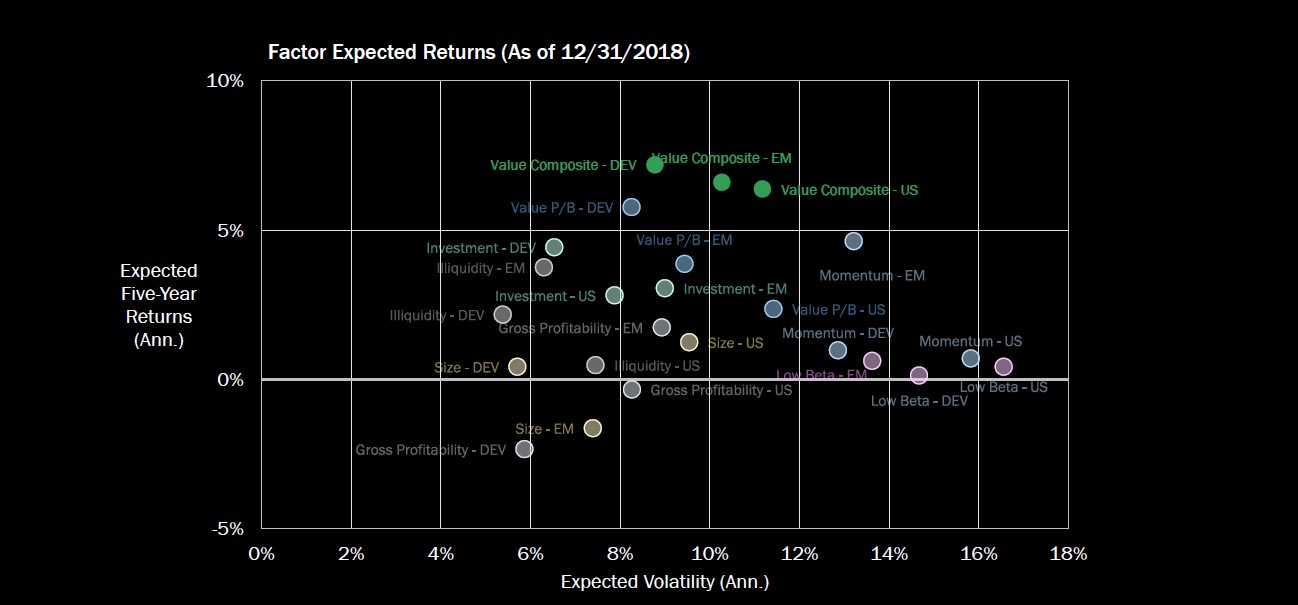

Current Equity Factor Return Forecasts: The Highest Return Potential Is Available from the Value Factor

Source: Research Affiliates, LLC, using data from CRSP/Compustatand Datascope/Worldstream. Please see important information at the end of this presentation regarding simulated data. Return expectations as of December 31, 2018.

See the full slides here by Research Affiliates