The 2023 T3/Inside Information Software Survey is now out and available, for free, to all interested parties in the profession (click here for your free copy) . As it does every year, the survey writeup includes market share statistics, market share rankings and user ratings in 36 different software categories. It’s the best guide to the 300+ fintech solutions in the marketplace, and a good buyer’s guide for advisory firms that are looking for additions or enhancements to their tech stack.

Q4 2022 hedge fund letters, conferences and more

This year, 3,309 advisors completed the survey, which gives it a broad, statistically relevant sample of what advisory firms are using. At the front, readers can see the demographics of the survey participants: the annual revenue of their firms (a proxy for firm size); years in business (almost half of the participants have been in the business more than 20); and their business model (a somewhat higher number of fee-only than dually-registered advisors).

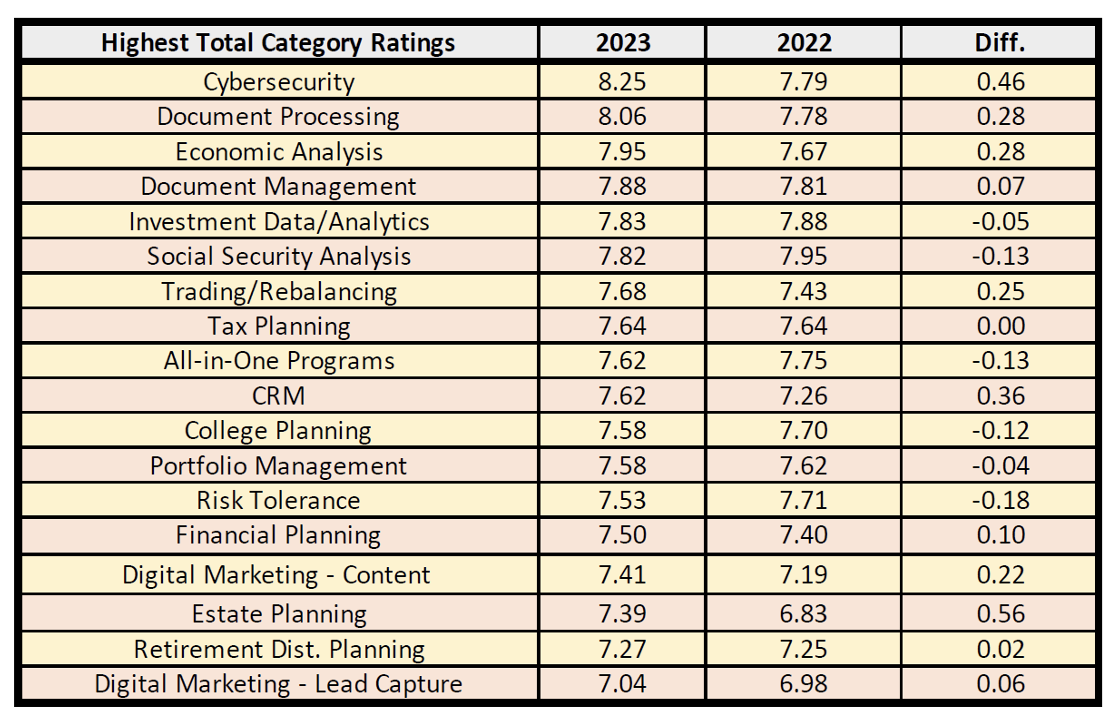

What did we find? We can get a window into the data with the ‘Market Penetration’ chart, which illustrates how some software categories are more prevalent than others in the fintech space, and how their adoption is growing. Once again (the statistics have been consistent year over year) CRM is used by very nearly 100% of the respondents, with Orion’s Redtail solution owning about half the category market share, followed by up-and-coming Wealthbox and Salesforce. One of the Salesforce overlays, Concenter XLR8, earned the highest rating in the category, with a remarkable 8.85 user satisfaction score. But Redtail (8.10) and Wealthbox (8.07) have, in aggregate, very satisfied users. Any score over 7.0 should be considered excellent; above 8.0 is rare.

CRM is followed by financial planning software. Just 84%? Some advisory firms must still be using spreadsheets. The planning fintech market is a three-horse race currently, with Envestnet’s MoneyGuidePro (31.52% market share), Fidelity’s eMoney Pro (28.47%) and RightCapital (15.65%) the only programs with double-digit market share numbers. And once again, the leaders also have excellent user ratings: 8.04, 8.27 and 8.42 respectively. Down the list, the FP Alpha machine-learning solution, which provides planning insights in 16 different planning categories from what it ‘sees’ in scanned client documents, earned a sparkling 8.13 rating, and a deeper analysis showed that it was used as a second planning solution by advisors who are also using one of the top three.

Read the full article here by Bob Veres, Advisor Perspectives.