Introduction

I believe that two of the most important investing principles that prudent investors should embrace are valuation and time in the market. Consequently, the title of this article is mildly misleading, because both concepts are extremely important towards achieving long-term investing success. In other words, I believe attempting to argue the importance of one over the other is a waste of time and energy. What is truly important is to understand the significance of both concepts, and then embrace them both intellectually and practically while implementing your investing strategies. Together, these two strategies are powerful.

[activistinvesting]

Q2 hedge fund letters, conference, scoops etc

Additionally, this article was inspired by comments made in my previous article suggesting that time in the market is more important than valuation. Consequently, I took the devil’s advocate with my title. However, to properly debate these issues, we must evaluate what the word “important” means and how it applies. My interpretation would suggest that importance is determined by identifying which principle leads to the highest long-term rates of return. In simpler terms, which will make you more money: time in the market or being disciplined to only purchase when valuation is attractive? Furthermore, importance would also relate to which principle controls risk better.

Additionally, this article was inspired by comments made in my previous article suggesting that time in the market is more important than valuation. Consequently, I took the devil’s advocate with my title. However, to properly debate these issues, we must evaluate what the word “important” means and how it applies. My interpretation would suggest that importance is determined by identifying which principle leads to the highest long-term rates of return. In simpler terms, which will make you more money: time in the market or being disciplined to only purchase when valuation is attractive? Furthermore, importance would also relate to which principle controls risk better.

Time In The Market -Versus- Market Timing

One of the primary aspects that distinguish investors from speculators is the amount of time they are willing or considering committing to. Investors tend to take a long-term view, while speculators are shorter run oriented. Consequently, for clarity, it would be useful to attempt to define long-term versus short-term. To me, the long run when investing in equities implies owning them for at the minimum over a complete business cycle. A business cycle typically runs between a minimum of 3 to 5 years or longer.

This is important because it relates to how and over what timeframe a business generates returns for its owners/shareholders. Businesses make money for their shareholders by profitably selling products and/or services to customers. Moreover, businesses tend to report their progress over quarterly and annual timeframes. In other words, it takes time for businesses to make the money from which to reward their owners. Even though a growing business is constantly becoming more valuable, it takes time for that value to manifest in a meaningful way.

With this concept in mind, consider the reality that short-term stock price movements might not be truly indicative of the true value of a publicly traded company at any specific point in time. This is true because the actual cash flows, profits and business opportunities, etc. are usually not publicly available except when companies file their quarterly or annual reports. Consequently, short-term price volatility is by its nature speculative.

The above applies to both public and private operating businesses. However, with publicly traded businesses there are minute-by-minute and hour-by-hour daily trading activities occurring when the markets are open. This provides a very important liquidity advantage, but it also provides enticements that can be financially dangerous. More simply stated, a rising price can tweak people’s greed whereas a falling price can elicit fear. In either case, irrational decisions are prone to be made. Emotions can and often do cause people to buy when they should sell – and vice versa. Additionally, short-term price volatility is highly unpredictable in great part simply because it is often emotionally charged.

Nevertheless, people have historically – and will in the future – continue to try and time the market, always have, always will. This behavior continues notwithstanding the reality that a preponderance of evidence suggests that market timing cannot be accomplished except by chance. Stated differently, short-term market timing tends to work until it doesn’t. Sure, market timing occasionally does produce enticing results, but those results are typically followed by disastrous ones. Consequently, market timing is speculation and a very close cousin to gambling.

In contrast, time in the market implies investing behavior where the investor positions themselves as an owner/partner of the business they chose to invest in. Owners/partners do not intend to impetuously sell their ownership; instead, they intend to participate in the long-term results they believe the businesses can generate on their behalf. Consequently, true owner/partners are less likely to react to short-term volatility because their focus is on business results instead. Therefore, rather than obsessing over minute-by-minute price quotations, they place their attention on evaluating quarterly and annual reports.

In summary, time in the market works because it aligns the investor with the operating success that their business achieves. However, at this point it’s important to understand and acknowledge that operating success is functionally related to growth. The better the company’s growth rate, the more cash flows, earnings and dividends it can provide to its stakeholders. In other words, a faster growing company produces a much greater income stream that can be shared by its owners thereby making it more valuable as time passes than a slower growing business. Importantly, this is where valuation comes into play.

Fair Valuation Is a Mathematical Reality Not an Opinion

In my personal experience when dealing with investors I have anecdotally surmised that people often confuse fair value with the commonly used metrics to measure it. This is where arguments arise about what is the best metric to value a stock with – P/E ratios, PEG ratios, multiples of free cash flow, enterprise value to EBITDA, etc. Personally, I think these debates are silly because all the aforementioned metrics, and others, can be skillfully utilized in order to ascertain a business’ intrinsic value relative to its fundamental strengths. Moreover, certain metrics are more applicable to certain kinds of businesses. Nevertheless, I believe that intrinsic value or fair value can be calculated, and more importantly should be calculated, within reasonable ranges of error and/or accuracy.

Valuation is not in the eyes of the beholder, nor is it arbitrary or capricious. Moreover, there is a difference between historical, current and future valuation calculations. Historical valuation calculations are generally factual because they are based on actual reported and generated fundamentals. Current valuations are related to historical results because past success does leave clues to future success. It is certainly true that past results do not guarantee future results. However, it is also true that companies with great track records tend to continue being great companies in the future.

Of course, there are always exceptions, but exceptions are not and should not be the rule. This relates to additional debates suggesting that quality is paramount and trumps valuation. However, quality is typically evaluated based on the company’s past results. Dividend Aristocrats, AA rated or better stocks, companies with little debt or great historical growth achievements are typical examples of so-called quality.

In contrast, future valuations are the most subjective and difficult to calculate. The future is always uncertain, but as investors we can only invest in the future. Consequently, it is my opinion at least, that it is incumbent upon us to have a clear idea, estimate or forecast of what the future results a company we are considering investing in can generate.

Finally, with all that said, the same mathematical principles apply to all valuation calculations. Whether we are ascertaining historical value, current value or future value, it all comes down to simple mathematics. Stated more clearly, do the numbers support the valuations? This question then begs another question. What do the numbers have to be to represent attractive or sound valuation? Although I would admit that there is no exact answer to either those questions, there are certainly reasonable ranges of answers that most people would accept or agree upon.

To my way of thinking, the best way to understand sound valuation is to think about it from the perspective of a business owner. In this vein, you should be asking yourself whether the business is generating a high enough return through its internal operations to reward you for the risk you are taking by owning it? One thing that I hope all investors and/or traders would agree upon is that investing in publicly traded stocks is risky. Consequently, one of our primary objectives should be determining whether we are being adequately compensated for the risk we are taking. In plain terms, what rate of return or rates of return would be acceptable and what rates would not. At the end of the day, this is what value investing is all about.

Consequently, I ask you to answer the above questions for yourself. What for you is an acceptable rate of return? Would it be 6%, 7%, 10%, 15%, 20% – or plug in your own number. Once you determine this, then ask yourself if the companies you own or are considering owning in the future, are capable of generating those returns through their business results. Not how the market is currently and temporarily treating the market prices of these companies, but how the companies are internally generating revenues, cash flows and profits on your behalf.

With that said, here is the important part. Fair valuation is relative to the internal operating results of the business and not its recent stock market performance. What people are currently willing to pay to invest in the stock is not controlled by the company management or the business results. In other words, management cannot control their stock market price, they can only have control over how the business performs. It is precisely for this reason that market price does not always reflect intrinsic value.

This is the heart and soul of Ben Graham’s famous metaphor: “in the short run the market is a voting machine, but in the long run it’s a weighing machine.” I can’t count the number of times I shared his quote, but I can easily count how many times people have recognized its value and/or its true meaning. Nevertheless, regarding fair valuation, it always comes down to running the numbers out to their logical conclusion. More precisely, don’t just invest in a stock hoping that it will make you money. Instead, estimate how much growth you believe the company can generate and then calculate what rate of return that income stream would produce for you. If you cannot do this within a reasonable range of accuracy, then you are speculating, not investing.

Once you’ve answered the questions above regarding what rate of return you would consider acceptable, there is a simple way to determine whether the stock you are considering meets those objectives without speculating on future stock price movement. Simply calculate the current earnings yield. This is a simple calculation; instead of price divided by earnings (P/E ratio) you simply divide the earnings by price (E/P). In my opinion, nothing provides an indication of current fair value better than the earnings yield calculation.

The earnings yield is telling you what your return (yield) would be if you owned 100% of the business and it paid you 100% of its profits. Therefore, don’t just simply say the P/E ratio is 20, or the P/E ratio is 15, or the P/E ratio is 30. Instead, understand what earnings yields those P/E ratios represent. Again, this is the essence of sound valuation. This process is empowering you to answer the simple question: does this compensate me for the risk I’m taking?

Finally, as a value investor the only reason I would accept a low current earnings yield would be if I expected future growth to be extremely high. Because, if that were to occur, then my future earnings yield would be high enough to compensate me for my risk. However, this is also one of the reasons why high growth stocks are more risky than blue-chip dividend paying stocks. It’s hard to grow fast enough long enough for a current low “earnings yield” to produce a high enough future earnings yield.

FAST Graphs Analyze Out Loud Video Valuation Versus Time in The Market

Both time in the market and investing prudently at sound valuation participate in the important investing concept “the time value of money.” The time value of money is important because it encompasses both the present value and the future value of money. The basic principle can be summed up by stating that a dollar in your hand today is worth more than a dollar that is collected in the future. Without going into too much detail, the money you have today can earn you future money, where money you’re going to receive in the future you must wait for before you can use it to make money.

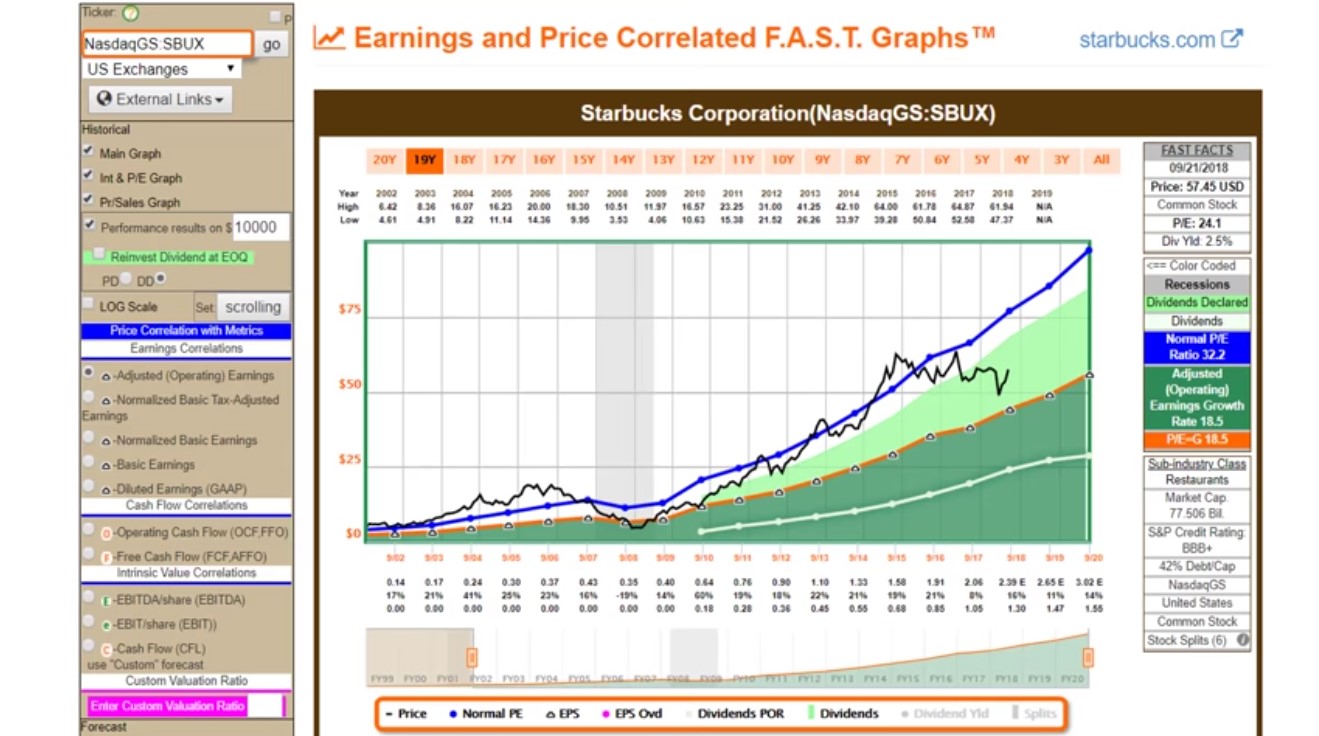

The following video will review the importance of valuation versus time in the market on Starbucks (SBUX), Campbell Soup (CPB) and FactSet Research Systems (FDS).

Summary and Conclusions

In this part 1 of a 2-part series, I attempted to articulate the philosophy of valuation and time in the market. Personally, I believe both concepts are extremely important for true investors to embrace. We should be prudent with how we initially invest our money, and once invested, we should be patient enough to allow the business we own the time to make us money.

In part 2, I will focus more on the simple mathematics that valuation is all about. With the next article I will attempt to illustrate that valuation is not some vague notion. A true understanding of valuation is based on simple mathematical principles that are rooted in common sense. Metrics such as the P/E ratio are only measuring sticks or barometers, if you will, that provide a quick insight into whether a common stock is overvalued or not.

In closing, it doesn’t make sense to me to take a high risk for a low reward. Valuation is a great risk mitigator, certainly not the only one, but a very important one that can be easily implemented and practically applied with patience and a little understanding of what the true essence of valuation is. In part 2, I will be providing these concepts by showing the simple mathematics that support the philosophy.

Disclosure: No positions.

Disclaimer: The opinions in this document are for informational and educational purposes only and should not be construed as a recommendation to buy or sell the stocks mentioned or to solicit transactions or clients. Past performance of the companies discussed may not continue and the companies may not achieve the earnings growth as predicted. The information in this document is believed to be accurate, but under no circumstances should a person act upon the information contained within. We do not recommend that anyone act upon any investment information without first consulting an investment advisor as to the suitability of such investments for his specific situation.

Article by F.A.S.T. Graphs