A company, that has been flying under the radar, (unexpectedly) sells an asset that is worth potentially more than the market cap of the whole company. In these cases, it often takes some time until the market fully realizes what has happened.

Sapec was a good example, Exmar is a recent case that is still ongoing.

Q2 2022 hedge fund letters, conferences and more

3U Holding – Weclapp

The current case is a small cap from Germany called 3U Holding. 3U was IPOed in the bubble days of the Dot.com boom in 1999. Other than many of its peers, its core communication business was quite solid. They sold their Communication business in 2007 and since then acted like mixture of Holding company and Family Office for the founders who own ~34% and effectively control the company.

Among others, they invested into renewable projects, real estate development, an E-commerce business and other activities. Shareholders didn’t really think much of these activities and the share price went sideways for 15 years or so:

Among these other activities is/was a SaaS company called WeClapp that offers ERP software for SMEs. There were always rumors that this is a very good Saas company and that they might IPO the company which explains the run-up of the share price last year. However, as it looked more and more likely that the IPO would not happen, the stock dropped back to a level of ~2,50 EUR. As of Friday, Sep. 2nd, 3U was valued at ~88 mn EUR (35,3 mn shares at 2,50)

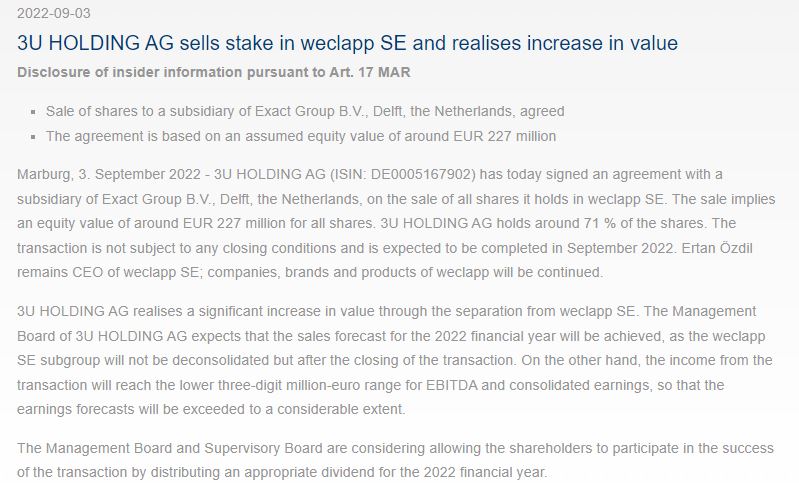

The bombshell: Sale of WeClapp to a PE buyer

On the weekend, 3U then dropped this bombshell:

So a 227 mn EUR sales price with an ownership of 71% translates into gross Cash proceeds of 161 mn EUR or roughly 4,56 EUR per share, or 1,83x Friday’s share price. They buyer, Exact Group is owned by PE behemoth KKR, so financing should not be an issue. To be conservative, I estimate 10 mn total costs for the transaction, leaving net proceeds (and profit and cash) of 4,28 EUR per share for WeClapp (no taxes on these kind of profits in Germany).

Just for the record: 3U managed to sell WeClapp at ~14,4 6M 2022 sales, which is remarkable. I don’t think they would achieved this via an IPO.

The “stub”:

Now the interesting question is of course: What other assets are there and how much could they be worth ? This is my best guess after looking at the annual and 6M report:

| EUR mn | per share | Comment | |

| Net cash | 10,0 | 0,28 | 6M report |

| Gold | 3,0 | 0,08 | annual report, other fin assets |

| Renewables | 62,0 | 1,76 | valued at 10xEBITDA (peers) |

| Debt for Renew. | -15,0 | -0,42 | debt net of Innohub and Weclapp |

| Net sales price Innohub | 8,3 | 0,24 | (Assets for sale – liabilities for sale) x0,75, no profit assumed |

| Selfio | 10,0 | 0,28 | 0,5x sales |

| IT&Comm | 15,0 | 0,42 | 5x EBITDA (2021: ~ 3 mn EBITDA ) |

| Holding | -10,0 | -0,28 | wild guess |

| Total | 83,3 | 2,36 |

One quick remark with regard to Innohub: This was a real estate development they had on their balance sheet that has been already sold. I used the book values, although management mentioned that they made a “satisfactory profit” that will be booked in Q3. I also assume that the value of the E-Commerce business (Selfio, run rate 30 mn EUR sales, slightly EBITDA negative) is 0,5x sales and the remaining communication business (10 mn EUR run rate sales, 3 mn EBITDA) is worth 15 mn.

So all in all we end up with an NAV of ~6,6 EUR per share, thereof EUR 4,80 will be in “net” cash.

Compared to the price at the time of writing (3,70 EUR), this would mean a potential upside of ~75% to fair value.

Of course, the share price doesn’t have to go to fair value and will most likely never do so, as a discount to fair value in such cases is quite common. Assuming a 30% discount, the price target would be “only” 4,60 EUR per share.

Potential dividend

The last sentence of the press release was quite interesting:

The Management Board and Supervisory Board are considering allowing the shareholders to participate in the success of the transaction by distributing an appropriate dividend for the 2022 financial year.

I have no clue what they consider an “appropriate” dividend, but similar to Exmar, a large dividend would have a positive effect on the price target assuming a constant 30% discount for the remaining part. Here is a table showing the impact of different dividend amounts on the price target:

| Dividend | 1 | 1,5 | 2 | 2,5 | 3 | 3,5 | 4 | |

| “Stub” | 5,6 | 5,1 | 4,6 | 4,1 | 3,6 | 3,1 | 2,6 | |

| “Stub” at 30% discount | 4,0 | 3,6 | 3,3 | 2,9 | 2,6 | 2,2 | 1,9 | |

| Total value | 5,0 | 5,1 | 5,3 | 5,4 | 5,6 | 5,7 | 5,9 | |

| Upside vs. current price | 3,7 | 33,8% | 37,8% | 41,9% | 45,9% | 50,0% | 54,1% | 58,1% |

The table reads as follows: In the case of a 1 EUR cash dividend, the expected value for an investor would be the 1 EUR dividend (pre tax) and a “stub” at 4 EUR, generating an expected return of ~32%.

In the case of a 4 EUR dividend, the stub would be estimated at 2,6 EUR and the total return would be +58%. My expected return would be somewhere in the middle. Not bad in my opinion for a holding period of maybe 9 months.

Catalysts:

The stock already has jumped by +50% but in my opinion is still undervalued. Further catalysts in my opinion could be:

- Closing of the WeClapp sale

- Release of the Q3 report including Innohub results and revealing the large cash balance

- Announcement of a detailed dividend number in 2023

Risks:

- There is clearly a residual risk that the WeClapp deal doesn’t close, however I consider it as small as the buyer seems to be very willing

- The major risk is clearly what 3U is doing with the money. This is the same risk as in the Exmar case. However over the years, 3U has allocated capital quite well and they promised a “suitable” dividend

- The final risk is of course the valuation of the stub. the lower the dividend, the higher this risk

Summary:

I think this one is quite comparable to the Exmar case from a risk/return perspective, with the main difference being that there is more relative net cash compared to market cap and that they already announced a dividend in principle. The main negative is the fact that the stock is a lot less liquid than Exmar. At the moment, with Exmar already up +17% since purchase, I find 3U slightly more attractive in relaative terms.

Therefore I allocated ~4% of the portfolio into this special situation at a share price of ~3,72 EUR per share into this special situation investment. Target return would be ~+40% over the next 9-12 months.

Disclaimer: This is not investment advice. Never trust any anonymous dudes on the internet. DO YOUR OWN RESEARCH !!!

Article by Value and Opportunity.