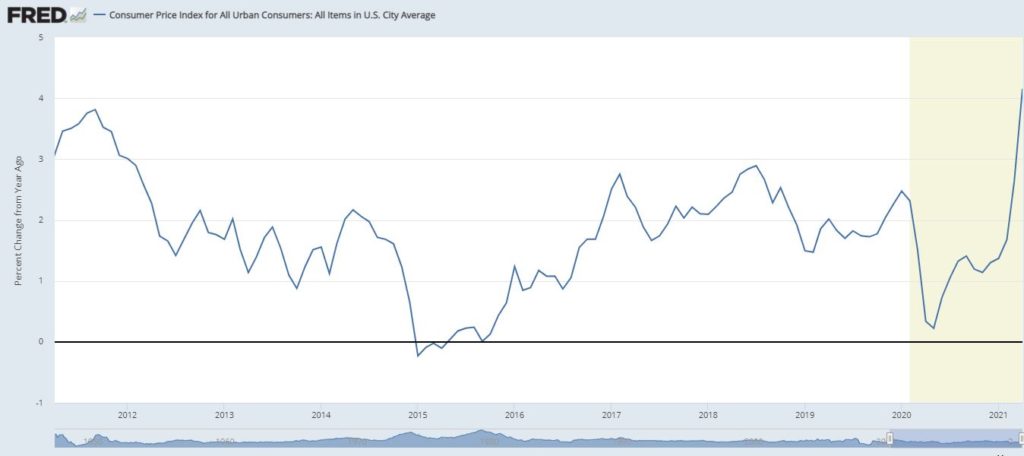

The recent April CPI data showed that prices rose by 4.2% yoy. It may not sound like a large amount but it’s the largest yoy increase in inflation in over a decade. You can see the upward spike in the CPI chart below. The Fed has taken the view that the increase is transitory. Clearly, we’re only talking about one data point, but the Fed’s commentary is not reassuring. Additionally, Jerome Powell may be the most dovish Fed Chairman in recent history. The Fed is openly discussing overshooting its 2% inflation target to ensure maximum employment. If the inflation is not transitory as the Fed expects, it’s going to be extremely negative for the US dollar and treasury securities.

Q1 2021 hedge fund letters, conferences and more

Even Warren Buffett had the following to say:

“We are seeing very substantial inflation… It’s very interesting. We are raising prices. People are raising prices to us and it’s being accepted.”

In my view, the main issue is that both monetary and fiscal policy are stuck in an environment geared toward recession. I do believe that the Fed made the right decision to flood the economy with liquidity at the height of the pandemic. However, they’ve shown no signs of slowing down the $120 b in treasury purchases and mortgage-backed securities that they began during the beginning of the pandemic. Before determining whether it’s appropriate to remove the stimulus, we have to answer the question whether the recession is over.

Is the Recession Over?

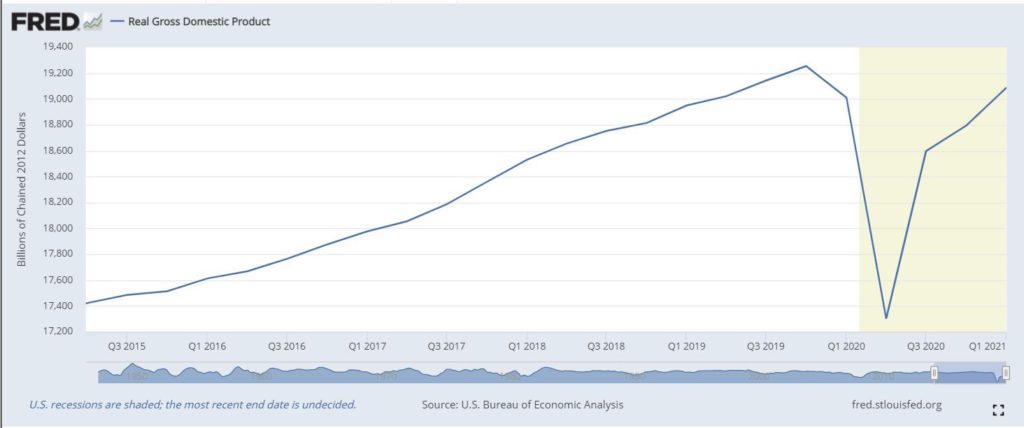

The shaded portion of the chart below indicates that we’re still technically in a recession. The National Bureau of Economic Research (NBER), the agency in charge of determining business cycle dates, still hasn’t called the recession officially over. Unemployment has recovered dramatically from the 15% level reached in April 2020 and a year later now stands at 6.1%. Although some sectors such as hospitality are more affected than others, it’s clear that from an unemployment perspective the recession is over. In fact, businesses are now having trouble finding minimum wage workers and have resorted to paying signing bonuses.

Even Real GDP has almost recovered to pre-pandemic levels. The US economy is now growing at the fastest rate since the 1980s. Furthermore, households are flush with cash due to fiscal stimulus. In my view, the recession is clearly over.

In all likelihood, the Covid-19 led recession may be the shortest on record. I’m expecting that the NBER will eventually date the recession as having ended in May 2020. But I wouldn’t wait for an official end to the recession before taking action. The NBER in notoriously slow and typically dates recessions up to 15 months after they end. Whether the recession ended in May or June 2020 is immaterial for the market and your portfolio going forward. The expansion is solidly in place and will continue to strengthen. You should be positioned accordingly.

How Should You Position Your Portfolio

In my view, there are three main traditional asset classes equities, fixed income and cash. If you want an expanded definition, I’ll also include real assets and cryptocurrencies. However, I view the latter as being unproven in a truly inflationary environment. It’s helpful to use Charlie Munger’s technique of inversion to find the right answer to a question. Rather than asking where to invest, we should be asking the question where we don’t want to be positioned. Naturally, US treasuries is the first asset class that comes to my mind. We can see that we’re at the tail end of the long bull market in US Treasuries. The 10-year yield peaked in 1981 and has been declining virtually nonstop for the past 40 years. The yield on the 10-year Treasury note has declined from 15% in 1981 down to 0.50% last summer. In my view, the bottom is already in place and yields can only go in one direction from current levels. The current 10-year US Treasury yield is 1.63%. Assuming the current inflation rate of 4.2% isn’t transitory, investors in government bonds are locking in a real return of -2.57%. Negative real yields destroy your spending power. If you have material exposure to US Treasuries, it’s time to start reducing it.

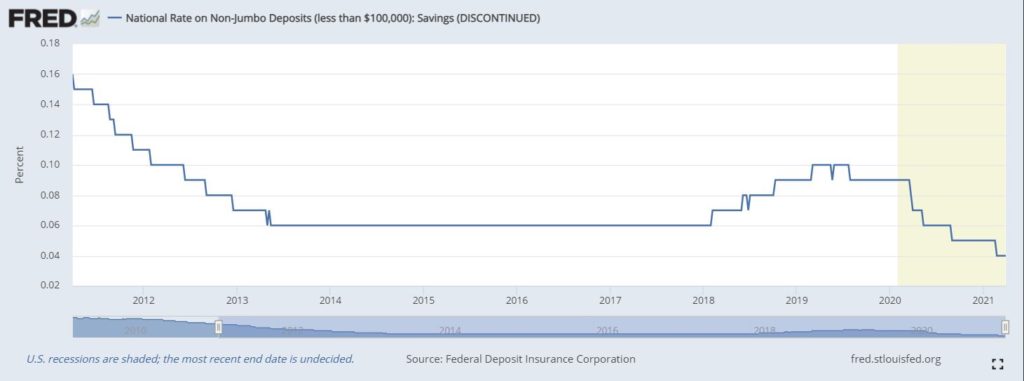

Naturally, cash is another asset class that should be avoided in inflationary periods. The FDIC’s national average for savings accounts is 0.4%. Thus, you are losing purchasing power at serious clip. You might as well keep your money under your mattress.

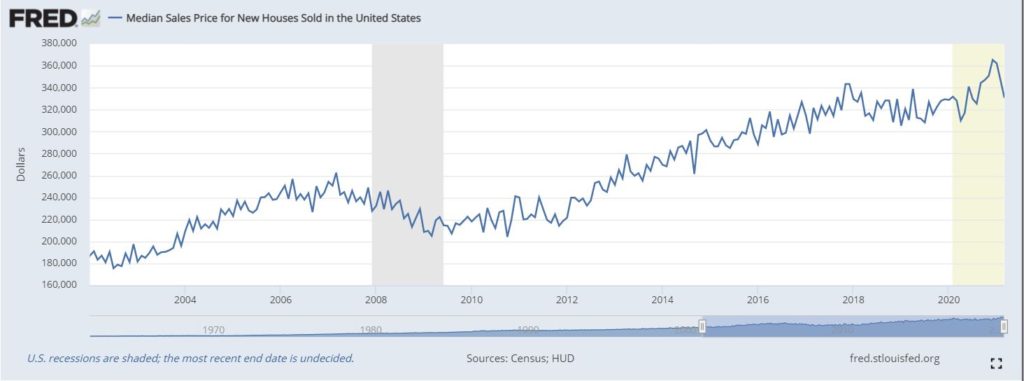

If you’re holding significant amounts of cash, I think you should just go to the nearest Home Depot and load up on lumber. I’m serious. There is a housing boom in the US and building materials are in short supply.

Real assets tend to perform well in inflationary periods. However, housing prices are at record highs in the US. If you keep waiting for better prices, you’re still losing purchasing power at more than 4% annualized. Even if you purchase property at today’s inflated prices you won’t be able to generate significant yield. Thus, you’ll be relying on further price increases to secure an adequate return.

Thus, the only viable asset class remaining that is capable of producing real returns in the current market environment is equities.

Will Stocks Hold Up?

Jeremy Siegel, a finance professor at the Wharton School and author of Stocks for the Long Run, recently stated that stocks can ‘more than compensate’ if inflation rises 20% over the next 2 to 3 years. Additionally, he thinks valuations in the tech sector have become excessive and that value stocks will outperform going forward. Value stocks that offer attractive dividend yields are where you want to be positioned. There was a dramatic pullback in value stocks during the Covid crisis, but they were left behind by growth stocks in the recovery. I agree with Siegel that this underperformance will reverse going forward as growth/Tech stocks have gotten ahead of themselves in terms of valuation. In Stocks for the Long Run, Siegel found that over the past 200 years equities have produced a 6.6% real return. I don’t expect the current environment to be different from the past.

However, you want to own high-yielding stocks to ensure an adequate return. As I’ve mentioned in my recent investor letter, I’ve been implementing various options strategies in the Ashva Capital portfolio to enhance current income. I’ve been able to effectively double the dividend yield for virtually all our core equity positions. If you’re interested in learning more, I recommend signing up for our email distribution list and reading the Q1 2021 investor letter using the following link.

Article by Ankur Shah, Ashva Capital