Janus Henderson is a money manager, which has shared some interesting data reports in the past. I recently read their 33rd Global Dividend Index, and found some interesting pieces of data to share.

The report shows a long-term study in global dividend trends. It shows dividend growth between various regions for example. It shows that the amount of total global dividends reached an all time high 2021, and was expected to further grow into 2022. This is amazing.

Q1 2022 hedge fund letters, conferences and more

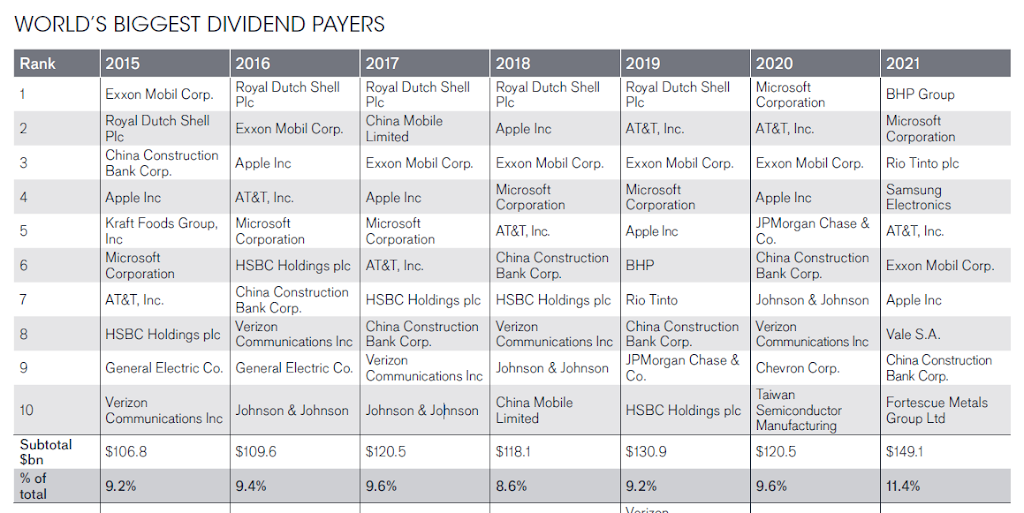

The most interesting piece was the list of World’s Biggest Dividend Payers by year since 2015. Janus Henderson sorted the largest dividend payers by amount of total annual dividends distributed (in billions of US Dollars), and listed the top payers per year. In order for a company to get on that list, it should be paying several billion dollars per year in dividends.

It is fascinating to observe how the list of largest dividend payers worldwide has changed over the past 6 – 7 years.

Some of these companies get off the list because of dividend cuts. Cyclical companies account for a large portion of the movement, as they get flush with cash and send dividends during boom times, only to cut them during a recession. Royal Dutch Shell is one example, which was the number one dividend payer between 2016 and 2019, before cutting dividends in 2020 amidst Covid-19 turmoil.

Another example is AT&T, which has been on the list for all 2015 – 2021, but will be out in 2022 as it cut dividends.

Other companies get off the list because the amount of dividends they pay is not as high as other newcomers.

You can view the complete list of the 20 largest dividend payers below:

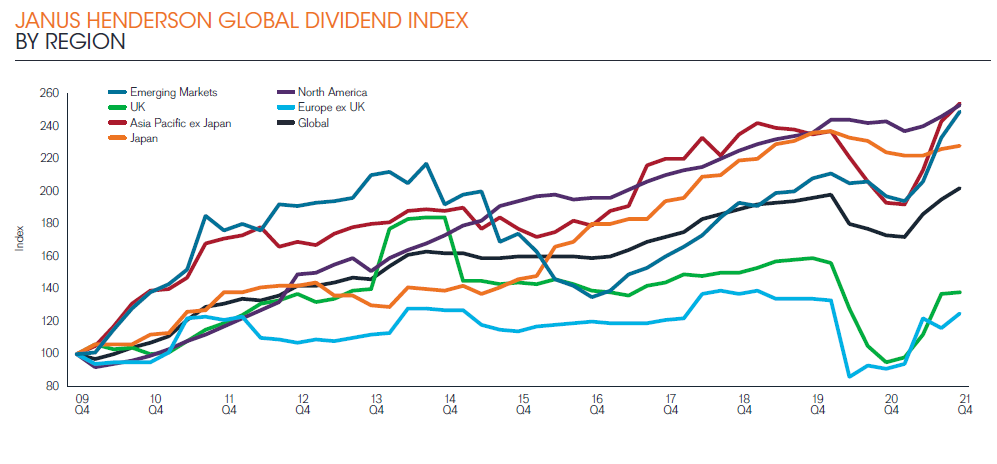

One of the most fascinating charts is the growth in dividends by Geography since 2009.

It shows that North America offers some resilient dividend payments to shareholders. That could be because it houses a lot of great dominant companies with recurring revenue streams that are shareholder friendly. This could also be because North American companies tend to have a culture of rarely cutting dividends, but keeping them. It is also possible that companies in North America are less cyclical than companies around the world ( based on industry/sector).