This article reviews an attractive high-yield opportunity that we originally shared with our members back in June, but we did NOT buy (we only added it to our watch list because we were waiting for some “price weakness“). In light of the recent market wide sell-off, we believe now is an attractive time for income-focused investors to consider the shares, especially since the company remains healthy, the dividend has a lot of cushion, and the shares have sold-off–and now trade at the lower-end of their historical range.

Q3 hedge fund letters, conference, scoops etc

“Investing is the only business I know that when things go on sale, people run out of the store.” -Mark Yusko

Ship Finance International (SFL), Yield: 10.5%

SFL’s High Yield Is Attractive, But Know The Risks

If you like high income, Ship Finance International (SFL) is another name to consider. This article highlights 4 attractive qualities, 6 risks to monitor, and concludes with our views on when to consider adding more shares.

Overview:

Ship Finance International Ltd. (SFL) engages in the ownership and operation of vessels and offshore related assets, and is also involved in the charter, purchase, and sale of assets. Its assets consist of oil tankers, dry bulk carriers, container vessels, Qs car carriers, jack-up drilling rig, ultra-deepwater drilling units, offshore supply vessels, and chemical tankers. The company was founded on October 10, 2003 and is headquartered in Hamilton, Bermuda.

4 Reason to Own It

- Steady Income from long-term contracts

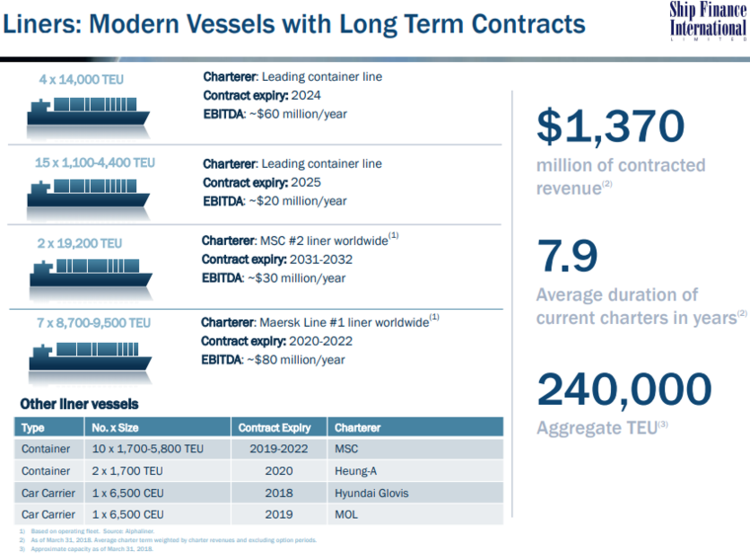

As shown in the following graphic, SFL has a backlog of contracts across multiple types of ships.

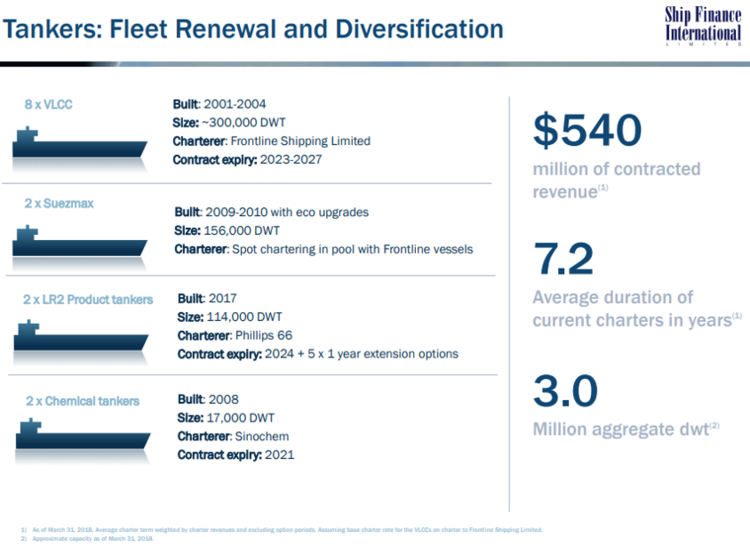

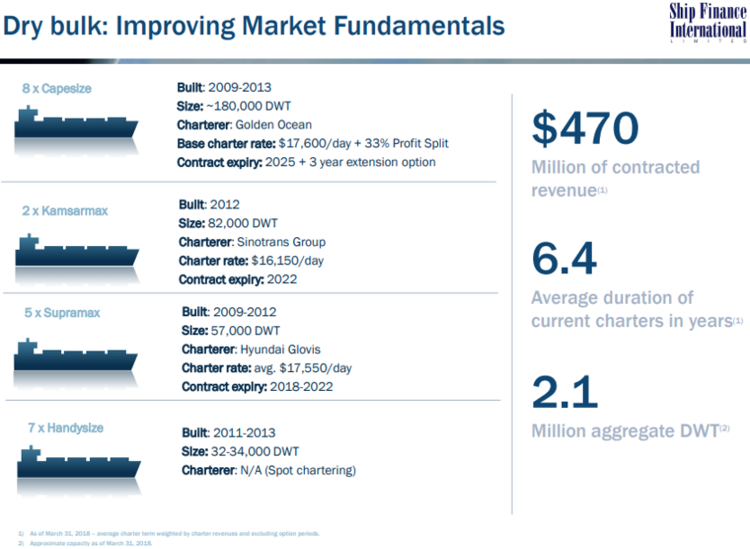

And more specifically, the billions of dollars of backlog revenue across each segment includes contracts lasting 6 to 7 years (or longer) as shown in the following graphics.

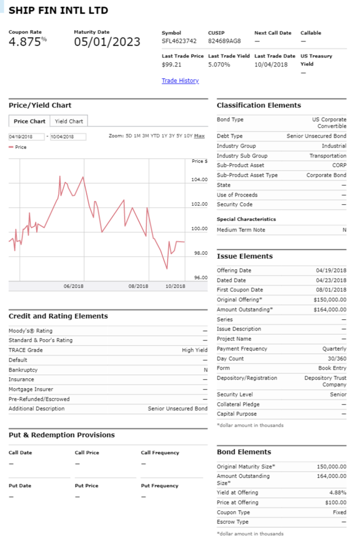

And with regards to the safety of this business, one significant piece of evidence is that SFL bonds trade at a reasonable spread to treasuries, as shown in the following SFL bond data, for example.

The fact that the yield on these 2023 bonds is just above 4%, and they trade at premium to par, is an indication that the market has faith in the relatively low risk of this business’s cash flows (if it were a risky business, the bonds would trade at a big discount and offer a much higher yield).

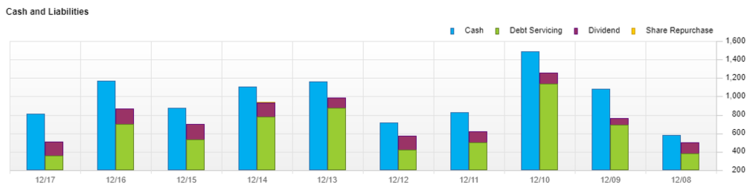

- Conservative payout ratio: This first chart shows the extra cash cushion on SFL’s dividend payout—a good sign for the safety of the dividend.

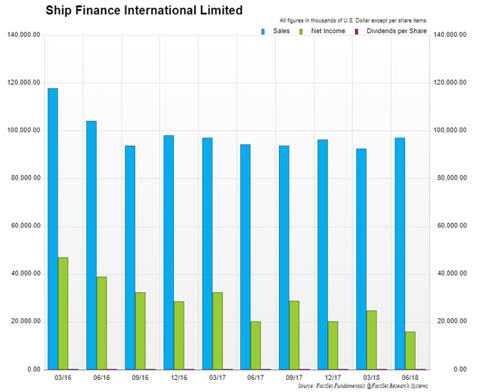

And for more perspective, here is a look at the relatively stable revenues (sales) from quarter to quarter.

Also worth mentioning, on the last quarterly call, SFL mentioned they’ve been holding back on the dividend to leave cash to fund future growth opportunities. This is a good thing because as the company grows, the dividend can be raised, and the growth will help sustain a higher future dividend level. Here is the quote:

“the distributable cash flow after interest is much, much higher than the 152 last 12 months, compared to the dividend payout. So — and I think we still have decent investment capacities.”

Basically, SFL has kept the dividend at a conservatively low level in order to protect against risk but also to be able to fund future growth opportunities.

- Seadrill and Frontline risks are being worked out: As SFL continues to work through challenges with customers, the business prospects are getting better. For example, one reason SFL has been so conservative with their dividend payment is because a major customer, Seadrill, was facing liquidity challenges. However, Seadrill recently announced that they have reached a global settlement in their Chapter 11 proceedings. And Seadrill has confirmed that its business operations remain unaffected by its restructuring efforts at this time. This is a good thing for SFL’s future considering a lot of the Seadrill risks were already baked into the price. Here is more detail from SFL’s annual report about Seadrill:

“Recently Seadrill announced that they have reached a global settlement in its Chapter 11 proceedings. Although Seadrill has confirmed that its business operations remain unaffected by its restructuring efforts at this time, we may be adversely impacted if the Restructuring Plan is not approved by the court. As of March 26, 2018, we have three bareboat leases with the Seadrill Charterers for the West Taurus, West Hercules and West Linus. The performance of the Seadrill Charterers under the leases is currently fully guaranteed by Seadrill. In September 2017, Seadrill announced that it entered into the Restructuring Plan, which will be implemented by way of prearranged chapter 11 cases in the Southern District of Texas, U.S. In February 2018, Seadrill announced that it had succeeded in reaching a global settlement with an ad hoc group of bondholders, the official committee of unsecured creditors, and other major creditors in its chapter 11 cases. As a result of the settlement, approximately 70% of Seadrill’s bondholders by principal amount have now signed up to the Restructuring Plan to support the restructuring. Ship Finance and approximately 99% of Seadrill’s bank lenders by principal amount had previously signed and remain party to the Restructuring Plan. Assuming the Restructuring Plan is approved by the court, Ship Finance has agreed to reduce the contractual charter hire for the three rigs by approximately 29% for a period of five years starting in 2018, with the reduced amounts added back in the period thereafter. The term of the leases for West Hercules and West Taurus will also be extended by 13 months until December 2024, and the call options on behalf of the Seadrill Charterers under the relevant leases have also been amended as part of the Restructuring Plan. Seadrill will continue to pay full charter hire while the Restructuring Plan is being processed by the court. If the Restructuring Plan is not approved by the court, this may have a material adverse effect on our earnings and profitability, and our ability to pay dividends to our shareholders. For more information about the Restructuring Plan, please see “Item 5. Operating and Financial Review and Prospects-Liquidity and Capital Resources”.

And regarding Frontline, another SFL customer (tankers, as shown in our earlier graphic), its charter rate has been reduced, and that is already baked into the price, as well. For perspective:

“The charter, which is Frontline Shipping Limited or FSL, is a non-recourse subsidiary of Frontline Limited and so far, FSL has been able to pay the base rate by drawing on a previously built up cash buffer in the company. In the first quarter, the vessels earned approximately $12,300 on average per day in the market, which was well below the base charter rate of $20,000 per day. We did receive the full charter rate for the full quarter, but according to Frontline, the charter does not currently have sufficient funds to continue supporting the full charter hiring going forward.”

These challenges are well known by the market and already baked into the price (for example, SFL recently issued convertible bonds, as shown earlier, at a low spread to treasuries, and indication that the market has faith in SFL’s cash flows). Further still, the fact that these challenges are being worked out enables SFL to focus more on growth opportunities, of which management believes there are many. Per the last quarterly earnings call:

“We continue to see opportunities out there. So I think we are definitely active in the market now. If you look at the distributable cash flow, as we indicate on slide 9 in the presentation, that’s of course after the continued steep loan amortization on our financings. So, you can say that the distributable cash flow after interest is much, much higher than the 152 last 12 months, compared to the dividend payout. So — and I think we still have decent investment capacities.”

- Energy Business as Inflation Hedge: Another reason SFL is attractive is the potential benefits of the entire energy sector against inflation (SFL is an industrial company closely tied to energy). Inflation can be very detrimental to the value of your investments. And based on recent fed comments and decisions (“inflation hawks” at the fed are pushing to raise interest rates more, faster). However, according to this Morningstar article, there is a high historical correlation between energy and inflation which is part of the reason why the energy sector can be a good hedge against inflation. Of course no one has a working crystal ball (energy prices are volatile, and could go much lower or higher), but SFL is part of the energy sector, and that sector is generally a beneficiary of inflation, especially relative to other market sectors.

Risks:

In addition to the attractive qualities of SFL, there are also risks that should be considered…

- Oil and Gas Supply and Demand: The supply and demand for oil and gas can undergo significant swings, and as such this creates risks for SFL. The company does a nice job summing up this risk in its annual report:

”The offshore drilling sector and also demand for offshore support vessels depend primarily on the level of activity in the offshore oil and gas industry, which is significantly affected by, among other things, volatile oil and gas prices, and may be materially and adversely affected by a decline in the offshore oil and gas industry. The offshore contract drilling industry and also demand for offshore support vessels is cyclical and volatile, and depends on the level of activity in oil and gas exploration and development and production in offshore areas worldwide. The availability of quality drilling prospects, exploration success, relative production costs, the stage of reservoir development and political and regulatory environments affect our customers’ drilling campaigns. Oil and gas prices, and market expectations of potential changes in these prices, also significantly affect the level of activity and demand for drilling units. Oil and gas prices are extremely volatile and are affected by numerous factors beyond our control.”

And as a specific example:

“Following the 2008 peak in the oil price of around $140 per barrel, there was a period of high utilization and high dayrates, which prompted industry participants to increase the supply of drilling units by ordering the construction of new drilling units. The reduction in oil prices since 2014 has resulted in reduced demand for drilling units, which has adversely affected the Seadrill Charterers’ ability to secure drilling contracts and, therefore, their ability to make lease payments to us. In addition, the new construction of high-specification units, as well as changes in the Seadrill Charterers’ competitors’ drilling rig fleets, could cause our drilling units to become less competitive.”

- The Dividend may not be qualified: SFL’s quarterly distribution payments may not necessarily always be qualified dividends thereby receiving the lower tax rate. According to SFL’s prospectus (emphasis ours):

“The distributions… will constitute taxable dividend income to a U.S. Participant to the extent of our current and accumulated earnings and profits. Such dividends may be eligible for taxation at reduced rates in the hands of a non-corporate U.S. Participant, provided that we are not a passive foreign investment company for the taxable year during which the dividend is paid or the immediately preceding taxable year (as discussed in detail in “Item 10.E_Taxation _U.S. Taxation_Passive Foreign Investment Company Status and Significant Tax Consequences” in our annual report on Form 20-F. for the year ended December 31, 2012, which is incorporated herein by reference), and certain holding period and certain other requirements are satisfied. There is no assurance that any dividends paid on our common shares will be eligible for these reduced rates. Any dividends which are not eligible for these reduced rates will be taxed as ordinary income to a non-corporate U.S. participant. Distributions in excess of our earnings and profits will be treated first as a nontaxable return of capital to the extent of the U.S. Participant’s tax basis in his common shares on a dollar-for-dollar basis and thereafter as capital gain.”

- The Dividend Could Change: Depending on market conditions, the distribution amount to shareholders could change. For example, it was recently reduced in the second half of last year to $0.35 from $0.45 (largely due to proactive conservatism related to Seadrill and Frontline). Here is what SFL’s website has to say about it:

“Changes in our dividend policy could adversely affect holders of our common shares. Any dividend that we declare is at the discretion of our Board of Directors. We cannot assure you that our dividend will not be reduced or eliminated in the future. Our profitability and corresponding ability to pay dividends is substantially affected by amounts we receive through charter hire and profit sharing payments from our charterers.”

For example:

“In particular, Seadrill’s Restructuring Plan (see below), may have a significant impact on the amount of charter hire we receive from the Seadrill Charterers, if any, which constitutes a significant portion of our contracted future charter hire payments. Our entitlement to profit sharing payments, if any, is based on the financial performance of our vessels which is outside of our control. If our charter hire and profit sharing payments decrease substantially, we may not be able to continue to pay dividends at present levels, or at all. We are also subject to contractual limitations on our ability to pay dividends pursuant to certain debt agreements, and we may agree to additional limitations in the future. Additional factors that could affect our ability to pay dividends include statutory and contractual limitations on the ability of our subsidiaries to pay dividends to us, including under current or future debt arrangements.”

Importantly, the charter-hire payments that SFL receives from customers constitutes substantially all of the company’s operating cash flows.

- Competition in the highly competitive international seaborne transportation industry creates a risk for SFL. Here is what the company has to say about competition in its annual report:

“We may not be able to compete for charters with new entrants or established companies with greater resources, and as a result we may be unable to employ our vessels profitably. We employ our vessels in a highly competitive market that is capital intensive and highly fragmented, and competition arises primarily from other vessel owners. Competition for seaborne transportation of goods and products is intense and depends on charter rates and the location, size, age, condition and acceptability of the vessel and its operators to charterers. Due in part to the highly fragmented market, competitors with greater resources could operate larger fleets than we may operate and thus be able to offer lower charter rates and higher quality vessels than we are able to offer. If this were to occur, we may be unable to retain or attract new charterers on attractive terms or at all, which may have a material adverse effect on our business, financial condition and results of operations. Although we believe that no single competitor has a dominant position in the markets in which we compete, we are aware that certain competitors may be able to devote greater financial and other resources to certain activities than we can, resulting in a significant competitive threat to us. We cannot give assurances that we will continue to compete successfully with our competitors or that these factors will not erode our competitive position in the future.”

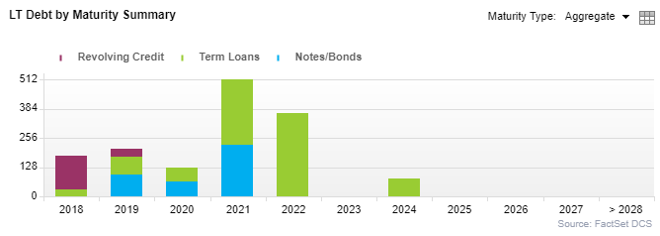

- Debt: Depending on the other risk factors, as described above, SFL’s debt load could create challenges. Specifically, if the company is not able to obtain attractive financing arrangement when existing debt comes due, that could create problems. The existing debt maturity schedule is shown in the following graphic.

However, as an encouraging sign, SFL was recently able to issue new convertible bonds at an attractive rate earlier this year (as described in the bond graphic earlier in this report). The fact that SFL was able to raise this capital, at an attractive rate, despite ongoing challenges with Seadrill and Frontline is actually a very good sign—specifically, the market is not overly concerned about the possible negative impacts of these challenges or SFL’s debt maturity schedule.

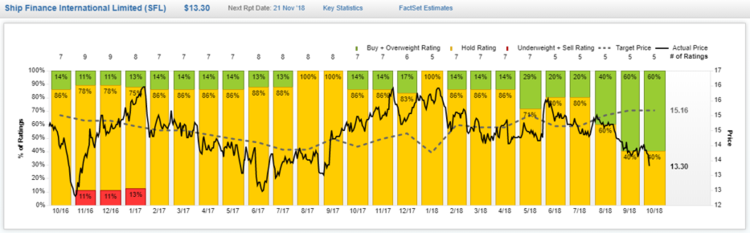

- Volatility: As shown in the following Wall Street analyst ratings and price target graphic, the price of SFL has been bouncing around a lot within the general range of $13 to $16 per share.

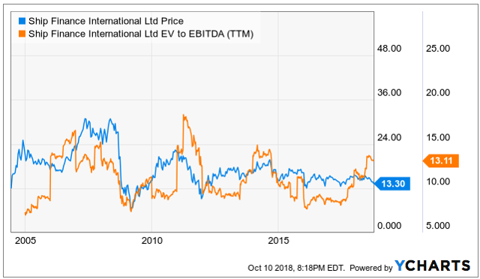

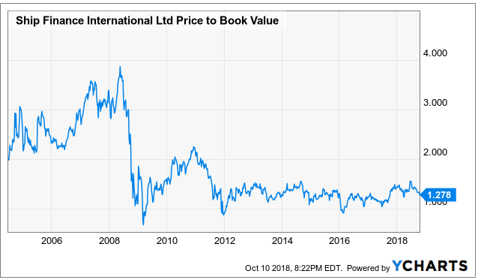

This information is important for a variety of reasons. First, due to ongoing volatility, investors could eventually get a better price if they are interested in entering a new position in SFL (not that the current price is terrible—it’s not, especially given the high dividend yield). (*Update: 10/10/18: the price now sits at the lower end of the range and is more attractive, in our view). Another thing to keep in mind is that if you are NOT reinvesting the dividends, then the value of your investment will likely not appreciate dramatically over the long-term (we think the price will increase, just not as dramatically as if they were able to reinvest all of the dividends in the business). Worth mentioning, SFL does offer a dividend reinvestment program. Also, for what it is worth, the average Wall Street analyst rating on SFL is a “hold.” (*Update: 10/10/18: the average rating is now a “Buy”). And for more perspective on SFL’s current valuation, here is a look at its EV-to-EBITDA and its price-to-book ratios, both current and historical for comparison purposes.

Previous (6/25/18) Conclusion:

In our view, SFL presents an attractive opportunity at its current price considering its big dividend yield and the company’s stable mid- and long-term contracts, especially if you are an income-focused investor. However, we do not currently own shares, and we are not buying at this time. Importantly, we have added SFL to our watch list. We recognize these shares have recently been volatile within a price range of $13 to $16 per share. It currently trades at around $15. We’d consider buying shares of SFL on price weakness. Additionally, we’d consider selling income-generating put options on SFL if the price fell a little further and if the premium income available was attractive. For reference, SFL is not expected to announce earnings until August 29th.

Updated (10/10/18) Conclusion:

Shares of SFL have sold-off, as the broader market has-sold off (for example, see: 100 High-Yielders Down Big: These 5 Are Worth Considering), thereby making them increasingly attractive. Specifically, SFL’s business remains healthy, there is plenty of cash flow to cover the dividend (management has proactively been conservative with the dividend payment), and business opportunities have improved (for example, the average Wall Street analyst now rates SFL a “Buy”). If you are looking for an attractive high-yielder, on sale, Ship Finance International’s 10.5% yield is worth considering at its current price.

Article by Blue Harbinger