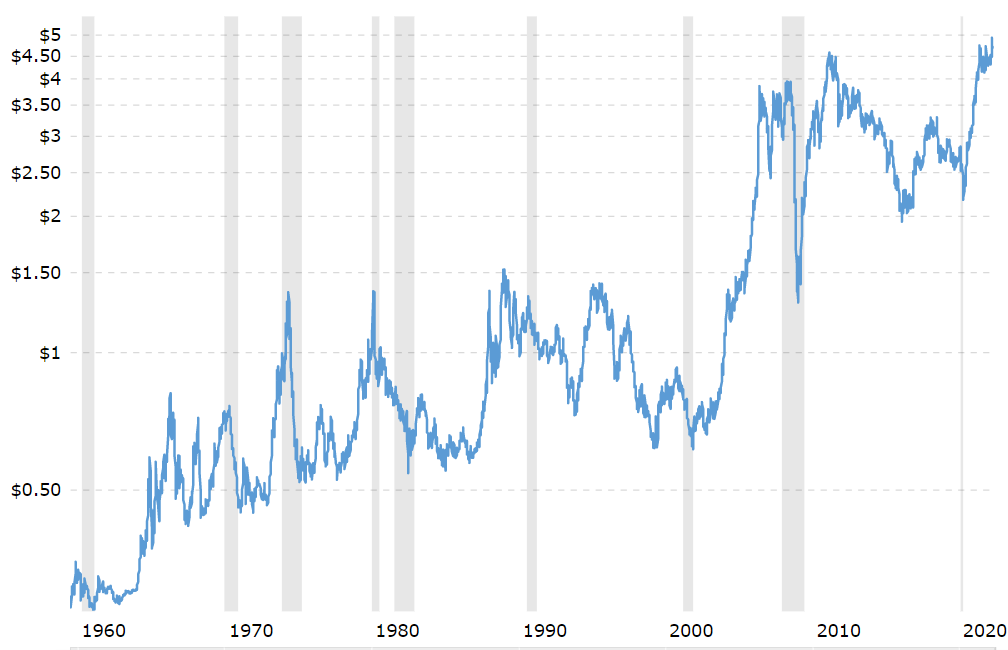

For over thirty years, excluding a few brief spikes, copper traded in a range between $0.60 and $1.00 a pound. In many ways, that range became self-fulfilling as an entire generation of producers and consumers came to expect that it would remain in that range. They’d sell excess inventory when it poked over a buck and fill warehouses in the sixties. That range defined the commodity and expectations around that commodity.

Q1 2022 hedge fund letters, conferences and more

In early 2004, copper poked its head up over $1.00 and it didn’t stop. I remember grey haired “experts” explaining how copper would decline back under a buck. They were so sure of it, that they shorted it. Yet, copper didn’t drop, instead, it kept climbing, all the way until it cleared $4.00.

I was a young investor back then, but I already had a rather healthy skepticism of “experts.” So, I did my own digging, which mostly involved pestering management teams. They pointed out that under a buck, they weren’t making money. They weren’t reinvesting. They were on life support. Meanwhile, the BRICS were rapidly increasing copper usage, along with the usage of all sorts of other commodities. It wasn’t hard to look at the rapid increases in diesel, steel, cement and wages, plug them into an income statement and realize that no one would earn a profit at $1.00. It didn’t matter what the “experts” said, the math simply wouldn’t work. While these pros were all warning investors that copper was going back under a buck, I was loading up on small copper producers at two and three times cash flow based on $1.50 copper. Why were they so cheap? Well, everyone was using $0.75 as the baseline price for copper and they were expecting the price to return there in a hurry. I am thankful that they were lazy longs, as I made an absolute fortune on these names, many of which went up ten-fold or more, as copper continued its march to $4.00.

During this time, I would joke that $1 became $2. Which was my way of saying that the three-decade ceiling at $1, was now a long-term floor at $2.00, because unless copper was above $2.00, no one would invest in new mines. I was just a kid back then, but in the two decades since, I was proven correct. Copper had found a new level.

I bring this all up because all sorts of commodities are finding a new level. Let’s talk about lumber, but first let me categorically say that I know absolutely nothing about lumber. I may know less than nothing about lumber. With that out of the way, look at a chart of lumber. Do you think it’s going back into the old range between $200 and $400? Or has it found a new range?? Look at the largest lumber producers in North America, they are earning record profits, but they’re not expanding capacity. Instead, they’re using that money to pay down debt, pay dividends and buy back stock. They’re also buying each other, which consolidates the industry and leads to better pricing. Remember how little I know about lumber? Well, I know one thing; lumber isn’t going back into the old range.

Both lumber producers and consumer are in shock. The producers cannot believe how much money they’re making after decades of pain. They don’t think this is sustainable, so they’re not reinvesting. Meanwhile, consumers have a price shock of their own. They’re waiting for the pullback that never seems to happen—that’s leading to pent up demand as consumers eventually accept the new level and pass that cost on.

Look at the periodic table. Various elements are careening out of control. Eventually, they’ll peak, pull back, and find their new levels. I am amazed at how many “experts” are convinced that prices will return to prior levels, just because they had been at those levels for years. A decade of reckless money printing is now suddenly getting reflected in all sorts of commodities, just like it got reflected in overvalued equities—it simply took longer. Even when more supply does come online, as it always does, I don’t think prices will decline. We’ve found a new level.

Meanwhile, there are hundreds of commodity producers that are trading for between 2 and 4 times cash flow. Everyone hates these companies because they’ve earned atrocious returns on capital for years and everyone assumes that the past few quarters were a covid-induced anomaly. Everyone thinks that these commodities are going back into the old range. I think these people are certifiable fukwits. There, I said it. They remind me of the “experts” that tried to talk me out of the copper mines that were deca-baggers.

Look, many of these commodity companies are currently earning astounding returns on capital. Meanwhile, many of these companies are buying back huge globs of stock each quarter and are growing earnings rapidly simply through the buybacks. What if these commodities don’t return to the old level? What if investors begin to believe that these earnings levels are sustainable??

Meanwhile, many of these companies have seen their shares collapse over fears of the Fed hiking rates or a recession or some other nonsense. With the recent declines, many of these companies trade at similar enterprise values as 2019 levels. Sure the share-prices are up, but that’s deceptive—the share-counts and debt levels are down even more. This sure feels like an opportunity to me as these companies weren’t earning much in 2019, but they’re absolutely gushing cash now—especially as they’re not blowing it all on cap-ex.