Research Also Reveals Increase in Newer Managers Registering with SEC

New York, NY—September 25, 2018—A new Study by the law firm Seward & Kissel LLP into the hedge fund industry’s use of side letters—special agreements between hedge funds and their investors—shows a major shift in the hedge fund landscape.

[timeless]

Q2 hedge fund letters, conference, scoops etc

In The Seward & Kissel 2017/18 Hedge Fund Side Letter Study, released today, the percentage of side letters containing fee discounts significantly decreased, while those with preferred liquidity increased dramatically. In addition, overall average regulatory assets under management grew, as did the number of newer managers registered with the SEC (an increase of nearly 33%, compared to last year). These developments seem to point to efforts by managers to raise more capital in order to pay increasingly higher operational costs to serve investor and regulatory demands.

Specific highlights from the Study include:

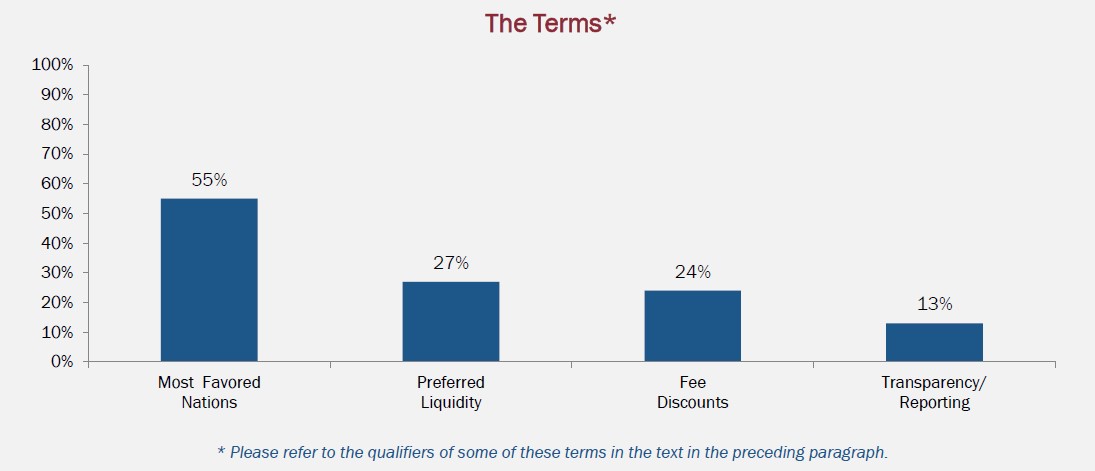

- As fees may be reaching a floor level, fee discounts were included in just 24% of side letters, down from 49% last year, when they were the most common term used in side letters.

- Fee discounts have been surpassed by most favored nations clauses (appearing in 55% of side letters) and preferred liquidity clauses (27%), the use of which has skyrocketed over the last two years. In 2015-16, preferred liquidity clauses appeared in fewer than 7% of side letters.

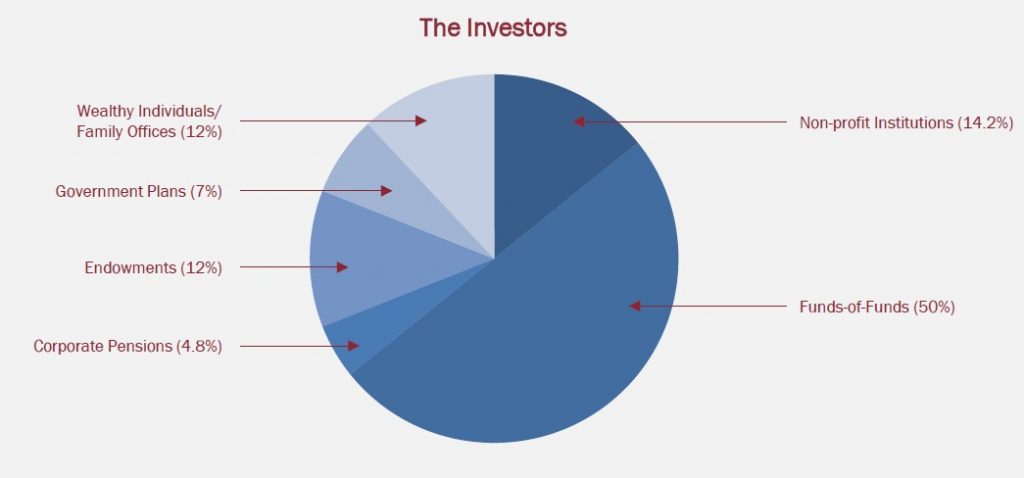

- Continuing a two-year-long trend, government plans continued to shrink as an investor category. They accounted for just 7% of all side letter investors, down from more than 27% two years ago.

- As government plans have withdrawn, non-profit institutions have emerged. Non-profits, including large medical or religious institutions, represented the second-largest investor category (after funds-of-funds), accounting for 14.2% of side letters (up from 4% in the prior year’s Study).

“Our third Side Letter Study has again unearthed valuable insights into the continued evolution of hedge funds and their investors,” said Steve Nadel, partner at Seward & Kissel and lead author of the Study. “The Seward & Kissel 2017/18 Hedge Fund Side Letter Study demonstrates that managers are listening to their investors and are making strategic choices as the industry continues to change.”

About Seward & Kissel LLP

Seward & Kissel LLP, founded in 1890, is a leading U.S. law firm with an international reputation for excellence. The firm is particularly well known for its hedge fund and investment management work, having established the first hedge fund ever, A.W. Jones, in 1949, and having earned numerous best in class awards over the years.