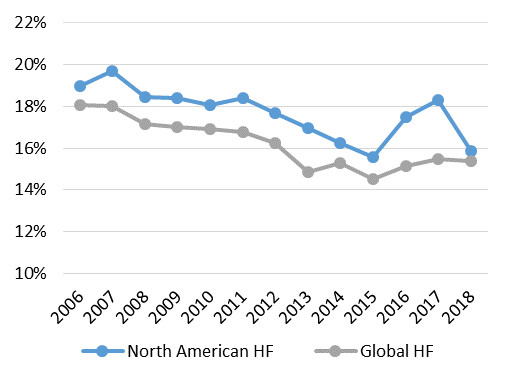

Equal-Weighted and Asset-Weighted Performance of Hedge Funds

Q3 hedge fund letters, conference, scoops etc

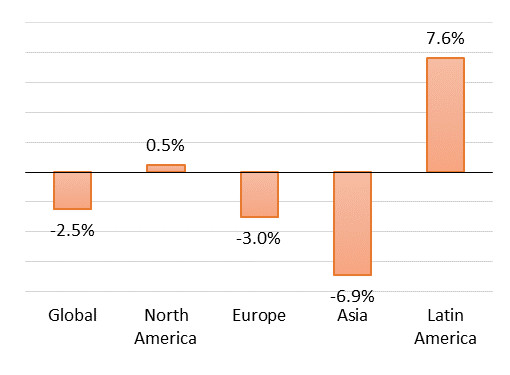

Hedge Fund Performance by Region (2018 YTD)

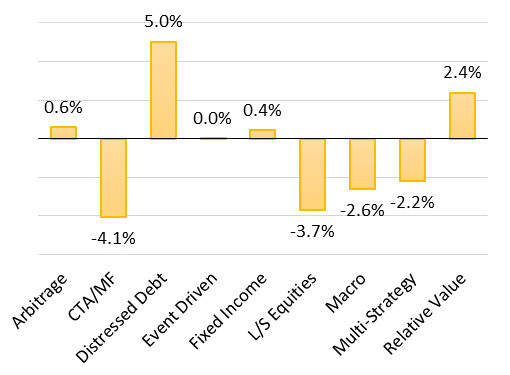

Hedge Fund Performance by Strategy (2018 YTD)

Region Highlight

North America (+0.46% YTD)

-US$36.4 billion AUM YTD

North American funds barely avoided dipping back into the red year-to-date, as the losses they suffered in October and November wiped most of the gains they made in 2018. The Eurekahedge North American Hedge Fund Index ended November flat, as fund managers struggled to profit off the equity market recovery.

Hedge Fund Performance Fee

Strategy Highlight

Long Short Equities (-3.69% YTD)

-US$20.2 billion AUM YTD

Long short equities hedge fund managers bore the brunt of the equity market movement in October, which left them down 3.64% during the month. The equity market selloff left around 80% of the equity fund managers posting losses in October, and resulted in US$29.1 billion of performance-based losses.

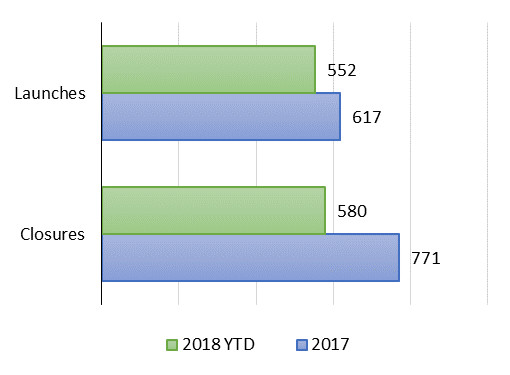

Hedge Fund Launches and Closures

Article by Eurekahedge