Trident Fund LP commentary for the month ended November 30, 2020.

Q3 2020 hedge fund letters, conferences and more

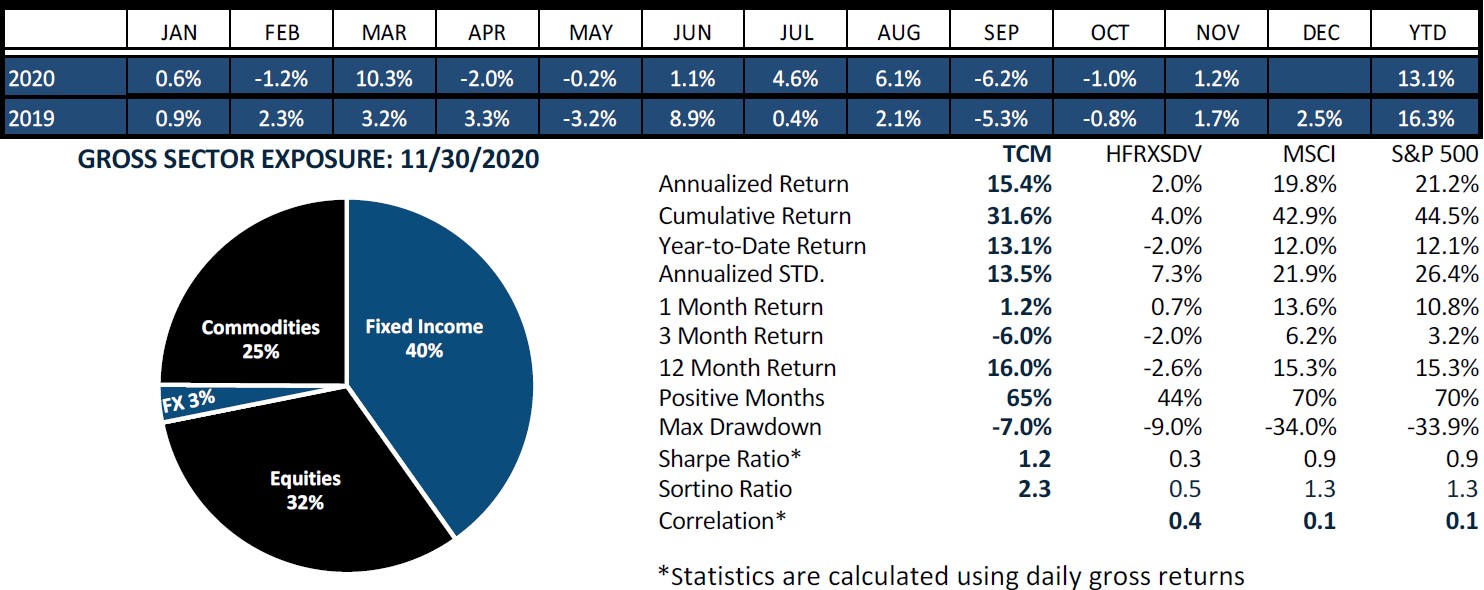

The Trident Fund LP returned +1.2 percent in November, and the fund is +13.1 percent net year to date.

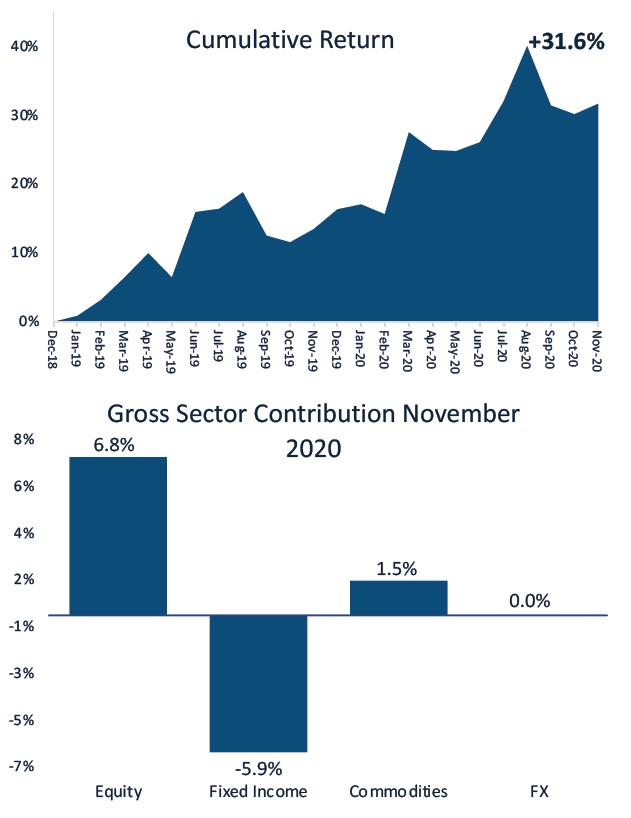

Commodity trading was the key to Trident’s +1.2 percent performance in November as profits in energies, metals, and softs accounted for all the gains. In financial markets, Trident’s Risk Regime model was in systematic “hedge mode” such that fixed income hedges offset profits in stock indices.

As a result, the Engel model accounted for all the +1.2 percent return, while the Risk Regime model preserved capital. The Vega model, which only “shorts” stock indices, did not trade. Within the Engel model, the most profitable markets were Copper, Gold, Natural Gas, and Sugar.

Heading into December, Trident remains in systematic “hedge mode” in financial assets while having greater exposure to commodities. Nonetheless, the Trident hedges have “gamma” such that if financial assets move substantially, Trident will take advantage.