ETFGI reports that US-listed ETFs and ETPs suffered US$2.96 Bn US dollars net outflows during March 2018, the second consecutive monthly outflows in 2018

BoAML: Investors Yet to Act on Fears

LONDON — April 17, 2018 — ETFGI, a leading independent research and consultancy firm on trends in the global ETF/ETP ecosystem, reported today that US-listed ETFs and ETPs suffered US$2.96 Bn net outflows during March 2018, the second consecutive monthly outflows in 2018 and the largest monthly amount since February 2018, when net outflows were US$10.60 Bn. Year-to-date net inflows reached US$65.22 Bn at the end of March which is significantly less than the US$133.62 compare to this point last year. (All dollar values in USD unless otherwise noted.)

[timeless]

Highlights

- US-listed ETFs/ETPs suffered $2.96 Bn net outflows during March 2018, the largest since February 2018, which saw $10.60 Bn in net outflows

- March 2018 marked the 2nd consecutive month of net outflows into ETFs/ETPs listed in the US

- Due to market moves assets invested in ETFs/ETPs listed in the US decreased by 1.58%, or $55.28 Bn, during March, to $3.441 Tn

According to ETFGI’s March 2018 US ETF and ETP industry insights report, an annual paid-for research subscription service, assets invested in ETFs/ETPs listed in the US decreased by $55.28 Bn during March 2018. The decrease of 1.58%, from $3.496 Tn at the end of February 2018 to $3.441 Tn at the end of March, also represents the worst monthly growth in assets since February 2018, which saw a monthly decrease of 3.99% from $3.642 Tn to $3.496 Tn.

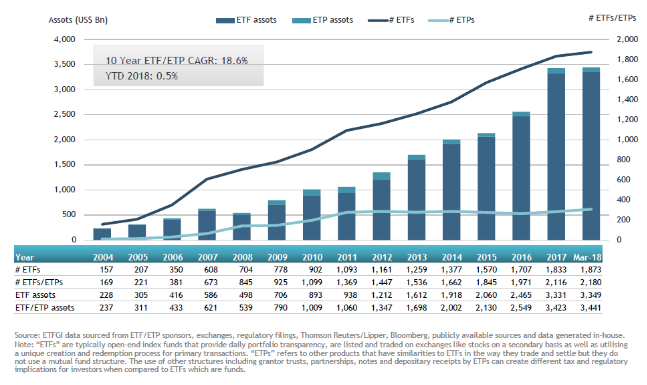

US ETF and ETP asset growth as at the end of March 2018

At the end of March 2018, the US ETF industry had 1,873 ETFs, assets of $3.349 Tn, from 119 providers on 3 exchanges. At the end of March 2018, the US ETF/ETP industry had 2,180 ETFs/ETPs, assets of $3.441 Tn, from 138 providers on 3 exchanges.

Extremes In S&P500 -Euphoria And Low Vol

March 2018 marked the 2nd consecutive month of net outflows from ETFs/ETPs listed in the US, which saw $2.96 Bn in net outflows. At this point last year, year-to-date net inflows were 51.19% higher, with $133.62 Bn gathered during the first three months of 2017.

The majority of these flows can be attributed to the top 20 ETFs by net outflows, which collectively have suffered $51.78 Bn during 2018. The SPDR S&P 500 ETF Trust (SPY US) on its own accounted for net outflows of $14.50 Bn.

Top 20 ETFs by net YTD net outflows: US

There is no serious asset price bubble In the US: Natixis

Similarly, the top 10 ETPs by net outflows have collectively experienced $5.07 Bn during 2018.

Top 10 ETPs by YTD net outflows: US

Equity ETFs/ETPs listed in the US suffered net outflows of $8.33 Bn during March, bringing net inflows for 2018 to $43.58 Bn, which is less than the $96.39 Bn in net inflows at this point last year. Fixed income ETFs and ETPs gathered net inflows of $4.05 Bn, growing net inflows for 2018 to $12.62 Bn, which is less than the $32.32 Bn in net inflows at this point last year.

During March investors chose to move from US Equity ETFs to Fixed Income and Commodities products.

Please contact us at deborah.fuhr@etfgi.com if you would like further information on our services.