The Chart of the Week is a weekly Visual Capitalist feature on Fridays.

Q3 hedge fund letters, conference, scoops etc

The tech boom is here, and it’s heating up.

Over the past decade, the tech industry has created more than 1 million jobs across the United States. Between 2010 and 2017, tech-related job growth averaged 6% – more than four times the national average across all industries. Though the figures slowed slightly in 2018, the tech industry still boasts twice the national growth average at approximately 4%.

What’s causing this growth, and where are tech hubs emerging from the woodwork?

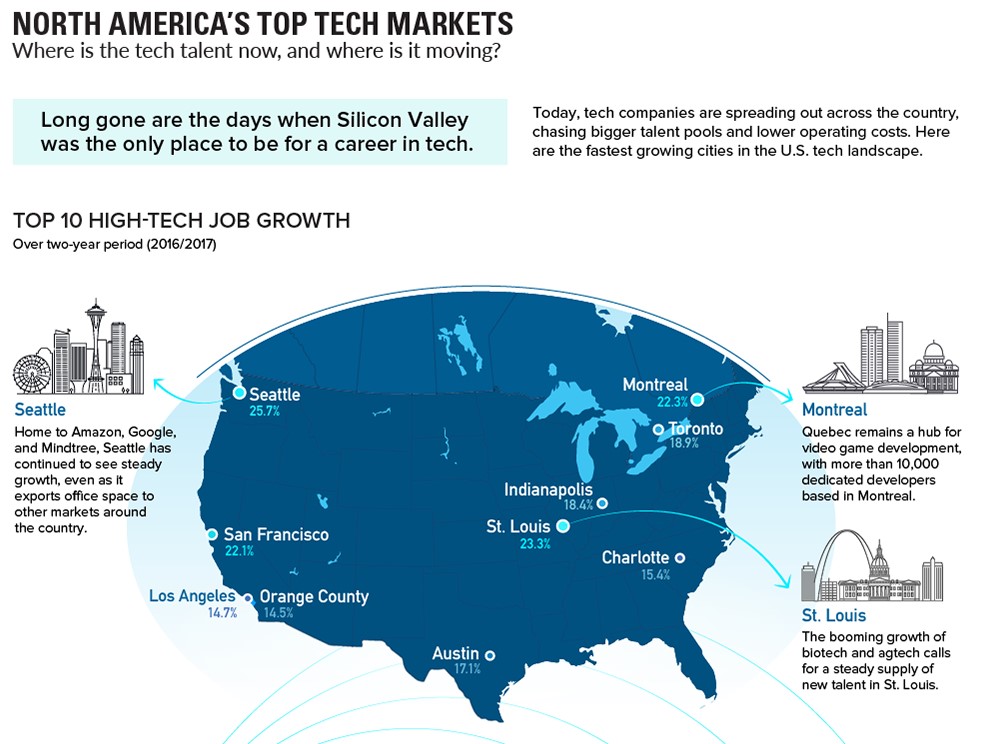

Today’s graphic, which uses data from the 2018 Tech-30 report from CBRE Research, offers a job-focused snapshot of the mammoth tech industry.

Which markets are hot or not?

Using job growth measures in various cities over two-year periods, CBRE identifies which cities’ tech markets are on the rise, and which are slowly declining.

Montreal, St. Louis, and Seattle have shown the most momentum over 2016/2017, gaining 23%, 22%, and 8% growth respectively over the previous two-year period. Interestingly, cities like New York, Chicago, and even Silicon Valley have seen a drop in growth over the past two years, while San Francisco and Phoenix are at the bottom of the list with job growth falling by more than 25%. It’s worth noting many of these markets still exceed the 9.2% US average of high-tech job growth, but overall momentum is in decline.

Here’s the full list of cities, along with their comparative data:

| City | Growth (2014-2015) | Growth (2016-2017) | Difference |

| Montreal | 0.1% | 22.3% | +22.2% |

| St Louis | 2.1% | 23.3% | +21.2% |

| Seattle | 17.5% | 25.7% | +8.2% |

| San Diego | 7.9% | 12.3% | +4.4% |

| Denver | 10.3% | 12.5% | +2.2% |

| Los Angeles | 13.5% | 14.7% | +1.2% |

| Orange County | 13.7% | 14.5% | +0.8% |

| Portland | 12.3% | 12.8% | +0.5% |

| Washington DC | 3.7% | 3.9% | +0.2% |

| Baltimore | 4.8% | 4.2% | -0.6% |

| Atlanta | 12.3% | 10.7% | -1.6% |

| Nashville | 16.0% | 12.3% | -3.7% |

| Boston | 11.5% | 7.7% | -3.8% |

| Raleigh-Durham | 16.0% | 10.2% | -5.8% |

| Salt Lake City | 14.2% | 8.1% | -6.1% |

| Philadelphia | 4.1% | -2.3% | -6.4% |

| Indianapolis | 24.8% | 18.4% | -6.4% |

| Minneapolis St Paul | 7.8% | 1.3% | -6.5% |

| Toronto | 25.8% | 18.9% | -6.9% |

| Silicon Valley | 22.7% | 13.9% | -8.8% |

| Detroit | 17.2% | 5.4% | -11.8% |

| Chicago | 22.1% | 9.6% | -12.5% |

| New York | 25.0% | 12.4% | -12.6% |

| Pittsburgh | 22.7% | 8.9% | -13.8% |

| Vancouver | 17.1% | 2.7% | -14.4% |

| Dallas Ft Worth | 18.1% | 3.4% | -14.7% |

| Austin | 34.1% | 17.1% | -17.0% |

| Charlotte | 32.6% | 15.4% | -17.2% |

| San Francisco | 47.3% | 22.1% | -25.2% |

| Phoenix | 36.3% | 10.9% | -25.4% |

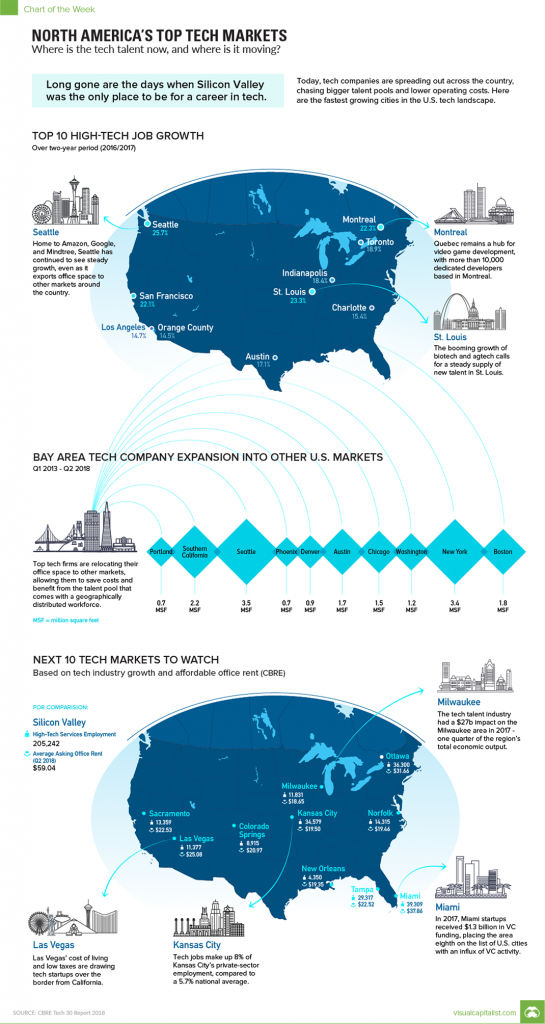

Expanding the tech footprint

As the tech job growth has boomed, so have real estate prices, particularly in prime areas favored by tech startups nationwide. In Seattle alone, the asking price for office rentals has increased by 14% over the last two years.

In response, technology firms have started to diversify their presence across the United States. By expanding their office space away from established headquarters, firms benefit from preferential rental rates and the talent pool that comes with a geographically distributed workforce. Over the past five years alone, the top four tech hubs – San Francisco, Seattle, Boston, and New York City – have exported more than a combined 25 million square feet of office space to other markets.

The silver lining to this tech expansion? If you aspire to a career in technology, you might not have to stray as far as Silicon Valley to get your foot in the door.

Next 10 tech markets to watch

With the tech hubs spreading across North America, a peek at 2018’s high-tech employment figures suggests which cities are on the rise. These are the cities flagged as the next ten tech markets to watch, based on tech industry growth and affordable office rent:

| Market | High-Tech Services Employment | Avg. Office Rent ($/sq. ft) |

| Miami | 39,309 | $37.86 |

| Ottawa | 36,300 | $31.66 |

| Kansas City | 34,579 | $19.50 |

| Tampa | 29,317 | $22.52 |

| Norfolk | 14,315 | $19.46 |

| Sacramento | 13,359 | $22.53 |

| Milwaukee | 11,831 | $18.65 |

| Las Vegas | 11,377 | $25.08 |

| Colorado Springs | 8,915 | $20.97 |

| New Orleans | 4,350 | $19.35 |

Is your city the next Silicon Valley? Only time will tell.

Article by Visual Capitalist